The crypto market opened as we speak with tales pulling consideration in numerous instructions. On one facet, Coinbase CEO Brian Armstrong stepped away from backing a Senate draft tied to the crypto invoice. Then again, the Ethereum worth stored doing what it has achieved for weeks now, transferring sideways and testing our endurance, even with slight pumps in between, identical to what occurred yesterday.

Regulatory stress from Coinbase’s withdrawal from the crypto invoice is rising simply because the Ethereum worth continues strolling close to the identical vary it has held for greater than two months now. Whereas worth motion feels boring on the floor, historical past tells us that these quiet durations normally reward holders.

Armstrong didn’t mince phrases when explaining why Coinbase pulled assist. In accordance with him, the present crypto invoice draft backed by lawmakers introduces restrictions that would suffocate DeFi and tokenized property. For Coinbase, supporting a dangerous invoice merely to “have regulation” isn’t definitely worth the trade-off.

One sticking level is how the crypto invoice shifts energy away from the CFTC and towards the SEC. One other is language that would successfully kill stablecoin rewards, pushing customers again towards conventional banks. From Coinbase’s perspective, such a framework punishes innovation whereas defending legacy finance.

After reviewing the Senate Banking draft textual content during the last 48hrs, Coinbase sadly can’t assist the invoice as written.

There are too many points, together with:

– A defacto ban on tokenized equities– DeFi prohibitions, giving the federal government limitless entry to your monetary…

— Brian Armstrong (@brian_armstrong) January 14, 2026

Coinbase, Crypto Invoice Debate, and Ethereum Worth Actuality

The Senate Banking Committee’s resolution to delay the invoice adopted shortly after Armstrong’s criticism, picturing simply how fragile the legislative course of nonetheless is. Coinbase’s stance places it firmly consistent with crypto-native corporations asking for smarter guidelines, even when we have to wait.

I’m really fairly optimistic that we are going to get to the correct consequence with continued effort. We are going to preserve exhibiting up and dealing with everybody to get there.” – Brian Armstrong on his X submit

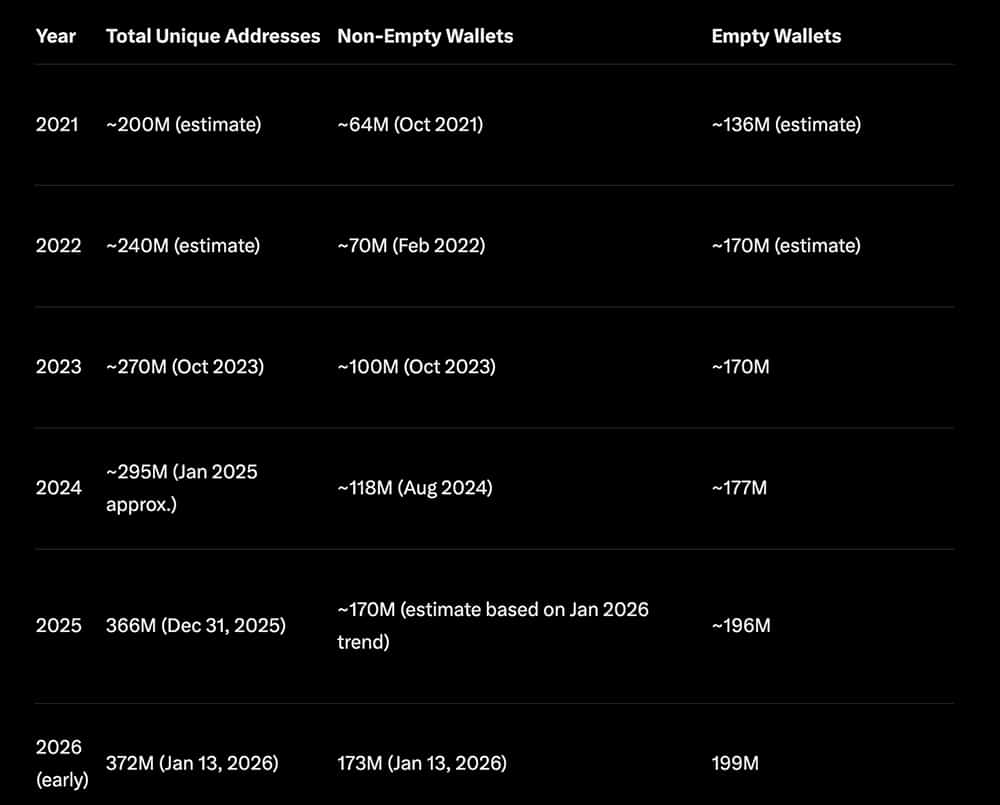

In the meantime, the Ethereum worth barely reacted, particularly in a nasty approach. Regardless of 62 days of tight vary buying and selling between $2,900 and $3,400, Ethereum’s on-chain information retains bettering. New pockets creation lately hit a report, pushing complete non-empty wallets to 173 million.

