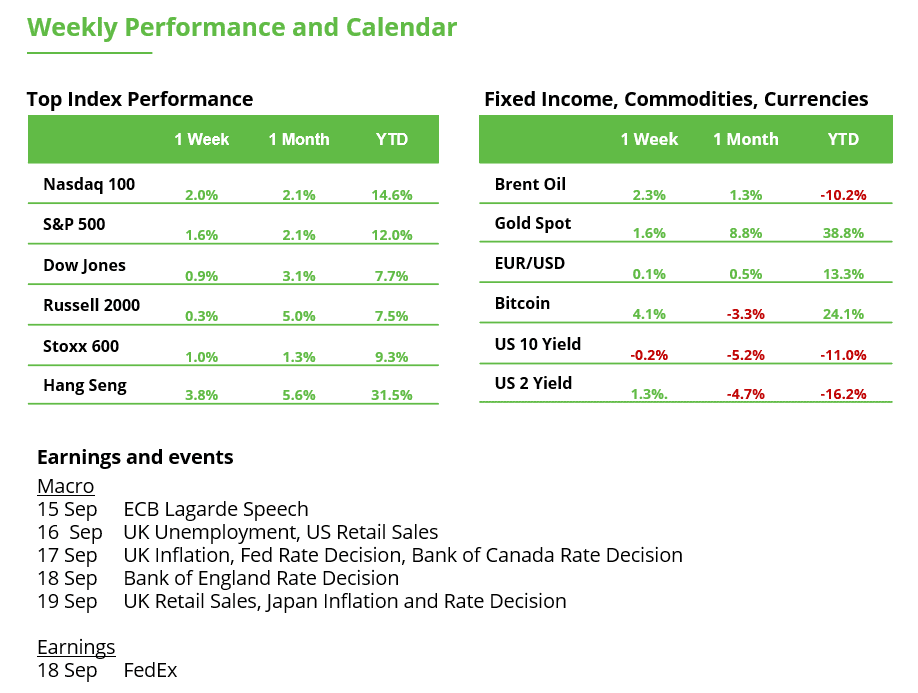

Analyst Weekly September 15, 2025

From EM tech power to report US buybacks, market drivers are stacking up forward of the Fed’s first fee lower of 2025. With US development nonetheless uneven and inflation expectations anchored, Powell is predicted to ship a 25 bp lower this week, however markets will likely be watching his steering on the tempo of additional easing simply as carefully.

Tech is the New EM Engine

Rising markets (EM) have usually been seen as risky and onerous to navigate, however the newest earnings season suggests issues could also be turning a nook. Whereas total EM earnings development was flat in Q2, the breadth of earnings revisions is enhancing for the primary time in months, particularly in Asia, due to tech power and supportive coverage strikes.

Semis lead the pack: The standout theme is know-how. Firms tied to the worldwide AI cycle are fueling earnings upgrades. Taiwan and South Korea, each tech-heavy markets, delivered stable revenue development due to sturdy demand for superior chips. Taiwan’s TSMC and Korea’s SK Hynix are clear beneficiaries, with management in areas like AI accelerators and high-bandwidth reminiscence.

Web shake-up: China’s huge e-commerce companies like Alibaba, JD, and Meituan stay below strain from intense competitors, particularly in meals supply and fast commerce. Nonetheless, Alibaba’s cloud and worldwide companies are serving to offset home challenges. In the meantime, ASEAN web companies equivalent to Seize and Sea are thriving. They’re exhibiting sturdy consumer development, resilient profitability, and increasing into fintech and digital providers. For buyers long-term structural development in EM, it is a key theme: the digital financial system is alive and properly exterior of China.

Financials Regaining Power: One other vibrant spot is financials. Chinese language banks (like China Retailers Financial institution, Financial institution of China) noticed income rebound in Q2, helped by larger charge revenue. Indian and Brazilian banks additionally reported resilient outcomes, with names like ICICI Financial institution and Itau Unibanco highlighted as well-positioned leaders. Robust capitalization and regular mortgage development make them standouts in areas which are nonetheless under-owned by world buyers. For retail shoppers, this implies the monetary sector, lengthy a spine of EM indices, is regaining relevance as a driver of regular returns.

