Bitcoin has not too long ago been buying and selling inside a traditionally slim 60-day value vary. Right here’s what often follows such intervals of compressed volatility.

Bitcoin Value Motion And Provide Are Each Constrained In A Tight Vary

In a brand new publish on X, the on-chain analytics agency Glassnode has mentioned how BTC hasn’t witnessed a lot sharp value motion not too long ago. Under is the chart shared by the analytics agency that reveals the historic situations the place the 60-day value vary was narrower than the present one (when it comes to proportion swing).

Appears to be like like there have not been many situations of a tighter value vary in historical past | Supply: Glassnode on X

From the graph, it’s seen that there have solely been a couple of intervals the place the asset has traded between a narrower vary throughout a 60-day interval than the final two months. This highlights simply how tight the worth motion has been for Bitcoin not too long ago.

Apparently, the situations with a extra compressed value vary all led to particularly unstable intervals for the asset. Thus, it’s doable that the newest stale interval may also find yourself unwinding with a extremely sharp swing within the cryptocurrency.

The volatility decompression after a slim vary hasn’t all the time been bullish; nonetheless, the well-known November 2019 crash, which marked the underside of that cycle’s bear market, occurred after traditionally stale motion within the coin’s worth.

The tight value vary isn’t the one indication that Bitcoin could possibly be resulting from volatility within the close to future, as Glassnode has identified {that a} important proportion of the BTC provide is concentrated across the present value degree.

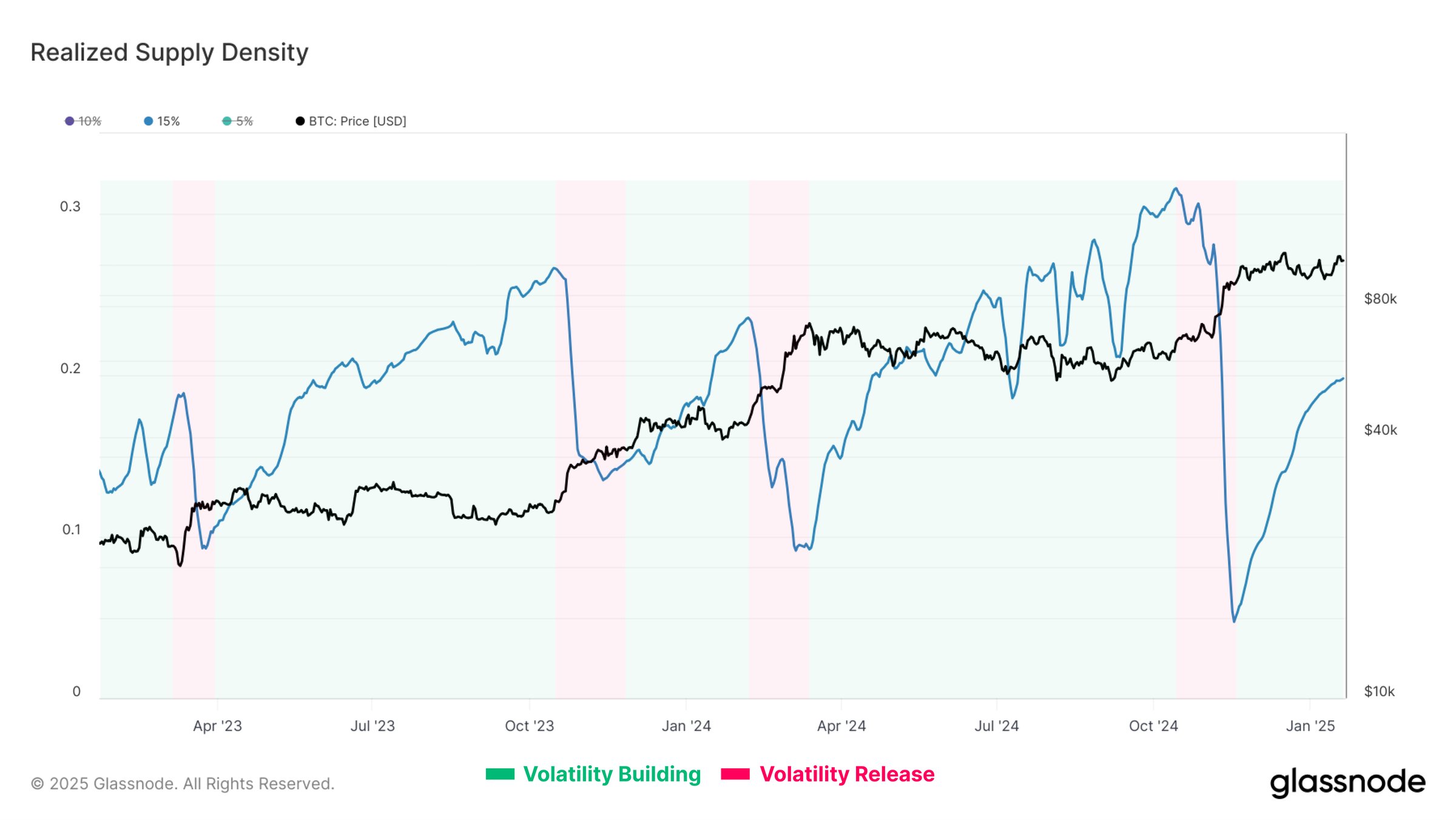

The info for the Realized Provide Density within the +15% to -15% value vary | Supply: Glassnode on X

The above chart reveals the info for the “Realized Provide Density,” which is an on-chain metric that tells us concerning the proportion of the asset’s provide that was final bought inside a given vary surrounding the present spot Bitcoin worth.

Within the graph, the analytics agency has chosen 15% because the vary, that means that the indicator is displaying the quantity of the availability that was final transferred between +15% and -15% from the newest value.

The Realized Provide Density for this value vary has traditionally adopted a curious sample: a gradual ascent in its worth has corresponded to a “volatility constructing” part for BTC and a subsequent sharp decline to a “volatility launch” one.

Just lately, Bitcoin has been inside the previous part from the angle of this indicator. Round 20% of the BTC provide is concentrated within the ±15% vary proper now, which is a notable worth. “This creates the potential for amplified market volatility as investor profitability shifts,” notes Glassnode.

BTC Value

On the time of writing, Bitcoin is floating round $105,700, up greater than 5% over the past seven days.

Appears to be like like the worth of the coin has seen an uplift throughout the previous day | Supply: BTCUSDT on TradingView

Featured picture from iStock.com, Glassnode.com, chart from TradingView.com