Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

As Bitcoin (BTC) retreats from its current all-time excessive (ATH) of $111,814 – presently buying and selling within the mid-$100,000 vary – rising on-chain knowledge indicators that the cryptocurrency’s robust momentum over the previous month could also be waning.

Deeper Correction Forward For Bitcoin?

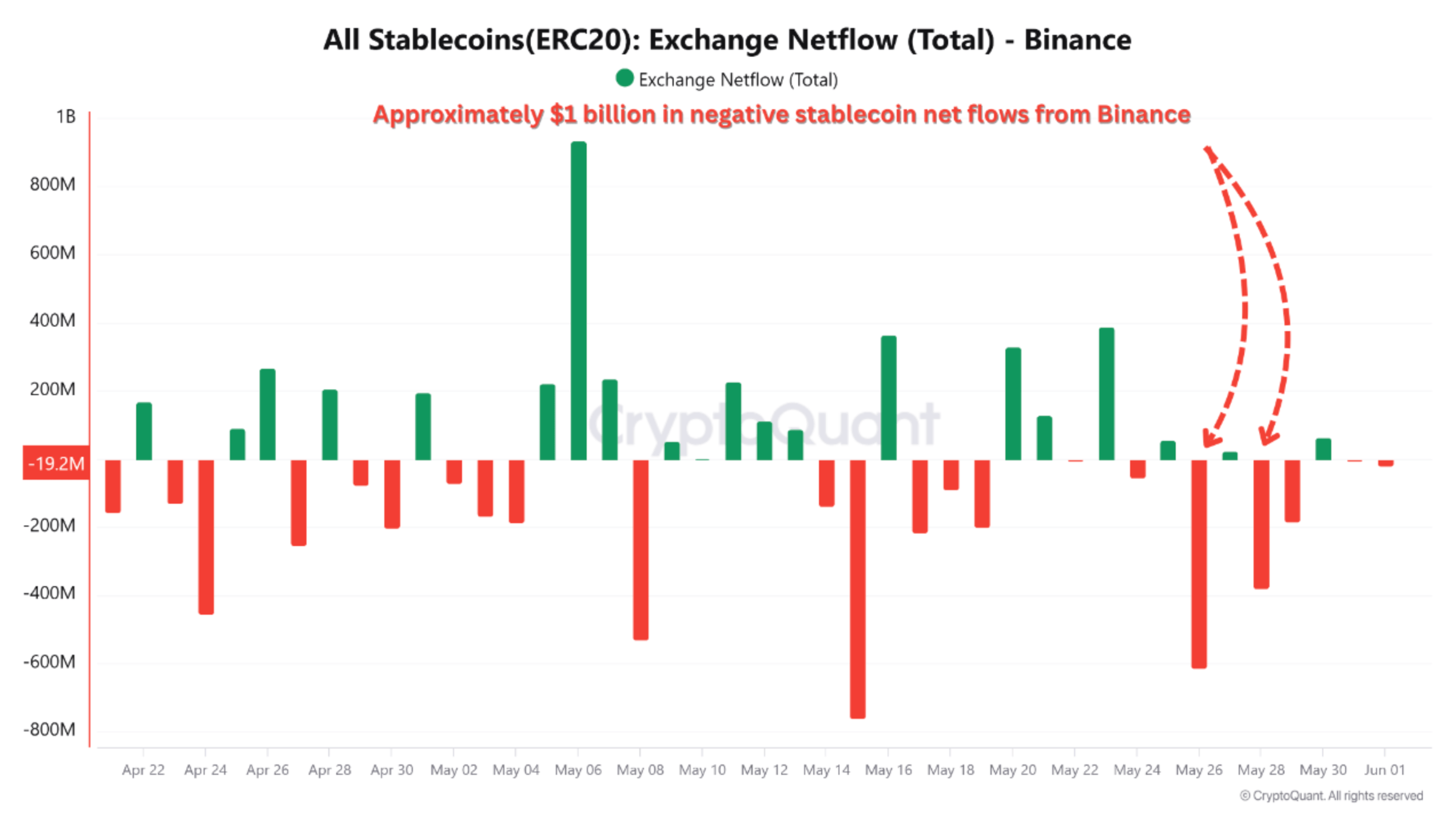

In line with a current CryptoQuant Quicktake put up by contributor Amr Taha, the Bitcoin market is present process a number of notable on-chain shifts. These embody important stablecoin outflows from Binance, a decline in long-term holder (LTH) participation, and diverging accumulation patterns amongst pockets cohorts.

Associated Studying

One of the crucial putting indicators is the online outflow of over $1 billion in stablecoins from Binance. This means merchants are shifting funds off the trade and into personal wallets, sometimes an indication of lowered threat urge for food or diminished intent to purchase crypto within the close to time period.

Such large-scale stablecoin withdrawals typically point out declining shopping for energy and might precede a lack of market momentum or a shift towards profit-taking and warning. If the development continues, BTC might slip additional, doubtlessly shedding the psychologically vital $100,000 stage.

In parallel, long-term holders (LTH) have additionally pulled again. The Web Place Realized Cap for LTHs plummeted from $28 billion to simply $2 billion by the tip of Could 2025 – signaling that these traders are now not growing their publicity regardless of the current worth surge.

Additional, 60-day pockets habits developments level to a divergence in market sentiment. Giant holders with 1,000 to 10,000 BTC have been step by step offloading their positions, whereas smaller retail cohorts holding 100 to 1,000 BTC have been aggressively accumulating, shopping for into the rally. Taha remarked:

The mix of heavy stablecoin withdrawals, lowered LTH accumulation, and shifting cohort behaviors indicators a market in transition. Whether or not this units the stage for a cooling-off interval, a wholesome consolidation, or renewed momentum will depend upon how new capital re-enters the system and whether or not retail consumers can maintain the present rally with out institutional reinforcement.

All Hope Is Not Misplaced

Whereas the aforementioned knowledge factors trace towards a possible looming worth correction for the apex digital asset, different on-chain knowledge exhibits that BTC is prone to proceed its upward trajectory, doubtlessly to new ATHs.

Associated Studying

CryptoQuant contributor Crypto Dan just lately highlighted that the Bitcoin Web Realized Revenue/Loss (NRPL) metric helps a continued upward trajectory, noting that present profit-taking ranges are modest in comparison with earlier cycle peaks.

Moreover, BTC outflows from centralized exchanges are growing, with a current 7,883 BTC withdrawal from Coinbase. This might level to renewed institutional curiosity and accumulation in anticipation of one other upward transfer. At press time, BTC trades at $103,854, down 0.2% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com