The Day by day Breakdown takes a scoop into Chipotle, inspecting what’s going mistaken with the inventory. Is the decline sufficient to entice traders?

Earlier than we dive in, let’s ensure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our day by day insights, all you have to do is log in to your eToro account.

Deep Dive

Most of us are accustomed to Chipotle, the corporate that’s well-known for its bowl and burrito choices. This fast-casual juggernaut commanded a market cap of just about $100 billion at its all-time excessive from 2024, however has struggled since, with shares down almost 40% from the height and into an fascinating technical space.

It didn’t assist that former CEO Brian Niccol — the one who helped lead an enormous turnaround on the agency — left final yr and went to Starbucks. From that perspective, some traders have seemingly misplaced religion in administration’s means to correctly steer the Chipotle ship.

The Enterprise

After we take a look at the enterprise, we are able to see that income, web earnings, and free money circulate have been steadily rising over time. After we take a look at expectations for 2025, analysts anticipate income to rise 7.5% and earnings to develop 8.5%. Additional, they anticipate each figures to speed up to double-digit progress in 2026 and 2027, with earnings progress outpacing income progress (which might be good for margins).

The danger: Whereas analysts’ estimates might be spot-on correct — and even too conservative — one danger is that the estimates are too optimistic. If that’s the case, Chipotle could not develop as quick as traders at the moment anticipate and that might inflict additional ache on its share value.

One other danger? The buyer. Within the firm’s final convention name, CEO Scott Boatwright stated:

“I believe a lot of what we’re experiencing proper now is because of macro and the low-income shopper is on the lookout for worth as a value level. At current you must look no additional than what’s occurring with our rivals with snack event or $5 meals, and that’s the place the patron is drifting in the direction of, [with] worth as a value level due to low shopper sentiment.”

Nonetheless, he added:

“We did see some share loss within the April-Might timeframe because the low-income shopper pulled again, however we’re again to share beneficial properties but once more in June-July.”

Wish to obtain these insights straight to your inbox?

Enroll right here

Diving Deeper

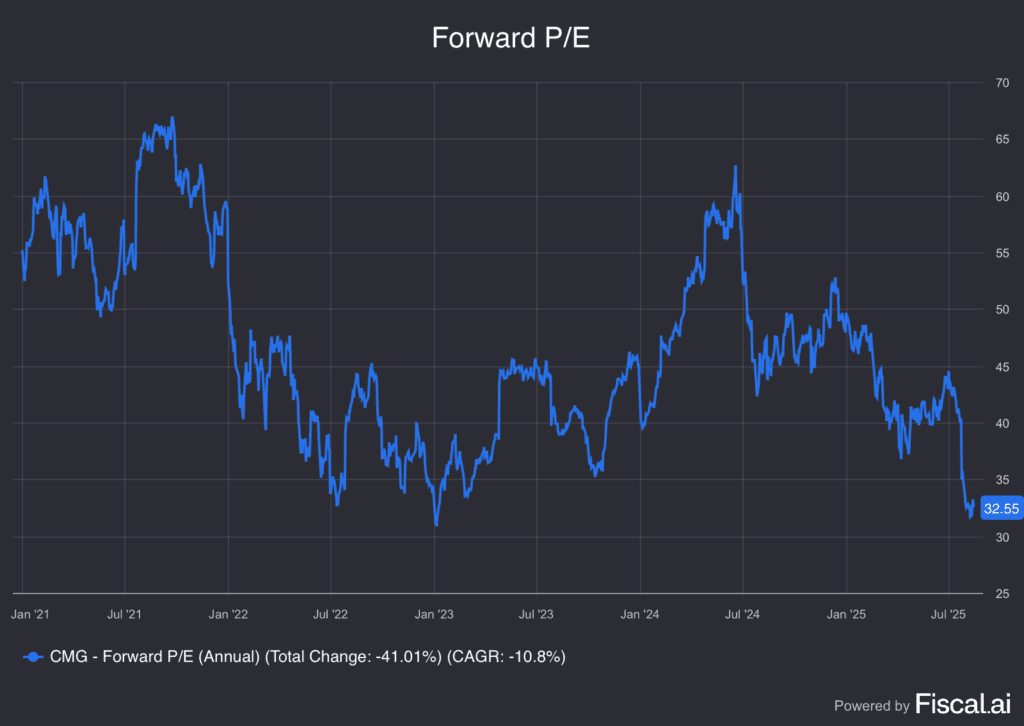

For what it’s value, analysts’ consensus value goal requires roughly 38% upside within the inventory. With expectations nonetheless calling for progress, we’ve seen Chipotle’s valuation fall because the share value has moved decrease.

The inventory now trades with its lowest ahead P/E ratio in additional than two years.

Bulls could determine {that a} ~40% decline within the inventory value, strong ahead progress, and a multi-year low in its ahead valuation is sufficient to warrant a long-term place. Different traders may argue that Chipotle might be susceptible to an additional slowdown in its enterprise or that its valuation is simply too wealthy — even when there isn’t an additional slowdown from right here.

Both means, the inventory’s decline has now introduced ahead an fascinating debate amongst traders.

Disclaimer:

Please be aware that as a result of market volatility, a number of the costs could have already been reached and eventualities performed out.