The crypto market continued to say no on Thursday and right now, October 17, following renewed world uncertainty after former U.S. President Donald Trump’s feedback about imposing 100% tariffs on Chinese language imports. The specter of commerce disruption pushed traders towards defensive property, weighing on each equities and digital currencies. With market sentiment sinking, merchants at the moment are questioning whether or not this correction might current the very best crypto to purchase alternative earlier than year-end.

Complete crypto market capitalization fell 4.67% to $3.61 trillion, whereas the CMC20 Index dropped 5.4%. Bitcoin

2.95%

traded close to $104,900, down 5.3% in 24 hours and 12.18% over the week. Ethereum

2.22%

slipped beneath $3,700, whereas Solana

4.92%

now at $176,

5.22%

, and Cardano

5.13%

every declined between 7% and 9%.

The Crypto Concern & Greed Index dropped to twenty-eight (“Concern”), signaling weakened sentiment. The typical crypto RSI of 35.88 additionally factors to oversold situations throughout main property.

EXPLORE: High 20 Crypto to Purchase in 2025

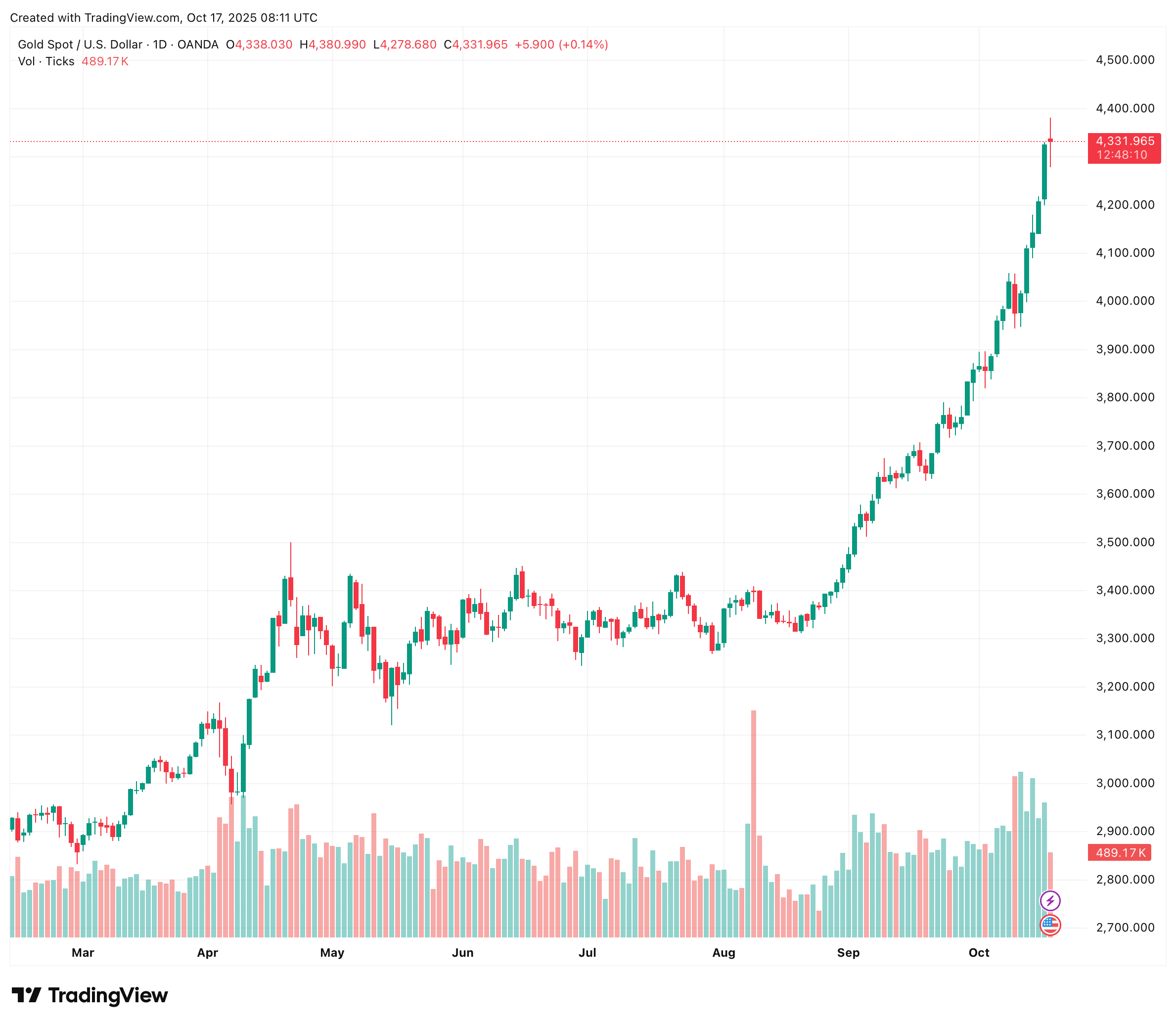

Gold Extends Report Rally as Traders Shift to Protected-Haven Belongings

Gold costs continued their record-breaking climb for a fourth consecutive day on Thursday, October 16, as merchants moved away from threat property amid escalating U.S.–China commerce tensions and rising fears of a U.S. authorities shutdown. Spot gold surged 3% to $4,380 per ounce.

