Gold ($GOLD) has all the time been a logo of wealth and stability, however its current efficiency has captured the eye of traders worldwide. The valuable steel has surged to a historic excessive of $3,000 per ounce, marking a powerful 50% enhance over the previous yr. This outstanding rally has left many questioning: what’s driving this surge, and may traders take into account including gold to their portfolios? On this article, we’ll discover the elements behind gold’s rise, its position as a protected haven, the potential dangers, and the way traders can strategy this asset in at this time’s unsure financial local weather.

Gold’s Historic Rally: Breaking Information

Gold’s ascent has been nothing wanting extraordinary. Over the previous yr, the value of gold has climbed by 50%, reaching an all-time excessive of $3,000 per ounce. This surge has defied conventional financial indicators that will sometimes weigh on gold costs, corresponding to declining inflation, a robust U.S. greenback, and elevated rates of interest. So, what’s behind this unprecedented rally?

Why Gold is Rising Towards the Odds?

Gold’s current efficiency is especially intriguing as a result of it contradicts a number of financial traits that often suppress its value. Let’s break down the important thing elements driving this surge:

Uncertainty as a Catalyst

Gold has lengthy been thought of a “protected haven” asset, that means traders flock to it throughout instances of uncertainty. Right now, the world is grappling with an ideal storm of political, geopolitical, and financial instability. From escalating commerce tensions to unpredictable coverage shifts, the worldwide panorama is rife with dangers. In such an setting, gold turns into a dependable retailer of worth, providing safety towards volatility in different asset courses like shares and bonds.

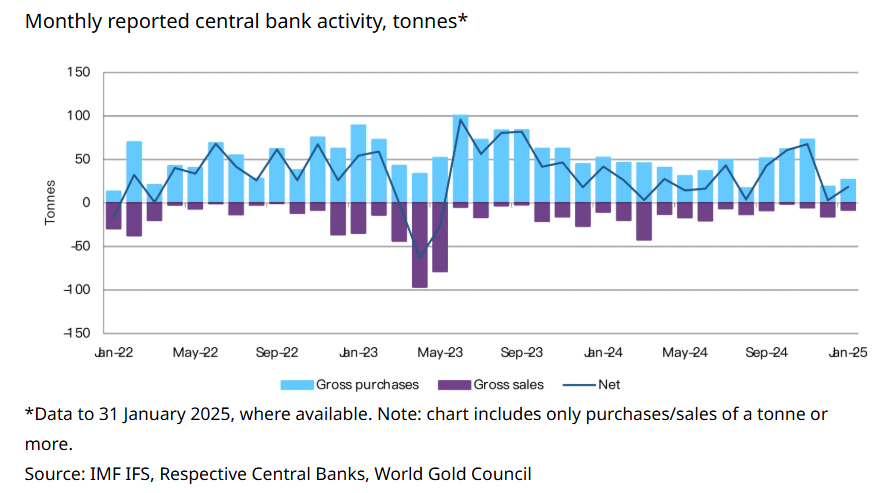

Central Banks’ Gold Rush

One other main driver of gold’s rise is the aggressive accumulation of gold reserves by central banks worldwide. International locations like China, Russia, and Iran have been stockpiling gold at an unprecedented fee. This pattern has intensified in response to the specter of U.S. sanctions, which regularly leverage the dominance of the U.S. greenback in international commerce and finance. By rising their gold reserves, these nations purpose to cut back their reliance on the greenback and insulate themselves from potential monetary or commerce wars.

Contradictory Financial Indicators

What makes gold’s rally much more fascinating is that it’s occurring regardless of a number of financial situations that will sometimes dampen its enchantment:

– Falling Inflation: Gold is historically seen as a hedge towards inflation. Nonetheless, inflation charges have been declining in lots of elements of the world, but gold continues to rise.

– Robust Greenback: Traditionally, gold tends to carry out nicely when the U.S. greenback weakens. This time, nevertheless, gold is climbing even because the greenback stays sturdy.

