Bitcoin’s value motion has pushed a carefully watched on-chain profitability gauge right into a configuration that, in 2022, preceded an prolonged drawdown and one analyst says a break under $70,000 would danger repeating that “year-long” reset.

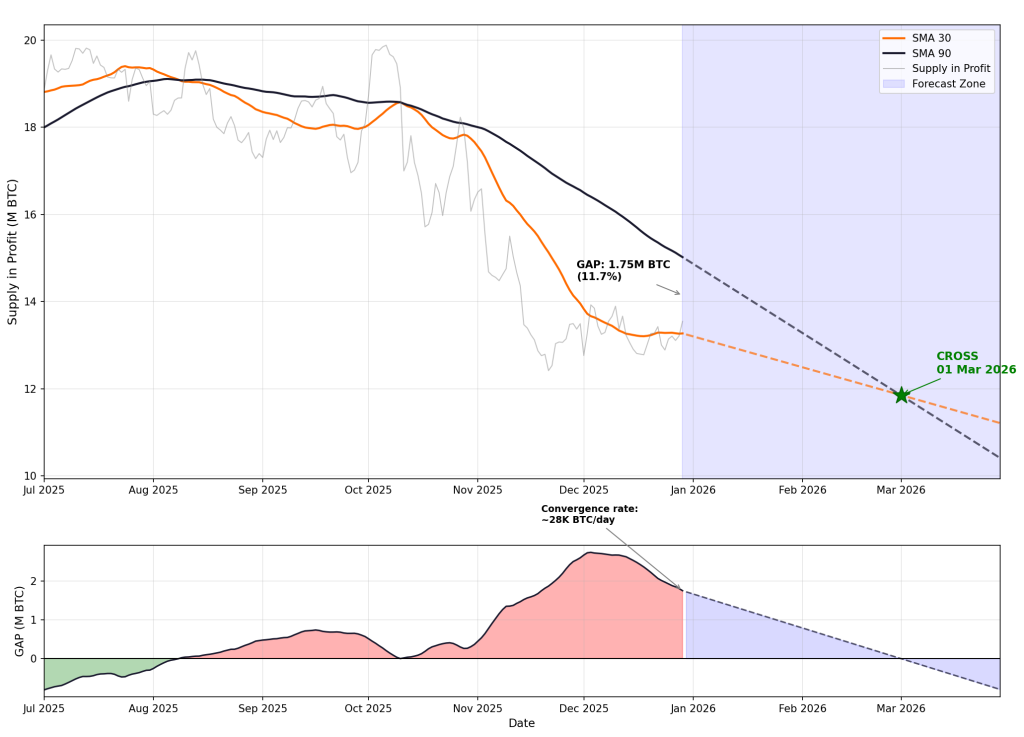

In a Dec. 30 morning transient, Axel Adler Jr. argued that Bitcoin’s “Provide in Revenue” development is at an inflection level after BTC stabilized within the $87,000–$90,000 vary following the pullback from October highs. The metric, which tracks how a lot BTC is held above its acquisition value, has fallen sharply from October peaks above 19 million BTC to roughly 13.2 million BTC, creating a large hole between short- and medium-term transferring averages.

A 2022-Like Setup Looms For Bitcoin

Adler’s core sign is the unfold between the 30-day and 90-day easy transferring averages of Provide in Revenue. After the correction from the all-time excessive, the 30-day common “dropped considerably under” the 90-day, forming a niche of about 1.75 million BTC.

Adler famous that “the same configuration was noticed in 2022 earlier than an prolonged bearish interval,” however careworn an vital distinction this time: the 365-day transferring common stays “at traditionally elevated ranges for now,” implying the longer-term revenue construction hasn’t absolutely rolled over.

Associated Studying

The near-term query is whether or not the 30-day development has bottomed. Adler flagged Dec. 18 as an area minimal for the 30-day common and mentioned it’s now “starting to show round,” with affirmation tied to a easy situation: Provide in Revenue should maintain above its 30-day common, which in apply requires BTC to maintain its footing at present ranges or larger.

Adler’s projection for a bullish restoration on this sign is unusually particular: he estimates the hole between the 30-day and 90-day averages is narrowing at roughly 28,000 BTC per day, primarily as a result of the 90-day common is being pulled down mechanically as excessive October values roll out of the window.

“Why is SMA 90 falling whereas value stays secure?” Adler wrote within the transient’s FAQ. “This can be a mechanical impact of the transferring common: values from early October are actually dropping out of the 90-day window, when Provide in Revenue was at peaks of 18–20M BTC with value at $115–125K. Even with secure present Provide, this pulls the common down.”

Associated Studying

That rollover impact, Adler mentioned, ought to persist by way of late January, offering a “tailwind” that would enable the 30-day line to reclaim the 90-day line even with no dramatic surge in Provide in Revenue. If the present charges of change maintain, Adler initiatives a bullish cross — the place the 30-day common rises above the 90-day — in late February to early March.

The Invalidation: $70,000

The forecast, nonetheless, is explicitly price-sensitive. Adler estimated Provide in Revenue has “elasticity to cost” of 1.3x, which means a ten% BTC drawdown may translate into a couple of 13% drop within the provide held in revenue. In his mannequin, the market’s important fault line is the $70,000 zone.

“At what value does the cross situation get invalidated?” Adler wrote. “The important zone is under $70K. At that stage, Provide would fall to ~10M BTC, and SMA 30 would start declining sooner than SMA 90. The GAP would cease narrowing and shift to growth, suspending the bullish sign indefinitely.”

In that situation, Adler mentioned the setup would extra carefully mirror 2022: the unfold expands relatively than compresses, and the bullish cross will get pushed out, with restoration probably taking “as much as one yr.” In contrast, he framed the constructive path as holding above $75,000–$80,000 by way of January, conserving Provide in Revenue supported and preserving the convergence tempo.

At press time, BTC traded at $88,102.

Featured picture created with DALL.E, chart from TradingView.com