Key Takeaways:

ETF professional Nate Geraci suggests BlackRock may file for an iShares XRP ETF following the top of the Ripple lawsuit.Ripple and the SEC have collectively dismissed all remaining appeals, affirming XRP is just not a safety in retail transactions.Market response: XRP surges over 13% in 24 hours; Polymarket odds for an XRP ETF approval soar to 88%.

The conclusion of Ripple’s years-long authorized battle with the U.S. Securities and Alternate Fee (SEC) has reignited hypothesis a few potential BlackRock XRP exchange-traded fund (ETF). Authorized readability surrounding XRP’s standing has eliminated a serious barrier to institutional merchandise tied to the token, and a few trade specialists consider the world’s largest asset supervisor could quickly broaden its crypto ETF lineup past Bitcoin and Ethereum.

Learn Extra: Ripple’s Recreation-Altering Transfer: Wormhole Integration Unlocks $60B Cross-Chain Potential

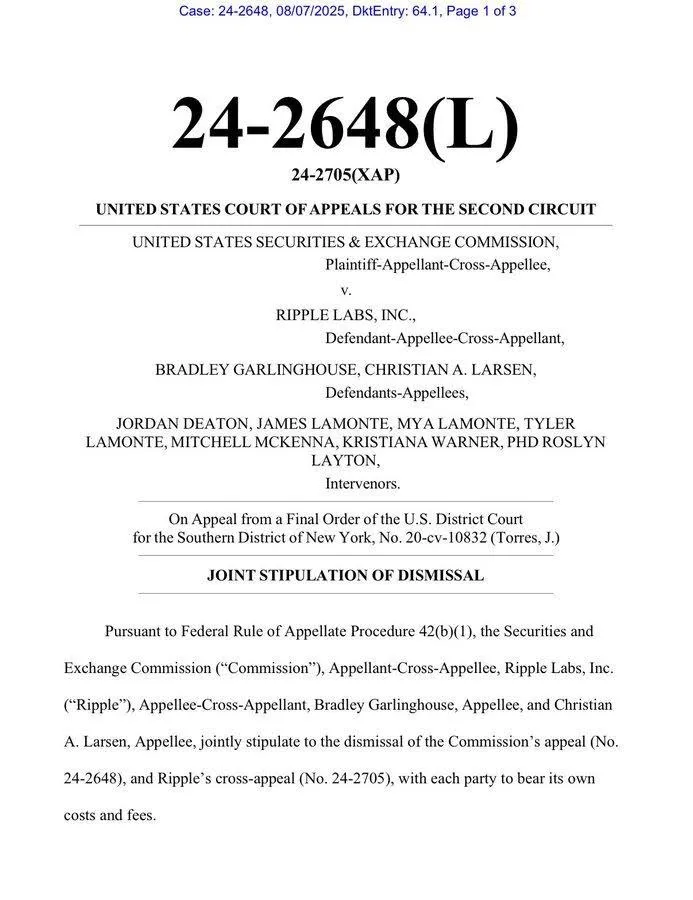

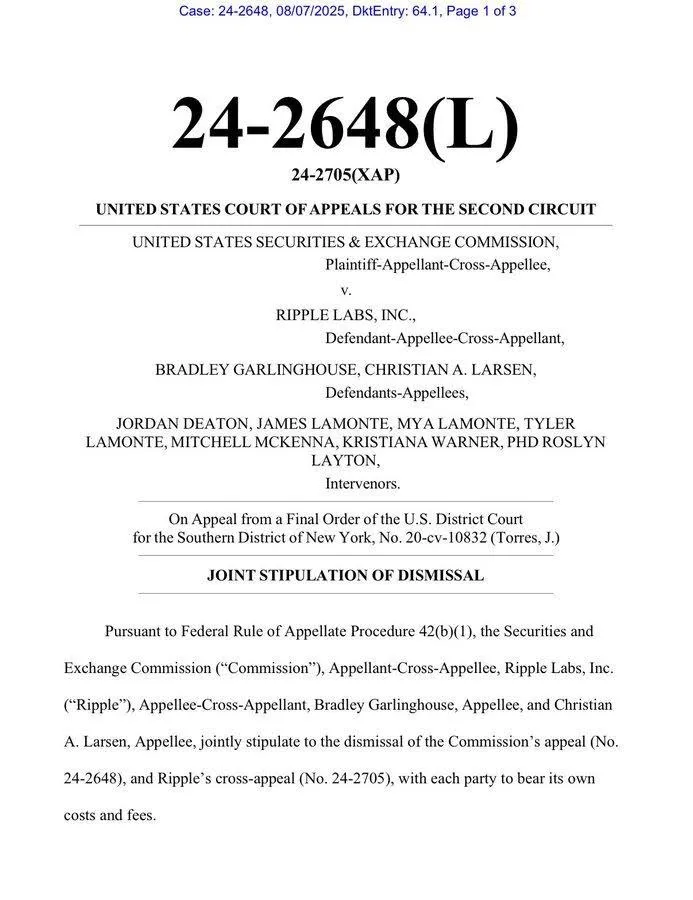

Ripple Lawsuit Formally Ends, XRP’s Standing Confirmed

On August 7, Ripple and the SEC filed a joint dismissal of all remaining appeals of their case, marking the official finish to a authorized saga that started in December 2020. The dismissal cements a big precedent: XRP is just not thought of a safety when traded in retail transactions.

For years, the lawsuit forged a shadow over XRP’s market potential within the U.S., limiting its inclusion in alternate listings, fee platforms, and controlled funding merchandise. With the case now closed, U.S.-based exchanges and monetary corporations have better freedom to listing XRP and create by-product merchandise based mostly on it.

Ripple wasted no time in capitalizing on this authorized readability. Simply earlier than the dismissal was filed, the corporate introduced its $200 million acquisition of Rail, a Toronto-based stablecoin funds platform. The transfer is geared toward enhancing infrastructure for Ripple’s RLUSD stablecoin challenge, signaling that the agency is accelerating its broader growth plans.

Learn Extra: Ripple Acquires Rail in $200M Transfer to Dominate Stablecoin Market

ETF Skilled Flags BlackRock’s Potential Entry into XRP Market

In a put up on X (previously Twitter), Nate Geraci, president of The ETF Retailer, stated he believes BlackRock was “ready to see this” earlier than doubtlessly submitting for an iShares XRP ETF.

“Makes zero sense for them to disregard crypto belongings past BTC & ETH,” Geraci wrote. “In any other case, they’re mainly saying these are the one ones that can ever have worth.”

