Ought to I revisit my thesis? Ought to I trim, maintain, or promote Adobe $ADBE ?

As skilled traders typically we wish to make quick choices once we see some actually dangerous information on a inventory we personal. That is the case now with Adobe $ADBE. As I’m drafting this Adobe simply dropped -3.5% after a wave of damaging headlines:

“Adobe Inventory Falls After Downgrade. The Case to Promote as AI Bites.”

“Adobe Faces Canva Competitors, Expands Firefly AI Instruments to Cellular Gadgets.”

“Figma has filed for an IPO.”

“Redburn Atlantic cuts Adobe to Promote, slashing goal from $420 to $280.”

As I learn the information, the primary feeling was concern – concern of being mistaken, concern of shopper losses, concern of capital erosion. However after the emotional response comes the self-discipline. I pause and ask:

“What does my course of say? Have the basics modified?” Nobody can see the long run, not even one of the best wizards/witches, so let’s concentrate on what we all know.

What We Know

Listed below are the important thing info I had in my thesis:

Adobe has constructed one of the vital predictable subscription fashions within the artistic software program house over the previous 20 years.

Adobe now faces actual competitors from AI instruments like Canva, CapCut, and others.

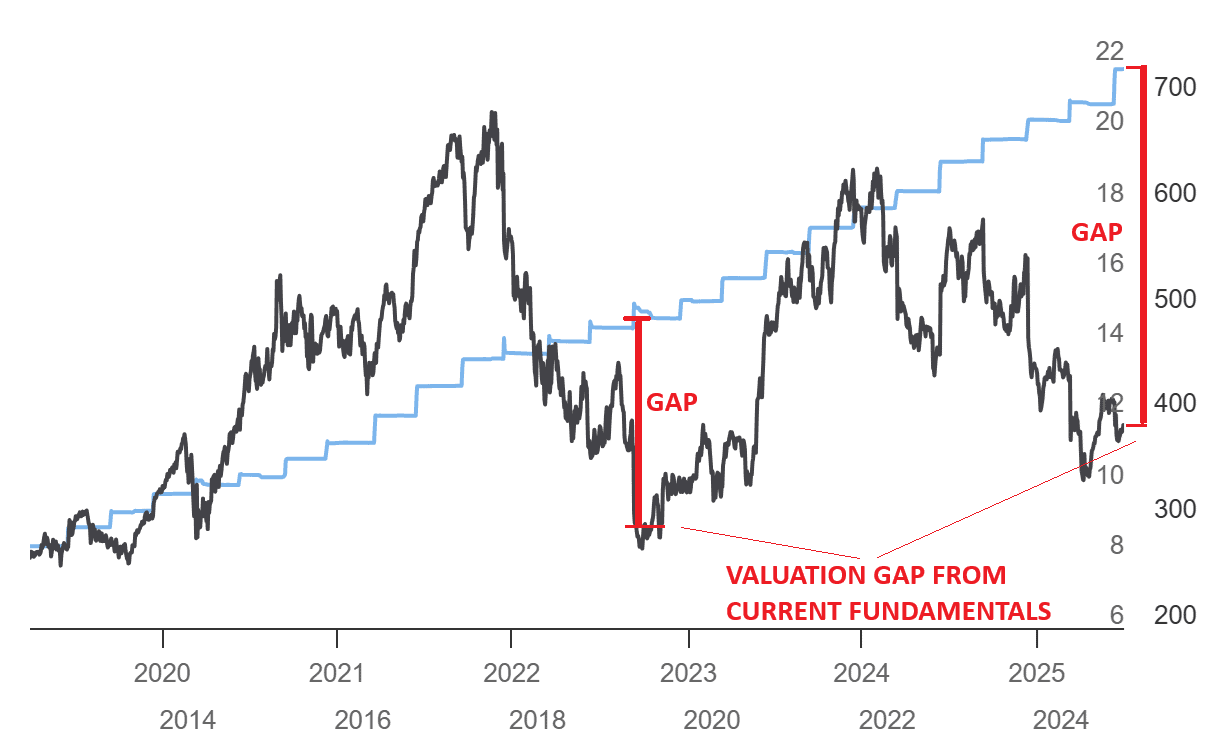

Nevertheless, the inventory is now buying and selling at a Ahead P/E of 17x, a traditionally enticing a number of.

Supply: TIKR $ADBE

Fundamentals stay sturdy: Excessive margins, sturdy free money circulation, high-quality stability sheet.

Adobe passes my inner guidelines with a rating of 85/100.

The bottom case initiatives income progress of 9% and EPS progress of 13%, which might drive an IRR of 24% per yr from present ranges.

Adobe is decreasing share rely by ~2% per yr through buybacks.

Supply: TIKR

Supply: TIKR

However what if my thesis is mistaken?

Re-Operating the Thesis: Dangers & Bear Circumstances

To emphasize-test my assumptions, I challenged my very own mannequin:

Income progress of 9% might masks slowing seat progress, with a few of it pushed by AI credit score worth hikes, actual seat licensed progress is mid-single-digits.

