MEXC vs Binance are two widespread cryptocurrency exchanges that provide merchants worldwide a variety of buying and selling choices, options, and companies. Each platforms additionally present aggressive instruments and functionalities.

MEXC gives a extremely complete crypto buying and selling platform. The trade helps over 2,800 cryptocurrencies and permits customers to commerce anonymously with out KYC verification. MEXC affords the bottom charges (typically as little as 0%) for spot and futures buying and selling.

Alternatively, Binance is understood for its in depth options, deep liquidity, and large buying and selling quantity. This crypto trade affords crypto loans and even a crypto debit card. It helps over 1,300 buying and selling pairs and gives many options, together with spot, margin, futures buying and selling, staking, and incomes alternatives.

Nevertheless, these aren’t the one variations between MEXC and Binance. This MEXC vs. Binance evaluation will embody an entire overview, what are the charges of MEXC and Binance? What are their finest buying and selling options?

As well as, we are going to cowl what are the variety of supported cryptocurrencies on MEXC and Binance? What are their safety ranges? Whereas highlighting, who ought to decide MEXC over Binance? And who ought to decide Binance over MEXC? Let’s get began!

MEXC vs Binance: A Full Overview

In contrast to Binance, which makes use of a tiered price construction during which the high-volume merchants pays decrease charges, MEXC has low buying and selling charges even for low-volume merchants. The desk beneath gives an entire overview of MEXC and Binance.

Since they’re each top-tier crypto exchanges with sure similarities, we summarized their options that will help you spot their variations simply.

Trade MEXCBinance Based20182017HeadquartersVictoria, Seychelles.No international headquarters at the moment.Supported Cryptocurrencies 2800+400+Buying and selling ChargesLow charges (0.1% – 0%)Low charges. (0.1% – spot buying and selling) and 0.5% for fast purchase and promote.Liquidity ExcessiveVery Excessive Leverage 300X150XSafety Two issue authentication (2FA), chilly storage for crypto, common safety audits, futures insurance coverage fund, and handle whitelisting.Insurance coverage fund, two issue authentication, handle whitelisting, and chilly storage of crypto.KYC Necessities Non-obligatoryNecessary Consumer Expertise Quick order execution however will not be essentially the most beginner-friendly.Newbie-friendly and superior instruments.Buying and selling pairs 3,000+1,300+P2P Buying and selling SureSureListed Digital Belongings 3,000+400+Buying and selling markets Margin, spot, and future buying and selling Futures, margin, choices, and spot buying and selling Accepted Fee Strategies Cryptocurrencies solelyCrypto, Direct Financial institution deposit, Debit/Credit score Card, Apple Pay, and Google Pay.Buying and selling QuantityUSD 6+ billion (Prime 10)USD 76 billion (World’s largest).

Maximize your income! Join on MEXC utilizing our referral and save 10% on charges whereas unlocking superb bonus rewards

What are the Charges of MEXC and Binance?

On this part, we’ll discover the charges related to crypto buying and selling on MEXC and Binance, together with buying and selling charges, withdrawal charges, and deposit charges. Understanding these price is important, as they impression your overal revenue. Let’s examine how these two exchanges construction their charges and what merchants ought to count on.

MEXC vs Binance: Deposit Charges

MEXC permits its customers to deposit most cryptocurrencies totally free and doesn’t impose any limits on deposit quantities. Binance additionally doesn’t cost charges for cryptocurrency deposits. Nevertheless, charges for fiat deposits fluctuate based mostly on the cost methodology and the fiat foreign money.

Be part of Binance immediately and luxuriate in a $100 price rebate, everlasting 10% buying and selling price low cost, and unique perks!