(Supply: TradingView)

Gold has now gained greater than 60% in 2025, supported by geopolitical uncertainty, expectations of Federal Reserve price cuts, sturdy central financial institution demand, and a continued transfer towards de-dollarisation. Analysts attribute a lot of the rally to renewed safe-haven shopping for, with traders more and more diversifying away from unstable equities and crypto property.

In the meantime, Washington’s criticism of China’s rare-earth export restrictions and Trump’s plan for one more summit with Russian President Vladimir Putin added to geopolitical uncertainty. The U.S. Federal Reserve is now broadly anticipated to chop charges twice earlier than year-end, with October and December possibilities at 98% and 95%, respectively.

Reflecting the broad transfer into valuable metals, silver rose 1.8% to US$54.04 per ounce, setting a brand new file at US$54.15, whereas platinum superior 3.2% to US$1,706.65, and palladium jumped 4.6% to US$1,606.00.

DISCOVER: Why Is Crypto Crashing? Did Robinhood Simply Mark the Finish of the Cycle?

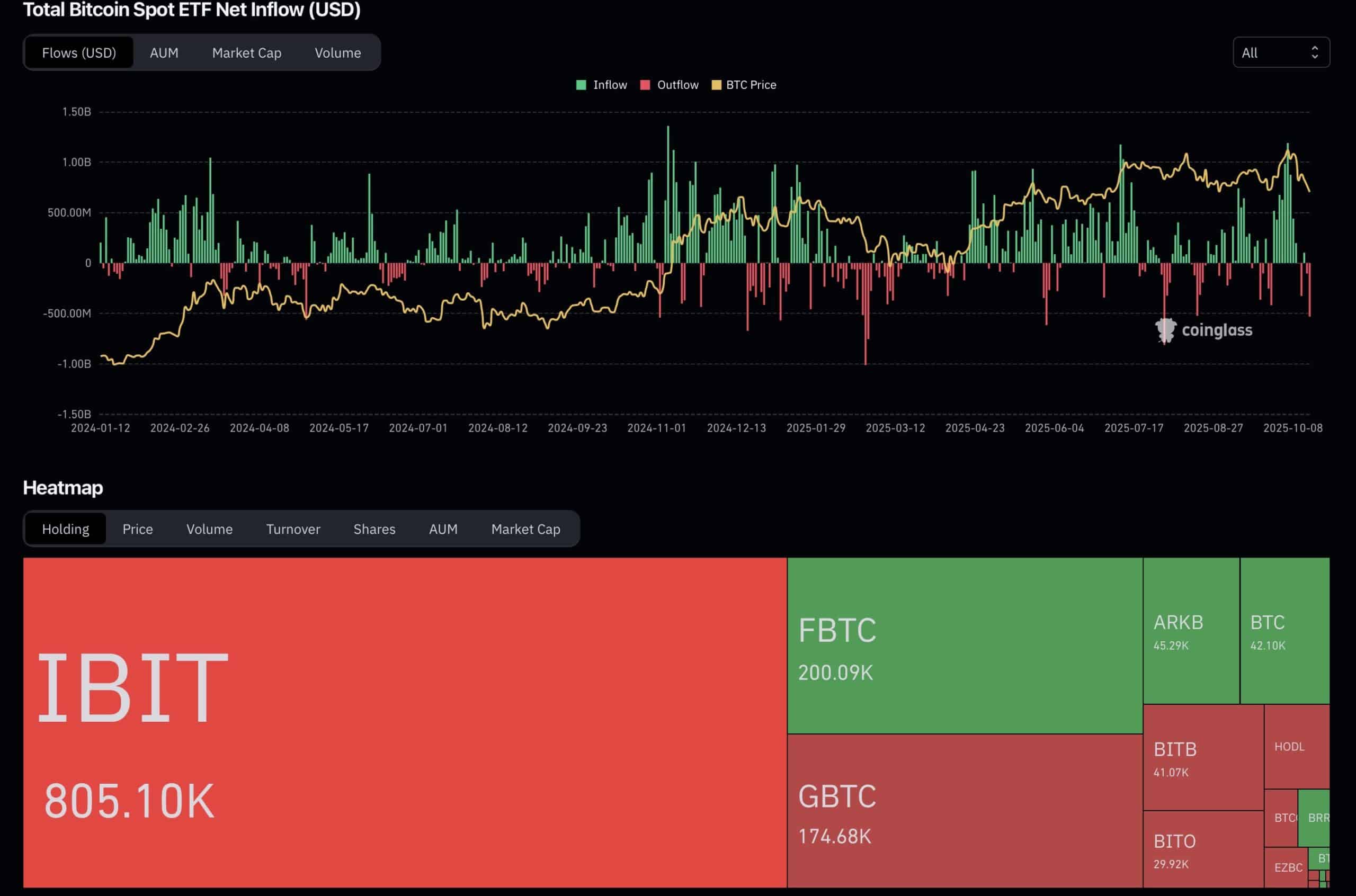

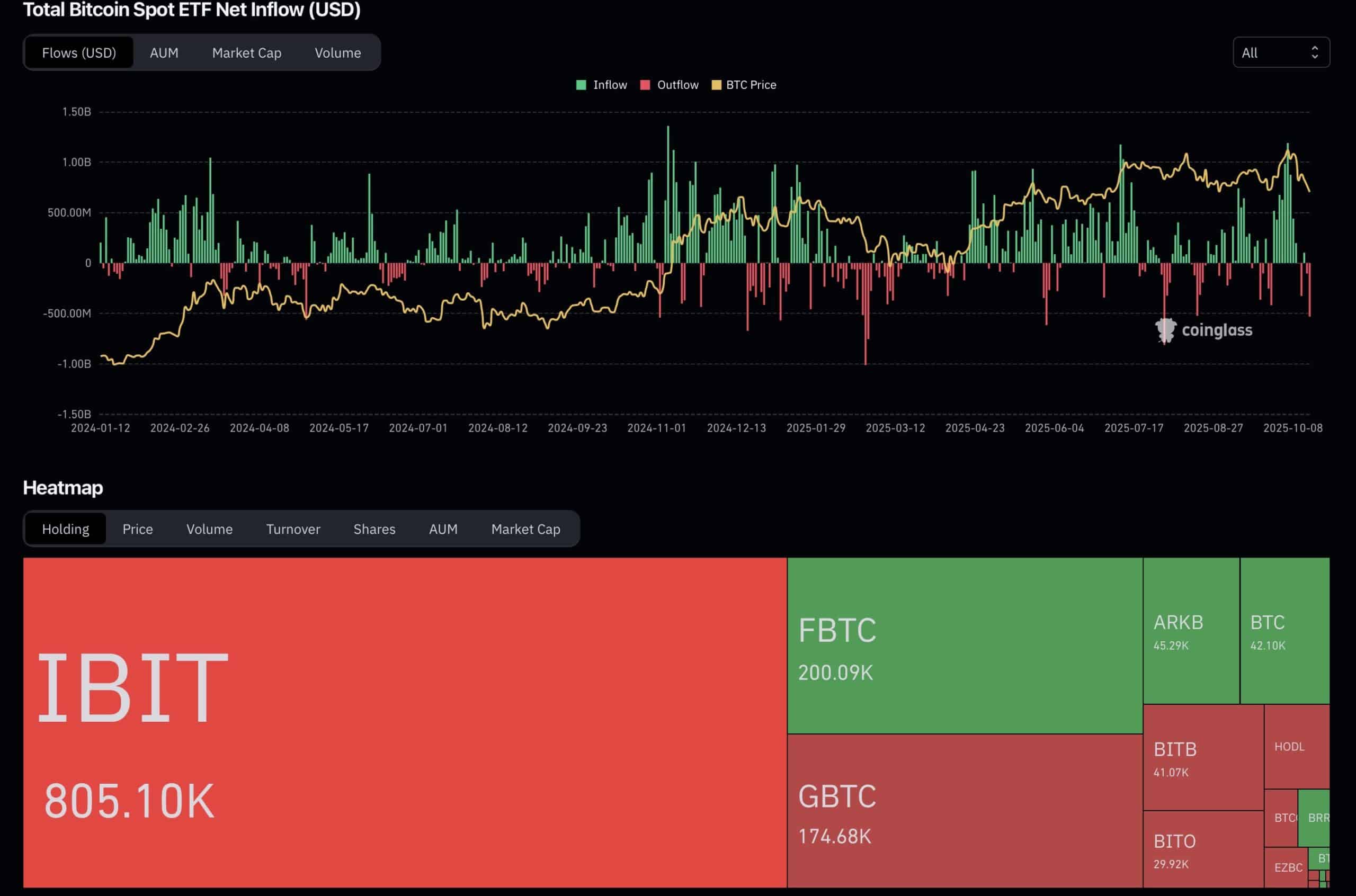

ETF Outflows Increase Warning, Merchants Ask: What’s the Finest Crypto to Purchase Now?

