Senior researcher at on-chain analytics agency Glassnode has defined how the current Bitcoin shark “accumulation” is just not an indication of natural shopping for.

Bitcoin Shark-Sized Entities Have Been Rising Just lately

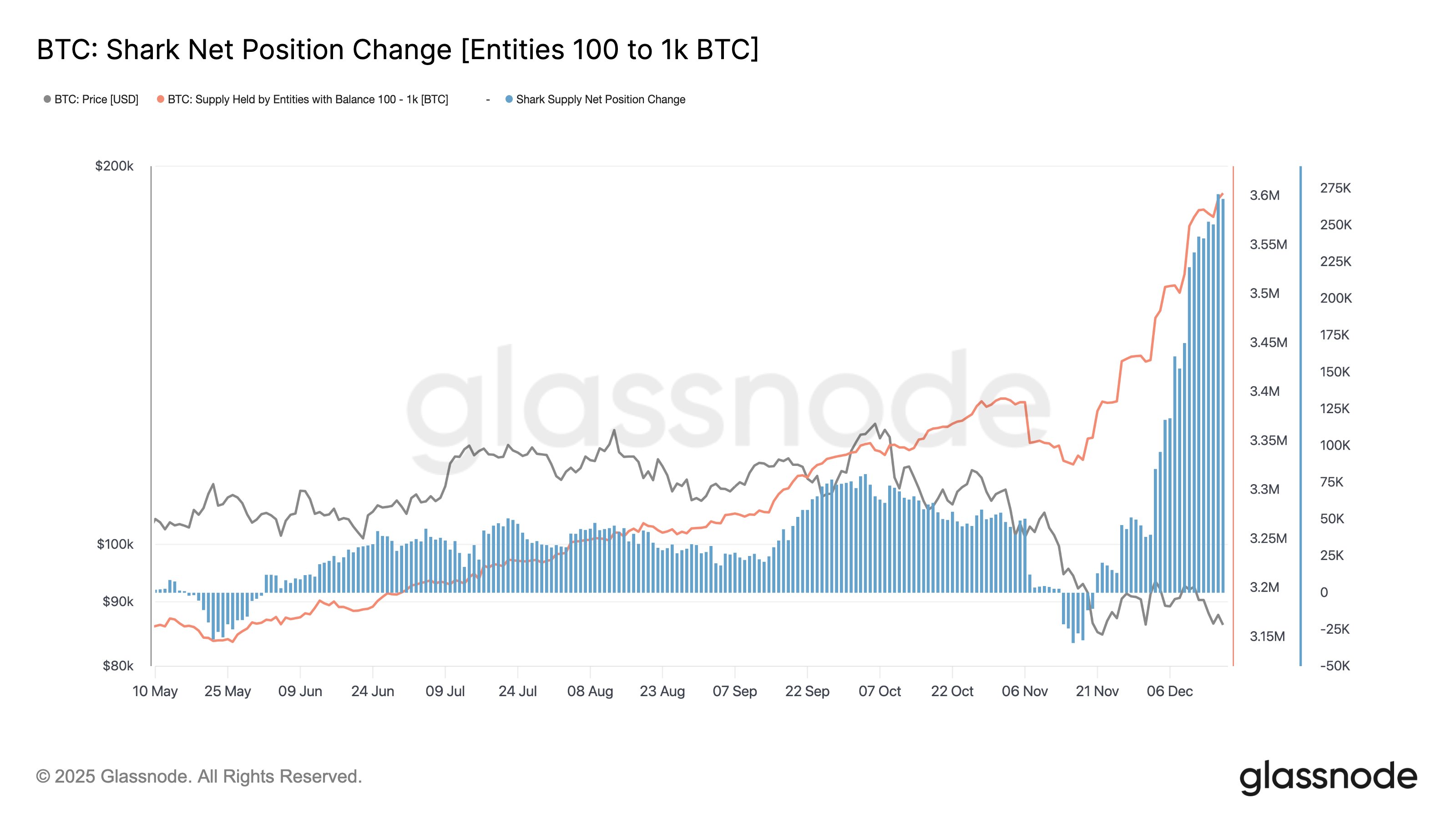

In a brand new put up on X, Glassnode senior researcher CryptoVizArt.₿ has talked in regards to the current development within the provide connected to the Bitcoin sharks. “Sharks” are outlined because the entities carrying between 100 and 1,000 BTC.

On the present change charge, the vary of this cohort converts to $8.7 million on the decrease finish and $87 million on the higher one. As a result of vital dimension concerned, sharks are thought-about as a investor group, though they’re much less influential than the whales (1,000+ BTC).

Recently, the provision of the sharks has been following a fast upward trajectory, because the chart shared by CryptoVizArt.₿ reveals.

How the provision of the sharks has modified throughout the previous few months | Supply: @CryptoVizArt on X

Since November sixteenth, the Bitcoin sharks have seen their mixed stability change from 3.33 million BTC to three.60 million BTC, reflecting a big rise of 270,000 tokens. “The important thing query, nevertheless, is whether or not this displays real internet accumulation, or merely inside reshuffling throughout cohorts, a distinction solely deeper on-chain evaluation can resolve,” stated the Glassnode researcher.

