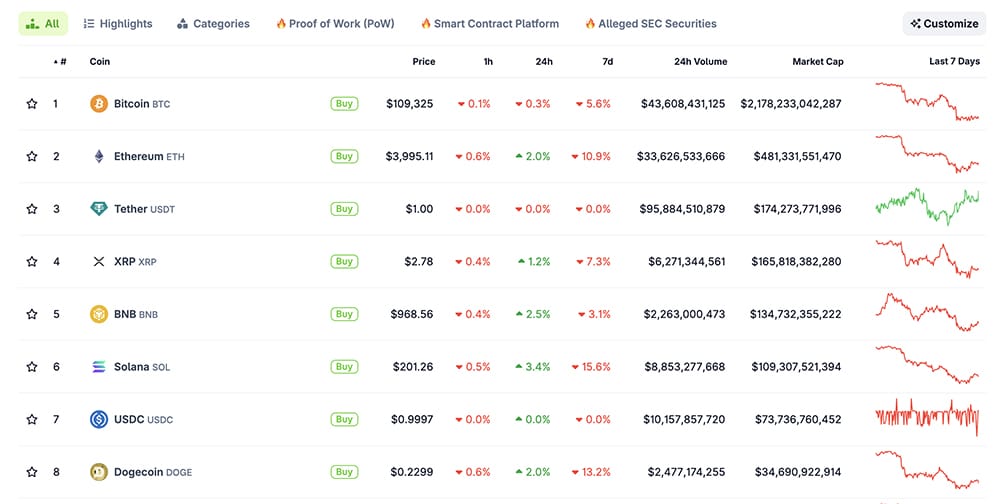

Right this moment, within the newest information, the crypto market is unexpectedly calm after yesterday’s high-stakes buying and selling choices expiry. BTC USD pair is holding regular just below $110K, a shock for many who anticipated brutal volatility. XRP USD pair exhibits minimal motion, because the market’s temper flatlined, regardless of the loopy information round it.

24h7d30d1yAll time

Ethereum and Solana USD pairs each posted gentle beneficial properties, including a inexperienced tinge to what was forecasted as a chaotic day. Regardless of widespread anticipation, there was no panic. The present sentiment is one thing that the majority crypto information shops report at this time.

24h7d30d1yAll time

DISCOVER: 9+ Finest Memecoin to Purchase in 2025

BTC USD and XRP Crypto Are in The Information Right this moment: Stability Over Shock After Buying and selling Choice Expiry

Wanting on the numbers, we see a transparent theme: resilience.

In keeping with CoinGlass, BTC ▲0.28% open curiosity dropped to $77 billion in the course of the expiry, however has already bounced again to $78 billion. Massive cash is repositioning. The BTC USD pair, which is commonly the bellwether, is performing as a barometer of this calm.

(supply – BTC/USD, Open Curiosity, CoinGlass)

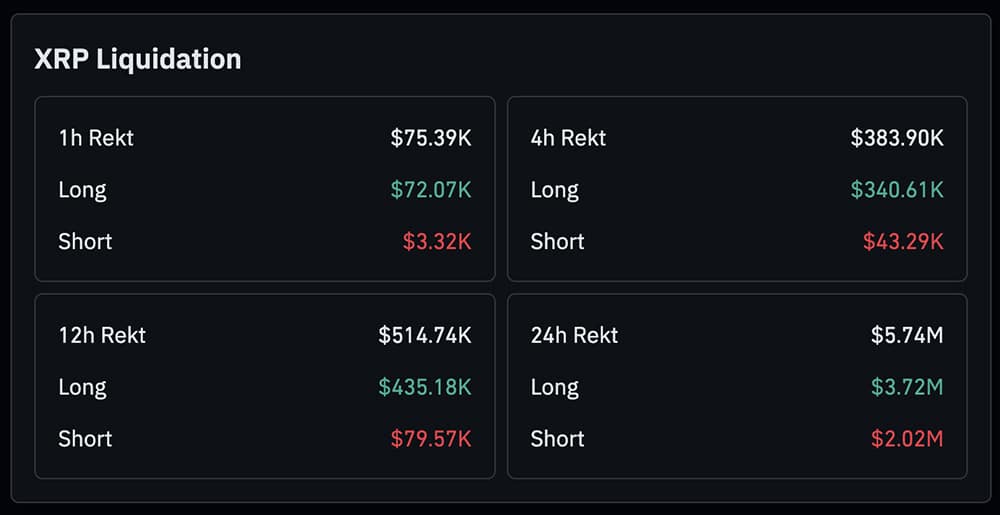

Over on the XRP ▲2.62% facet, studies that every day liquidations stay below $10 million, an unusually quiet stat given latest market circumstances.