–Excessive Curiosity Charges: Gold doesn’t generate yield, making it much less enticing in a high-interest-rate setting. But, demand for gold stays sturdy regardless of elevated charges.

These contradictions spotlight gold’s distinctive position as a monetary asset. Whereas it might not all the time observe typical financial logic, its worth as a protected haven and retailer of wealth continues to resonate with traders.

The Dangers of Investing in Gold

Whereas gold’s current efficiency has been spectacular, it’s necessary for traders to know the potential dangers related to this asset. Gold just isn’t with out its drawbacks, and its value could be influenced by a wide range of elements which will result in volatility or losses.

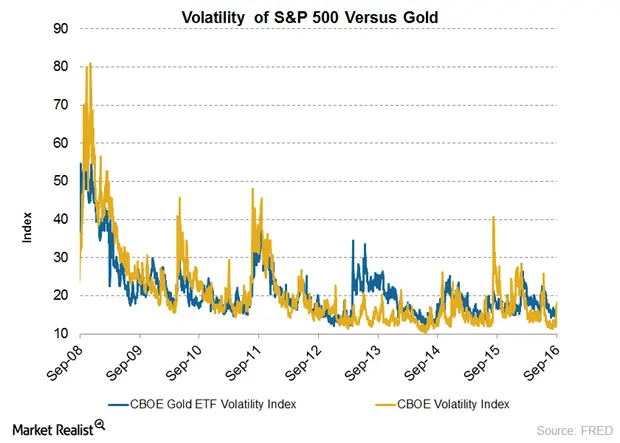

Value Volatility

Gold costs could be extremely risky, experiencing sharp fluctuations over quick durations. Whereas it’s typically seen as a secure asset, exterior elements corresponding to modifications in rates of interest, forex actions, or shifts in investor sentiment can result in important value swings. Traders must be ready for the potential for sudden declines, particularly if financial situations stabilize or enhance.

No Yield or Revenue

In contrast to shares or bonds, gold doesn’t generate any revenue, dividends, or curiosity. Its worth is solely primarily based on value appreciation, which suggests traders rely totally on market demand to appreciate good points. In a high-interest-rate setting, this may make gold much less enticing in comparison with yield-generating belongings.

Geopolitical and Market Dangers

Whereas gold is commonly seen as a hedge towards geopolitical dangers, these similar dangers also can affect its value unpredictably. For instance, if tensions ease or international markets stabilize, demand for gold as a protected haven might decline, main to cost corrections. Moreover, modifications in central financial institution insurance policies or large-scale promoting of gold reserves by establishments also can have an effect on its worth.

Storage and Liquidity Issues

For these investing in bodily gold, storage and liquidity could be important challenges. Storing gold securely typically incurs further prices, and promoting bodily gold could be much less handy than buying and selling different belongings like shares or ETFs. Furthermore, bodily gold might carry premiums or reductions relying on market situations, which might affect returns.

Speculative Nature

Gold is commonly topic to speculative buying and selling, which might amplify value actions. Whereas this may result in important good points, it additionally will increase the danger of losses, notably for short-term traders. Lengthy-term traders ought to rigorously take into account whether or not gold aligns with their general monetary targets and danger tolerance.

Ought to You Put money into Gold?

Given gold’s spectacular efficiency, many traders are questioning whether or not they need to add it to their portfolios. The reply will depend on your monetary targets, danger tolerance, and funding technique.

Gold as a Monetary Anxiolytic

For some traders, gold serves as a type of monetary insurance coverage. If holding gold gives you with peace of thoughts throughout turbulent instances, specialists suggest allocating a small portion of your portfolio sometimes 2-3% to the dear steel. This modest allocation can act as a hedge towards market volatility and financial uncertainty.

