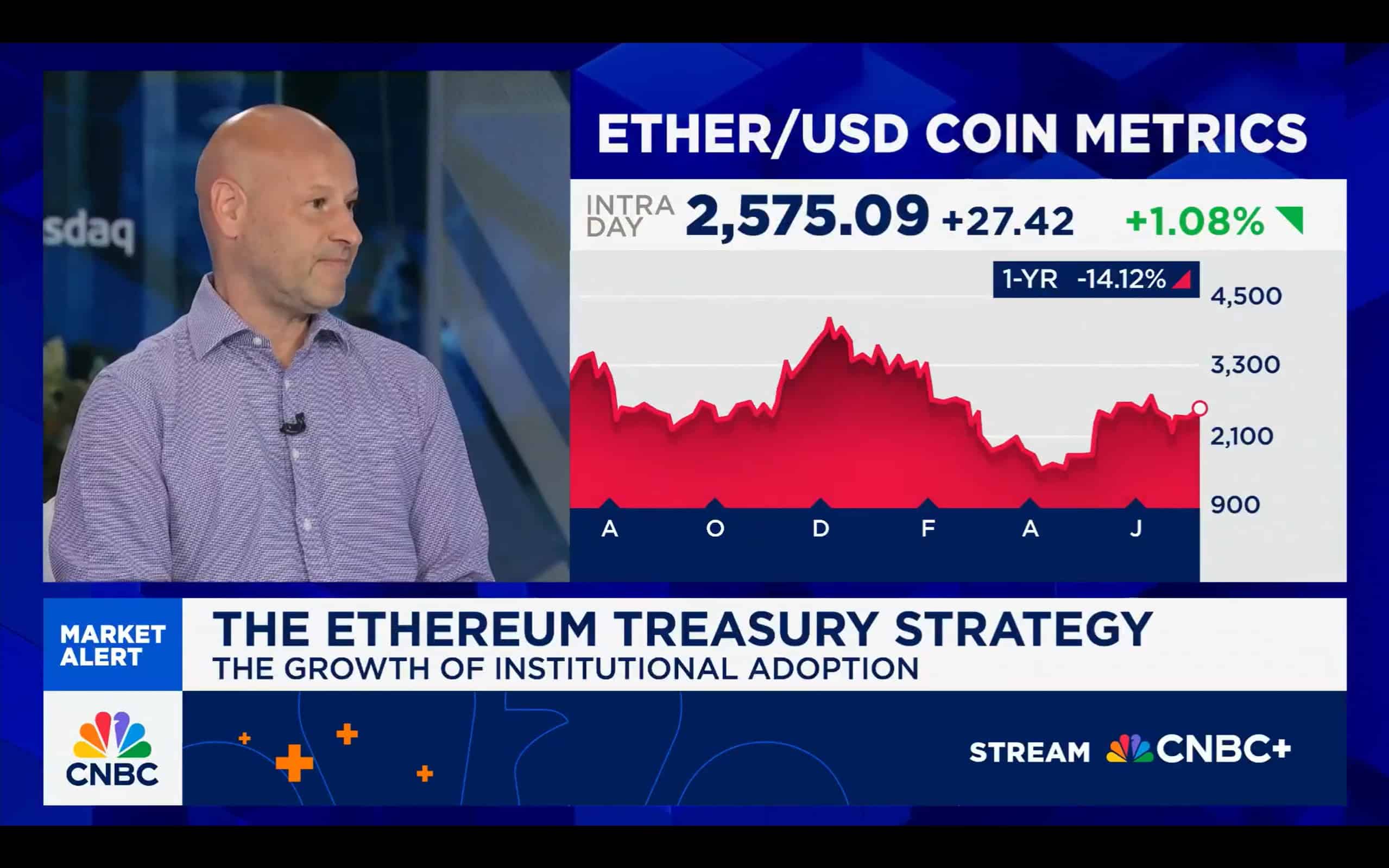

Ethereum co-founder and ConsenSys CEO Joe Lubin believes that Ethereum is beginning to achieve actual floor in how conventional finance thinks about digital property. He sees a rising variety of corporations holding ETH of their treasuries as a strategic alternative that might affect how Wall Avenue treats crypto as an entire. Joe Lubin says the Ethereum treasury pattern is gaining traction as extra corporations deal with ETH as an actual working asset, not only a headline seize.