MEXC vs Binance: Buying and selling Charges

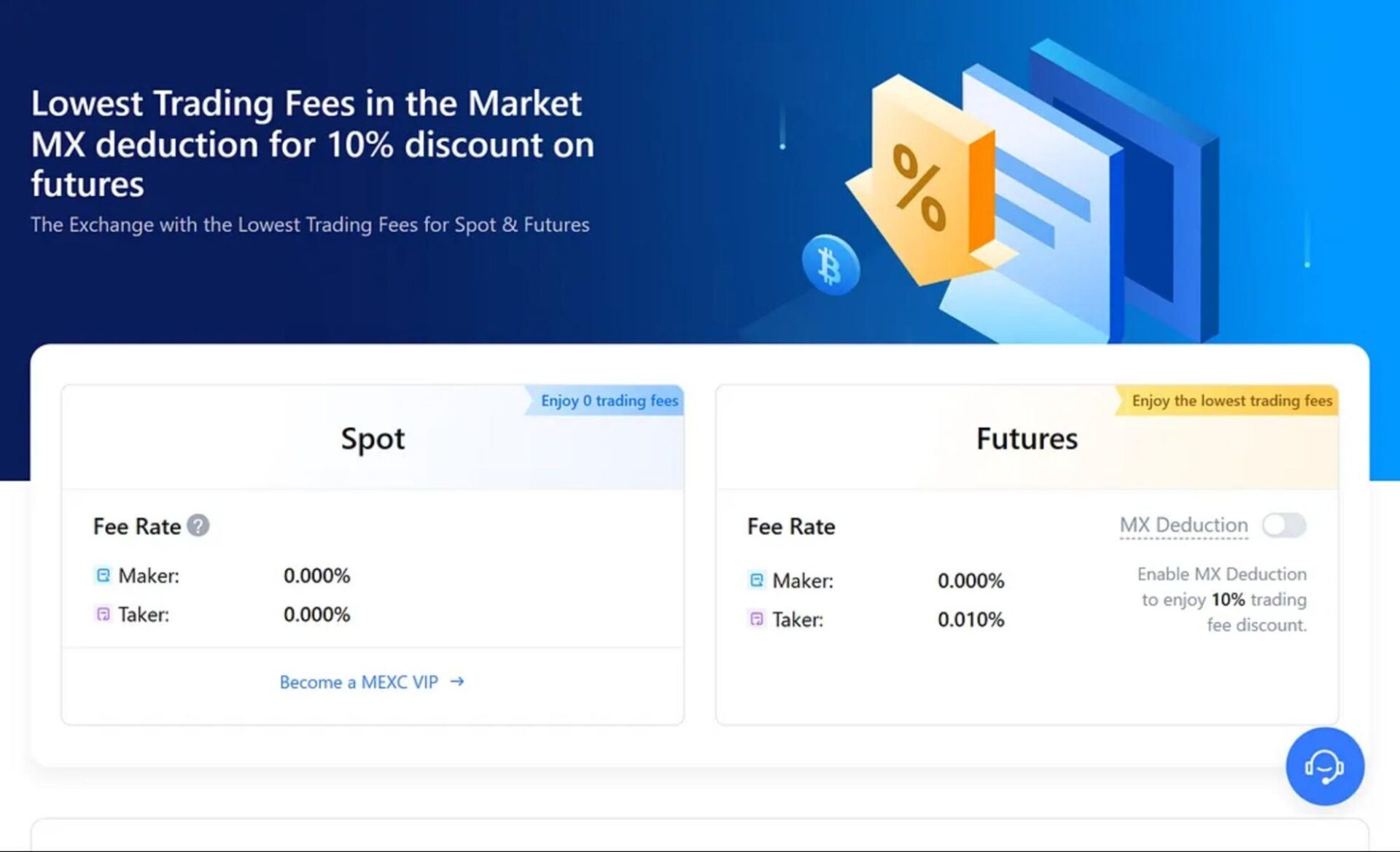

MEXC affords aggressive buying and selling charges to its customers. The MEXC maker price is 0.00% for spot buying and selling, and the taker price is 0.20%. For futures buying and selling, MEXC expenses a maker price of 0.00% and a taker price of 0.02%.

The crypto trade additionally has “particular buying and selling pairs.” These are pairs that futures and spot merchants can commerce at 0% maker and taker charges. MEXC is the very best zero-fee crypto trade because of its charges, which could be additional diminished based mostly in your buying and selling quantity and by holding the platform’s native token, MX.