Watch place sizes & FX Threat: EM strikes could be sharp, pacing publicity helps handle swings– broad EM or Asia ex-Japan ETFs assist easy out country-specific shocks. Pair EM tech/financials with publicity to gold (a basic EM hedge) or developed markets. To eradicate foreign money threat, buyers can put money into a foreign money hedged fairness ETF; exchange-traded foreign money (ETCs); or via CFDs or unfold bets.

Funding Takeaway: Rising markets could look uninteresting on the floor, however momentum is quietly constructing. Tech is prospering, banks are stabilizing, and coverage help is boosting home demand. The scary “tariff shock” from US commerce coverage has been much less extreme than anticipated, giving exporters some respiration room. AI and tech cycles stay a worldwide resilience issue, serving to offset weak spots like shopper staples. Alternatives are broadening from Taiwan semis to Indian banks to Southeast Asian web platforms. With valuations nonetheless low cost and development selecting up together with Fed fee cuts, EM publicity may very well be a approach to stability portfolios tilted closely towards US mega-caps.

Huge Buybacks, Greater Affect

US firms are shopping for again inventory at report ranges in 2025. Almost $1 trillion in buyback bulletins have been made up to now this 12 months, placing 2025 on tempo to surpass final 12 months’s whole. Tech giants are main the way in which; Apple ($100B), Google ($70B), and Nvidia ($60B) all unveiled large buyback packages this earnings season. Huge banks like JPM ($50B), GS ($40B), WFC ($40B), and BAC ($40B) have additionally dedicated tens of billions every.

For buyers, buybacks matter as a result of they scale back the variety of shares in circulation. That may increase earnings per share, present worth help, and sign that administration is assured within the firm’s future. However the exercise is very concentrated – a handful of mega-caps signify about 66% of all buybacks this 12 months. For retail portfolios tilted towards tech and financials, that focus means buybacks might play an outsized position in driving returns.

VIX Slips as Markets Keep Pinned

Volatility retains grinding decrease (14.76), with the VIX sliding as key financial knowledge passes with out sparking main swings. Market focus has shifted extra towards indicators of labor market weak point than inflation, whereas the backdrop of potential stagflation, slower development alongside sticky costs, stays a part of the dialog. AI-related shares past the “Magazine 7” have been a vibrant spot, serving to sentiment stabilize.

Nonetheless, supplier positioning into month-end suggests rallies are offered into and pullbacks are purchased, maintaining the S&P 500 range-bound. As soon as September choices and quarter-end expirations are behind us, the market might commerce extra freely, although company buyback blackouts could take away a layer of help. With volatility low, some buyers are eyeing October as window so as to add safety with methods equivalent to QQQ put unfold collars – which cap upside in alternate for cheaper draw back safety – drawing elevated consideration.