On October 16, U.S. spot Bitcoin ETFs reported $536 million in web outflows, the most important single-day withdrawal since August. Not one of the twelve funds recorded inflows, whereas Grayscale’s GBTC and Constancy’s FBTC led redemptions. Spot Ethereum ETFs noticed $56.88 million in outflows, with BlackRock’s ETHA the one one to publish a small influx.

Bitcoin is now testing key help close to $104,000, a stage that beforehand triggered $2.1 billion in liquidations. The continued correction displays a mixture of trade-related nervousness, institutional withdrawals, and derivatives stress.

Whereas sentiment stays weak, analysts are watching whether or not ETF flows stabilize and if present costs might signify long-term accumulation zones.

For traders assessing alternatives amid worry, upcoming periods could assist establish the very best crypto to purchase as market volatility settles.

Bitcoin’s Rollercoaster: $103,500 Landing Alerts Potential Backside?

Bitcoin’s wild experience hit a nerve-wracking low of $103,500 right now, October 17, 2025, earlier than clawing again to $104,907. For the primary time since July, BTC dipped beneath $106,000, erasing billions in leveraged longs amid a historic liquidation cascade. However is the ache lastly easing?

A snapshot of alternate futures reveals the bearish warmth:

Platforms like Binance (42.91% lengthy vs. 57.09% quick, $3.61B longs/$4.81B shorts) and Bybit (41.06% lengthy/58.94% quick) present overwhelming quick dominance, fuelling the sub-$100K push.

KuCoin’s $73M longs pale in opposition to $107M shorts, underscoring the squeeze.

Whispers of doom linger: shedding $104K might unleash a cascade to $98K, per analysts eyeing liquidity voids. But, worry could breed alternative.

Crypto dealer James Wynn, recent off a brutal 10x PEPE lengthy liquidation, flipped to a 10x PUMP quick. However let’s be truthful, his efficiency prior to now few months… is disappointing. As Wynn flips bearish, might this sign that lastly the underside is in?

As James (@JamesWynnReal) bought liquidated on his $PEPE (10x) lengthy place, he opened a $PUMP quick place with 10x leverage.

Basic name to go lengthy on $PUMP? NFAhttps://t.co/1hAeECtml2 pic.twitter.com/Bd605dM9C0

— Onchain Lens (@OnchainLens) October 17, 2025

Binance Is Returning to Seoul: Will South Korea Crypto Greenlight Set off New Binance Listings?

Binance has secured regulatory approval to take majority management of GOPAX, marking its official return to the South Korean crypto market after greater than two years of scrutiny.

The Monetary Intelligence Unit (FIU) confirmed the approval on Wednesday, ending a chronic deadlock that had delayed its reentry since its 2021 exit over tighter banking and AML laws. In the meantime, an all-new crypto market presale is about to blow up if the bull market returns in This autumn.

GOPAX mentioned the board change was a part of “enhancing administration stability and assembly essential regulatory necessities.” – GOPAX

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Is Binance Taking Over The Crypto World Earlier than Coinbase?

99Bitcoins analysts imagine the approval is a regulatory milestone quite than a market disruptor. Upbit and Bithumb nonetheless dominate South Korea’s alternate panorama, commanding roughly 72% and 24% of the market share, respectively, in accordance with Kaiko Analysis.

This indicators reconciliation with regulators, however not a serious disruption to Korea’s buying and selling panorama,” one Seoul-based analyst instructed Decrypt.

Learn The Full Article Right here

Uniswap Provides Solana Help: Swap Solana Tokens Straight from the Net App

Beginning right now, Uniswap is rolling out native help for Solana, permitting customers to attach their Solana wallets and swap Solana tokens straight from the Uniswap Net App. This integration provides Solana to Uniswap’s rising checklist of supported networks, which already consists of Ethereum, Base, Unichain, and 13+ others.

The replace addresses one of many neighborhood’s most-requested options. Solana has rapidly turn out to be a serious DeFi hub with over $11.4 billion in whole worth locked (TVL), however till now, Uniswap customers needed to change apps to commerce Solana property.

Why you’ll be able to belief 99Bitcoins

Established in 2013, 99Bitcoin’s group members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Knowledgeable contributors

2000+

Crypto Initiatives Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the newest updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now