Everybody wished a crypto moonshot. For OG Bitcoin holders deep in inexperienced, maybe the FOMC occasion didn’t matter a lot. Nevertheless, all good degens who purchased the highest, Jerome Powell, and the Federal Reserve have been their solely saviors. There was a lot hope for the Bitcoin value to maneuver increased till it didn’t, and as Murphy’s Regulation struck, the world’s most beneficial crypto crashed, falling by -5% beneath $110,000.

The Bitcoin value, and crypto basically, is but to get well from yesterday’s crickets. With hopes smashed, the BTC USDT value is decrease from this week’s open, and the one approach for a restoration is that if the $110,000 degree holds by the tip of the day.

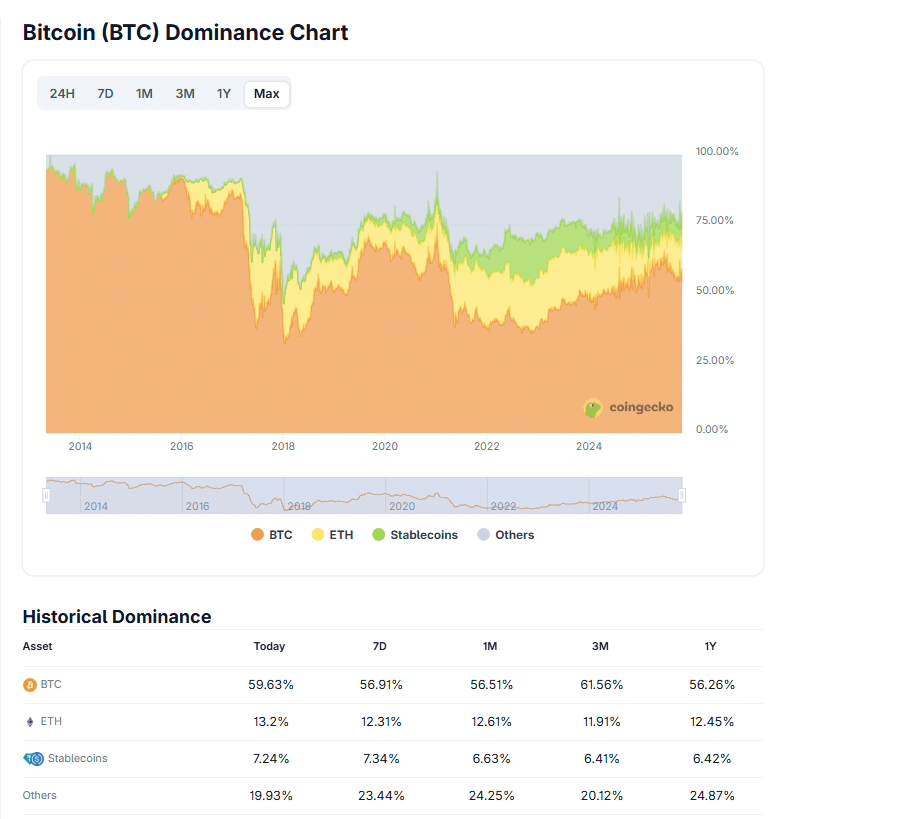

Earlier than then, merchants ought to carefully monitor value motion. The Bitcoin dominance continues to be above the +59% degree as of October 30. It’s more likely to improve ought to crypto costs fail to carry the excessive expectations amongst late patrons. In the meantime, the full crypto market cap is down practically -2% to over $3.8T.

(Supply: Coingecko)

DISCOVER: Greatest New Cryptocurrencies to Spend money on 2025

Jerome Powell and FOMC Slashed Charges As Anticipated

There was a close to +100% chance of a price lower yesterday. Everybody anticipated the FOMC and the central financial institution to ease for the second time this 12 months. And Powell and the workforce didn’t disappoint.

