This week’s version of Finovate International examines latest fintech information from Mexico.

Earlier this month, ResearchAndMarkets.com printed its Mexico Embedded Finance Databook Report for 2025. The 230-page report famous that the embedded finance market in Mexico is anticipated to succeed in greater than $18 billion this 12 months and high $22 billion by the top of 2030. Among the many key takeaways from the report is the rising traction of embedded credit score merchandise corresponding to Purchase Now Pay Later (BNPL), and the expansion of embedded funds in mobility, meals supply, and social commerce pushed by rising smartphone use and authorities assist for digital, real-time funds choices. Embedded finance options corresponding to lending are enabling non-fintech companies in Mexico to leverage APIs and BaaS to increase their choices, the report notes. That is serving to deliver extra monetary providers to underserved communities within the nation. It’s also creating larger competitors for firms in each the lending and funds areas.

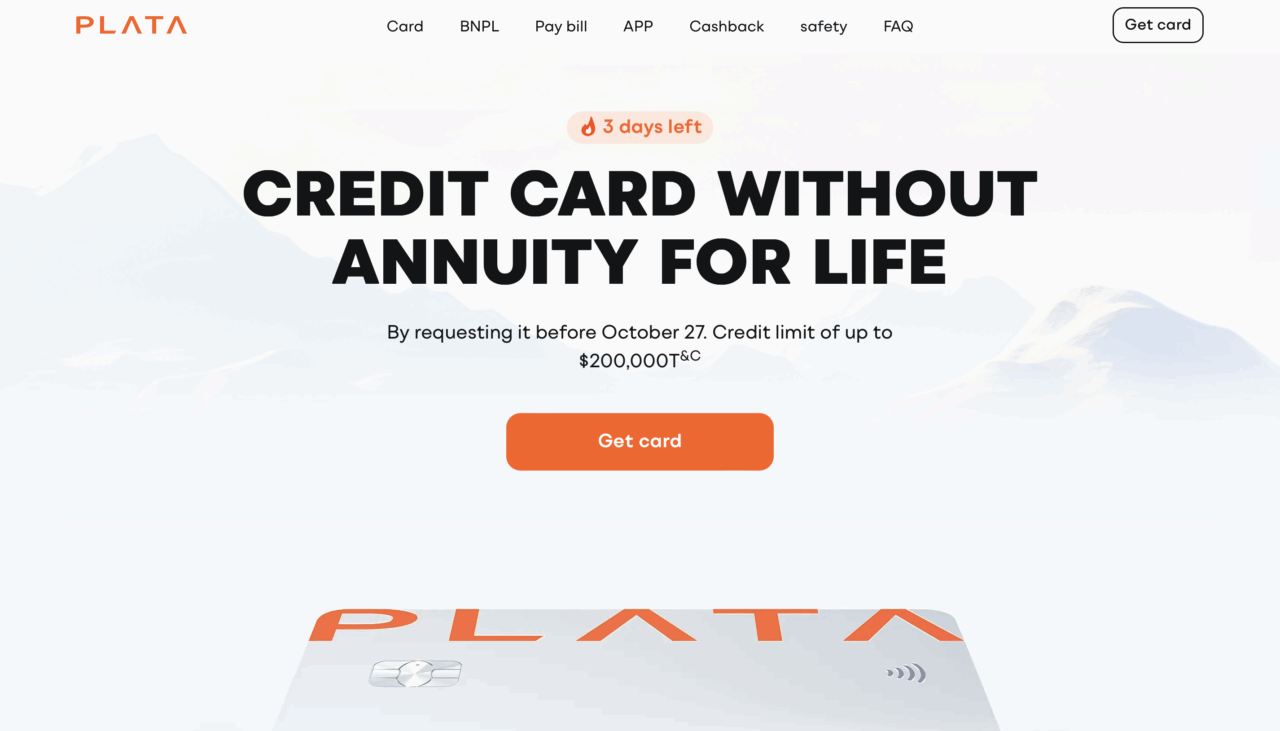

Mexican Fintech Plata Double Valuation on Newest $250 Million Fundraise

Mexican digital monetary platform Plata has secured $250 million in new fairness funding. The spherical, which incorporates each a main fairness increase and a secondary fairness transaction, was led by Kora and featured participation from Moore Strategic Ventures, Audio Ventures, Spice Expeditions, Hedosophia, in addition to a number of US and European household workplaces. The funding builds on an earlier funding by Televisa-Univision and boosts Plata’s valuation to $3.1 billion.

“The expansion we now have achieved in such a short while demonstrates a transparent technique and a shared conviction: construct a robust establishment from its foundations,” Plata CEO and Co-Founder Neri Tollardo stated. “This transaction displays traders’ confidence, the energy of our technological mannequin, and the expertise we now have assembled. We got down to create a digital financial institution constructed on innovation, operational excellence, compliance, and effectivity—and at the moment, we’re seeing the outcomes of that effort.”

Plata acquired its banking license in December 2024 and is ready for authorization to start banking operations. The corporate boasts its personal technological and operational infrastructure, together with a core banking system that permits a completely digital, branchless mannequin with automated danger administration and 24/7 customized customer support. Over the previous 30 months, Plata has topped the 2 million mark when it comes to energetic credit score prospects, making it one of many fastest-growing digital monetary platforms in Latin America. The corporate’s Plata Card offers customers two months to pay with out curiosity and as much as 15% of money again in actual cash.