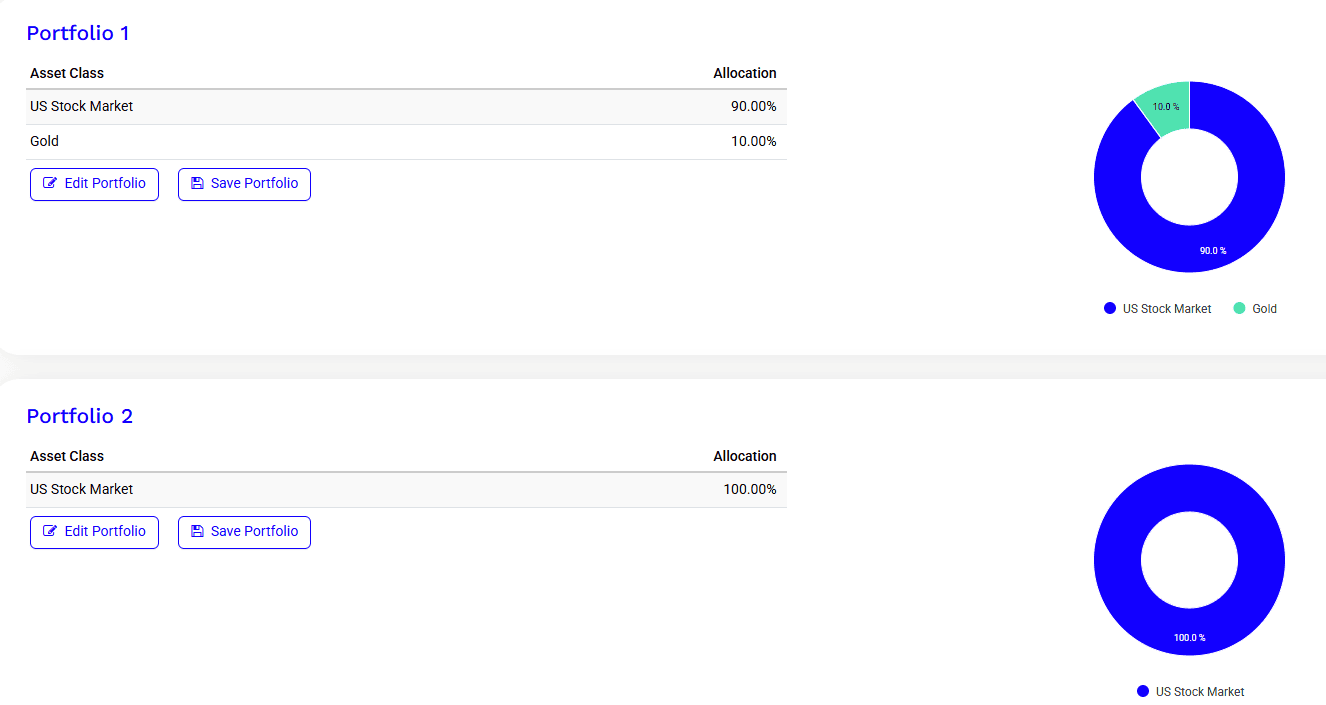

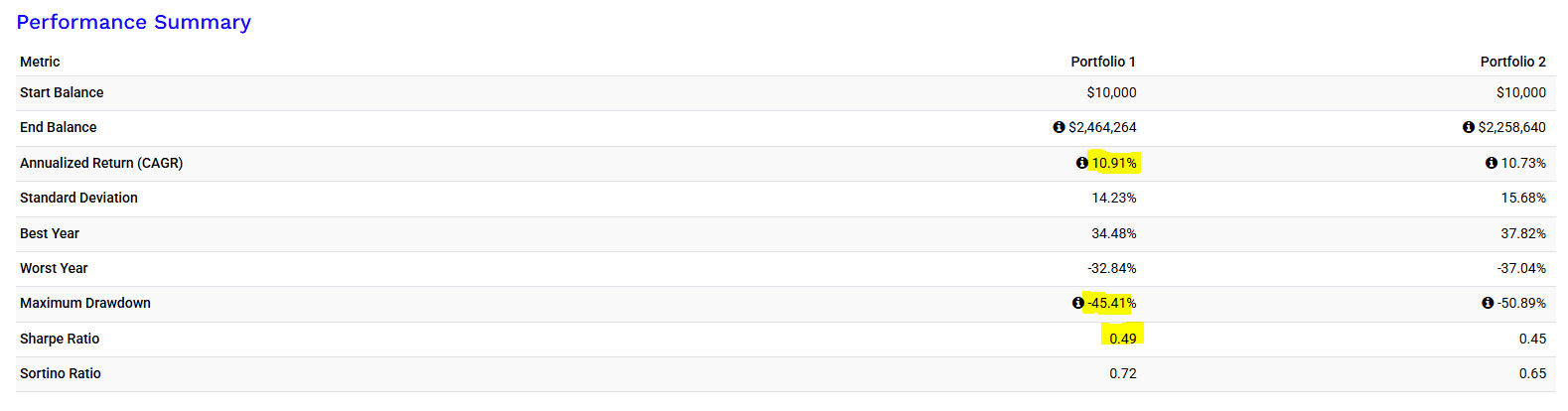

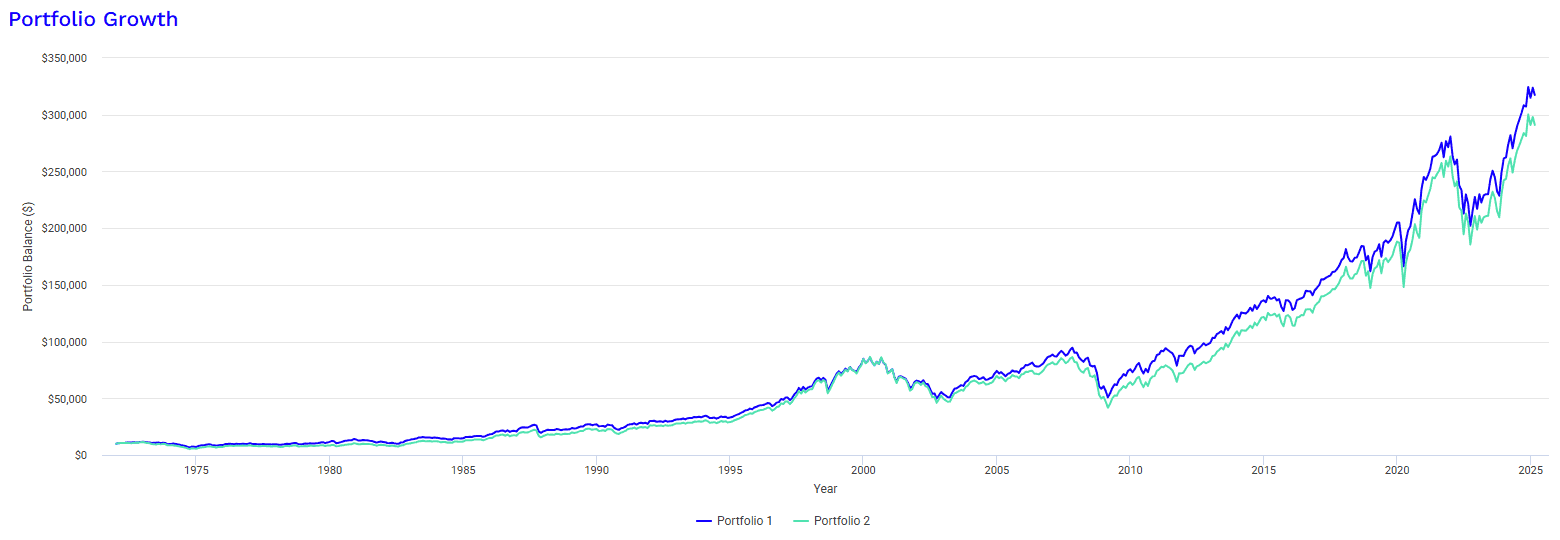

As an example this, let’s examine two portfolios: one with 100% U.S. shares and one other with 90% U.S. shares and 10% gold. Since 1972, the portfolio with 10% gold has outperformed the all-stock portfolio, delivering an annual return of 10.91% in comparison with 10.73%. Furthermore, the gold-included portfolio has proven decrease danger, with a most drawdown of 45.41% versus 50.89% for the all-stock portfolio. This demonstrates how including gold can improve returns whereas decreasing danger over the long run.

Warning Suggested

Whereas gold has its deserves, it’s necessary to strategy it with warning. Gold is a speculative asset, and its value can expertise sharp corrections. In contrast to shares or bonds, gold doesn’t generate revenue or dividends, making it purely a play on value appreciation. As such, it’s greatest suited to traders who perceive its dangers and are snug with its volatility.

Easy methods to Put money into Gold

If you happen to’re contemplating including gold to your portfolio, there are a number of methods to take action. Every technique has its execs and cons, so it’s necessary to decide on the one which aligns together with your funding targets and preferences.

Bodily Gold

Bodily gold contains gold bars and cash, which could be bought from banks, specialised sellers, or numismatists. Whereas proudly owning bodily gold could be satisfying, it comes with some challenges:

