Earlier than MicroStrategy started shopping for Bitcoin in November 2020, it was extraordinary for a public firm to stack up “dangerous” cryptos. True, a number of the greatest cryptos to purchase have had greater than 100X since their launch. Nevertheless, the shortage of clear rules was an enormous impediment.

This quickly modified after Michael Saylor went all-in on Bitcoin, shopping for billions price of BTC. In January 2026, Technique bought shares and acquired over $3Bn of Bitcoin. To not be left behind, Metaplanet can also be executing its personal plan to boost funds and purchase Bitcoin.

第三者割当による新株式及び第 25 回新株予約権の発行に関するお知らせ pic.twitter.com/YPhua9p7d3

— Metaplanet Inc. (@Metaplanet) January 29, 2026

All that is taking place simply when the Bitcoin value is caught beneath $90,000, with hopes fading that the BTC USD value will break $100,000 within the subsequent two weeks. Sentiment stays bearish, however trying on the fundamentals, there may very well be an opportunity for consumers to indicate their hand.

Crypto Concern and Greed Chart

All time

1y

1m

1w

24h

DISCOVER: Greatest New Cryptocurrencies to Spend money on 2026

Earlier as we speak, Japan-listed Metaplanet accepted a plan to boost as much as $137M from abroad buyers to purchase extra Bitcoin and repay debt. Apparently, even after this information was made public, the Metaplanet inventory barely flinched after the submitting, an indication that markets already count on aggressive Bitcoin accumulation from the agency. If something, it exhibits that the market helps Metaplanet’s shift from a resort operator to a “Bitcoin Treasury Firm.”

Metaplanet will promote new shares and warrants to overseas buyers. Particularly, the increase is break up into two primary components to maximise capital whereas managing the dilution of present shareholders. They’re issuing 24.5 million new widespread shares at roughly $3 per share, aiming to boost roughly $78M instantly.

Metaplanet has closed its first institutional shares + warrants transaction to speed up our Bitcoin technique. Complete proceeds of as much as ¥21B, comprising ¥12.2B in shares issued at a 5% premium (¥499) and as much as ¥8.8B from 1-year warrants issued at a 15% premium (¥547 train… pic.twitter.com/OprgedN4Fd

— Simon Gerovich (@gerovich) January 29, 2026

Shareholders additionally accepted the issuance of 159,440 warrants, giving buyers the appropriate to purchase extra shares later at a hard and fast value. If all are exercised throughout the subsequent 12 months, it might usher in one other $56M.

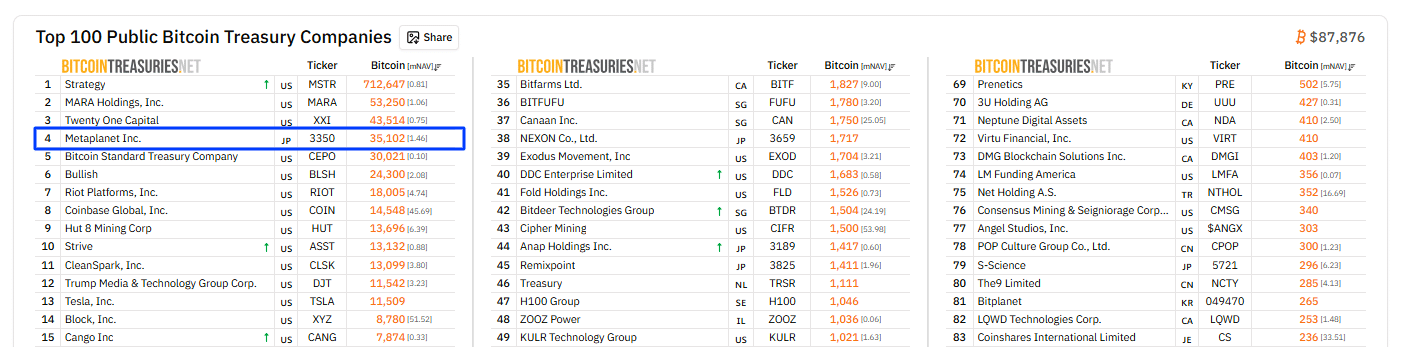

It must be famous that Metaplanet has been very clear about its Bitcoin shopping for plan. Out of the $137M, an enormous chunk will probably be allotted to purchasing Bitcoin. After they do, it’ll cement their place as one of many largest company holders globally.

(Supply: Bitcoin Treasuries)

One other portion of the raised quantity will probably be used to pay down present loans. Logically, clearing debt permits them to reload their credit score services. In flip, it will give them extra flexibility to borrow once more if the Bitcoin value dips.

Nevertheless, not like MicroStrategy, Metaplanet will probably be placing its BTC to work. For instance, they’re investing of their “Bitcoin Revenue” section. This division makes use of derivatives, like promoting put choices, to generate yield on its present holdings.

DISCOVER: Greatest Meme Coin ICOs to Spend money on 2026

Is This A New Playbook for Company Bitcoin Treasuries

Metaplanet calls itself a “Bitcoin Treasury Firm.” Meaning Bitcoin sits on the heart of its technique, not as a facet experiment. This mirrors the playbook utilized by MicroStrategy and mentioned in our information to company crypto treasuries. Nevertheless, they’re altering the sport in the case of elevating funds.

The corporate already holds tens of 1000’s of BTC price billions of {dollars}. By focusing on overseas buyers primarily by personal placements, Metaplanet is tapping right into a deeper pool of capital than what is usually obtainable to small-cap corporations on the Tokyo Inventory Change. That flexibility issues if you need to purchase Bitcoin throughout value dips.

The motivation is straightforward: Metaplanet is capitalizing on the excessive volatility of its personal inventory. As a result of the inventory typically trades at a “premium” to the precise worth of the Bitcoin the corporate owns, they’ll promote costly shares to purchase “low-cost” Bitcoin. This can be a play straight out of MicroStrategy’s playbook.

Moreover, the diversification away from the Yen means MetaPlanet is now, greater than ever, targeted on the BTC Yield, which is solely a measure of the quantity of BTC held per share. Regardless that shares will probably be diluted after the $137M increase, the BTC Yield will rise since they are going to personal extra BTC.

🔥METAPLANET MOON MATH🔥

Metaplanet had a 568.2% BTC Yield final 12 months.

Their small dimension helped.

Even assuming they by no means commerce at an enormous a number of, and assuming a a lot decrease BTC Yield, the returns are nonetheless ridiculous over the subsequent 5 years.

1× mNAV returns with a 75 % BTC… pic.twitter.com/92zLtbA9rz

— Adam Livingston (@AdamBLiv) January 5, 2026

Total, this can be a bullish signal for Bitcoin. When public corporations increase actual cash to purchase Bitcoin, it reinforces the concept establishments view BTC as a long-term hedge, not a fast flip. Company shopping for tightens provide. Bitcoin has a hard and fast cap, so when corporations lock it away on steadiness sheets, fewer cash commerce freely. That provide squeeze typically helps greater costs over time.

DISCOVER:

Observe 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Each day Professional Market Evaluation.

Why you may belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Professional contributors

2000+

Crypto Initiatives Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the newest updates, developments, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now