A sturdy curiosity in Ethereum, the second-largest digital asset, seems to be returning to the market. A number of institutional traders, particularly company treasury companies, are at present accumulating the main altcoin in mild of ongoing market volatility and fast fluctuations in ETH’s worth.

Bitmine Resumes Its Strategic Ethereum Shopping for Spree

Whereas the worth of Ethereum is experiencing bearish strain, giant treasury firms are doubling down on ETH as they proceed to buy the asset in huge chunks. One of many newest notable ETH buys comes from Bitmine Immersion Applied sciences Inc., a public blockchain expertise firm.

Bitmine Immersion as soon as once more is making headlines with a large strategic buy of ETH on Thursday. Main intelligence and blockchain analytics firm Arkham shared the latest ETH acquisition on the social media platform X.

In line with the intelligence platform, the corporate bought over 104,336 ETH, valued at $417 million, strengthening its treasury reserve. Such a large Ethereum buy from Bitmine Immersion reinforces the agency’s long-term conviction within the asset and its increasing ecosystem.

Moreover, the transfer additionally signifies renewed rising institutional curiosity in ETH regardless of its waning worth motion up to now few days on account of final weekend’s market crash. As institutional curiosity in digital belongings grows, BitMine‘s ongoing acquisitions underscore a bigger sample of progressive firms getting ready for Ethereum’s future technological and financial supremacy.

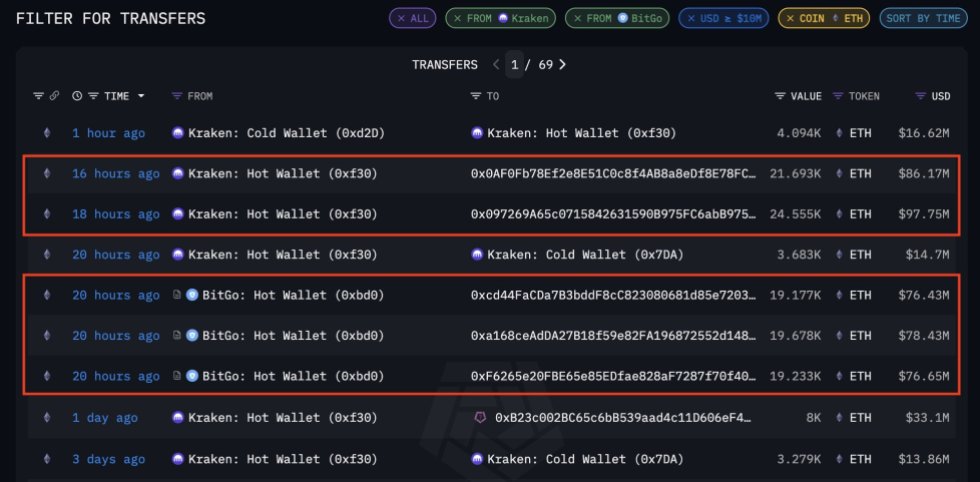

Information shared by Arkham reveals that two pockets addresses related to the corporate took $185 million in ETH out of American-based crypto change Kraken on Wednesday night time. As well as, one other ETH motion valued at $231.5 million was withdrawn from BitGo the identical day.

Is Bitmine Changing into The MicroStrategy Of ETH?

Bitmine Immersion’s newest Ethereum purchase to extend its treasury reserve has triggered a frenzy within the crypto group. Given its persistent accumulation of the altcoin over time, ZYN, a crypto investor, has declared Bitmine the MicroStrategy of ETH. This assertion attracts a comparability to the sample adopted by Michael Saylor towards Bitcoin, the flagship digital asset.

In line with the knowledgeable, Bitmine’s huge acquisition of ETH is an indication of huge conviction. Regardless of the heavy buys seen amongst giant companies, ZYN believes it isn’t sufficient, and extra large consumers are wanted. His main cause for this assertion is the continued panic promoting amongst traders. In his view, extra consumers, particularly institutional ones, are required to soak up that promoting strain.

Presently, Ethereum is witnessing historical past as its treasuries and Spot Change-Traded Funds (ETFs) develop exponentially. Information from everstake.eth on the X platform exhibits that the cumulative provide of ETH held in each areas has reached 12.8 million ETH, price a staggering $48.6 billion. These huge holdings now symbolize over 10% of the Ethereum provide.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.