By “reshuffling,” CryptoVizArt.₿ is referring to the merging or splitting of holdings that traders generally participate in. For instance, a whale deciding to interrupt their stability throughout a number of wallets can register as a lower within the whale provide, and a rise within the provide of no matter bracket the smaller holdings fall inside.

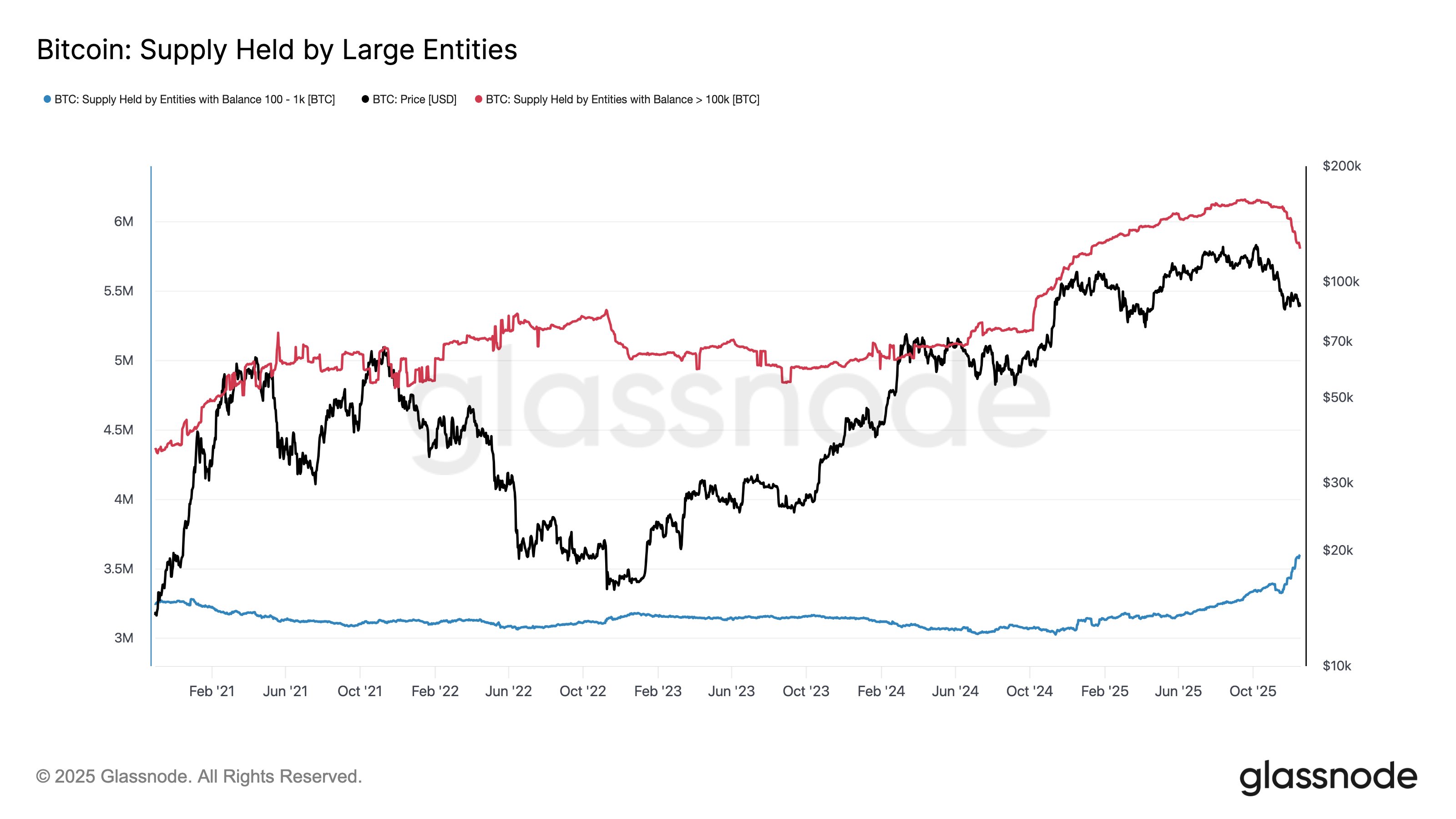

Indicators level to one thing comparable being an element behind the current Bitcoin shark provide enhance. Under is one other chart shared by the analyst, this one evaluating the development within the provide of the 100,000+ BTC entities in opposition to that of the sharks.

Appears to be like like the 2 provides have gone reverse methods in current weeks | Supply: @CryptoVizArt on X

The 100,000+ BTC cohort corresponds to the most important of entities on the blockchain, together with exchanges, exchange-traded funds (ETFs), and custodial companies. From the graph, it’s obvious that the holdings of this group have been declining not too long ago.