– Storage: Bodily gold requires safe storage, which could be expensive and inconvenient.

– Liquidity: Promoting bodily gold could be extra cumbersome than promoting different varieties of investments.

– Premiums: Cash, specifically, typically carry premiums attributable to their collectible worth, making them much less correlated with the value of gold itself.

Paper Gold

For many traders, paper gold is a extra sensible and cost-effective choice. This class contains:

– ETFs (Trade-Traded Funds): Gold ETFs ($GLD) observe the value of gold and could be purchased and bought like shares. They provide excessive liquidity and low prices.

– Certificates: These characterize possession of a certain amount of gold saved by a monetary establishment.

– Gold spot foreign exchange like right here on Etoro ($GOLD):

– Mining Shares: Investing in corporations that mine gold can present publicity to the steel, however these shares are additionally influenced by company-specific elements and market situations.

($GOLD.BARRICK)

Paper gold is mostly simpler to handle and extra accessible than bodily gold, making it a well-liked alternative for each particular person and institutional traders.

The Way forward for Gold: What to Count on

As we glance forward, gold’s outlook stays carefully tied to international financial and geopolitical developments. If uncertainty persists—whether or not attributable to commerce tensions, political instability, or monetary market volatility gold is more likely to preserve its enchantment as a protected haven. Moreover, the continued accumulation of gold by central banks may present additional assist for its value.

Nonetheless, traders ought to stay vigilant. Gold’s value could be risky, and its efficiency is influenced by a posh interaction of things. Whereas it may be a priceless addition to a diversified portfolio, it’s not a one-size-fits-all resolution.

Conclusion: Shining Vivid in Turbulent Occasions

Gold’s current surge to a document excessive of $3,000 per ounce underscores its enduring position as a protected haven in turbulent instances. Regardless of defying conventional financial indicators, the dear steel continues to draw traders looking for stability and safety towards uncertainty. Whether or not by way of bodily gold or paper devices, gold is usually a priceless addition to a diversified portfolio but it surely must be approached with care and moderation.

Because the world navigates ongoing geopolitical and financial challenges, gold’s attract is unlikely to fade anytime quickly. For traders, the bottom line is to know its distinctive traits, weigh the dangers and rewards, and make knowledgeable selections that align with their monetary targets. In an unpredictable world, gold stays a timeless asset, providing each safety and alternative for individuals who know learn how to harness its potential.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding goals or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.