On 22 August 2025, the altcoin king managed to breach its earlier all-time excessive (ATH) of $4,885, achieved in November 2021. The brand new ATH now stands at $4,866. Is it the very best crypto to purchase now? Business insiders definitely suppose so.

The market projection for ETH is quickly turning bullish. Customary Chartered has revised its year-end 2025 worth goal to $7,500, up from $4,000. Additional, it predicted that ETH will attain $25,000 by 2028.

ETH surged by greater than 15% on 22 August 2025 after Federal Reserve Chair Jerome Powell hinted at an upcoming fee lower, prompting traders to show up the ante.

As of this writing, ETH’s worth has decreased barely, buying and selling across the $4,770 degree.

24h7d30d1yAll time

In accordance with crypto analytics and buying and selling platforms like Hyblock, this rally in ETH is basically completely different from its earlier peaks. Hyblock maintains that on this case, the worth motion is being pushed by real demand relatively than early traders offloading provide and stalling momentum.

Now that the ETF influx is accelerating and the treasury is starting to undertake ETH, paired with the tailwinds from the GENIUS Act, the altcoin is perhaps getting into a section of maximum bullishness.

THE WHALE PLAYBOOK

One Bitcoin OG retains shifting BTC into ETH.Newest shift: 4,000 $BTC ($460M).

Totals up to now:– 179,448 $ETH purchased ($806M)– Avg worth $4,490– Nonetheless lengthy with 135,265 ETH ($581M)

He’s not speculating, he’s constructing conviction.

The one query:What does… pic.twitter.com/HNNHM5IUqg

— Merlijn The Dealer (@MerlijnTrader) August 24, 2025

ETH ETFs on 21 August 2025, recorded $287.6 M in inflows after witnessing 4 straight days of outflow. Supported by the inflows, the overall ETF holdings have pushed previous $12.12 B because the feels a renewed institutional confidence.

In the meantime, company treasuries are accumulating quietly within the background. BitMine, SharpLink, BTCS and GaneSquare have collectively added round $1.6B in ETH during the last month, pushing whole company reserves to $29.75B.

EXPLORE: Prime 20 Crypto to Purchase in 2025

BTC Sustaining At $114k. Is It Nonetheless The Greatest Crypto To Purchase Now? Or Is An Altcoin Season Coming?

Whereas BTC noticed a bump as much as the $117k degree on 22 August 2025, it has since then slid again all the way down to the $114k zone and is sustaining. This draw back in efficiency has coincided with ETH’s rally, resulting in it breaching its ATH.

24h7d30d1yAll time

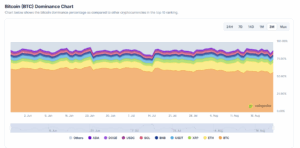

BTC is dealing with an outflow downside. BTC’s share of the crypto market capitalisation has fallen under 60% for the primary time in 4 months. As of this writing, its market dominance sits at 56.6%, based on CoinGecko’s information.

At its peak this 12 months, BTC commanded 66% of the overall crypto market capitalisation.

(BTC Dominance Chart)

Waning BTC efficiency alerts a transparent shift in investor behaviour. They’re rotating capital into altcoins, notably into large-cap property like ETH, chasing the next yield potential.

BTC created a CME worth hole on 23 August 2025 after shedding roughly 1.87% because the session’s open. Such gaps have traditionally been stuffed fairly shortly, which signifies that BTC might doubtlessly rebound in the direction of $117k within the close to time period.

$BTC has fashioned a $2000 CME Hole

I’ve bought a cautious learn on this hole. Its dimension is notably bigger than prior ones, which suggests it might take longer to fill.

Watch out in case you are making an attempt to focus on this on the LTF. pic.twitter.com/Cmng2FdLEO

— Killa (@KillaXBT) August 23, 2025

The RSI is in a impartial territory however trending downward. In the meantime, the MACD reveals a bearish divergence. Each technical indicators counsel a waning of momentum. Moreover, a drop in buying and selling quantity suggests a weakening of shopping for stress.

Apparently, current worth motion reveals hammer-like candles with lengthy wicks forming close to the $112k help zone, suggesting that consumers are defending this place.

If BTC holds above the 112k degree and manages to breach the $117k degree decisively, bullish momentum will carry it ahead, the place upside targets might emerge at $120.9k and $124.5k, aligning with the higher Fibonacci retracement zone.

#Bitcoin is holding $112K help after hammer candles signaled purchaser protection. A break above $117K might unlock targets at $120.9K–$124.4K, with $130K in play. 📊 pic.twitter.com/zgjCHY14F4

— Arslan Ali (@forex_arslan) August 24, 2025

On the draw back, a break under $112k might see BTC take a look at $108.7k with a deeper help at $105.2k.

