Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum is exhibiting renewed energy because it consolidates above the $2,500 mark, signaling resilience within the face of broader market volatility. After a number of weeks of testing the $2,700 area, ETH stays inside putting distance of this crucial resistance, maintaining bullish momentum alive. Market sentiment has shifted in Ethereum’s favor, with analysts and traders more and more pointing to the potential for an upcoming altseason.

Associated Studying

High analyst Huge Cheds shared a technical breakdown, noting that ETH is presently again to a key transferring common after flexing a transfer above the $2,700 vary. This transfer aligned with the underside of a key resistance stage, forming a confluence zone that would act as a springboard or rejection level within the days forward.

Whereas Bitcoin consolidates slightly below its all-time excessive, Ethereum seems to be gaining traction as merchants search for alternatives past BTC. With ETH holding greater lows and establishing a gentle base, a breakout above the $2,700–$2,800 vary might verify a broader market rotation into altcoins. For now, bulls should preserve management above $2,500 to maintain the construction intact and gas hopes of a transfer greater.

Ethereum At A Pivotal Degree As Bulls Defend Help

Ethereum is dealing with a vital check because it struggles to reclaim greater costs and ensure a sustained uptrend. After a number of makes an attempt to interrupt above the $2,700 resistance zone, the worth has been met with volatility, making a uneven surroundings that displays broader uncertainty within the crypto market. Regardless of this, analysts stay optimistic about Ethereum’s prospects, particularly as altseason chatter grows louder.

Cheds lately shared a key perception: Ethereum is now again at its 20-day transferring common (DMA) after briefly surging above the $2,700 vary. This push met the underside of the 200-day easy transferring common (SMA), making a confluence zone that would act because the launchpad for the following rally, or the road within the sand that decides short-term course. Holding this DMA help is crucial. If bulls defend this stage, it might sign renewed energy and spark a breakout that sends ETH again towards $3,000 and past.

Amid rising hypothesis and technical strain, Ethereum’s present construction nonetheless leans bullish. It’s sustaining greater lows and continues to point out indicators of accumulation, which helps the thesis of a doable altseason within the close to future. If BTC stabilizes and ETH clears resistance, your complete market might shift upward quickly.

Associated Studying

Ethereum Checks Help At Key Brief-Time period Ranges

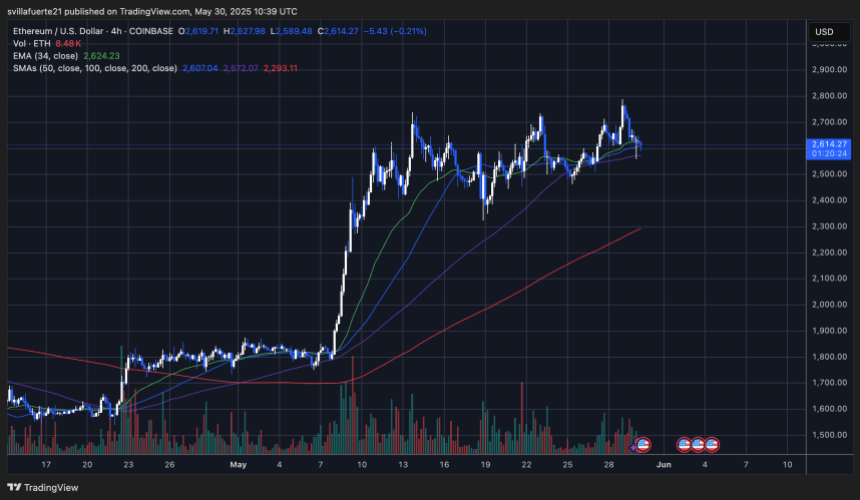

Ethereum is consolidating on the 4-hour chart because it hovers round $2,614, following a minor pullback from the $2,780 native prime. The chart reveals ETH retesting the 34-period EMA (presently close to $2,624) and discovering short-term help alongside the confluence of the 50 and 100-period SMAs. These transferring averages are performing as a dynamic help band that has held agency throughout earlier retracements in Could.

The construction stays bullish general, with greater lows maintained because the breakout on Could 9. Nevertheless, the present worth motion is forming a tightening wedge sample, which suggests {that a} breakout—both up or down—is imminent. Quantity has been declining barely, indicating a possible pause earlier than a decisive transfer.

Associated Studying

For bulls, holding above the $2,580–$2,600 zone is crucial. A clear bounce from right here might arrange one other try to interrupt the $2,700–$2,800 resistance space. On the flip aspect, a break beneath the 100 SMA might expose ETH to a deeper retracement towards $2,500 and even the $2,400 zone if promoting strain accelerates.

Featured picture from Dall-E, chart from TradingView