Senator Elizabeth Warren is escalating her long-running conflict with crypto, this time zeroing in on decentralized exchanges and singling out PancakeSwap as a possible nationwide safety danger.

Warren actually as soon as tried to cease two sandwich firms from merging. Individuals couldn’t afford each lease and meals beneath Bidenflation, and she or he was out combating Large Sandwich. Whole joke of a senator.

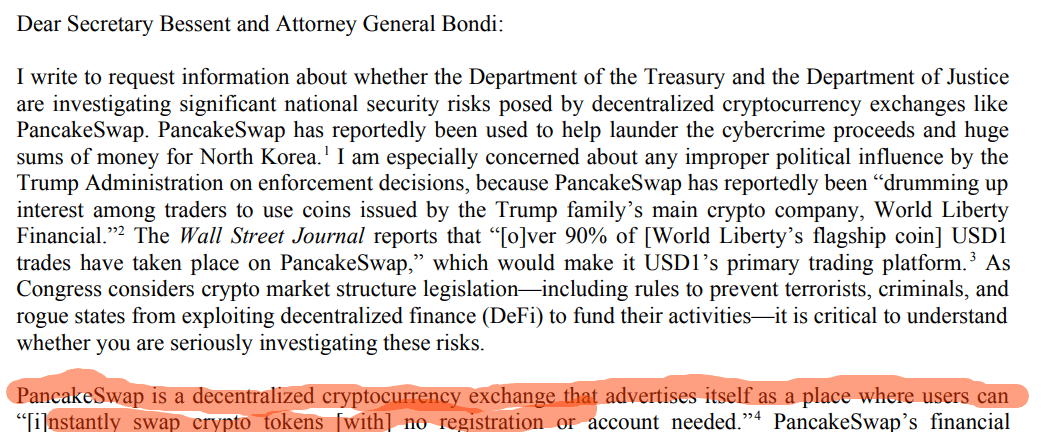

In the meantime, in a letter despatched this week to Treasury Secretary Scott Bessent and Lawyer Normal Pam Bondi, the Massachusetts senator demanded solutions by January 12 on whether or not US regulators are adequately policing DeFi platforms that function exterior conventional anti-money laundering frameworks.

Warren’s concern just isn’t summary. She factors on to PancakeSwap’s alleged position in laundering funds tied to North Korea’s largest-ever crypto heist and its newer embrace of USD1, a dollar-backed stablecoin linked to Trump-backed World Liberty Monetary. Right here’s what to know:

Why Is Elizabeth Warren Mad? The $1.4 Bn Hack That Put DeFi Again within the Crosshairs

Warren’s letter leans closely on blockchain forensics. Analytics agency Allium and investigations specialist TRM Labs traced roughly $263 million, about 20% of the $1.4 Bn stolen from Bybit in February, by means of PancakeSwap liquidity swimming pools.

Warren wrote: “With out regulatory monitoring, illicit actors will more and more be capable to purchase crypto belongings on decentralized exchanges and facilitate transactions with out establishments that would in any other case flag suspicious exercise.”-Senator Elizabeth Warren

That is the core of her argument. DEXs course of billions every day with out KYC, and that design selection is now being framed as a nationwide safety vulnerability reasonably than a philosophical function.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Trump, USD1, and the Politics of Enforcement: What’s Subsequent?

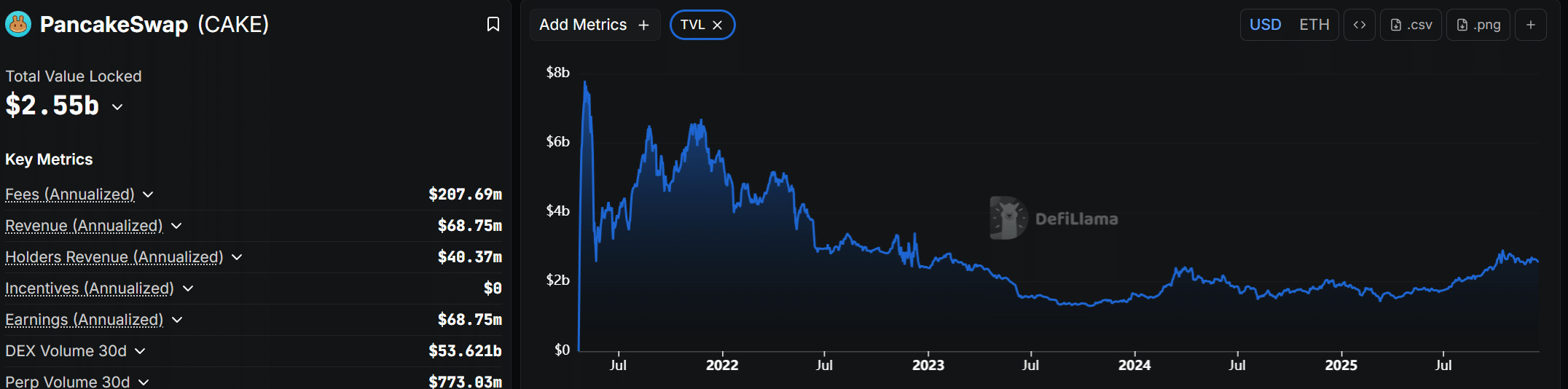

In accordance with DeFi Llama, PancakeSwap often clears billions in month-to-month buying and selling quantity throughout BNB Chain and Ethereum-linked networks. CoinGecko information reveals it stays one of many prime DEXs globally by customers and liquidity. On the similar time, Glassnode estimates illicit on-chain flows surged throughout main hacks in 2025 whilst centralized alternate monitoring tightened, pushing dangerous actors towards DeFi rails.

That shift issues as Congress debates crypto market construction.

Moreover, the politics and potential Trump-led corruption make this flamable. PancakeSwap partnered with World Liberty Monetary earlier this yr to advertise USD1 buying and selling, simply months after Binance deepened its personal integration of the Trump-linked stablecoin. Binance has denied any connection between that enlargement and Changpeng Zhao’s pardon, however Warren is unconvinced.

She warned: “It’s vital to grasp whether or not enforcement choices are being influenced by political connections.” – Senator Elizabeth Warren

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Why This Struggle Issues for Crypto Markets in 2026

Vitality markets, equities, and crypto are all repricing round political danger once more. If DeFi turns into the sacrificial lamb to get a invoice handed, liquidity might migrate quick.

If it doesn’t, Warren is signaling she’s going to preserve dragging platforms like PancakeSwap into the highlight. Both means, the period of DeFi flying beneath the radar is over; one of many last fights is right here.

EXPLORE: Looking for a Profession Change? Develop into a Bitcoin Bounty Hunter in Fordow, Iran

Key Takeaways

Senator Elizabeth Warren is escalating her long-running conflict with crypto, this time zeroing in on PancakeSwap

“With out regulatory monitoring, illicit actors will more and more be capable to purchase crypto belongings on decentralized alternate,” mentioned Warren

Why you’ll be able to belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Professional contributors

2000+

Crypto Tasks Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the newest updates, traits, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now