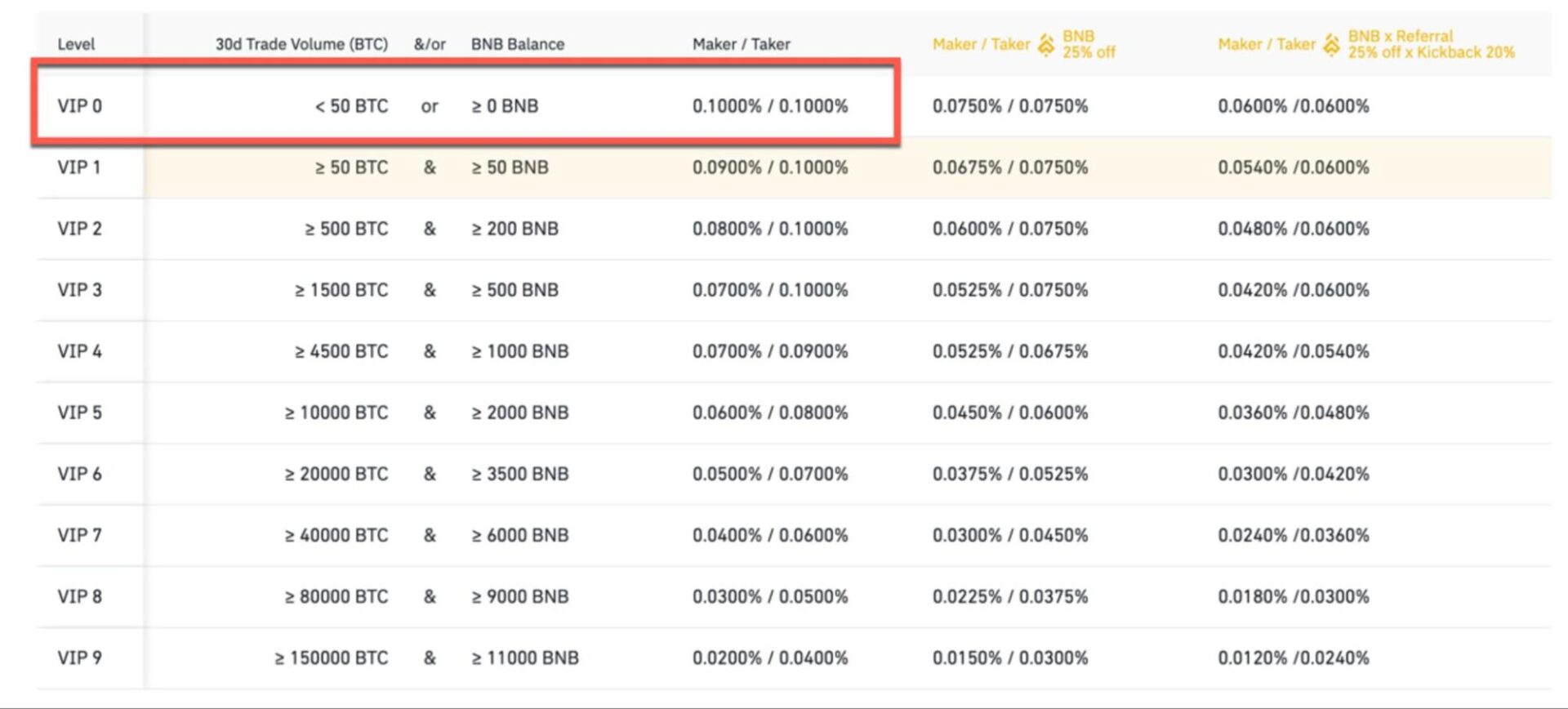

Conversely, Binance makes use of a tiered price system based mostly on a dealer’s 30-day buying and selling quantity. For those who’re an everyday consumer with lower than $15 million in buying and selling quantity, you’ll pay a regular spot buying and selling price of 0.10% for each makers and takers.

For futures buying and selling, the charges begin at 0.02% for makers and 0.04% for takers. The platform affords customers a 25% low cost on buying and selling charges by paying with Binance’s native token, BNB, and additional reductions can be found for high-volume merchants.

The charges for Binance USD-M Futures are 0.0200% for makers and 0.0500% for takers when utilizing USDT. Nevertheless, in case you are buying and selling with BUSD, the maker price drops to 0.0180%, whereas the taker price is 0.0450%. In the meantime, Coin-M Futures merchants are charged a 0.0200% maker price and a 0.0500% taker price.