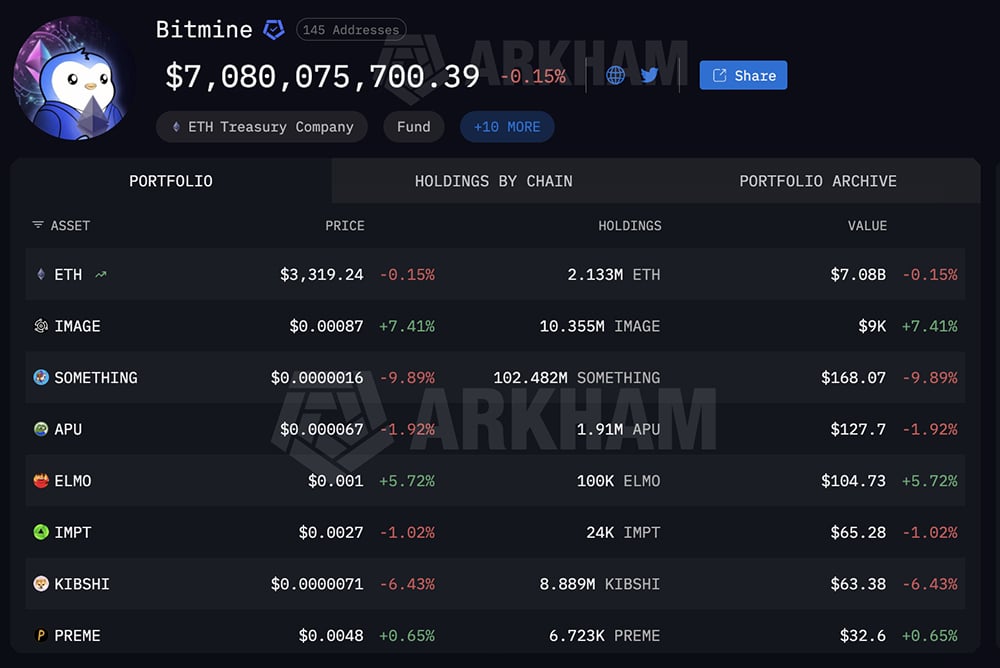

Establishments are clearly watching past the short-term Ethereum worth chart. Bitmine’s newest transfer added over 154,000 ETH to its staking pile, from a complete holdings of two,133 million Ethereum price greater than $7 billion on the present worth. If Bitmine is bullish, so am I.

(supply – Arkham)

DISCOVER: 10+ Subsequent Crypto to 100X In 2026

What Comes Subsequent?

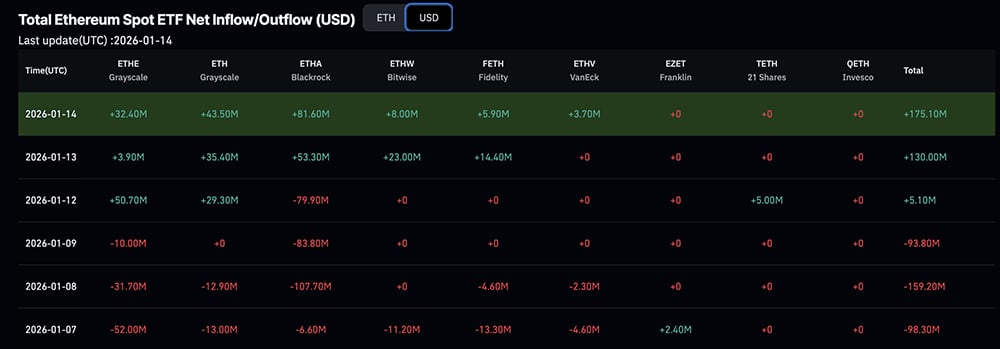

Ethereum nonetheless controls over 60% of the stablecoin and tokenization market, a dominance that’s but to be cracked regardless of a whole lot of recent rivals. ETF flows went constructive once more, with over $175 million transferring into ETH-focused funds from corporations like BlackRock and Constancy, bringing 3 days of inexperienced flows.