Treasuries because the New Gateway

Lubin’s view is that Ethereum is starting to play a job much like what money and even gold as soon as did for company treasuries. It’s not nearly shopping for crypto to sit down on a steadiness sheet. He makes the case for ETH as a useful a part of the monetary stack. Lubin factors to Bitcoin’s entry into company treasuries because the early spark however says Ethereum takes it additional due to what it could actually do.

Joe Lubin: ‘Ethereum treasury technique simply is smart’ pic.twitter.com/Ewodk53txw

— Altcoin Each day (@AltcoinDaily) July 8, 2025

In contrast to Bitcoin, Ethereum has built-in yield by means of staking and utility by means of sensible contracts. Lubin argues that this provides corporations extra instruments to handle their property, earn passive revenue, and keep concerned in a community that retains evolving.

Ethereum as a Monetary Spine

Ethereum’s flexibility is what makes it totally different from different cryptocurrencies since it isn’t solely a retailer of worth. Lubin explains the truth that ETH will be deployed programmatically for yield, danger administration, and even service funds inside decentralized programs.

One instance comes from SharpLink, a publicly traded firm that not too long ago moved a chunk of its treasury into Ether. The corporate isn’t just holding ETH, they’re staking it, utilizing it to generate yield, and folding it into their long-term planning. That, in line with Lubin, might turn into the brand new playbook for different companies.

DISCOVER: Finest New Cryptocurrencies to Spend money on 2025

Why This Issues

Lubin can also be making the case that if corporations deal with ETH like some other working monetary asset, the notion round it is going to shift. This might have ripple results all through conventional finance, particularly in how buyers and regulators classify crypto property.

24h7d30d1yAll time

It additionally hints on the thought that crypto is maturing within the eyes of people that usually function exterior the area. Lubin thinks Ethereum is positioned nicely to turn into a bridge between tech innovation and mainstream monetary technique. It’s now not nearly holding a token, it’s about what the token can truly do when put to work.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

The Highway Forward

Lubin believes {that a} rising concentrate on Ethereum treasury strikes might result in extra severe consideration from conventional finance. If extra corporations start holding and utilizing ETH as a part of their treasury operations, it might change the way in which Wall Avenue evaluates digital property. Lubin sees this as a turning level. It’s not simply the worth of Ethereum that issues now, it’s the construction it provides for monetary instruments, funding methods, and future merchandise.

As extra companies discover staking, on-chain finance, and DeFi integration, Ethereum’s position within the international monetary system might develop considerably. Lubin believes that the future might already be taking form.

Whether or not or not Wall Avenue totally catches on this 12 months, Ethereum’s push into company treasuries is gaining consideration. And for now, Joe Lubin is betting that ETH has extra to supply than simply value motion. It could be laying the groundwork for a extra dynamic and programmable monetary future.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

Joe Lubin believes Ethereum’s entry into company treasuries is greater than a pattern and will shift how Wall Avenue sees digital property.

Ethereum provides built-in yield by means of staking and sensible contract utility, making it extra useful than conventional treasury property.

Public corporations like SharpLink are already staking ETH from their treasury, utilizing it for yield and long-term planning.

Lubin sees Ethereum as a monetary spine, not only a retailer of worth, with use circumstances in asset administration and decentralized funds.

If extra companies undertake ETH as a working treasury asset, it might result in broader acceptance of crypto in conventional monetary methods.

Why you may belief 99Bitcoins

Established in 2013, 99Bitcoin’s staff members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Knowledgeable contributors

2000+

Crypto Tasks Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the newest updates, traits, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now