MEXC vs Binance: Withdrawal Charges

Withdrawal charges on each platforms fluctuate relying on the particular cryptocurrency you withdraw. For instance, MEXC expenses 0.0003 BTC for Bitcoin withdrawals and 1 USDT for Tether (USDT) withdrawals.

Binance’s withdrawal charges are usually aggressive and rely on the cryptocurrency and community used; for example, the price for Bitcoin withdrawals is 0.0002 BTC.

It’s vital to notice that withdrawal charges are topic to alter based mostly on the blockchain community and the community circumstances. So, confirm the present charges on the respective platforms earlier than initiating a withdrawal.

Your buying and selling journey begins right here! Register on MEXC now and seize unique rewards as much as $1,000, plus a ten% price low cost!

MEXC vs Binance: What are Their Greatest Buying and selling Options?

MEXC’s finest options are its deep liquidity for altcoins, low buying and selling charges, MEXC Launchpad and Kickstarter, MEXC Futures M-Day, copy buying and selling, and a strong collection of futures buying and selling choices, together with leveraged ETFs.

The very best options of Binance are the Binance web3 pockets, NFT market, excessive liquidity, BNB vault, superior charting instruments, and Binance Launchpad and Launchpool. It additionally affords a number of incomes methods, similar to staking, financial savings, and liquidity farming.

MEXC vs Binance: What are Their Variety of Supported Cryptocurrencies?

MEXC and Binance are each widespread cryptocurrency exchanges, however they differ within the variety of property they help. MEXC helps greater than 2,800 cryptocurrencies, together with lesser-known altcoins. It additionally has round 3,696 buying and selling pairs, giving customers a variety of choices.

Binance, however, helps greater than 400 cryptocurrencies, with about 1,395 spot buying and selling pairs accessible. Fortunately, you’ll be able to commerce Bitcoin, the most well-liked altcoins, and a few newer altcoins, as Binance all the time provides new listings, particularly for promising initiatives.

Begin buying and selling on Binance now and luxuriate in a $100 rebate, a ten% lifetime price low cost, and unique advantages!

MEXC vs Binance: What are Their Safety Degree?

MEXC and Binance present robust security measures, however their safety measures differ. MEXC safety measures are listed beneath;

1. Common Safety Audits: MEXC conducts common safety audits via third-party cybersecurity corporations to examine for safety dangers.

2. 2FA: MEXC encourages customers to arrange two-factor authentication. This safety function requires customers to supply two verification kinds earlier than accessing their accounts. This may help MEXC customers forestall unauthorized entry to their accounts even when somebody steals their passwords.

3. Withdrawal Whitelist: You possibly can add a number of pockets addresses to the whitelist and withdraw funds to solely pre-approved pockets addresses. This safety function prevents hackers from transferring funds to any pockets handle not listed, even when they achieve entry to your account.

4. Chilly Pockets Storage: MEXC shops a major quantity of consumer funds in offline wallets (chilly wallets) relatively than on-line wallets (scorching wallets).

Binance safety measures are listed beneath;

Binance additionally makes use of chilly pockets, two-factor authentication, and withdrawal whitelist to guard customers’ funds from hackers. In addition they implement different safety measures like:

1. Anti-Phishing Codes: This helps customers acknowledge official emails from the trade. By setting a private Anti-Phishing code of their account. When you set it up, each electronic mail from Binance will carry that code. So, if you happen to obtain an electronic mail from Binance that doesn’t have the code, it’s possible a phishing try.

2. Safe Asset Fund for Customers (SAFU): Binance has put aside a reserve fund to compensate customers in case of safety breaches. To fund the reserve, Binance allocates 10% of its buying and selling charges to the SAFU fund, so if a hack happens, Binance will reimburse affected customers.

Who Ought to Choose MEXC over Binance?

MEXC is appropriate for Merchants who prioritize entry to new or low-cap tokens, no-KYC buying and selling, and decrease charges.

MEXC in a Nutshell

MEXC is a cryptocurrency trade based in 2018. The trade is understood for its wide selection of buying and selling choices and help for brand new and smaller altcoins. Whether or not you’re into spot buying and selling, futures, or margin buying and selling, MEXC has one thing for you.

MEXC affords its customers MEXC Financial savings, the place they’ll earn rewards by locking up their crypto property or taking part in yield farming. The trade has in depth options, however a user-friendly interface accompanies it.

Key Options of MEXC

MEXC stands out as one of many crypto exchanges with nice options designed to provide merchants extra alternatives to earn and develop their portfolios. A number of the finest options embody Spot buying and selling & Copy buying and selling, Futures M-Day, Launchpad, and Kickstarter.

1. Spot Buying and selling on MEXC

MEXC makes spot buying and selling easier and environment friendly by providing excessive liquidity and quick order execution. Most buying and selling pairs are pegged to USDT, and the platform’s superior dashboard offers you real-time insights into buying and selling volumes.

2. Copy Buying and selling on MEXC

If you’re new to buying and selling, MEXC’s Copy Buying and selling function means that you can comply with skilled merchants and robotically copy their strikes within the futures market. You possibly can comply with the merchants based mostly on their ROI, win fee, and general efficiency.

3. MEXC Launchpad

MEXC handpicks high-potential initiatives, and customers who maintain at the very least 2,000 MX tokens can simply earn free token airdrops. Suppose you maintain 1,000 MX tokens for 30 days. In that case, you may as well take part in non-lockup occasions and get rewarded based mostly on the variety of tokens you commit.

4. MEXC Kickstarter

This is a pre-launch voting occasion the place you’ll be able to again new initiatives by voting. If a mission will get sufficient help, everybody taking part will get free token airdrops. To affix, you want at the very least 500 MX tokens in your pockets 24 hours earlier than the occasion begins.

5. MEXC Futures M-Day

MEXC Futures M-Day is a particular occasion the place you’ll be able to earn rewards for buying and selling particular futures contracts. The extra you commerce, the extra lottery tickets you accumulate, rising your possibilities of successful free airdrops. Even if you happen to don’t win, taking part earns you free raffle tickets and futures bonuses, which you should utilize as buying and selling margins.

MEXC affords much more options not mentioned on this article; you’ll be able to take a look at this MEXC evaluation article to study extra concerning the trade.

Upsides & Downsides of MEXC

Upside: MEXC affords a variety of cryptocurrencies with low buying and selling charges and excessive liquidity. You possibly can commerce on MEXC with out KYC verification, and as a brand new consumer, you’ve got an opportunity to obtain as much as 8,000 USDT in sign-up bonuses. For those who’re on the lookout for the very best crypto sign-up bonuses, MEXC is a high contender. Learn this MEXC referral code article to learn the way to qualify for this unique reward.

Draw back: MEXC has restricted fiat help, rules across the platform are shaky, and buyer help could be gradual typically.

Who Ought to Choose Binance over MEXC?

Skilled merchants, institutional traders, and customers who prioritize excessive liquidity, regulatory compliance, and straightforward fiat transactions ought to decide Binance over MEXC.

Binance in a Nutshell

Binance is the world’s largest and hottest cryptocurrency trade by buying and selling quantity. It was based in 2017 by Changpeng Zhao (CZ) and shortly grew to become a go-to platform for brand new and skilled crypto merchants. Binance Trade has over 300 tradable cash, together with widespread tokens, meme cash, GameFi, and AI cash.

One among the massive perks of Binance is its low buying and selling charges; if you happen to use its BNB, you will get much more reductions. The platform additionally helps many and totally different buying and selling strategies like spot, margin, and peer-to-peer, together with varied order varieties similar to restrict, market, and stop-limit orders.

Key Options of Binance

1. Binance Web3 Pockets: Binance has a built-in Web3 pockets that lets customers simply change to and discover the Web3 ecosystem and decentralized finance (DeFi). The Web3 pockets is a gateway for Binance merchants to execute cross-chain token swaps, take part in unique airdrop campaigns, and discover varied decentralized functions.

2. Binance Referral Program: Binance has a referral program that encourages present customers to refer their buddies, household, and group to affix the platform in return for rewards and bonuses. The referral program is split into two arms: normal and lite. The primary offers you 20% lifetime reductions on buying and selling charges, whereas the second affords 100 USDT buying and selling credit score.

If you use our Binance referral code to register a brand new account, you’ll stand up to $100 price of presents, lifetime reductions on buying and selling charges, and different unique rewards you’d miss if you happen to registered a brand new account with out the referral code.

