What to Know:

Rising U.S. debt and heavy Treasury issuance are killing the attraction of long-duration bonds, so establishments are trying towards Bitcoin and different digital belongings as hedges.

As Bitcoin adoption grows, demand is shifting away from easy value bets towards actual infrastructure for quick funds, DeFi, NFTs, and gaming.

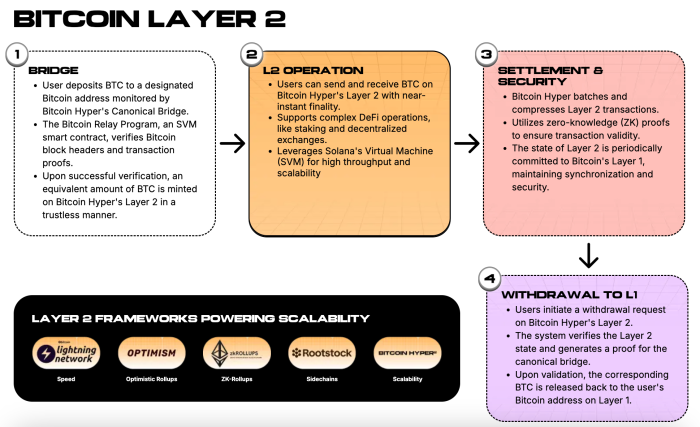

Bitcoin Hyper ($HYPER) introduces a Bitcoin-anchored Layer 2 that makes use of the Solana Digital Machine to repair Bitcoin’s sluggish transactions, excessive charges, and lack of sensible contracts.

Competitors amongst Bitcoin Layer 2 networks will warmth up as macro pressures and institutional inflows reward tasks that blend Bitcoin’s belief with actual efficiency.

Surging US debt and sticky deficits are now not a quiet background difficulty. They’re beginning to really feel like the whole plot.

BlackRock’s current AI-driven analysis makes it clear: nonstop Treasury issuance and rising curiosity prices put stress on long-term bonds.

When the idea of a risk-free asset begins wobbling, buyers start asking the basic query: the place will we flip subsequent?

Bitcoin retains exhibiting up in these conversations. After the spot ETF wave, $BTC become a boardroom-friendly hedge.

If US debt continues to climb, a supply-capped and rules-based asset begins trying fairly good. That’s the broad concept BlackRock is pointing towards.

However as soon as establishments agree Bitcoin belongs within the hedge bucket, the following query hits quick: how do you really use $BTC inside in the present day’s high-speed markets?

On-chain Bitcoin is sluggish, block area is tight, and charges can spike into tens of {dollars} when the community will get busy. Nice for chilly storage. Not nice for something that should transfer shortly.

It markets itself as a high-performance Bitcoin Layer 2 constructed on the Solana Digital Machine (SVM), providing sub-second settlement and sensible contracts whereas anchoring its safety to Bitcoin.

If BlackRock’s macro outlook drives extra capital into $BTC, Bitcoin Hyper goals to be the platform the place that capital really generates outcomes. Suppose funds, DeFi, gaming, NFTs, and extra.

Why Debt Dangers And Institutional Flows Favor Excessive-Throughput Bitcoin Infrastructure

If the U.S. is heading towards persistent deficits, increased charges, and nonstop Treasury issuance, then long-duration bonds cease trying like a secure parking spot and begin performing like a stress check.

That’s the reason giant asset managers discuss needing new hedges. Bitcoin suits that position, as do gold and tokenized belongings backed by actual collateral.

As establishments add Bitcoin publicity, the stress builds to make $BTC usable, not simply one thing you lock in a vault.

Lightning facilitates funds, but it surely doesn’t help complicated sensible contracts or high-performance DeFi purposes.

Ethereum rollups and Solana resolve these issues, however they aren’t secured by Bitcoin, which issues to buyers who need their hedge and their infrastructure to be primarily based on the identical financial basis.

That’s the reason the race amongst Bitcoin-aligned Layer 2s and sidechains is rushing up. Stacks, Rootstock, and others are attempting to push programmability nearer to Bitcoin, every making completely different trade-offs.

Bitcoin Hyper is without doubt one of the new crypto tasks taking a extra formidable strategy: as an alternative of constructing a brand new system, it makes use of the Solana VM and anchors it to Bitcoin. It’s like taking a sports activities automobile engine and dropping it right into a truck identified for reliability.

Inside Bitcoin Hyper’s SVM Layer 2 And The Ongoing Presale

Bitcoin Hyper ($HYPER) focuses closely on pace.

The design is modular: Bitcoin Layer 1 handles settlement and knowledge availability, whereas an SVM-powered Layer 2 handles execution. Builders can use Rust and Solana-style instruments, however the chain in the end settles again to $BTC as an alternative of $SOL.

The purpose is straightforward: push past Solana speeds whereas inheriting Bitcoin’s belief and model energy.

Bitcoin Hyper at the moment depends on a single trusted sequencer. It batches transactions and anchors its state to the Bitcoin blockchain.

This setup permits extraordinarily low-latency confirmations, which works effectively for order-book DEXs, gaming loops, and NFT mints.

Charges intention to remain at fractions of a cent, not the standard on-chain $BTC spikes. A decentralized canonical bridge strikes $BTC into wrapped belongings for quick swaps, funds, lending, and staking.

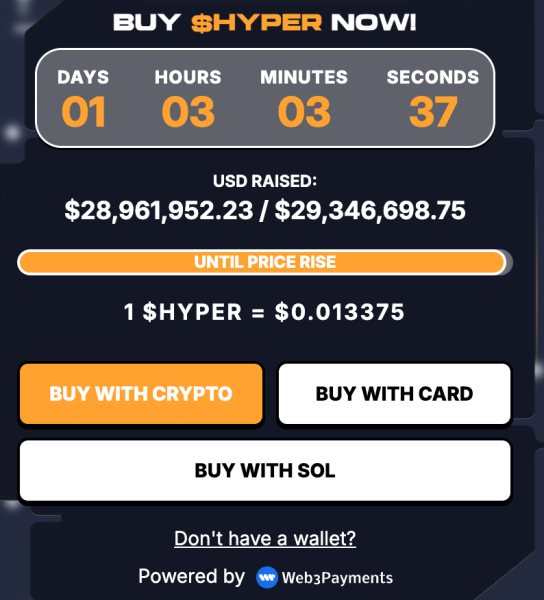

The presale is already giant. Bitcoin Hyper has raised over $28.9M and you should purchase $HYPER now for simply $0.013375.

For Bitcoin holders and DeFi customers, the pitch is easy. If institutional cash continues to circulation into $BTC as a result of macroeconomic dangers, the following stage of the commerce might manifest within the infrastructure that makes Bitcoin really helpful.

Bitcoin Hyper needs to be that high-throughput SVM Layer 2 constructed for funds, gaming, and composable DeFi.

Be a part of the $HYPER presale now.

This text is for informational functions solely and doesn’t supply monetary, funding, or buying and selling recommendation. At all times do your individual analysis (DYOR) earlier than investing in crypto.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/information/blackrock-warns-on-us-debt-bitcoin-hyper-presale-accelerates