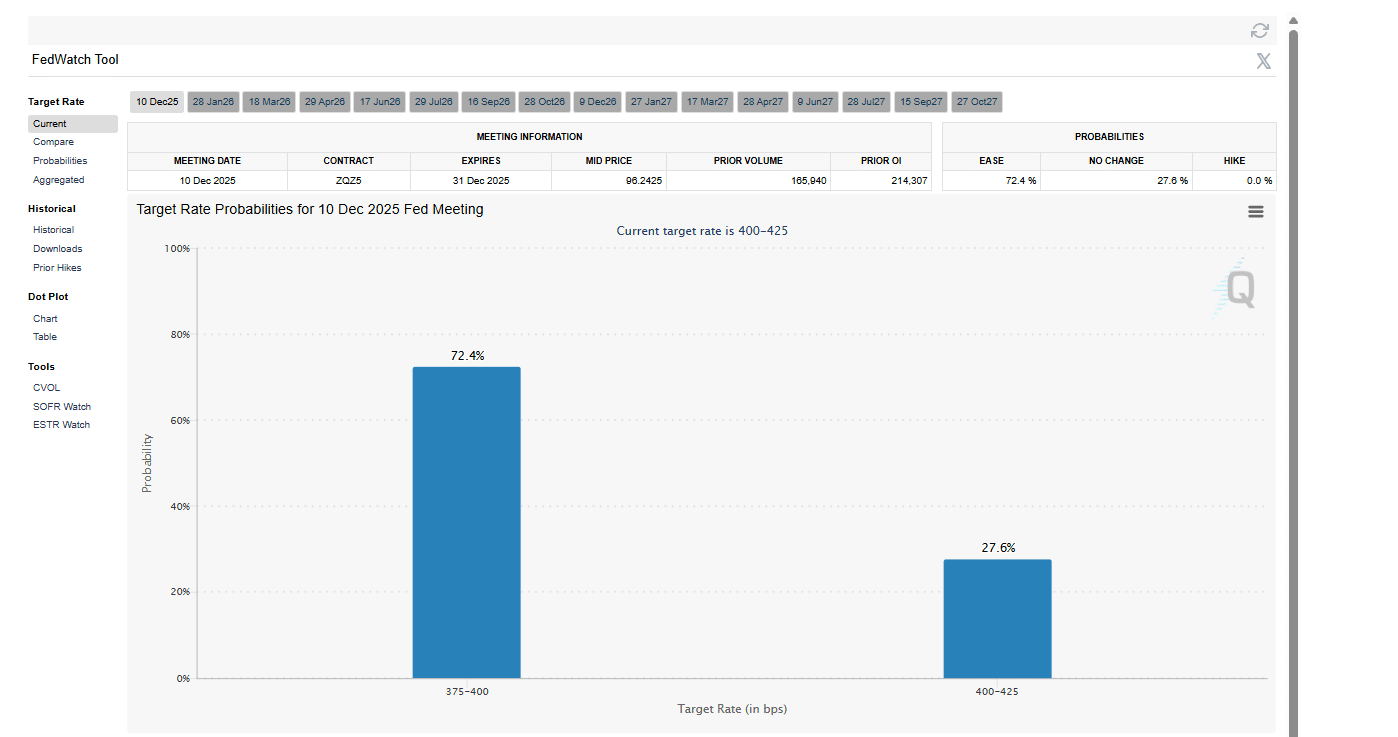

Even with the federal government shutdown, the central financial institution slashed charges to the anticipated +3.75% and +4% vary, one other tick decrease, permitting extra money to movement into circulation.

General, the FOMC, tasked with regulating financial coverage and curbing inflation whereas watching labor market situations, aimed to assist employment, which, sadly, has been floundering in latest months.

Their determination to slash charges comes when inflation stays “considerably elevated”, above the best +2% mark.

DISCOVER: Greatest Meme Coin ICOs to Spend money on 2025

What Occurred? Why Did The Bitcoin Worth Fall?

Right here’s the sucker punch, although.

Though the speed lower was in alignment with the overall market expectations, BTC USDT costs first rose, however that was earlier than the Powell presser.

That’s when all hell broke unfastened.

Throughout the press convention, Jerome stated the FOMC remained data-dependent, as all the time, however an extra discount in rates of interest in December will not be a “foregone conclusion.”

The choice follows a break up amongst FOMC members, with two dissents in reverse instructions. The Fed chair added that the central financial institution can even monitor labor market modifications “very, very fastidiously”. Nonetheless, even when there are modifications for the higher, they received’t rush to slash charges if inflation reaccelerates.

This assertion was hawkish and unhealthy for danger belongings, largely crypto belongings, together with all 100X cash.

It caught all analysts and merchants without warning as a result of earlier than this assembly, the chance of a December price lower stood at over +90%. It has since fallen beneath +75% and can doubtless drop additional.

(Supply: CME)

The query now could be: What is going to transfer the Bitcoin value?

How the crypto and a number of the prime Solana meme cash carry out within the subsequent few days depends upon elementary elements.

Sure, whereas charges are low and simpler cash may discover its option to crypto, the soundness of the a number of offers between China and the USA will play a job.

Moreover, institutional movement by way of spot ETFs will decide the pace at which the Bitcoin value zooms previous essential resistance ranges, presently at $115,000 and $120,000.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

If a FOMC Charges Minimize Will not Transfer Bitcoin Worth What Will?

FOMC dropped charges, aligning with market expectations

Jerome Powell notes the persistently excessive inflation

Fed is in no hurry to drop charges once more in December

With the Bitcoin value down, will China and Trump enhance demand?

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Knowledgeable contributors

2000+

Crypto Initiatives Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the newest updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now