(supply – Coinglass)

Previous cycles present comparable Ethereum worth consolidations that acted as launchpads for altcoin rallies. If ETH clears resistance at $3,450, momentum may construct shortly towards $4,000. Failure there seemingly means extra chop.

Both approach, Coinbase continues to be pushing for a repair from a “flawed” crypto invoice, and Ethereum is constructing energy. Good issues come to those that wait.

DISCOVER:

Observe 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Skilled Market Evaluation.

DZ Financial institution Will get MiCA License: Crypto Buying and selling Strikes Into German Banks

Germany’s second-largest lender, DZ Financial institution, secured a MiCA license, clearing a authorized hurdle to run regulated crypto companies throughout its cooperative banking community.

MiCA stands for Markets in Crypto-Belongings, the EU’s new rulebook for crypto corporations. Consider it like a single driver’s license that works throughout Europe, relatively than 27 separate permits, and DZ Financial institution now holds that license. Zoom out, and this suits right into a broader European push to deliver crypto into acquainted, regulated banking channels.

Newest: DZ Financial institution takes an enormous leap because it secures MiCA license from BaFin! Retail crypto buying and selling is now obtainable in Germany by way of the newly launched platform, meinKrypto. Embrace the foreign money of the digital age. 🚀#Cryptocurrency #GermanyDZBank pic.twitter.com/xdR9fqqvCr

— CoinLaw (@coinlaw_io) January 14, 2026

Bitcoin held above $96,000 through the announcement and is up +1.4% in a single day, indicating that markets handled this as slow-burn infrastructure information relatively than a set off for a big worth spike.

The broader crypto market is holding up extraordinarily effectively regardless of rising tensions in Iran and Greenland, with U.S. forces reportedly poised to deploy floor forces in each international locations. The mixed crypto market cap stands at $3.34 trillion, up +0.5% over the previous 24 hours.

Learn the total protection right here.

