Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum (ETH) is now buying and selling under the essential $2,000 mark, struggling to seek out momentum after days of promoting stress and consolidation round $1,900. The broader crypto market stays beneath heavy bearish management, and ETH has misplaced over 57% of its worth, making it more and more troublesome for bulls to stage a restoration.

Associated Studying

With Ethereum now under a multi-year help stage, this zone may flip into robust resistance, additional complicating any potential rebound. The market is in a extremely unstable section, and merchants are watching carefully for indicators of power or additional draw back dangers.

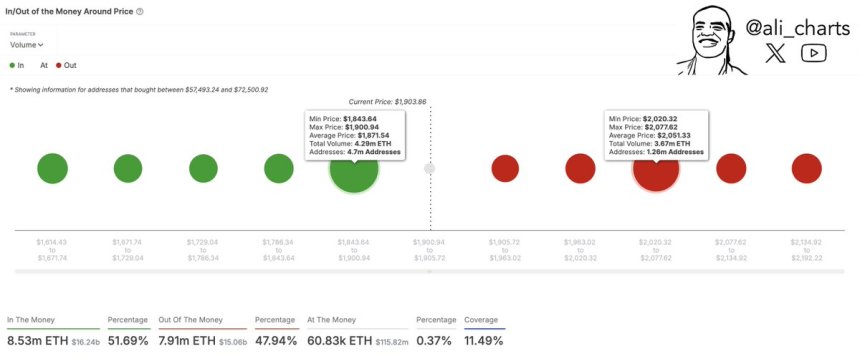

On-chain knowledge highlights two key value ranges for Ethereum’s speedy trajectory. $1,870 at the moment serves as its vital help; in the meantime, $2,050 is now its most difficult resistance, appearing as a significant barrier that ETH should reclaim to substantiate a pattern reversal.

For now, Ethereum stays susceptible, with uncertainty driving value motion. If bulls fail to defend present help, ETH may see additional declines, however a profitable reclaim of resistance may spark renewed confidence available in the market. The following few days will likely be essential in figuring out ETH’s short-term route.

Ethereum Faces Important Check As Bulls Battle To Reclaim $2,000

Ethereum is at an important turning level, buying and selling close to its lowest stage since October 2023 as bears preserve management. After weeks of promoting stress and uncertainty, bulls should reclaim the $2,000 mark as quickly as potential to forestall additional draw back and restore market confidence.

Associated Studying

The broader macroeconomic panorama stays unsure, with commerce warfare fears and world monetary instability weighing closely on each crypto and US inventory markets. These elements have set the stage for a possible deeper correction, leaving traders on edge. Nevertheless, some analysts imagine a market restoration remains to be potential within the coming months, notably if Ethereum can regain key resistance ranges.

High analyst Ali Martinez not too long ago shared on-chain metrics, figuring out $1,870 as Ethereum’s strongest help stage. Because of this if ETH breaks under this zone, an additional decline may very well be imminent. On the upside, $2,050 is now Ethereum’s most difficult resistance, appearing as an important barrier that bulls should overcome.

If Ethereum efficiently reclaims $2,050, it’s going to sign a robust pattern reversal, probably setting the stage for a strong restoration rally. The following few buying and selling periods will likely be vital, as ETH should both maintain its floor or threat additional draw back, with traders carefully monitoring value motion.

ETH Bulls Should Maintain Above $1,900

Ethereum is at the moment buying and selling at $1,920, following days of consolidation under the essential $2,000 stage. Regardless of makes an attempt to push larger, bulls have struggled to reclaim misplaced floor, leaving ETH in a susceptible place.

To substantiate a restoration, ETH should break above the $2,000 mark and push past the 4-hour 200-moving common (MA) and exponential shifting common (EMA) round $2,400. A profitable reclaim of those ranges would sign renewed shopping for momentum, probably setting the stage for a robust rally towards larger resistance zones.

Nevertheless, if Ethereum fails to reclaim these ranges, promoting stress may intensify, driving ETH towards decrease demand zones round $1,750. A breakdown under this stage would put much more stress on bulls, probably resulting in additional draw back and prolonged bearish sentiment.

Associated Studying

With market situations nonetheless fragile, ETH’s short-term route stays unsure. Bulls should step in quickly to defend key ranges, or Ethereum dangers shedding additional floor, making a fast restoration far more troublesome. The following few days will likely be essential, as ETH merchants look ahead to a breakout or additional draw back motion in response to broader market traits.

Featured picture from DALL-E, chart from TradingView