EXPLORE: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Xai Sues Elon Musk’s xAI in Battle Over Blockchain Gaming Trademark

Ethereum-based gaming firm XAI has sued Elon Musk’s synthetic firm xAI, accusing it of trademark infringement and unfair competitors.

The go well with was filed on 21 August 2025 by Ex Populus, the Delaware company behind XAI.

It claimed that XAI has been utilizing the “XAI” trademark since June 2023 in reference to its blockchain gaming ecosystem and $XAI tokens.

The submitting notes, “Plaintiff isn’t solely being irreparably harmed by the lack of management over its hard-earned goodwill in its XAI Trademark… but additionally Plaintiff is broken as a result of the complicated affiliation with Elon Musk is leading to vital damaging client sentiment.”

𝗫𝗔𝗜 𝗧𝗔𝗞𝗘𝗦 𝗠𝗨𝗦𝗞 𝗧𝗢 𝗖𝗢𝗨𝗥𝗧#Ethereum gaming community $Xai is suing Elon Musk’s xAI for trademark infringement and market confusion.

In the meantime, $XAI is down -96.7% from its ATH of $1.60 (Mar 11, 2024).

Do you suppose Musk will simply purchase out Xai? If he does…how excessive… pic.twitter.com/qUfxbrxa9r

— Clever Recommendation (@wiseadvicesumit) August 24, 2025

The conflicts escalated when Musk’s xAI introduced plans to enter the gaming area, creating widespread market confusion and repute harm.

Moreover, the lawsuit claimed that Musk’s authorized group tried to stress them into releasing its trademark, whereas the US Patent Workplace has already suspended a number of of xAI’s purposes attributable to potential conflicts.

The lawsuit goals to dam Musk’s firm from utilizing the “xAI” identify in gaming and blockchain contexts and is asking for damages.

EXPLORE: 20+ Subsequent Crypto to Explode in 2025

Maelstrom CEO Arthur Hays Predicts Ethereum To Hit $20,000

Maelstrom’s CEO, Arthur Hays, has mounted his Ethereum worth goal vary between $10,000 and $20,000 by the tip of the present bull cycle. His prediction hinges on a number of macro and crypto native components.

Arthur Hayes simply admitted he purchased again ETH as a result of “the chart says it’s going larger.”

He sees Ethereum working as much as $20K this cycle.

When requested $ETH vs $SOL?

He’s chubby $ETH 🚀 pic.twitter.com/Yd3q1t0aCe

— SamAlτcoin.eth 🇺🇸 (@SamAltcoin_eth) August 21, 2025

One key issue for Hays’s prediction is his perception that the Trump administration will undertake main quantitative easing, a financial coverage that enables for brand spanking new cash to be created that’s then used to buy monetary property.

Hays expressed his ideas on the Crypto Banter podcast to Ran Neuner, stating, “Now we have from the center of 2026 till Trump leaves workplace for them to go completely insane with how a lot they’re going to print.”

EXPLORE: Greatest New Cryptocurrencies to Spend money on 2025

World Liberty Token Causes Aave To Drop Over 10%

The worth of Aave fell sharply by 10% during the last twenty-four hours following social media rumours a few token allocation cope with World Liberty Monetary (WLFI), a decentralised monetary (DeFi) platform linked to members of President Trump.

Blockchain reporter Colin Wu stated, “The WLFI group advised WuBlockchain that the declare that ‘Aave will obtain 7% of the overall WLFI token provide’ is fake and faux information.”

The WLFI group advised WuBlockchain that the declare that “Aave will obtain 7% of the overall WLFI token provide” is fake and faux information. Beforehand, a neighborhood member claimed that, based on a beforehand launched proposal, AaveDAO would obtain 20% of the protocol charges generated by…

— Wu Blockchain (@WuBlockchain) August 23, 2025

Wu on his X was referencing a neighborhood proposal from October 2024 that advised Aave’s DAO would obtain 7% of WLFI’s token provide and 20% of protocol revenues from WLFI’s deployment from Aave v3.

Whereas WLFI denied these claims, Aave’s founder, Stani Kulechov, referred to the proposal as “the artwork of the deal” and implied the phrases have been nonetheless legitimate.

Following this, Aave dropped from $385 to $339, later rebounding to $352.

This controversy comes amid renewed curiosity in DeFi, with TVL (whole worth locked) climbing previous $167 billion.

EXPLORE: The 12+ Hottest Crypto Presales to Purchase Proper Now

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s group members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Knowledgeable contributors

2000+

Crypto Initiatives Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the newest updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now