(supply – XRP Liquidation, Coinglass)

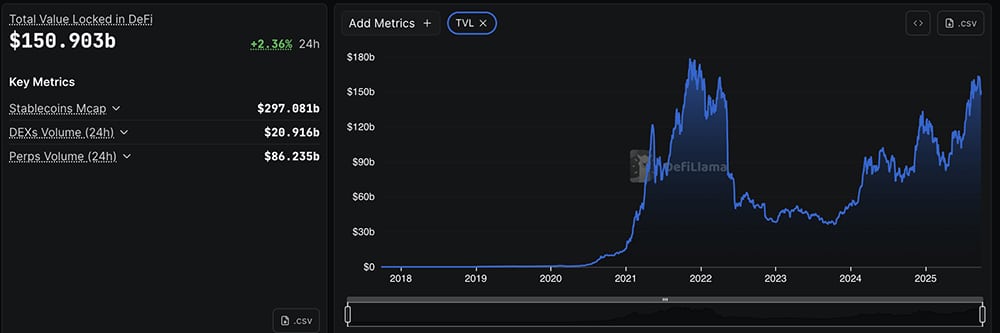

DeFiLlama information places complete worth locked (TVL) on crypto at round $150 billion, a marginal weekly enhance. That won’t appear big, however within the context of low volatility, it signifies that capital is staying and including.

(supply – DeFi TVL, Defillama)

In the meantime, ETH ▲3.12% is within the information at this time after its funding charges flipped optimistic once more, displaying a protracted and maintain sentiment. Solana, however, recorded a 5% DEX quantity climb up to now 24 hours.

🔥 STATS: Ethereum tops DEX exercise with $9.3B in 24H quantity, adopted by Solana at $6B and BSC at $5.2B. pic.twitter.com/rPv34Bs5d7

— CryptoHunt (@CryptoHunt47045) September 27, 2025

With skew flattening and sellers now not aggressively hedging, this calm interval would possibly sign a bullish “calm earlier than the storm.”

BTC dominance holds round 58%, indicating that the market would possibly see an altcoin season quickly.

(supply – BTC.D, TradingView)

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

What occurs subsequent? Based mostly on development information, a sluggish grind upward is anticipated. Information on crypto market at this time has Bitcoin up 0.8% over the past 24 hours, Ethereum by 1.2%, and XRP up 0.5%.

Whole liquidations are properly beneath common at $150 million, pointing to decrease danger within the system.

Open curiosity for October is tilted bullish, with CoinGlass exhibiting $78 billion in excellent calls. Group sentiment continues to be below concern, after weeks of chops.

In the meantime, CoinGecko rankings present that altcoins like SOL ▲4.66% and

BNB ▲3.92% are barely outperforming Bitcoin, which is an efficient signal for the altcoin market.

(supply – CoinGecko)

This quiet section is misleading. If macro circumstances will not be worsening, restoration may come before anticipated. The market will probably be led by BTC, ETH, XRP, as USD stablecoins being minted because the bullish information proceed being within the headlines.

DISCOVER: Finest Meme Coin ICOs to Spend money on 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Crypto Closing at Regular Worth Right this moment

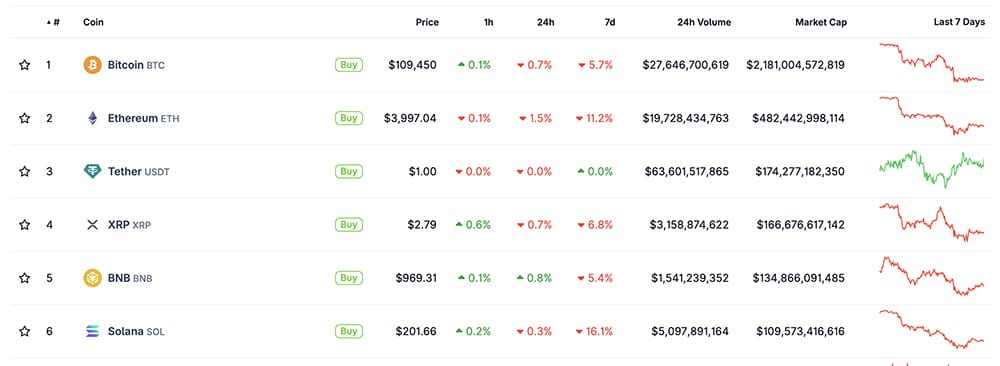

This Saturday ended with BTC steadying at $109K, ETH closing simply shy of $4K. In the meantime BNB, Solana, and XRP nonetheless but present any main strikes.

(supply – CoinGecko)

Contact grass, benefit from the weekend.

