Massive information from the Federal Reserve as they only injected $2.5 billion into the US banking system in an in a single day repo, including to the $120 billion pumped into the market this 12 months. However, regardless of this huge liquidity increase, Bitcoin worth remains to be lagging and struggling to interrupt the $90,000 resistance.

On a optimistic be aware, Visa has formally declared crypto as “mainstream” in 2025, with stablecoins and AI funds main the cost. These all occur when gold hit a document excessive of $4,562 per ounce, and silver is now at $79. Each metals have been on a run currently, similar to the sample seen in 2020 when gold ($2,075/oz) and silver ($29/oz) hit their peaks, which then began huge rallies in different belongings.

With a lot bullish information surrounding Bitcoin, it’s a bit stunning to see its worth lag behind, particularly with gold and silver holding breaking their highs.

So, may Bitcoin be subsequent in line for a significant surge?

Gold and Silver at All-Time Highs because the Federal Reserve Injected Extra Liquidity

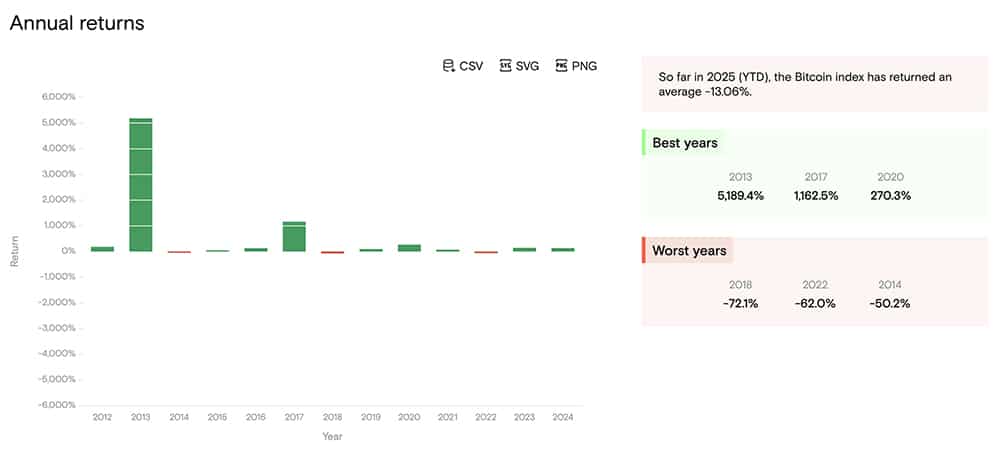

Monitoring again to 2020, after gold and silver reached their highs, Bitcoin had an enormous breakout. It jumped from $11,500 to $29,000 by the tip of the 12 months, which was a 150% achieve. By 2021, the crypto market cap shot up from about $390 billion to over $2 trillion. Conventional shares just like the S&P 500 additionally noticed good positive factors, with a 7% rise in 2020, adopted by a 27% enhance in 2021.

(supply – Curvo)

Now, with the Federal Reserve persevering with to pump liquidity into the market, Bitcoin may comply with an identical path, and the bear market may lastly finish. The query is: when will that occur?

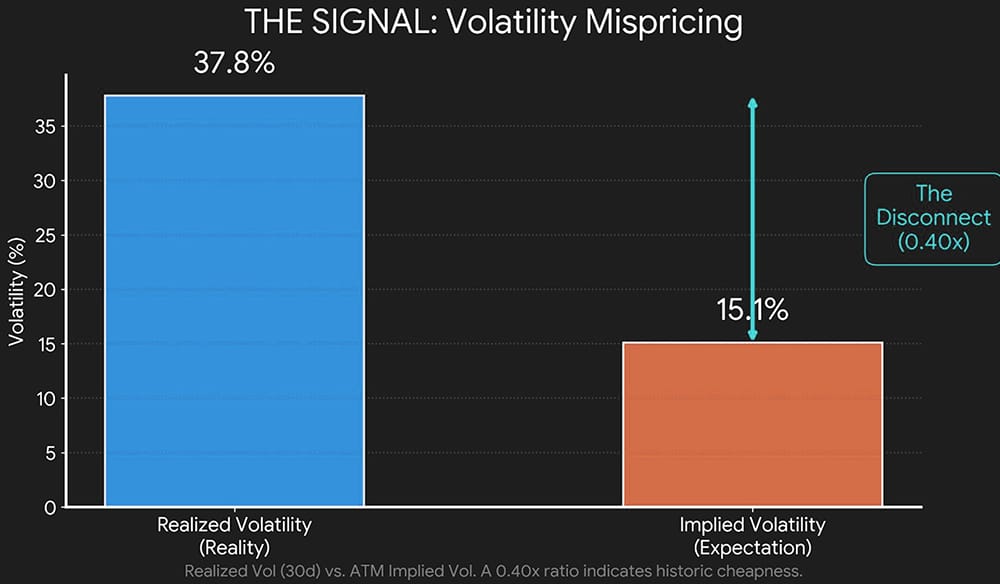

Proper now, Bitcoin is caught beneath $90,000, however there’s an enormous volatility anomaly taking place that may result in a breakout. Realized volatility is sitting at 37.8%, which exhibits that Bitcoin is definitely shifting, however implied volatility is far decrease at 15.1%.

This mismatch between what the market expects and what’s really taking place is traditionally unsustainable, and it’d as effectively ship Bitcoin worth upward quickly.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

The Volatility Anomaly and Bitcoin Value

So why is that this volatility mismatch so necessary? As a result of, merely put, it’s placing Bitcoin on sale proper now. Persons are leaping into name choices (which wager on larger costs), anticipating that the value of Bitcoin will go up. Consequently, sellers must chase the rising costs to satisfy these bets, which flip small rallies into a lot greater runs.

There’s additionally the truth that a 4chan consumer who accurately predicted Bitcoin’s October peak at $126,198 is now forecasting a Bitcoin worth of $250,000 by 2026. Gemini’s CEO, Tyler Winklevoss, additionally tweeted that Bitcoin is “Gold 2.0” and stated, “Wait until the world realizes.” These can all be the sparks wanted for subsequent 12 months’s bull run.

Wait til the world realizes that bitcoin is gold 2.0 https://t.co/RIPu8wL9lL

— Tyler Winklevoss (@tyler) December 26, 2025

As Satoshi Nakamoto famously stated,

In case you don’t consider me or don’t get it, I don’t have time to attempt to persuade you, sorry.”

It’s a robust assertion, however with all the pieces taking place out there proper now, Bitcoin is poised to interrupt out in an enormous means.

Control the Federal Reserve’s strikes and the way they could push Bitcoin worth larger. The market could be lagging proper now, however historical past exhibits that crypto at all times catches up in essentially the most violent means.

In case you don’t consider me, I don’t have time to attempt to persuade you.

DISCOVER: 10+ Subsequent Coin to 100X In 2025

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Each day Skilled Market Evaluation.

There aren’t any reside updates obtainable but. Please verify again quickly!

Why you’ll be able to belief 99Bitcoins

Established in 2013, 99Bitcoin’s workforce members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Initiatives Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the most recent updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now