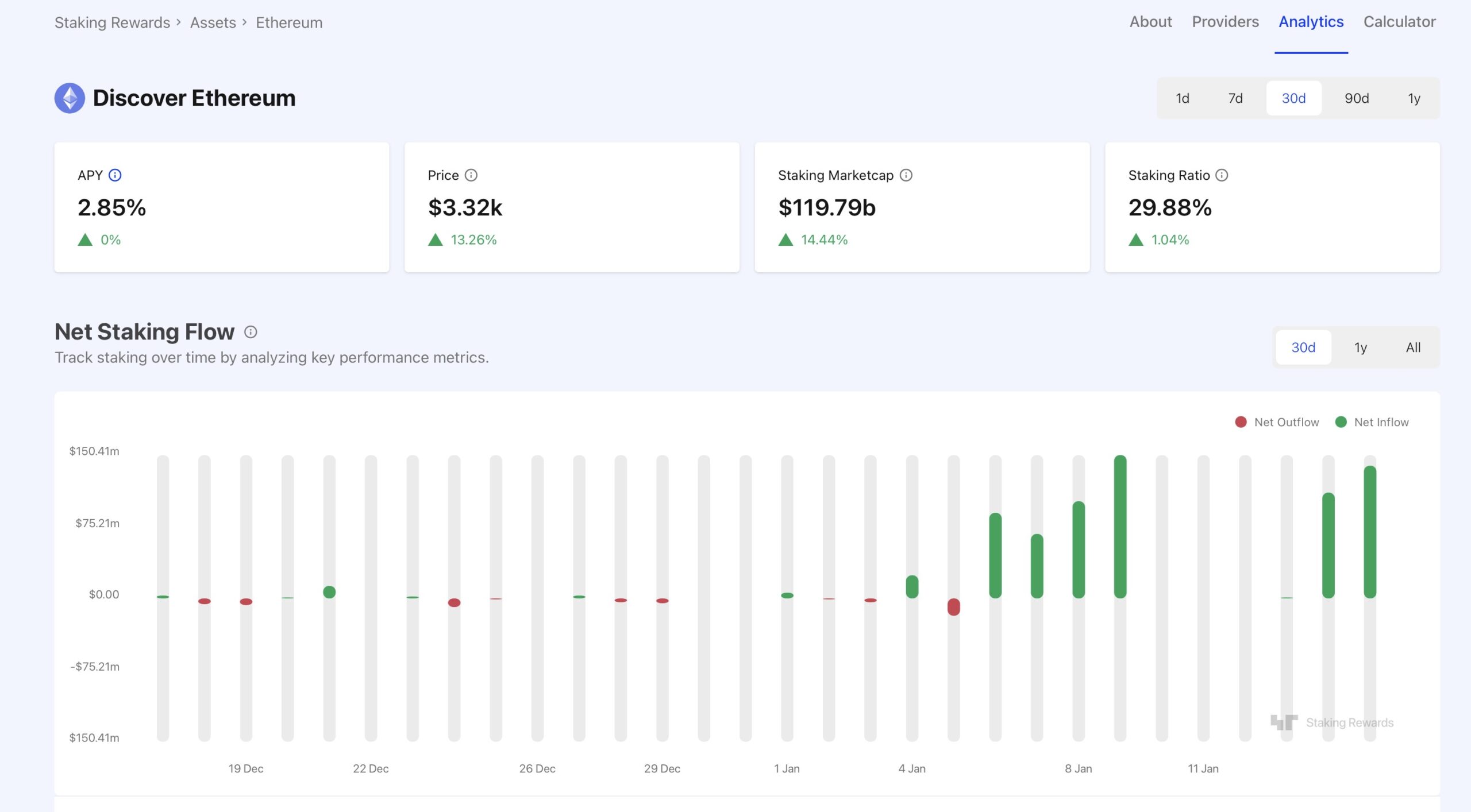

ATH for Ethereum Staking: Practically 30% of ETH Is Now Locked

Ethereum staking simply hit an all-time excessive, with roughly 36 million ETH, nearly 30% of the full provide, now locked up securing the community.

Launched in 2015 by Vitalik Buterin and a workforce of builders, ETH has advanced from a proof-of-work consensus mechanism, much like Bitcoin’s mining course of, to proof-of-stake following the Merge improve in September 2022.

This shift permits members to safe the community by staking ETH relatively than utilizing energy-intensive {hardware}, making the system extra environment friendly and environmentally sustainable.

Staking is like placing your ETH right into a financial savings account that helps run Ethereum. You lock up ETH, and in return, you earn rewards for serving to validate transactions. Proper now, that base reward normally sits round 3–5% a yr.

One out of each three ETH cash is now locked and unavailable for fast promoting. Much less liquid provide typically reduces promoting strain.

(Supply: Staking Rewards)

This milestone displays rising confidence within the platform’s long-term viability, as stakers contribute to transaction validation whereas incomes rewards. The staked quantity equates to over $119.79 billion at present market values.

Learn the total story right here.

SEC Drops Zcash Probe: Uncommon Readability for Privateness Cash, ZEC Crypto To $1,000?

The US Securities and Change Fee (SEC) used to terrorize crypto corporations below Gary Gensler through the Biden administration a lot in order that it was pointless for founders to innovate. Lawsuits used to pile up and enforcements stay the order the day. Donald Trump took over, promised to finish the nightmare, and he did, and now, the period of regulation by way of enforcement is over.

Underneath Trump and Paul Atkins, the present SEC chair, lawsuits in opposition to prime crypto corporations like Coinbase and Uniswap have been settled or withdrawn altogether. Due to this fact, it got here as no shock when the regulator formally closed its 2023 investigation into Zcash, a privacy-focused cryptocurrency, with out recommending enforcement motion.

We’re happy to announce that the SEC has concluded its evaluation and knowledgeable us that it doesn’t intend to suggest any enforcement motion or different adjustments in opposition to Zcash Basis relating to this matter. https://t.co/zjxfh3mmst