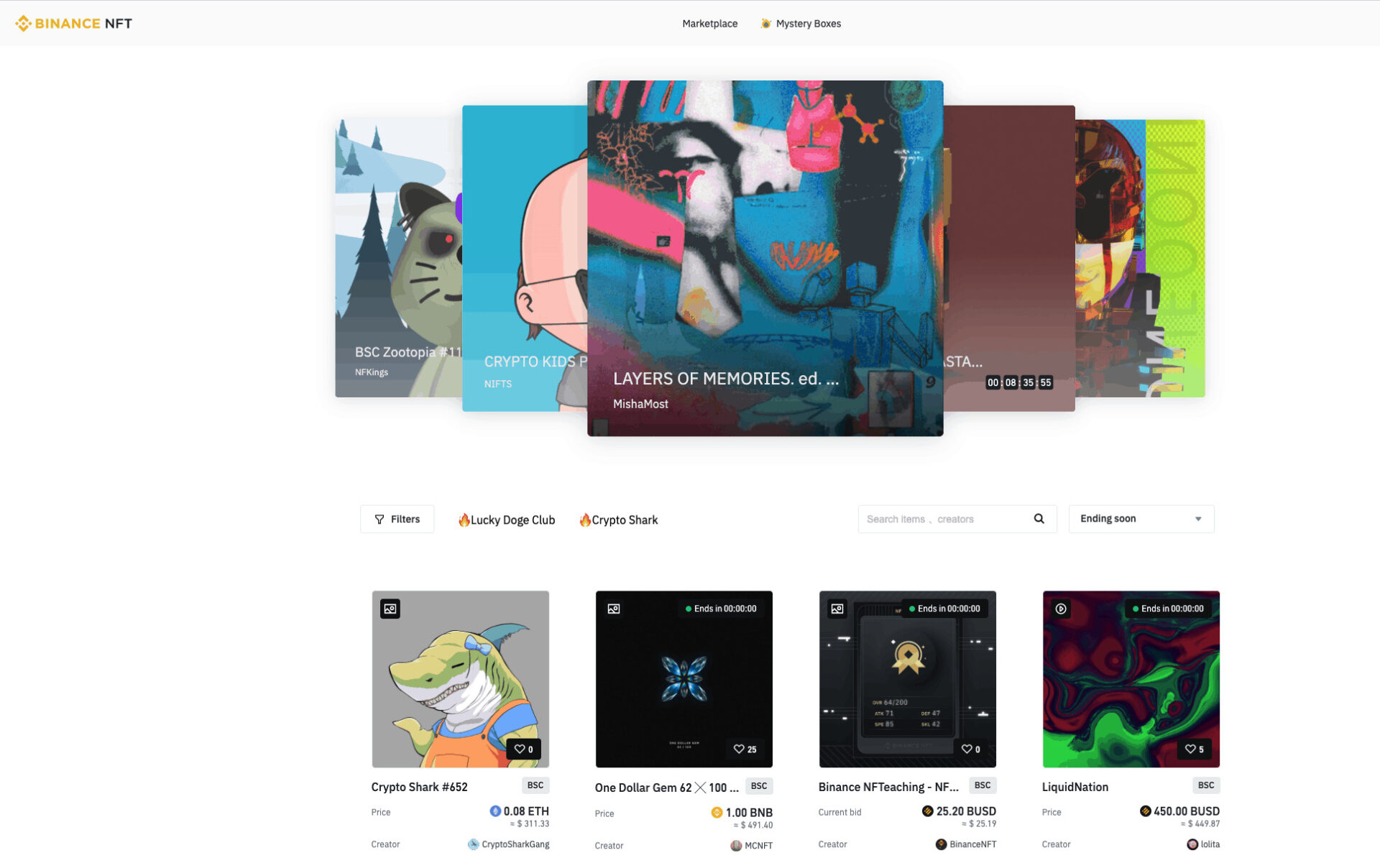

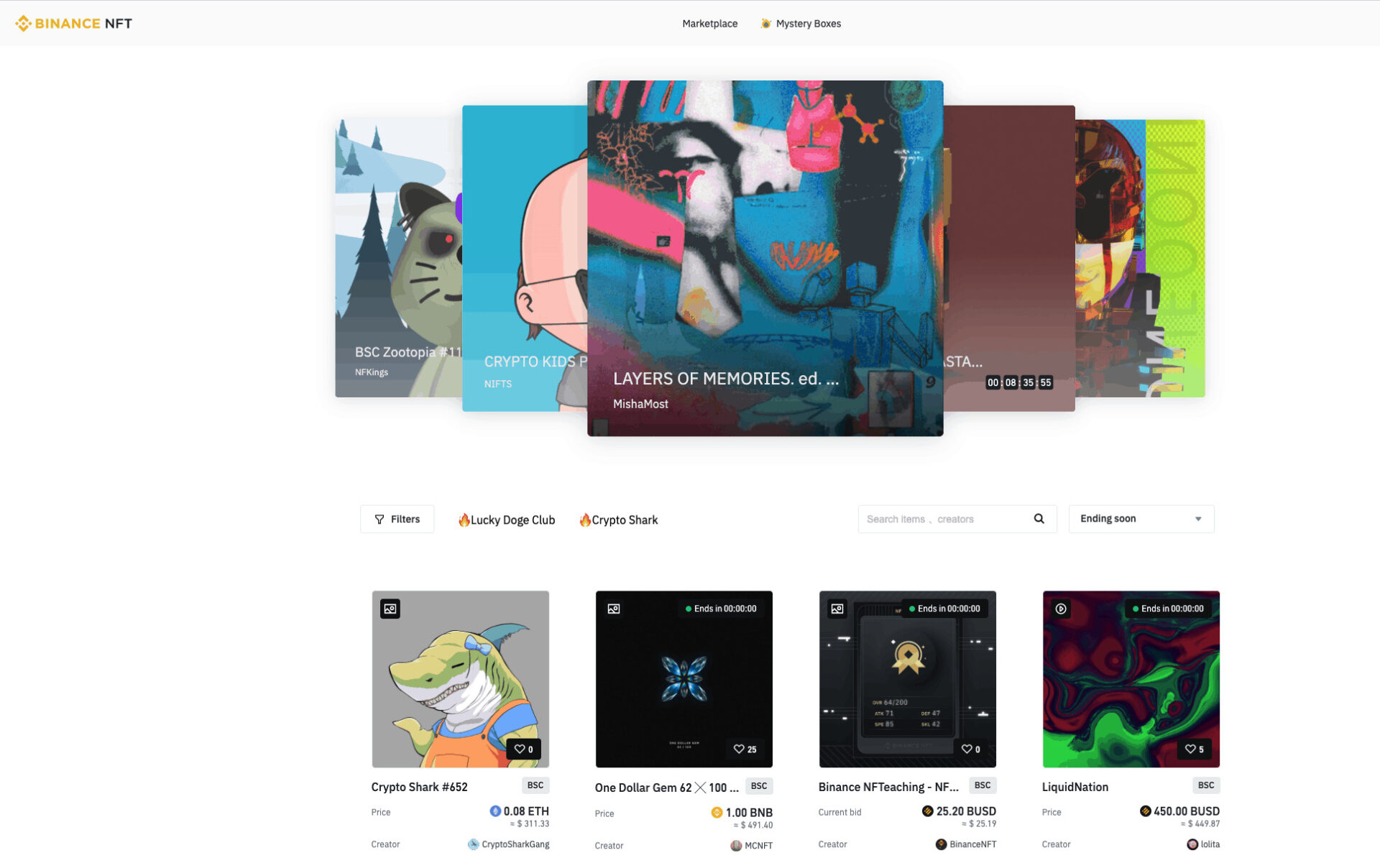

3. NFT Market: Binance has a completely outfitted NFT market for merchants to browse, mint, promote, bid on, and buy NFTs from digital creators. Itemizing and looking are free, and you’ll find among the hottest NFT collections, like Golden Ape Membership and BULL BTC CLUB.

Upsides & Downsides of Binance

Upsides: Binance has low buying and selling charges and gives primary and superior buying and selling options for brand new and skilled merchants. It additionally affords a number of incomes alternatives, similar to staking and financial savings. On this complete Binance evaluation, we mentioned extra options that make Binance a great trade.

Downsides: Binance has confronted regulatory scrutiny in a number of international locations, and the obligatory KYC is a deal-breaker for merchants seeking to commerce anonymously. Additionally, buying and selling on the trade may overwhelm new customers because of in depth product choices.