“We consider Plata represents the brand new customary for digital banking in rising markets,” Kora Co-Founder Nitin Saigal stated. “In a really quick time, the corporate has demonstrated spectacular execution, combining technological innovation with a transparent imaginative and prescient for monetary inclusion. We’re excited to proceed strengthening our partnership and to assist Plata on this new section of progress.”

Revolut obtains Mexican banking license; SumUp goes dwell

This week we realized that two Finovate alums—Revolut and SumUp—are actively exploring alternatives in Mexico. Revolut introduced this week that it has acquired remaining regulatory approval to provoke banking operations in Mexico. The authorization got here from the Nationwide Banking and Securities Fee (CNBV), with approval of the Financial institution of Mexico. Now a A number of Banking Establishment in Mexico, Revolut is the primary impartial digital financial institution to immediately apply for and full the total licensing and approval course of within the nation.

“We’re exceptionally pleased with our workforce and the financial institution we now have constructed right here in Mexico,” Revolut Financial institution S.A., Institución de Banca Múltiple CEO Juan Miguel Guerra stated. “We’re very grateful to the authorities for this vote of confidence and their dedication to fostering competitors within the business, and we’re assured that our providing will profit thousands and thousands of individuals throughout the nation.”

Revolut is a digital banking and monetary providers platform that provides a variety of options, together with multi-currency accounts with real-time change charges; inventory, cryptocurrency, commodity, and ETF investing and buying and selling; in addition to enterprise accounts, company playing cards, and expense administration instruments. Based in 2015, Revolut serves as a monetary providers “tremendous app” for greater than 65 million prospects all over the world.

In the meantime, funds platform SumUp introduced its official launch in Mexico this week. The corporate has launched its SumUp Go card reader to the Mexican market, enabling retailers to simply accept funds anytime, anyplace, with no month-to-month fastened prices. The cardboard reader is suitable with all main credit score and debit playing cards and options each distinctive battery life and limitless 4G mobile connectivity on account of its built-in SIM.

“Increasing into Mexico marks a pivotal step in SumUp’s strategic progress throughout Latin America,” SumUp North America CEO Andrew Helms stated. “We see outstanding potential within the area and acknowledge a robust demand for accessible, user-friendly cost options that streamline enterprise operations. At SumUp, our mission is to simplify enterprise for our retailers and we’re delighted to deliver this dedication to Mexico.”

Based in 2012, SumUp counts greater than 4 million retailers in 37 markets as customers of its cost processing options and enterprise administration instruments. These embody cellular card readers and point-of-sale (POS) techniques, in addition to options for gross sales monitoring and stock administration, buyer loyalty applications, and monetary reporting and analytics.

Revolut has been a Finovate alum since its debut at FinovateEurope 2015. SumUp gained Better of Present in its Finovate debut at FinovateEurope 2013. Each firms are headquartered in London.

Right here is our take a look at fintech innovation all over the world.

Center East and Northern Africa

Oman’s BankDhofar launched its new braille debit card.

The Cooperative Financial institution of Oromia, a regional financial institution primarily based in Ethiopia, partnered with digital transformation firm JMR Infotech to go dwell with Oracle Monetary Providers Crime and Compliance Studio.

Saudi Nationwide Financial institution subsidiary Samba Financial institution unveiled its new fraud detection system powered by BPC’s SmartVista Fraud Administration.

Central and Southern Asia

Mongolian fintech AND International raised $21.4 million in Collection B funding in a spherical led by the Worldwide Finance Company and AEON Monetary Service.

Karandaaz Pakistan and Walee Monetary Providers cast a strategic partnership to launch Pakistan’s first Shariah-compliant, digital asset financing resolution for feminine entrepreneurs.

Did India ban dialogue of cryptocurrencies on the world’s largest fintech convention in Mumbai?

Latin America and the Caribbean

Mexican digital monetary platform Plata doubled its valuation to $3.1 billion upon securing a $250 million Collection B funding spherical.

Uruguay-based cross-border funds platform dLocal teamed up with Alchemy Pay to streamline crypto-to-fiat funds all through Latin America.

Funds platform SumUp introduced its launch in Mexico this week.

Asia-Pacific

Three of Japan’s largest banks—MUFG Financial institution, Sumitomo Mitsuio Banking Corp, and Mizuho Financial institution—introduced plans to collaborate on the launch of a unified stablemcoin.

Tracxn’s not too long ago launched Southeast Asia FinTech Report famous that fintech startups within the area raised $839 million within the first 9 months of 2025, a decline from earlier years.

Fintech innovation in Pyongyang? A take a look at the expansion in recognition of e-payments in North Korea.

Sub-Saharan Africa

African all-in-one monetary platform Moniepoint secured greater than $200 million in Collection C funding.

Sanlam teamed up with TymeBank to construct a co-branded fintech tremendous app for shoppers in South Africa.

Capitec Financial institution partnered with accounting software program firm Stub to offer South African small and micro-sized companies with direct entry to their transactional information.

Central and Jap Europe

German fintech Aifinyo AG introduced that it was changing its stability sheet to bitcoin, changing into the primary German agency to undertake a full bitcoin treasury mannequin.

SoftPOS options firm MineSec inked a Memorandum of Understanding (MoU with Turkish digital funds firm Paymore.

Latvian fintech Eleving Group raised €275 million ($319.5 million) by way of a public bond situation.

Picture by Pyro Jenka on Unsplash

Views: 55