The current Fed (Federal Reserve) fee reduce and information in regards to the US-China commerce realignment has created some favorable tail wind for riskier belongings equivalent to BTC, nonetheless, opposite to the collective hopes of many, the market has not but discovered its footing.

For now

0.25%

is consolidating and has stabilized above $110,000, posting a 0.98% acquire the in final 7 days and 0.50% within the final 24 hours.

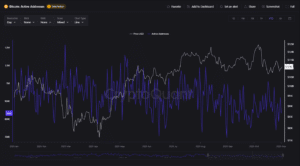

BTC has been shifting sideways between the 100-dam SMA (Easy Transferring Common) $114,194 and the 200-day SMA performing as assist at $109,763. The decrease finish close to $109,000 has constantly attracted robust shopping for curiosity.

(Supply: TradingView)

The higher finish close to $114,000 is the place many of the revenue taking is going on. This forwards and backwards exhibits that the market is at present balanced, with purchaser and sellers evenly matched.

For BTC to regain its upward momentum, it must decisively breach its 100-day MA or maintain on to its 200-day MA for assist.

If BTC manages to shut above the $114k degree on the each day chart, it might escape and head in the direction of $120k and even $122k. Nonetheless, if it slides beneath $108k, it would fall additional to the subsequent assist zone the place consumers are prone to step in, across the 102k or the 104k degree.

EXPLORE: Subsequent 1000X Crypto – Right here’s 10+ Crypto Tokens That Can Hit 1000x This 12 months

BTC Value Information: 4 Hour Chart Evaluation Reveals BTC Consolidating Earlier than A Breakout

On the 4-hour chart, BTC worth retains bouncing off the $108k -$109k degree, which is performing as a flooring the place consumers step in. Every time it bounces off of this degree, its worth makes a better low, displaying power.

Nonetheless, it hasn’t been capable of breach the $115k degree, which is performing as vendor stronghold.

For now, the worth swings are getting smaller and the strain is constructing earlier than its potential breakout. It BTC climbs above $116k, it might generate additional momentum to deal with $115-$116k ranges.

$BTC worth is approaching the $111,075 resistance degree. A sustained break above this degree would counsel that no less than wave-(C) is unfolding to the upside. pic.twitter.com/VCGaMeZt5M

— Man of Bitcoin (@Manofbitcoin) November 2, 2025

Nonetheless, if it drops beneath $108k, it would check the subsequent assist zone at $102k.

Both means, till certainly one of these ranges give, BTC worth motion will proceed to maneuver forwards and backwards between this vary earlier than its breakout.

EXPLORE: Greatest New Cryptocurrencies to Spend money on 2025

BTC Community Exercise Slows, However $108k Help Holds Agency

In one other BTC information, although BTC worth is up and has stabilized above $110k, the variety of lively addresses have slowly dropped. This often signifies that the market is cooling off a bit.

(Supply: CryptoQuant)

Hypothesis clever, it seems to be like merchants are taking earnings, or are ready for the subsequent transfer. Nonetheless, the present market exercise is greater than that it was throughout the 2024 accumulation part, suggesting that the market isn’t in panic mode as of but.

In actual fact, related dips in handle exercise close to worth assist ranges have come simply earlier than an enormous shopping for part and pattern reversals, like what occurred in late 20223 or mid 2024.

If the variety of lively addresses begin to stabilize whereas BTC worth holds regular between $108 -$110k, it could possibly be an indication that buyers are quietly accumulating once more.

EXPLORE: Prime 20 Crypto to Purchase in 2025

Is BTC Mining Serving to Decrease Energy Prices In Texas?

Based on a current Forbes article, Bitcoin mining, usually criticized for its vitality consumption, is unexpectedly contributing to cheaper electrical energy in Texas.

Per the article, Mining operations within the area are more and more partnering up with renewable vitality suppliers, particularly wind and photo voltaic farms to absorb extra vitality that might in any other case go to waste.

Throughout the interval of low vitality demand, miners act as versatile shoppers, shopping for surplus electrical energy and stopping worth crashes. Likewise, when demand spikes, miners can rapidly shut down, releasing up energy for households and companies.

Texas is Bitcoin nation. 🤠

The Lone Star State is primary in Bitcoin mining, boasting practically 30% of the nation’s hashrate.

It is also 1 of three states to move a Strategic Bitcoin Reserve invoice. pic.twitter.com/O6FBrhCzkv

— Bitcoin Voter Mission (@BitcoinVoter) October 29, 2025

This balancing act reduces pressure on the grid and helps keep away from blackout.

Furthermore, Texas’s deregulated vitality market and entry to ample renewable assets make it an excellent hub for this synergy to exist.

Discover: 20+ Subsequent Crypto to Explode in 2025

BTC Ain’t Lifeless But: Brace For A 70% Drop

Based on Vineet Budki, CEO of a enterprise capital agency, Sigma Capital, BTC will proceed to observe its sample of rising sharply after which falling laborious.

He believes that throughout the subsequent countdown, BTC might drop by as a lot as 70%, primarily as a result of many merchants don’t perceive what they’re investing in and that this sort of 65-70% retracement might occur within the subsequent two years.

Even with this warning nonetheless, Budki is optimistic about BTC’s long run future. He predicts that BTC might attain $1 million throughout the subsequent decade.

🚨 Bitcoin’s 4-12 months Cycle Nonetheless Intact, Says VC – Predicts 70% Drawdown in Subsequent Crash

Bitcoin’s legendary four-year cycle will not be useless in spite of everything and the subsequent downturn could possibly be brutal.

Based on Vineet Budki, CEO of Sigma Capital, Bitcoin’s worth might fall as a lot as 70%… pic.twitter.com/1ghhXVfNfT

— CryptoBullish X (@CryptoBullish_X) October 31, 2025

Additional extra, he mentioned that the expansion will come not simply from folks betting on worth will increase but additionally from BTC getting used extra in on a regular basis life.

EXPLORE: Greatest New Cryptocurrencies to Spend money on 2025

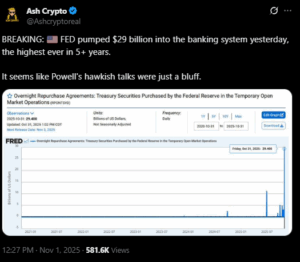

BTC Bounces To Above $110k After Fed Liquidity Increase

The Fed injected $29 billion within the the US banking system and the crypto market reacted immediately. BTC, ETH and the broader crypto market rebounded by 2% after a number of days of losses to $3.71 trillion.

The FED’s money increase was not meant to flood the financial system with cash. As a substitute it was a short lived repair to ease strain from the banking system. Analyst Ash Crypto summed up this transfer as Fed Chair Jerome Powell is maintaining look publicly however ensuring that the monetary system doesn’t freeze.

The transfer highlights a balancing act by the Fed the place it makes use of robust phrases to keep up credibility whereas performing as dovish to retains the banks secure.

Furthermore, the $29 billion injection additionally lifted the market sentiment. The Concern and Greed Index, ticked up from 29 to 33, displaying a slight shift away from worry.

EXPLORE: 9+ Greatest Memecoin to Purchase in 2025

Why you’ll be able to belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Tasks Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the most recent updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now