Bitcoin is as soon as once more below stress because it struggles to interrupt above $114,000 whereas failing to shut decisively under $110,000, creating a decent vary that displays uncertainty out there. Bulls are shedding floor as momentum shifts, and concern is starting to unfold amongst merchants and buyers. The lack to reclaim larger ranges highlights the burden of promoting stress, with some analysts warning of a potential deeper correction if demand doesn’t improve quickly.

Nonetheless, sturdy fundamentals proceed to assist the long-term market outlook. Institutional adoption stays a key driver, with extra firms quietly including BTC to their treasuries regardless of short-term volatility. Macroeconomic situations, notably rising inflation considerations, are additionally preserving Bitcoin related as a hedge, whilst markets wobble.

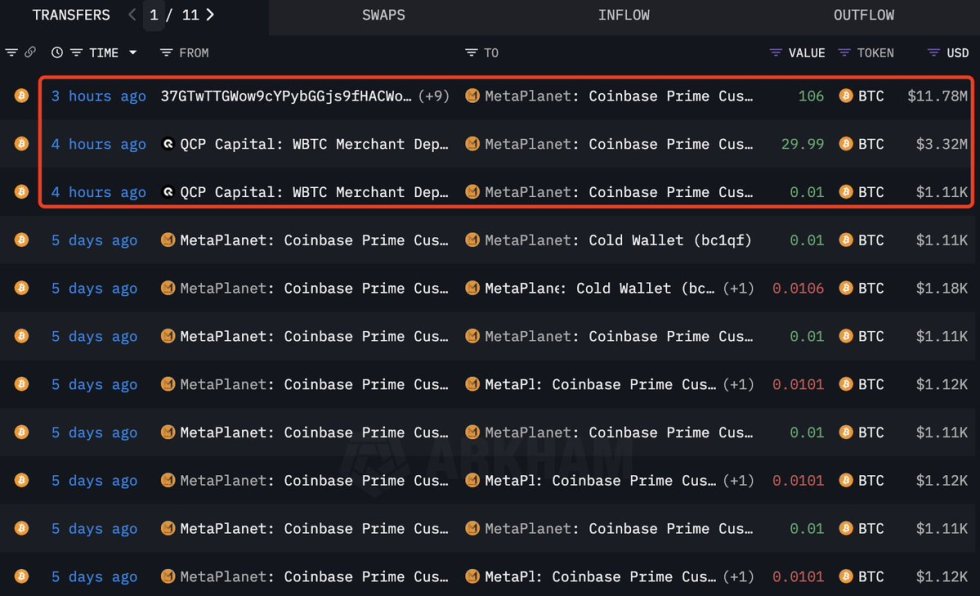

Including to this narrative, blockchain analytics platform Lookonchain reported that Metaplanet, Japan’s first and solely publicly listed Bitcoin Treasury firm, purchased one other 1.36 BTC ($15.26M) at a median value of $112,180. This buy pushes its holdings additional, reinforcing its long-term conviction in Bitcoin as a reserve asset.

Institutional Adoption Strengthens Bitcoin

In keeping with Lookonchain, Metaplanet now holds 20,136 BTC valued at roughly $2.24 billion, with a median buy value of $102,495. This milestone underscores the corporate’s conviction in Bitcoin as a long-term treasury asset. In contrast to many companies that solely experiment with small allocations, Metaplanet has cemented itself as Japan’s main company adopter of Bitcoin, reflecting a broader international shift in institutional methods.

You will need to word that not solely US-based companies equivalent to Technique, Bitmine, and SharpLink are driving crypto adoption. Japanese firms like Metaplanet are additionally coming into the world, showcasing Bitcoin’s growing attraction as a treasury reserve asset past US borders. This diversification in adoption additional validates Bitcoin’s position as a world retailer of worth.

Trying forward, the approaching weeks can be decisive. Traditionally, September has been thought-about a bearish month for Bitcoin, with many analysts anticipating additional corrections. But, markets typically defy seasonal expectations, and this yr may carry surprises if each Bitcoin and Ethereum handle to reclaim larger ranges. With BTC holding above key assist zones and establishments steadily including to their treasuries, sentiment might rapidly shift from warning to optimism.

Dealing with Consolidation Above $110K

Bitcoin is buying and selling round $112,019, displaying indicators of stabilization after weeks of volatility and sharp pullbacks from its all-time excessive close to $124,500. The chart highlights how BTC is making an attempt to construct a base above the $110K stage, which has grow to be a key demand zone. The worth is at the moment holding above the 100-day SMA (inexperienced line) at $111,980, signaling that bulls are defending vital medium-term assist.

Nevertheless, momentum stays fragile. The 50-day SMA (blue line) is trending downward, displaying that short-term sentiment remains to be below stress. The 200-day SMA (pink line), sitting a lot decrease at round $101,824, marks a long-term security internet, however a retest of this stage would sign a a lot deeper correction. For now, the battle stays between holding the $110K–$112K vary and reclaiming the $115K zone, which is the subsequent resistance aligned with the declining transferring averages.

If bulls handle to shut decisively above $115K, the trail towards a retest of $123K resistance may open. On the draw back, a break under $110K would doubtless speed up promoting stress, exposing BTC to $105K and even deeper. General, the chart reveals consolidation, with patrons making an attempt to regain management amid cautious sentiment.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.