Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value climbed 3% within the final 24 hours to commerce at $3,857.27 as of 1 a.m. EST on an 8% drop in buying and selling quantity to $35.91 billion.

The ETH value rise comes as sentiment within the crypto market recovers a tad, with the Crypto Worry & Greed Index ticking as much as a ”worry” studying of 33 from 29 a day earlier.

Day by day buying and selling quantity stays sturdy, and key technical indicators are starting to tilt constructive.

The market feels unhealthy proper now.

Bitcoin is dumping, liquidity is skinny, and there are actually no patrons.

However below the floor, one thing vital is going on on Ethereum.

On chain exercise throughout seventy six main Ethereum primarily based tokens simply hit a brand new all time excessive with… pic.twitter.com/rr056Ob6MI

— BitBull (@AkaBull_) October 31, 2025

Business watchers be aware that Ethereum is outperforming some friends as patrons step in round vital assist ranges, with ETH exhibiting indicators it might maintain its rebound

Coin Worth Resilience: ETH Worth Holds Above Key Ranges

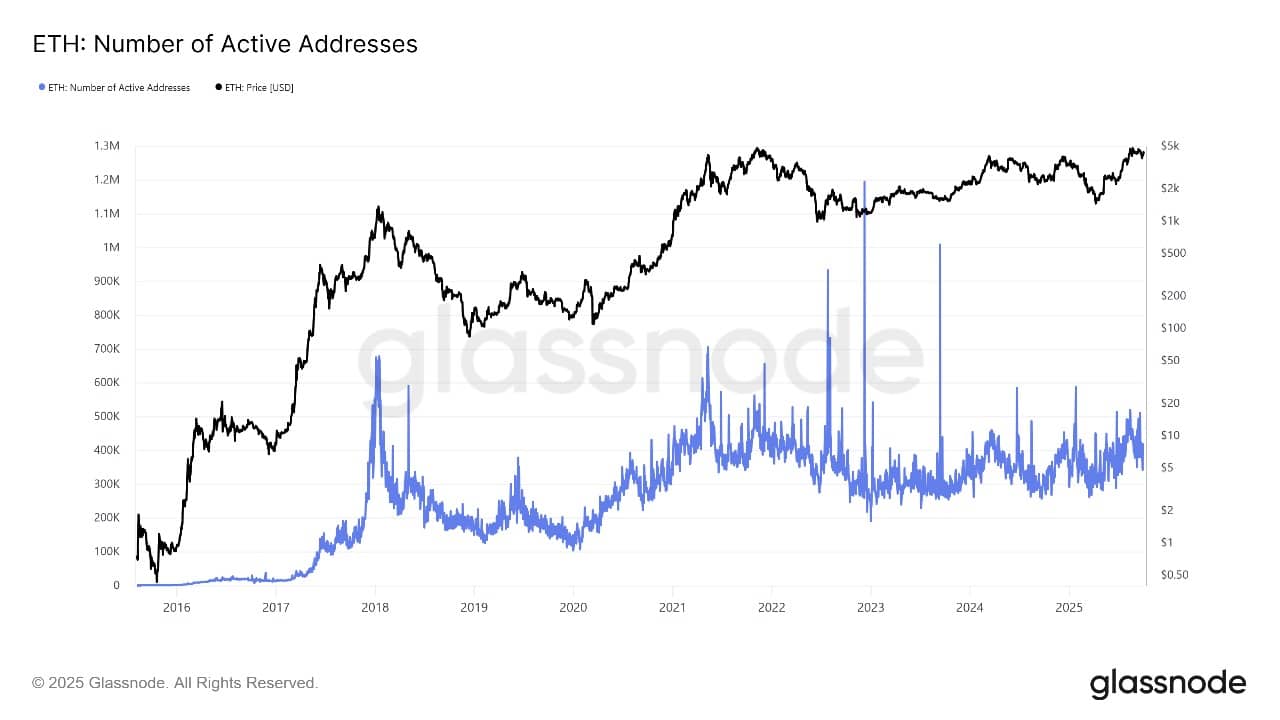

On-chain exercise displays the constructive vibe. Transaction counts and exercise throughout Ethereum dApps are booming, bringing renewed confidence to long-term holders and signaling wholesome community utilization. Extra wallets are lively.

The ETH value turned a focus for merchants in November, as on-chain exercise on the Ethereum community hit all-time highs. Current information from analytics firms like Santiment and CryptoOnChain reveals Ethereum’s blockchain hosts the deepest stage of developer and consumer engagement ever recorded.

ETH Lively Addresses Supply: Glassnode

In latest weeks, institutional inflows have began selecting up once more. Massive funds are rotating capital into Ethereum, making use of decrease costs and constructive developments from new DeFi and NFT tasks constructing on the community. Ethereum staking participation additionally stays excessive, which limits provide on exchanges and helps increased costs when new demand arrives.

With Blockchain upgrades nonetheless on monitor and main firms exploring Ethereum for tokenised finance, the outlook stays upbeat for the ETH value. Bulls are watching carefully to see if the present uptrend can outlast ongoing regulatory debates in key markets. To date, the development suggests buyers stay optimistic.

ETH Worth Technical Evaluation: Uptrend Awaits Breakout

Technical evaluation of the ETH value reveals that the coin is making an attempt to interrupt above its 50-day easy transferring common (SMA) of $4,180.90 however stays above key assist on the 200-day SMA of $3,341.15, as proven within the chart.

The relative energy index (RSI) sits at 43.13, signaling that ETH is neither overbought nor oversold, which implies there’s room for extra upside motion earlier than any sturdy correction is probably going.

ETH has been largely range-bound between $3,700 and $4,180, with the 38.2% Fibonacci retracement at $3,852 performing as an vital pivot. If ETH can maintain above this stage, the subsequent resistance sits close to $4,108 after which $4,180.

ETHUSD Evaluation Supply: Tradingview

A profitable break might see ETH push in direction of the psychological $4,500 stage and maybe even problem the yearly excessive round $4,952 if momentum gathers tempo.

On the draw back, if sellers take management, ETH might slide again to $3,341 (200-day SMA) or fall additional to the 61.8% Fibonacci retracement at $2,743, which might take a look at investor persistence and certain herald new dip patrons. The typical directional index (ADX) worth at 19.10 alerts that the development continues to be forming however not but sturdy, so market route might shift rapidly.

Primarily based on market fashions and forecasts, ETH value might even see an 11–19% enhance via the remainder of November, with typical goal ranges transferring in direction of $4,250 and presumably extending to $4,595 if bullish alerts persist.

Predictive fashions recommend that whereas sentiment began the month cautious, bettering fundamentals and technicals make additional features more and more seemingly.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection