Crypto is down once more, and the drop is chewing our portfolios as we see the rise in crypto liquidations and debate on Michael Burry and his Bitcoin feedback. With crypto down throughout main belongings and liquidations climbing, we’re questioning why Bitcoin is falling even whereas conventional markets are up.

What deepens the dialogue is how usually Michael Burry skepticism on Bitcoin comes throughout these volatility spikes, particularly when crypto is down with none direct unfavorable catalyst. Because the crypto market absorbs the most recent wave of liquidations, the vibe has shifted from shock to concern.

Crypto Concern and Greed Chart

All time

1y

1m

1w

24h

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

One other Crypto Liquidations Regardless of Robust Markets

The strangest a part of at present’s liquidations is the belongings contradiction: Nasdaq is up, silver is pumping, and the S&P 500 is inexperienced, but crypto is down. And Bitcoin is shedding 3% on the day.

All these above intensified the push of liquidations, making a cascade that reminded a lot of earlier crypto shakeouts. Proper now, Bitcoin briefly fell towards the $89,000 space, distancing itself from the October excessive and including strain simply as we hoped for stabilization.

Earlier within the day, bullish PCE information sparked a pointy bounce in BTC and ETH, however the momentum evaporated quick. Inside half-hour, practically $100 million in lengthy positions vanished in recent crypto liquidations. The full has now climbed above $414 million for this session alone.

(supply – Liquidation Information, Coinglass)

Trying again to the October 10 flash crash, the size turns into clearer as that single day noticed a staggering $19 billion liquidated as Bitcoin plunged from $126,000 to $110,000. For the reason that disastrous occasion, waves of follow-up promoting have cleared out greater than $637 million in further positions. Crypto is down seems like an understatement.

Nonetheless, regardless of the turbulence, the overall crypto market cap nonetheless hovers close to $3.1 trillion, rebounding from a low vital stage of $2.9 trillion. These ranges usually mark turning factors, although crypto liquidations delay volatility and weaken confidence.

(supply – Whole Crypto Market Cap, TradingView)

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Michael Burry Bitcoin Skepticism Comes as Crypto Is Down

In his first interview in additional than ten years, Michael Burry criticism is violent. Burry in contrast Bitcoin to a tulip bulb, claiming it’s nugatory and weak to crime.

He drew the Bitcoin comparability from gold, which he has considered as a steady retailer of worth since 2005. His bearish stance is shifting the vibe at a second when crypto is down, and sentiment already feels fragile.

Michael Burry of The Massive Quick fame offers first interview in over 10 years and says, “Bitcoin isn’t value something. It’s the tulip bulb of our time.” pic.twitter.com/ge1zteSVqS

— Documenting ₿itcoin 📄 (@DocumentingBTC) December 4, 2025

Not simply Bitcoin, Michael Burry predicts a much bigger crash, worse than the dot-com bust, citing overstretched valuations and mounting shopper debt. His brief positions in Nvidia, Tesla, and Palantir, alongside together with his fund deregistration, convey debate over if markets have grown too euphoric. However critics argue that these firms stay worthwhile.

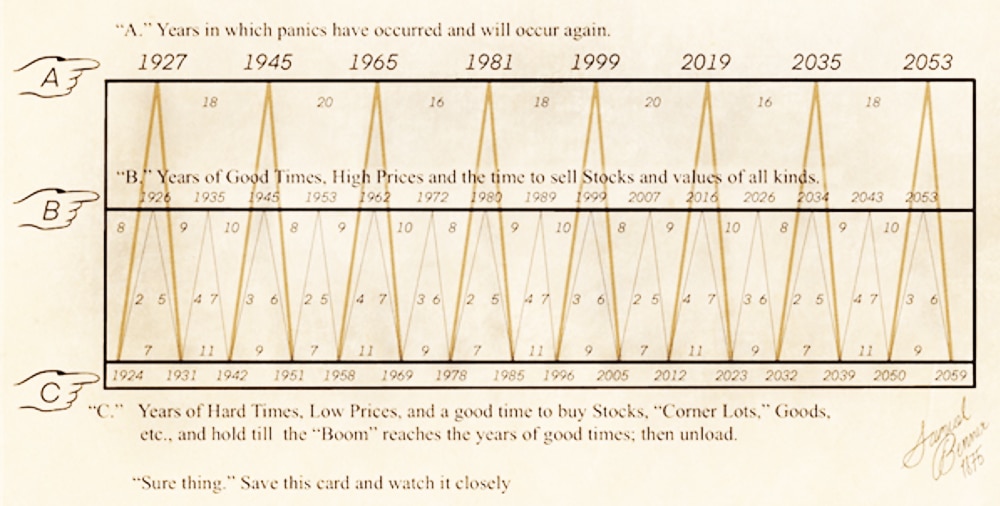

Countering the gloom is Samuel Benner’s 1875 cycle chart. It labeled 2023 as a hardship yr and a robust time to build up danger belongings, together with crypto(if it was out there throughout his time), with a projected market high in 2026. Even now, as crypto is down, the sample exhibits alternative, a yr away from collapse, whether it is to break down.

Benner 1875 cycle chart

And so, because the market waits, crypto is down, and liquidations proceed, however skilled cycle merchants insist restoration usually begins proper the place worry peaks, and the place merchants least anticipate it.

This Saturday, benefit from the weekend, contact grass, and adorn the Christmas tree, trigger Santa Claus is coming to city.

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

SUI Crypto ETF With 2x Leverage Inexperienced Lighted by SEC: Bitcoin Layer-2 Subsequent?

The SEC’s approval of the brand new 2x leveraged SUI Crypto ETF landed with good timing. Proper when the market appears to crave the following regulatory shock.

This inexperienced gentle offers SUI one other push into the institutional highlight, and the arrival of a leveraged crypto ETF on Nasdaq offers conventional buyers a option to experience SUI’s day by day strikes with out touching the token itself.

The hammer additionally hits an indication that regulators are warming as much as altcoin ETFs after months of approvals throughout the crypto market, and it provides gasoline to the rising Sui’s environment friendly community.

Learn the total story right here.

Hawk Tuah Woman Crypto Coin: The Aftermath

Is the Hawk Tuah woman Crypto coin making a comeback? Hailey Welch, the viral “Hawk Tuah” star whose 2024 catchphrase turned web forex, is now going through a really actual authorized one.

In case you don’t keep in mind:

Welch ran a crypto rugpull rip-off

After stealing hundreds of thousands from her followers, she took the highway

Truly, it wasn’t even hundreds of thousands. She possibly gotten just a few hundred thousand, which ain’t dangerous, nevertheless it destroyed her “profession” in consequence. In the meantime, there’s a brand new improvement with Welch being added to a federal class motion lawsuit alleging she performed a key promotional function within the failed HAWK token.

Learn the total story right here.

Why you’ll be able to belief 99Bitcoins

Established in 2013, 99Bitcoin’s staff members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Professional contributors

2000+

Crypto Tasks Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the most recent updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now