Bitcoin’s grip available on the market has remained agency. Its dominance, measured as a proportion of complete crypto market capitalization, presently hovers close to 63.9% after hitting a excessive of 65.3% in Could.

Traditionally, such energy from Bitcoin precedes a broad shift the place merchants rotate income into smaller property. But this time, that shift hasn’t materialized on a significant scale. Individuals are questioning: When will altcoin season start?

Many anticipated 2025 to be the 12 months altcoins made their comeback, however that optimism is beginning to put on skinny midway by way of the 12 months.

EXPLORE: OnlyFans Wealthy Checklist 2025: Sophie Rain Steals Crown as Cracks Emerge in Creator Inequality

Nonetheless, Consultants Agree: Altcoin Season Is Not Lifeless, Simply Delayed

A number of components clarify this uncommon dynamic. One of the vital vital is the rise of institutional buyers, who now view Bitcoin as a regulatory-safe entry level into crypto. With the launch and speedy adoption of spot Bitcoin ETFs, large-scale capital flows straight into BTC.

In earlier cycles, altcoins typically served as speculative stand-ins for Bitcoin. At the moment, establishments can entry BTC straight. That is precisely what they’re doing. This shift has had a dampening impact on the remainder of the market.

Bitcoin stays the consensus commerce amongst establishments. The notion of BTC as a safer wager, backed by regulatory readability and operational reliability, makes it tough for capital to rotate towards altcoins. In distinction, many altcoins are nonetheless grappling with good contract dangers, unclear rules, and excessive centralization. This makes institutional buyers reluctant to enterprise past Bitcoin, no less than for now.

Bitcoin Dominance Chart Indicators: Nonetheless in a BTC-Led Section

(BTC.D)

A have a look at the Bitcoin dominance chart reinforces this narrative. Round 64.8% of Bitcoin’s market share has been climbing steadily since late 2022. In distinction to the 2020–2021 bull run, when BTC dominance peaked at ~73% earlier than quickly falling and sparking a full-fledged altcoin season, there isn’t a signal of reversal but.

