The Ethereum value struggled to interrupt out of the $2,500 – $2,700 vary over the previous week, mirroring the sluggish situation of the final market. On Friday, June 20, the altcoin succumbed to a recent wave of bearish strain, falling towards the $2,400 mark to shut the week.

Unsurprisingly, this newest downturn seems to be forcing the palms of traders who’ve been banking on the $2,500 assist degree over the previous few weeks. Right here’s how the falling ETH value and the ensuing sell-off might have an effect on the altcoin’s future trajectory.

ETH Worth At Danger As Taker Sellers Unload Their Tokens

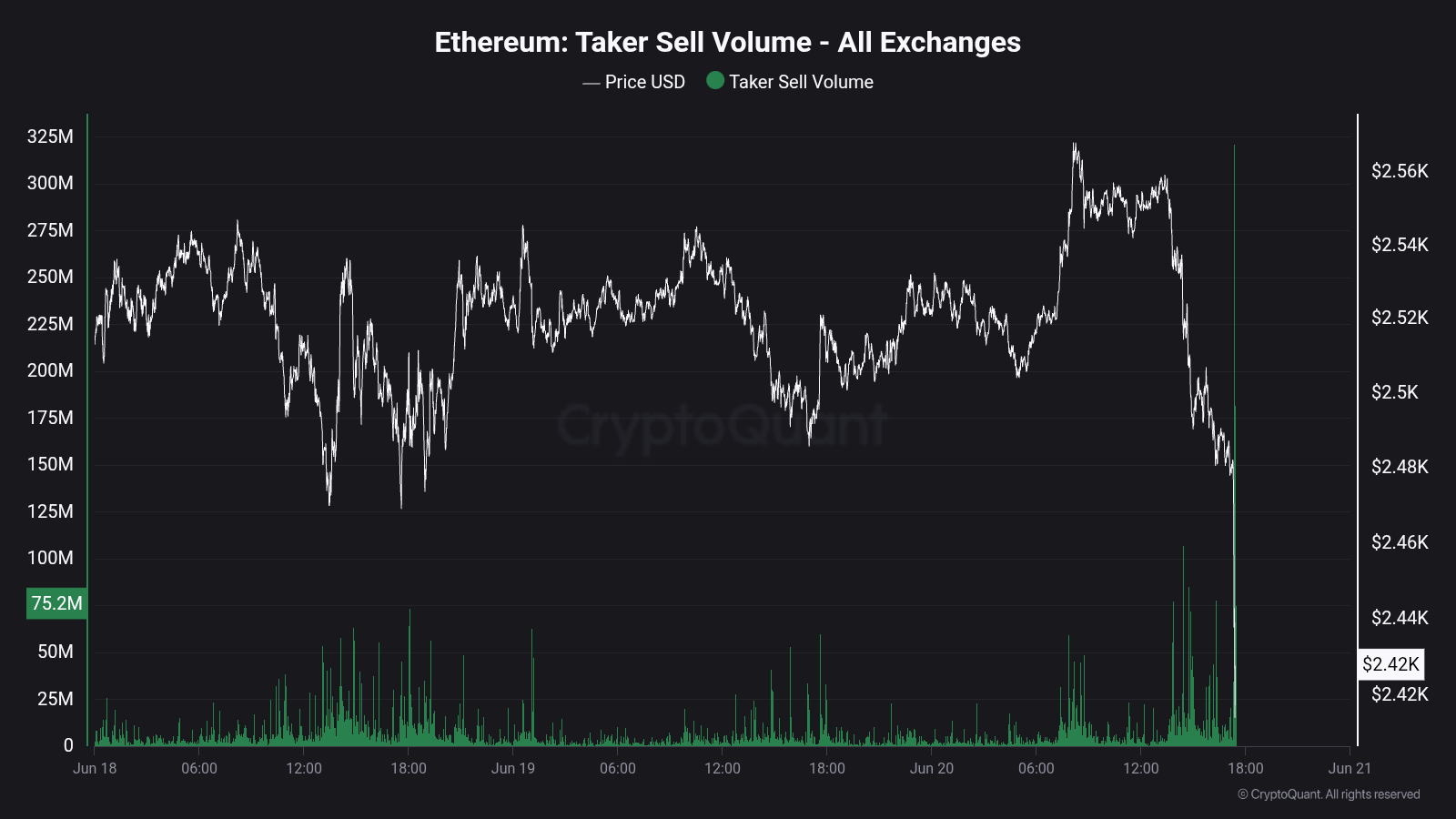

In a current submit on the social media platform X, on-chain analyst Maartunn revealed {that a} set of Ethereum merchants could be on the transfer once more. This on-chain remark revolves round a soar within the Taker Promote Quantity, a metric that estimates the whole quantity of promote orders crammed by takers in perpetual swaps of a particular cryptocurrency (ETH, on this case).

To supply some context, a taker refers to a market participant who locations an order matched with an current order on the order guide. With this definition, the Taker Promote Quantity represents the whole quantity of a cryptocurrency offloaded or offered by these market individuals inside a particular interval.

Within the submit on X, Maartunn highlighted in his submit that promote strain is mounting within the Ethereum market, as taker sellers are starting to dominate the consumers on exchanges. In keeping with information from CryptoQuant, the ETH Taker Promote Quantity on all centralized exchanges surged to round $321.3 million inside a minute on Friday.

Supply: @JA_Maartun on X

Usually, vital spikes within the Taker Promote Quantity have usually been adopted by a interval of downward strain on the worth of Ethereum. If historical past is something to go by, traders may count on the second-largest cryptocurrency to wrestle over the subsequent few days.

Ethereum Worth Overview

As of this writing, the worth of ETH sits simply above the $2,410 degree, reflecting an nearly 5% decline up to now 24 hours. In keeping with information from CoinGecko, the altcoin is down by almost 6% over the past seven days.

The Ethereum value has been caught in consolidation throughout the $2,500 – $2,800 vary over the previous few weeks. With the token’s value now beneath a significant assist in $2,500 and the rising bearish strain, the percentages of ETH embarking on a sustained rally look slimmer.

The worth of ETH on the each day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.