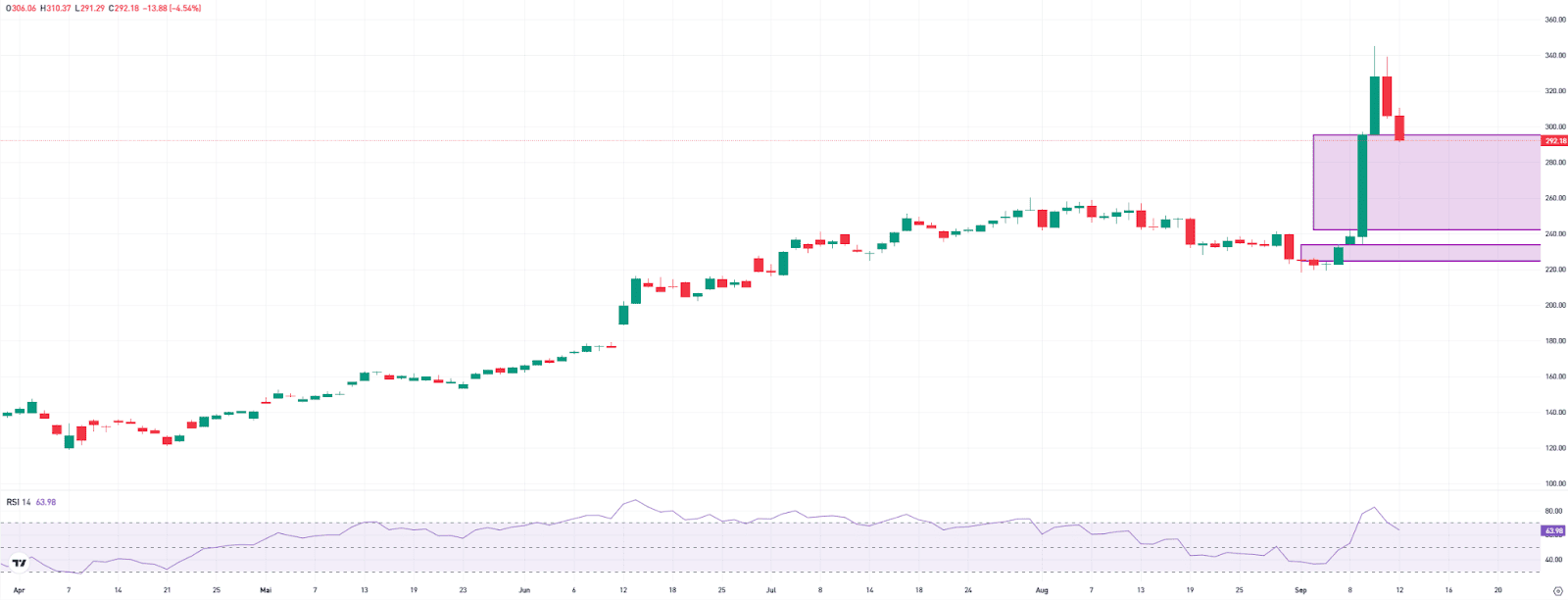

South Korean Shares With Dynamic Restoration

The EWY (iShares MSCI South Korea ETF) ended final week with a 7% achieve at 78.66 factors. In the long run, there may be nonetheless catching as much as do in comparison with the U.S. and European inventory markets. The final report excessive was reached on the finish of 2020 at 96.20 factors. The hole has now narrowed to 18%. Within the medium time period, buyers have more and more turned again to South Korean shares. Because the low in April, the index has risen 62%, whereas the S&P 500 gained solely 37% over the identical interval. From a technical perspective, EWY might proceed its restoration within the coming weeks and months – at the least so long as the help zone between 70.96 and 69.59 factors (Truthful Worth Hole) holds.

EWY within the weekly chart. Supply: eToro

Cloud Enterprise Triggers a Surge in Oracle Shares

Oracle’s inventory skyrocketed final week, gaining over 25%. Robust cloud offers fueled a large order increase. In only one quarter, a number of multibillion-dollar contracts have been signed, together with with OpenAI, Nvidia, and TikTok. The order backlog surged to $455 billion — greater than 4 occasions the earlier 12 months’s stage. On the danger aspect, Oracle faces extraordinarily excessive investments, which put strain on money stream and margins. As well as, there’s a sturdy dependence on a number of main prospects.

The market was closely overbought at occasions, however situations have since eased considerably. Buyers ought to watch the reactions within the two Truthful Worth Gaps created by the rally: between $241 and $296, and between $219 and $234. Bullish reversal alerts in these zones might point out {that a} new upward transfer is about to start.

Oracle within the each day chart. Supply: eToro

Macro Calendar: All Eyes on Powell

The Fed is predicted to chop rates of interest on Wednesday for the primary time this 12 months (determination at 8:00 p.m.). Weak spot within the labor market provides the Fed the inexperienced mild for a lower. A small step of 25 foundation factors to a spread of 4.00 to 4.25 % is predicted. By the top of 2026, markets count on a complete of six small cuts. Persistently excessive inflation might sluggish this tempo. That’s why the brand new quarterly projections from the central financial institution will likely be decisive. In June, the Fed projected core PCE inflation of two.4% for 2026 and a couple of.1% for 2027. A downward revision would give shares and bonds a lift. As well as, Jerome Powell’s press convention at 8:30 p.m. might present key steering on what occurs after the September assembly.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.