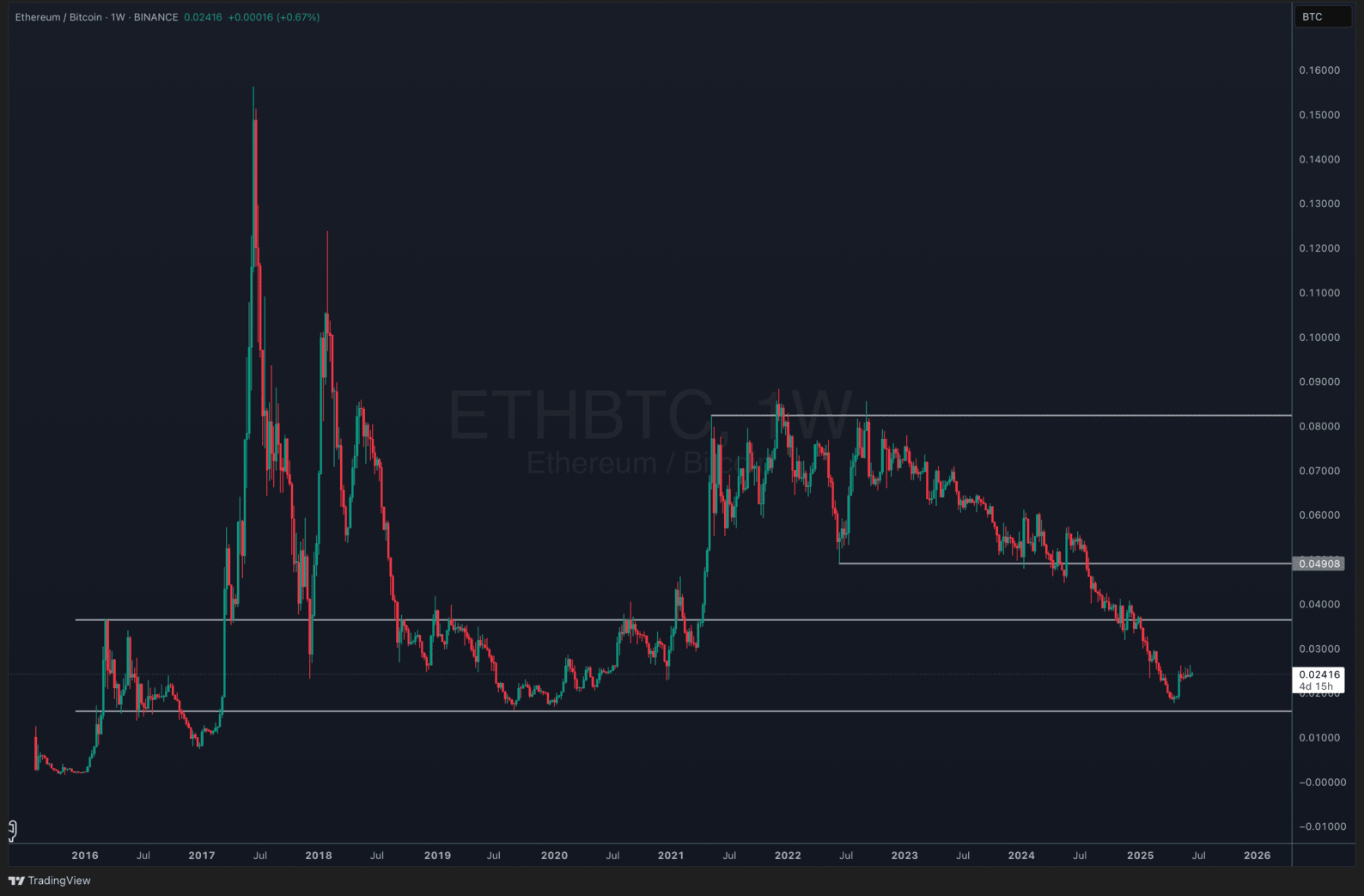

The weekly chart exhibits persistently greater highs and better lows, with capital persevering with to circulate into Bitcoin whereas most altcoins lag. This dominance turns into even clearer within the ETH/BTC chart.

(BTCETH)

Ethereum has struggled to outperform BTC. Whereas it has remained comparatively secure towards the U.S. greenback, it has misplaced floor towards Bitcoin for practically two years. Merely put, holding BTC over ETH throughout this era delivered a greater ROI.

Why this issues: ETH/BTC is commonly seen as a proxy for altcoin confidence. When ETH performs nicely towards BTC, it sometimes alerts rising threat urge for food and a more healthy altcoin market. A falling ETH/BTC ratio, alternatively, suggests defensive positioning and capital consolidation into Bitcoin.

Jess Houlgrave, CEO of Reown, notes that altcoins lag as a result of hype reasonably than fundamentals nonetheless drives many. In the meantime, Bitcoin has solidified its repute with institutional belief, constant utility, and macro relevance.

Some crypto influencers consider the most important altcoin season in historical past may nonetheless start in June—echoing earlier cycles. However macroeconomic components can’t be ignored. Geopolitical tensions, rate of interest uncertainty, and a cautious threat atmosphere have made buyers hesitant to embrace volatility. Liquidity can be unfold skinny throughout an ever-growing pool of latest altcoin initiatives, diluting market consideration.

The result’s a fragmented atmosphere the place few altcoins handle to maintain vital momentum.