Geraci’s feedback replicate a rising sentiment available in the market: with authorized uncertainty resolved, the pathway for an XRP ETF is far clearer. BlackRock, already managing the most important Bitcoin ETF on the planet and an Ethereum ETF, has the assets, model recognition, and regulatory experience to deliver such a product to market rapidly.

Not all of the analysts nonetheless consider {that a} submitting is imminent. Eric Balchunas, a senior ETF analyst at Bloomberg, was skeptical, nonetheless, saying that BlackRock may prefer to proceed to work with BTC and ETH because it now not is sensible to proceed so as to add crypto-based ETFs to its portfolio.

“I feel they’re proud of the 2,” Balchunas stated, whereas acknowledging his place was extra “intestine feeling” than based mostly on concrete proof.

Learn Extra: BlackRock’s $547M Ethereum Wager Alerts Daring Pivot, 5x Heavier ETH Focus Than Bitcoin

Market Response Alerts Sturdy Demand

The crypto market reacted swiftly to the lawsuit’s conclusion. XRP surged over 13.27% inside 24 hours, far outpacing the broader cryptocurrency market’s 3.75% achieve over the identical interval. On South Korean exchanges, XRP buying and selling quantity skyrocketed by 1,211%, indicating sturdy worldwide curiosity.

Derivatives markets additionally noticed a surge in exercise. Merchants on Deribit bought over 100,000 name and put contracts at $3.20 and $3.10 strike costs, paying a complete of $416,000 in premiums. These positions recommend that market members count on heightened volatility within the coming weeks.

Spot markets have been equally energetic. Web inflows exceeding $42 million briefly pushed XRP above $3.30, with a peak at $3.32, elevating its complete market capitalization to $22 billion.

ETF Approval Odds Rise

The authorized decision has additionally influenced prediction markets. On Polymarket, odds for an XRP ETF approval surged to 88%, recovering from a current low of round 65%. The sooner dip got here after SEC Commissioner Caroline Crenshaw voted in opposition to sure crypto-related measures, a transfer analysts like Balchunas dismissed as routine, given her constant opposition to all crypto ETFs.

Advocates say {that a} BlackRock XRP ETF can be strategically sound. It will lengthen the number of crypto merchandise provided by the agency, cater to the pursuits of establishments, who wish to have publicity to a wider crypto asset vary, and comply with the tendencies within the fast-evolving crypto funding sphere.

The idea of going past Bitcoin and Ethereum to enter blended institutional crypto publicity has been prevailing. Though these two belongings monopolize the market capitalization and institutional buying, different tokens similar to XRP include particular use instances – the latter is cross-border funds and settlement effectivity.