13% EPS CAGR assumes margin enlargement + continued buybacks. AI inference prices might compress margins.

Firefly utilization progress might truly harm margins if GPU prices keep elevated.

Opponents like Canva provide related instruments at 1/4 the value.

Freelancers and SMBs might churn to cheaper platforms if Adobe pricing isn’t clear.

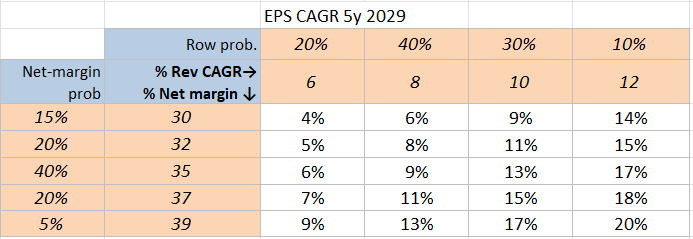

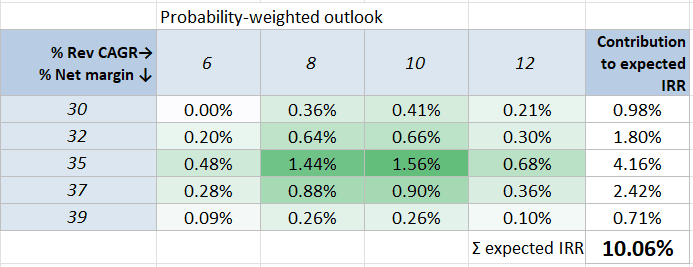

So I ran a brand new IRR (Inner Charge of Return) sensitivity grid, based mostly on completely different progress/margin situations and their possibilities for Adobe $ADBE for the CAGR for the following 5 years in a extra pessimistic state of affairs.

Supply: AMWorld’s Figures

The Pessimistic Case: Nonetheless Cheap

In essentially the most possible “worst case,” I see Adobe $ADBE rising EPS at ~10% CAGR over the following 5 years. That may nonetheless justify holding the place at at the moment’s valuation. But it surely brings up an essential query:

🕛 Is that this a chance value, or a misunderstood tech titan in transformation?

What Might Go Proper? (Alternatives)

Right here’s what may make the bear case too pessimistic:

Firefly is integrating fashions from Google Veo $GOOG, Open AI, Pika, Runway, so it’s conglomerating all options beneath one roof.

AI chip and infra prices decline (Google Cloud TPUs, AMD MI300 chips $AMD), bettering Firefly margins.

Freemium funnel works: Categorical seats develop >10%.

Firefly credit turn out to be a internet tailwind if GPU prices drop sooner than utilization grows (gross margin > 35%).

Adobe can nonetheless use cashflow to purchase or out-innovate smaller AI opponents.

A breakout of >$1B in annual AI income might push valuation again to >20x EV/FCF.

Supply: Adobe Buyers Relationships

When It’s Exhausting to Determine… We are likely to Overthink

It’s not at all times simple to make choices with out overthinking or counting on assumptions. In these moments, one of the best we will do is:

Let the numbers information us

Watch how the story unfolds

Monitor key information from earnings calls, 10-Ks, seat license traits, and churn stories

So right here’s how I body Adobe shifting ahead:

Worst case state of affairs: EPS CAGR 10% subsequent 5 years → Nonetheless an okay enterprise

Base case: EPS CAGR 10–12% → Adobe pushes AI instruments efficiently

Finest case: EPS CAGR 12–14% → Progress resumes, AI proves worthwhile, and Adobe retains innovating

Bull case: Not even checked out… not essential to take a position.

However what would make me exit? I created for myself a small “Adobe Metrics Dashboard” with some KPI triggers to know when to trim or promote that can assist me to decide.

Exit Warning Indicators:

Digital Media ARR YoY < 8% for two consecutive quarters

Web-new seats < 0.4M in 1 / 4 + seen churn

Firefly connect < 25% of Inventive Cloud subs by FY26

Gross margin < 85% in any quarter (non-GAAP)

Bullish Affirmation Alerts:

Web-new seats > 1M per quarter

Firefly connect > 30%

AI ARR > $1B run-rate

Remaining Ideas

We don’t have a crystal ball. Investing isn’t about making good predictions. It’s about shopping for high-quality companies at truthful costs, understanding your draw back, and reassessing repeatedly.

So I’m staying in Adobe, watching fastidiously, and sustaining a modest, appropriately-sized place. If my KPIs deteriorate, I’ll trim. If the bull thesis performs out, we’ll be holding a compounder.

🕵️ What about you? Would you maintain, trim, or promote? Would you rotate it for a extra clear alternative?

Let me know your ideas. And if you wish to comply with how I deal with these choices in actual time, you’ll be able to comply with or copy my portfolio on eToro.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.