Ethereum Accumulates Quiet Energy as Bitcoin Dominance Holds

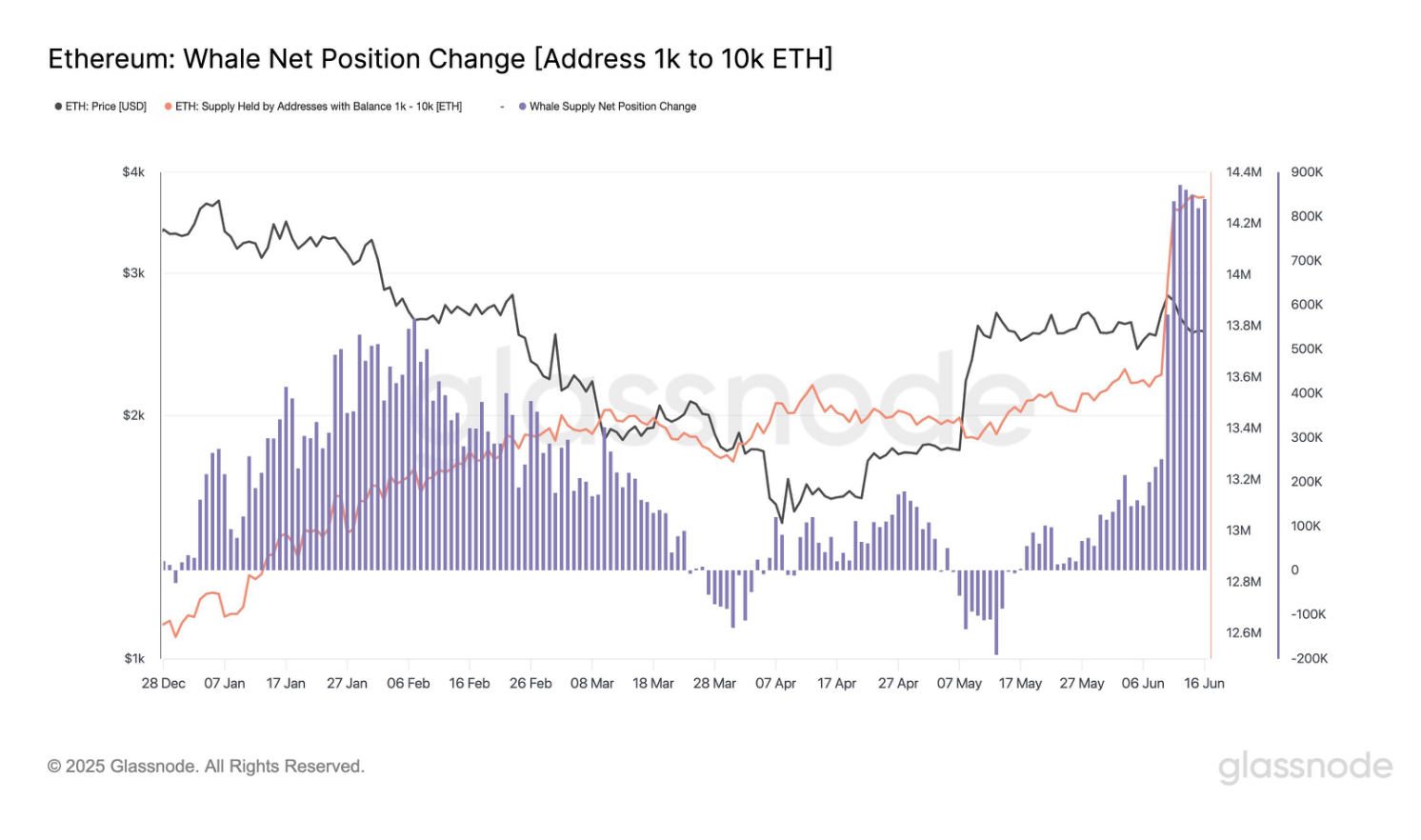

On the brilliant aspect, Ethereum is seeing sturdy accumulation from whales and regular inflows into spot ETFs: over 870,000 ETH was purchased in someday lately, the best since 2017. ETFs have now seen 19 consecutive days of internet inflows, totaling over $500 million.

(Supply)

Regardless of this, ETH’s value has dipped barely on account of a pointy rise in brief positions on CME futures, with internet shorts now at $1.55 billion. This displays a preferred delta-neutral technique: buyers go lengthy through ETFs or spot whereas shorting futures to hedge and earn yield with out direct value publicity.

If staking is accepted for U.S.-based ETH ETFs, this technique may broaden considerably, providing yields shut to eight%. For now, Ethereum’s sturdy fundamentals are being weighed down by refined hedging exercise.

For crypto fans questioning when Bitcoin dominance will lastly fall, the reply could also be: not but, however quickly. Altcoin season could also be taking its time, nevertheless it’s removed from canceled. As Bitcoin’s surge plateaus and contemporary capital seems to be for greater returns, the altcoin market may stage a comeback, doubtlessly as we close to the top of 2025 or enter 2026.

DISCOVER: High Solana Meme Cash to Purchase in 2025

Key Takeaways

Is an altcoin season close to? Bitcoin dominance stays close to 64%, displaying no indicators of reversal and delaying the beginning of a broad altcoin rally.

Institutional capital flows into BTC through ETFs, lowering speculative curiosity in altcoins in comparison with previous cycles.right this moment’s Institutional buyers are prioritizing Bitcoin, leaving much less liquidity for the broader altcoin market.

Ethereum underperforms towards Bitcoin, however whale accumulation and ETF inflows recommend quiet energy constructing. Whales are accumulating ETH, and ETFs have seen over 19 consecutive days of inflows.

Altcoin season could emerge by late 2025, as Bitcoin plateaus and buyers rotate into higher-risk property in search of stronger returns.

Why you may belief 99Bitcoins

Established in 2013, 99Bitcoin’s staff members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Knowledgeable contributors

2000+

Crypto Tasks Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the most recent updates, traits, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now