— Zcash Basis 🛡️ (@ZcashFoundation) January 14, 2026

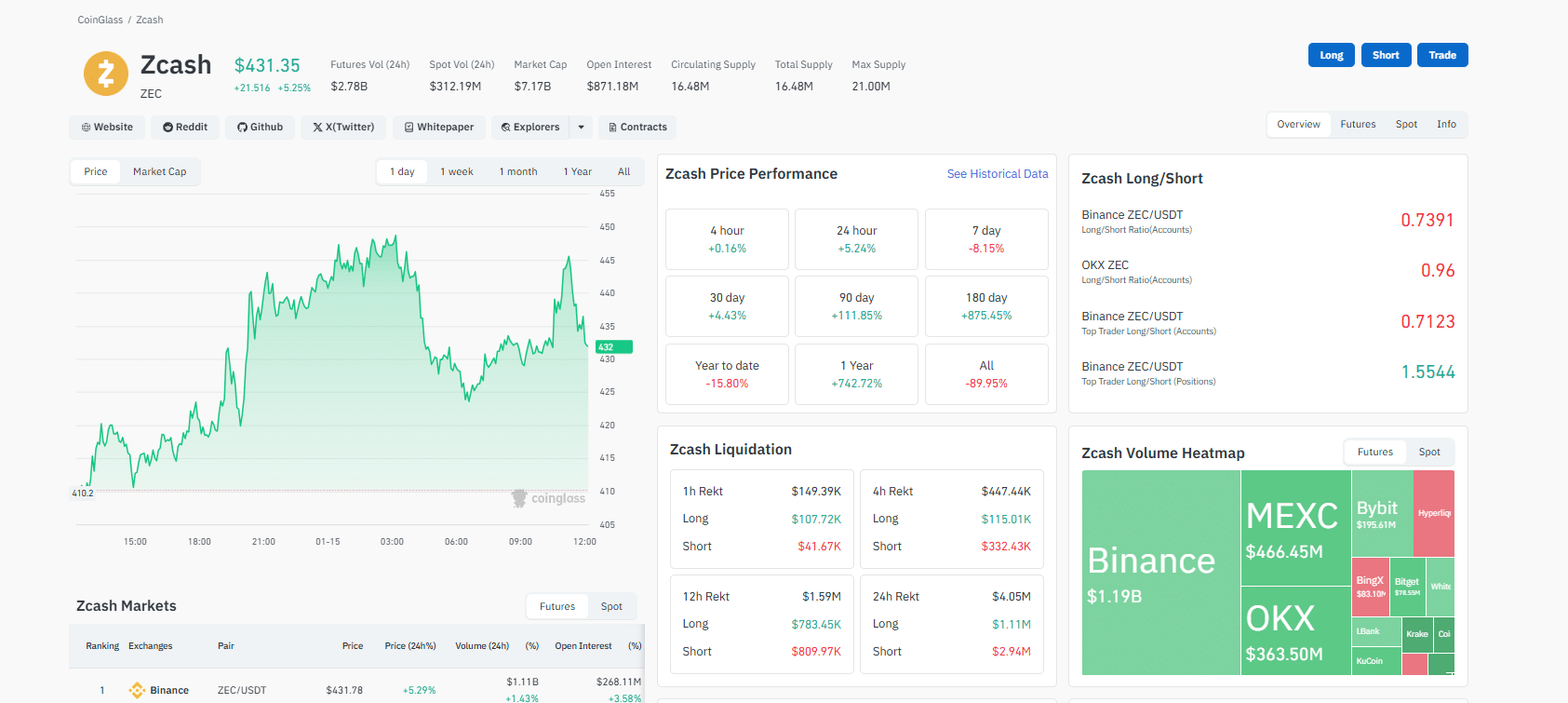

ZEC crypto, which is undoubtedly one of many prime cryptos to think about on this cycle, reacted calmly, holding its current vary after months of strain tied to regulatory concern. ZEC USDT is agency above $400, and stays one of many prime performers, standing out from the 1000’s of cash. On Coinglass, practically $3M of ZEC crypto shorts had been additionally liquidated costs briefly jumped.

(Supply: Coinglass)

Learn our full protection right here.

Ethereum Is Catching As much as Bitcoin: Right here’s Why 2026 is Big for ETH USD

Ethereum is exhibiting early indicators that it could lastly outperform Bitcoin in 2026, following a lackluster two years. In accordance with on-chain and institutional information, Ethereum is rising quickly. ETH USD is up +5.8% over the previous seven days and is buying and selling at round $3,300 as we speak, whereas Bitcoin is hovering round $96,000.

Nonetheless, the value hole tells solely a part of the story. The larger development is a gradual shift in investor consideration away from Bitcoin-only bets and towards Ethereum’s broader utility. Establishments are rotating from BTC to ETH as a consequence of its yield-bearing nature, with round 2.8% APY on supply for staking Ethereum, whereas Bitcoin

has no native staking yield.

Though 2026 has gotten off to a robust begin for each BTC and ETH, when Bitcoin cools after a robust run, capital typically appears to be like for the subsequent asset to pop. Proper now, Ethereum represents the most effective altcoin play.

The macro backdrop helps this concept. Bitcoin ETFs stabilized in 2025, whereas Ethereum entered 2026 with main community upgrades, rising utilization, and rising institutional curiosity.

Learn the total story right here.

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Initiatives Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the newest updates, traits, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now