Ethereum is buying and selling at a crucial juncture after briefly dropping the $3,200 degree, with bulls struggling to defend it amid rising promoting stress. The broader crypto market stays on edge, as worry and uncertainty proceed to weigh on sentiment following days of regular declines throughout main belongings. Merchants are watching carefully to see if Ethereum can stabilize above this key assist zone — a failure to take action may set off a deeper correction towards the $3,000 space.

Associated Studying

Regardless of the mounting stress, one outstanding Ethereum whale — identified for a sequence of large-scale purchases this month — continues to build up aggressively. This investor has persistently added to their place whilst the worth fell, signaling robust long-term confidence in Ethereum’s fundamentals and restoration potential.

This divergence between short-term worry and long-term accumulation paints a posh image for Ethereum. Whereas short-term volatility stays a priority, massive holders’ continued shopping for could also be setting the inspiration for a extra sustained rebound as soon as market situations stabilize and sentiment improves.

Ethereum Whale Retains Shopping for Regardless of Market Turbulence

In line with information from Lookonchain, the outstanding Ethereum investor often known as Whale ’66kETHBorrow’ has continued his large-scale accumulation regardless of the continued market downturn. Earlier immediately, the whale bought 19,508 ETH value roughly $61 million, increasing his already huge place constructed over the previous week.

Shortly after, an replace revealed yet one more buy — 16,937 ETH valued at $53.91 million — bringing his complete accumulation since November 4 to 422,175 ETH, value roughly $1.34 billion at a mean worth close to $3,489. Regardless of the current worth drop, the whale is presently sitting on greater than $120 million in unrealized losses, however continues to double down on Ethereum publicity.

This aggressive technique signifies robust long-term confidence, because the investor seems unfazed by short-term volatility. Market observers recommend this accumulation sample may sign institutional-level conviction that Ethereum’s present costs signify a strategic shopping for zone.

Whereas retail sentiment stays cautious amid heightened uncertainty, the whale’s constant exercise underscores a broader pattern: massive gamers are quietly accumulating, positioning themselves forward of a possible restoration as soon as macro situations stabilize and danger urge for food returns to the crypto market.

Associated Studying

ETH Struggles Beneath $3,300 as Promoting Strain Intensifies

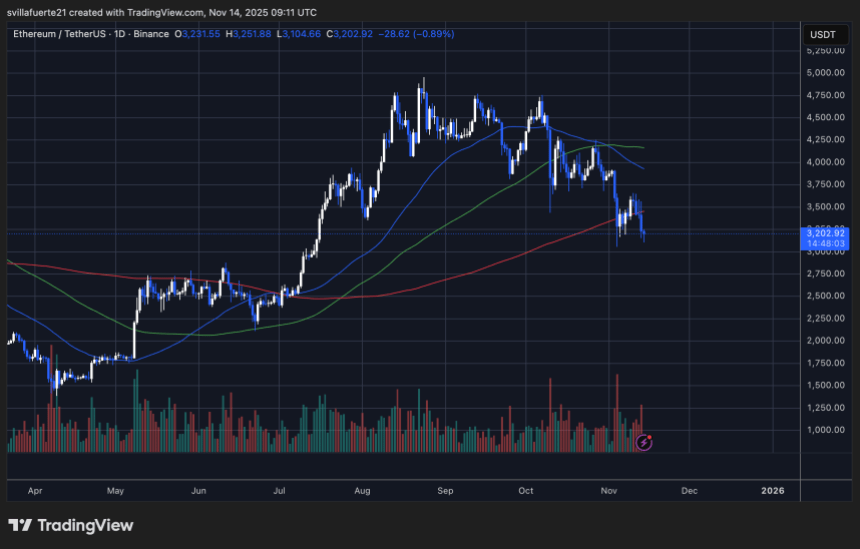

Ethereum is presently buying and selling round $3,200, dealing with renewed promoting stress after briefly reclaiming the $3,400 zone earlier this week. The each day chart exhibits ETH struggling to carry above its 200-day transferring common (pink line) — a key assist degree that usually defines long-term market construction. A decisive shut under this line may affirm a deeper correction part.

The 50-day and 100-day transferring averages proceed to pattern downward, reinforcing the short-term bearish outlook. If Ethereum fails to recuperate momentum, the subsequent main assist sits close to $3,000, adopted by $2,850, the place consumers beforehand stepped in through the summer season consolidation. Conversely, a restoration above $3,400–$3,500 can be the primary sign that bullish momentum is returning.

Associated Studying

Regardless of the pullback, analysts emphasize that giant holders — together with the #66kETHBorrow whale — proceed to build up ETH, signaling robust conviction within the asset’s long-term potential. For now, Ethereum’s pattern stays fragile, and bulls should defend the $3,000 area to stop additional draw back momentum.

Featured picture from ChatGPT, chart from TradingView.com