Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

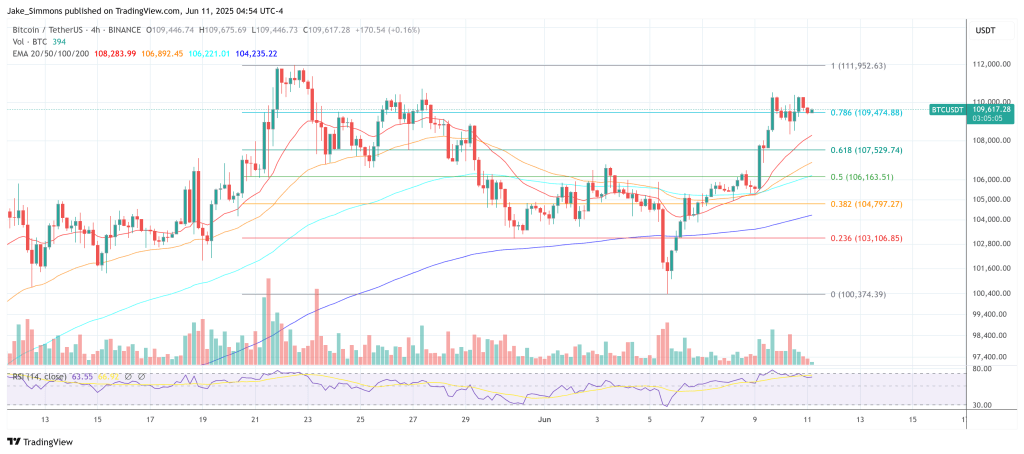

Bitcoin is as soon as once more knocking on the door of value discovery, however researchers at Bitwise Asset Administration argue that spot quotations nonetheless understate what the community is value. Of their Week 24 Crypto Market Compass circulated late Tuesday, Dr. André Dragosch, Bitwise’s Head of Analysis for Europe, and analyst Ayush Tripathi calculate that “quantitative fashions estimate Bitcoin’s hypothetical ‘truthful worth’ amid the present sovereign default possibilities at round $230,000 immediately.” The determine implies a premium of simply over 110 p.c to the market value, which was hovering close to $109,600 at press time on 11 June 2025.

Bitcoin’s ‘True Value’ Is Explosive

Dragosch ties that evaluation to the rally in sovereign-risk hedges. United-States one-year credit-default-swap spreads are buying and selling close to half-percentage-point territory—ranges final seen through the 2023 debt-ceiling scare—reflecting “broader issues over the US fiscal deficit,” Reuters reported final week. “Bitcoin can present another ‘portfolio insurance coverage’ in opposition to widespread sovereign defaults as a scarce, decentralised asset which is freed from counterparty dangers,” the be aware argues, including that web curiosity outlays projected by the Congressional Price range Workplace level to a tripling of US debt-service prices to roughly $3 trillion by 2030.

Associated Studying

The macro backdrop, nevertheless, will not be the one pillar supporting Bitwise’s fair-value name. The agency’s in-house Cryptoasset Sentiment Index reveals twelve of fifteen market-breadth gauges trending larger, whereas the cross-asset risk-appetite index (CARA) compiled from equities, credit score, charges and commodities has surged to a five-year excessive. “Each cryptoasset and cross-asset sentiment at the moment are decisively bullish,” Dragosch writes, noting that Bitcoin’s climb again above $110,000 locations it inside two p.c of the all-time excessive close to $112,000 set in Might.

On-chain knowledge stay constructive. Change reserves have slipped to 2.91 million BTC—about 14.6 p.c of the circulating provide—after whales withdrew an estimated 390,632 BTC final week. On the identical time, web exchange-spot outflows slowed to roughly $0.53 billion from $1.78 billion the earlier week, suggesting lighter profit-taking stress.

By-product positioning echoes the spot-market resilience. Combination Bitcoin futures open curiosity added 2,200 BTC throughout venues, whereas the CME leg gained 6.4 ok BTC. Funding charges on perpetual swaps stayed constructive total regardless of flipping damaging for elements of the weekend, and the three-month annualised foundation held round 6.3 p.c. In choices, open curiosity expanded by 27,300 BTC, with the put-to-call ratio settling at 0.55; one-month 25-delta skew remained modestly damaging, implying continued demand for draw back hedges whilst realised volatility slipped to twenty-eight.2 p.c.

Institutional flows are reinforcing the bullish tone. International crypto ETPs absorbed $488.5 million final week, of which $254.9 million went into Bitcoin merchandise. US spot Bitcoin ETFs led the cost with $525 million of inflows, counterbalanced by a $24.1 million weekly leak from the Grayscale Bitcoin Belief. Bitwise’s personal BITB car attracted $78.1 million, whereas its European bodily Bitcoin ETP (BTCE) noticed solely marginal outflows. Ethereum merchandise additionally loved $260.9 million in web inflows, sustaining the broad-based threat bid.

Associated Studying

Bitwise concedes that headline threat can nonetheless provoke sharp, short-lived drawdowns—final week’s spat between Elon Musk and President Donald Trump briefly drove BTC again to $100,000—however sees structural forces firmly tilted to the upside. “US financial coverage uncertainty has more than likely handed its zenith already and continues to say no on the margin,” Dragosch writes, pointing to Might non-farm-payroll progress of 139,000 and a moderation in recession odds.

With Bitcoin already outperforming conventional belongings year-to-date and cross-asset sentiment now confirmed by Bitwise’s indicators, the analysts argue that the market is starting to cost the asset much less as a speculative car and extra as a macro hedge. Whether or not merchants embrace the $230,000 fair-value marker hinges on the identical variables underscored within the be aware—sovereign-risk premiums, coverage uncertainty and the tempo of institutional adoption—however the groundwork, they are saying, is seen on-chain, on desks and within the movement knowledge.

“Bitcoin additionally reclaimed 110k USD and is near its earlier all-time excessive,” the report reminds readers. For Bitwise, that proximity will not be an finish level however a staging space: the financial asset’s intrinsic worth, they conclude, resides “significantly additional north.”

At press time, BTC traded at $109,617.

Featured picture created with DALL.E, chart from TradingView.com