Apparently, the quantity distributed by the cohort on this drawdown is 300,000 BTC, which is roughly equal to that amassed by the sharks (270,000 BTC). “This sample strongly factors to pockets reshuffling, not natural accumulation,” famous CryptoVizArt.₿.

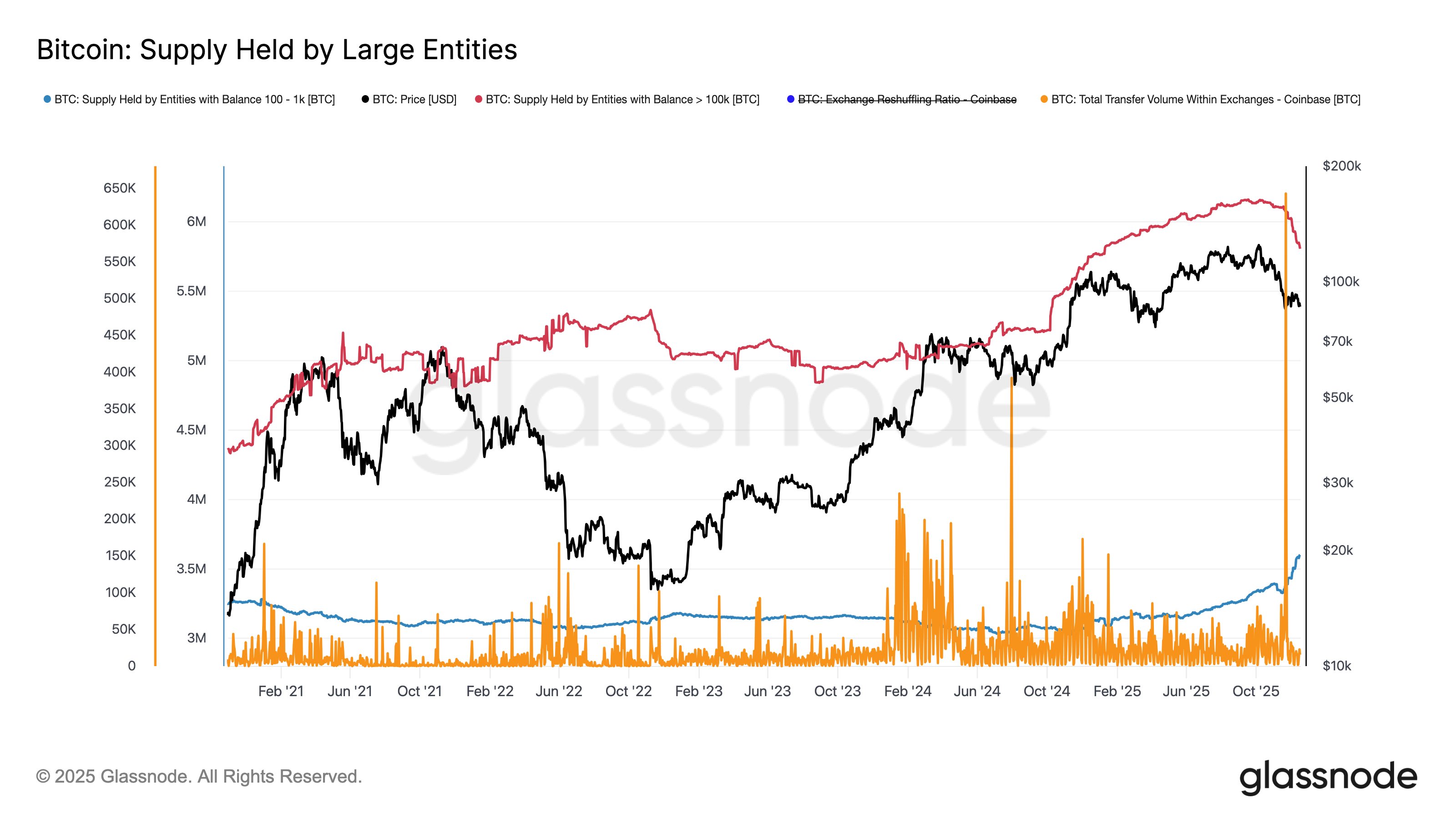

Because the 100,000+ BTC bracket additionally consists of exchanges, reshuffling out of those platforms (that’s, withdrawals) can nonetheless level towards constructive accumulation. It seems, nevertheless, that the character of the reshuffling is really more likely to be inside, as Coinbase made inside pockets transfers amounting to an enormous 640,000 BTC alongside this development.

The development within the whole inside switch quantity of crypto change Coinbase | Supply: @CryptoVizArt on X

Based mostly on the info, the analyst has concluded:

The important thing takeaway is that >90% of the obvious “shark accumulation” is probably going pushed by inside reshuffling by massive custodial entities, reasonably than internet shopping for by new 100–1K BTC holders.

BTC Value

On the time of writing, Bitcoin is floating round $87,300, down over 3% within the final seven days.

The value of the coin appears to have gone via some volatility | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.