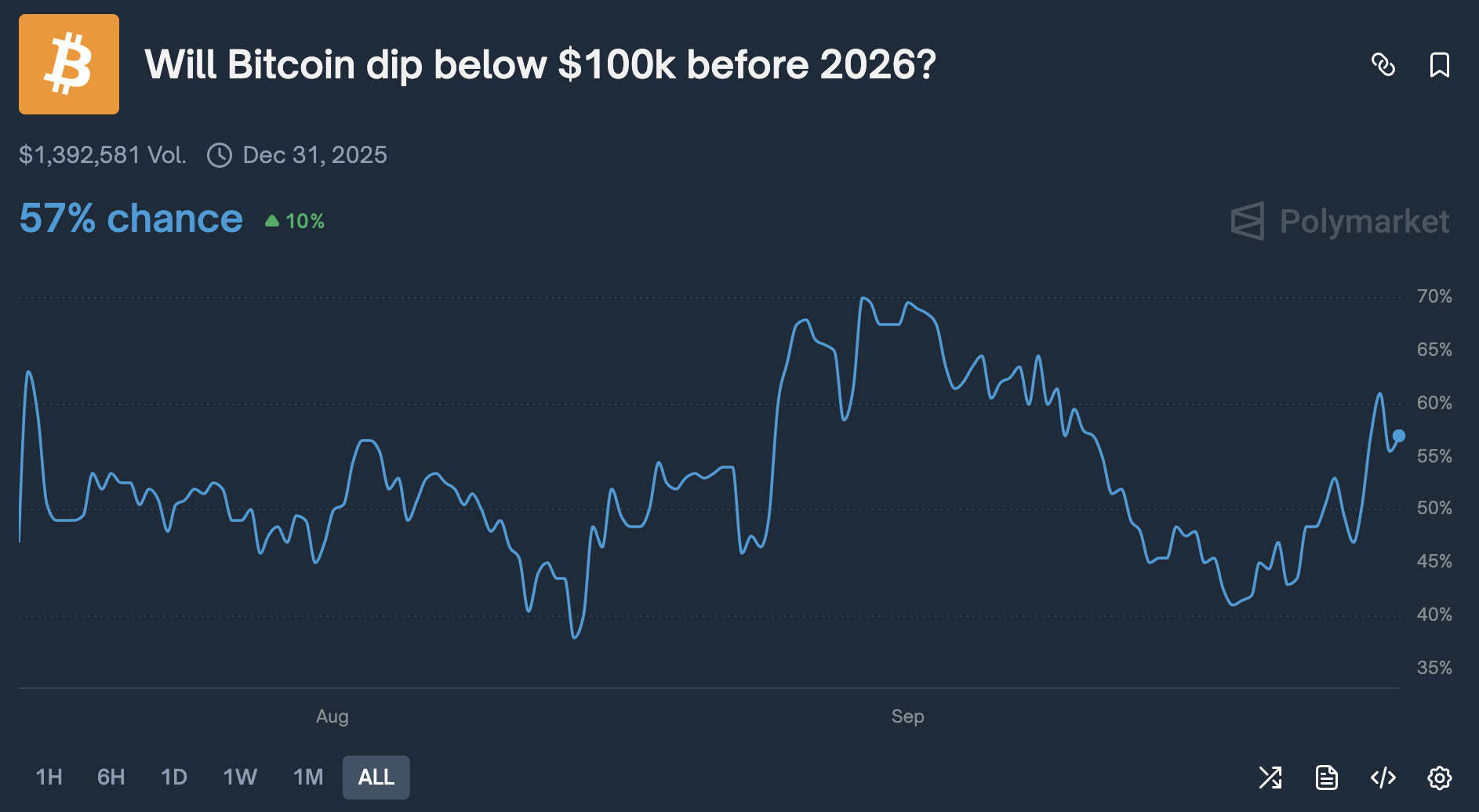

Polymarket Predicts BTC USD Falls Beneath $100K by 2026: Is This the Finish?

A ‘Will Bitcoin dip beneath $100k earlier than 2026’ market on Prediction platform Polymarket has surged 10% in a single day, and is now flashing a 57% likelihood of ‘Sure’. It comes as BTC USD continues to wrestle in its try to reclaim $110,000, highlighting its weak short-term value motion.

All eyes are presently on the month-to-month shut for Bitcoin. If it enters October above $108,000, its high-timeframe bullish construction will stay intact. Nevertheless, if it falls below $108,000, This fall may get ugly for the main digital asset and, by proxy, the broader altcoin market.

(SOURCE: Polymarket)

Learn the complete story right here.

First Digital ID: Is the British Pound Going Digital? Tokenized Sterling Defined

British Prime Minister Keir Starmer triggered fury Right this moment as he revealed plans for UK digital ID, however are main banks planning to take the British pound (GBP) digital too?

Britain’s greatest banks have launched reside checks of “tokenized” sterling, digital variations of financial institution deposits designed for quicker and extra managed funds.

(Supply – GBP USD, TradingView)

Six lenders, Barclays, HSBC, Lloyds Banking Group, NatWest, Nationwide, and Santander, are collaborating within the pilot, which is being coordinated by UK Finance. The venture started on September 26 and can run till mid-2026.

The checks deal with three use circumstances: market funds, remortgaging, and digital-asset settlement.

In keeping with UK Finance, the objective is to chop fraud, pace up settlement, and provides clients extra management over how cash strikes.

This marks probably the most important steps but within the UK’s push towards programmable cash. As a substitute of making a brand new foreign money, tokenized deposits work as digital representations of cash already held at banks.

They’re anticipated to play a central function within the nation’s broader digital-finance technique, sitting alongside the Financial institution of England’s work on digital cash and securities.

DISCOVER: 9+ Finest Excessive-Threat, Excessive-Reward Crypto to Purchase in 2025

Learn the unique piece right here.

Why you’ll be able to belief 99Bitcoins

Established in 2013, 99Bitcoin’s group members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Initiatives Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the most recent updates, traits, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now