Bitcoin simply notched its third straight weekly acquire for the primary time since July. Bitcoin USD hovered close to current highs, holding agency amid political and geopolitical headlines. That resilience matches a much bigger pattern: giant traders hold shopping for quietly by means of regulated Bitcoin ETFs.

Whereas each day value strikes seemed calm, the weekly chart advised a distinct story. Bitcoin climbed whilst conventional markets reacted to uncertainty in Washington and overseas. For rookies, that disconnect issues as a result of it reveals who controls momentum proper now.

DISCOVER: High Ethereum Meme Cash to Purchase in 2026

Why Is Bitcoin Rising Even When Headlines Look Messy?

The brief reply is ETFs. A Bitcoin ETF is sort of a inventory wrapper round Bitcoin that lets establishments purchase BTC with out holding it straight. Consider it as a bridge between Wall Road and crypto.

(Supply: Bitcoin ETFS whole / Coinglass)

U.S. spot Bitcoin ETFs pulled in over $1.7 billion in simply three days this week. Earlier in January, they logged a $697 million single-day surge. That regular shopping for acts like a flooring underneath value.

This explains why Bitcoin USD can grind increased even when retail merchants keep quiet. Huge funds transfer slowly, however they transfer measurement. And so they have a tendency to carry, not flip.

Institutional Demand Is Doing the Heavy Lifting

ETF possession now represents greater than 6% of Bitcoin’s whole market cap. That share is giant sufficient to form value habits. When ETFs purchase, provide on exchanges tightens.

Merchandise like BlackRock’s IBIT and Constancy’s FBTC drive most of that demand. These names matter as a result of conservative traders belief them. That belief spills into Bitcoin by affiliation.

Bitcoin ETF cumulative inflows this 12 months have reached 3.8K BTC, surpassing 3.5K BTC in the identical interval final 12 months.

Traditionally, January inflows are modest, with main inflows usually beginning between February and April. pic.twitter.com/lk4YrKfz6L

— Ki Younger Ju (@ki_young_ju) January 16, 2026

We’ve lined how Bitcoin ETF inflows act as a sentiment gauge. When cash flows in, confidence follows. This week matches that sample.

DISCOVER: High 20 Crypto to Purchase in 2026

What Does This Imply for On a regular basis Bitcoin Patrons?

Three weekly beneficial properties in a row don’t imply value solely goes up. Bitcoin nonetheless swings exhausting. However it does imply the market has help past hype.

For rookies, this can be a sign to zoom out. Weekly developments matter greater than hourly candles. If establishments hold accumulating, sudden crashes turn into tougher to set off.

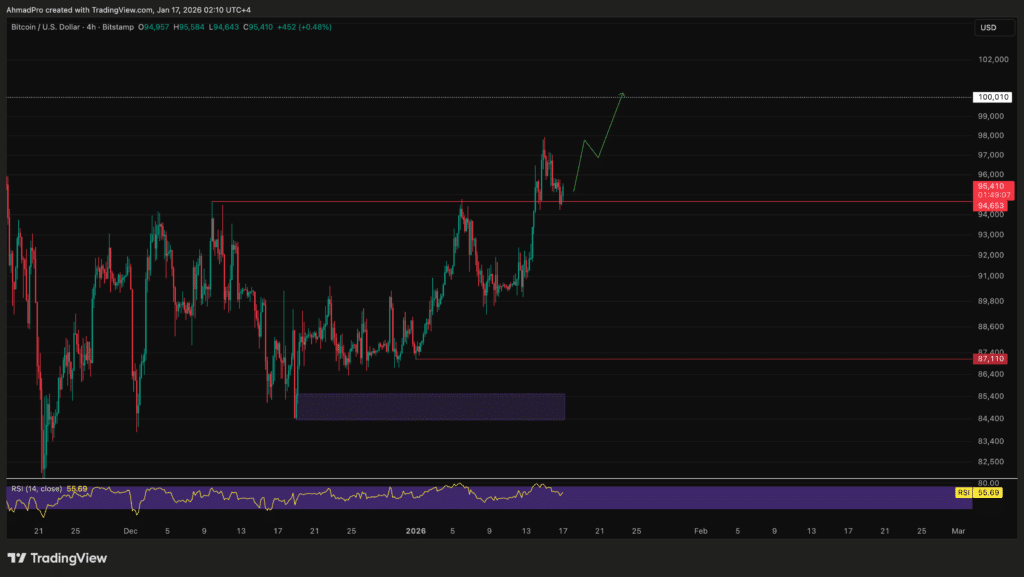

(Supply: BTCUSD / TradingView)

That mentioned, volatility by no means disappears. Bitcoin has a protracted historical past of sharp pullbacks after sturdy runs. This isn’t a inexperienced gentle to chase with lease cash.

The Threat Facet Most Headlines Skip

ETF flows can reverse. If macro situations tighten or regulators shift tone, those self same funds can pause shopping for. That may take away a key help layer. Bitcoin USD additionally trades in a world formed by rates of interest and world danger. A relaxed crypto chart doesn’t cancel real-world shocks.

Bitcoin ETF Each day Circulation – US$

BTC (Grayscale): 0 million

For all the information and disclaimers go to:https://t.co/04S8jMGl07

— Farside Traders (@FarsideUK) January 16, 2026

That is why we stress place sizing. Begin small. Be taught custody fundamentals. Deal with Bitcoin as a long-term schooling, not a short-term wager.

If ETF demand stays regular, Bitcoin’s gradual grind increased is sensible. Simply bear in mind: energy builds quietly, and danger administration issues greater than excellent timing.

DISCOVER: High Solana Meme Cash to Purchase in 2026

Observe 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Each day Skilled Market Evaluation

Why you may belief 99Bitcoins

Established in 2013, 99Bitcoin’s crew members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Tasks Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the newest updates, developments, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now