Bitcoin seems to be on the verge of a serious worth motion, and knowledge means that volatility might return in an enormous method. With Bitcoin’s worth motion stagnating over the previous few weeks, let’s analyze the important thing indicators to know the potential scale and course of the upcoming transfer.

Volatility

An incredible place to begin is Bitcoin Volatility, which tracks worth motion and volatility over time. By isolating the previous 12 months’s knowledge and specializing in weekly volatility, we observe that Bitcoin’s worth lately has been comparatively flat, hovering within the $90,000 vary. This extended sideways motion has resulted in a dramatic drop in volatility, which means Bitcoin is experiencing a few of its most steady worth conduct in current historical past.

View Dwell Chart 🔍

Traditionally, such low volatility ranges are uncommon and are usually short-lived. When taking a look at earlier situations the place volatility was this low, Bitcoin adopted up with vital worth actions:

A rally from $50,000 to a then all-time excessive of $74,000.

A drop from $66,000 to $55,000, adopted by one other surge to $68,000.

A interval of stagnation round $60,000 earlier than a surge to $100,000, its present all-time excessive.

Each time volatility dropped to this stage, Bitcoin skilled a transfer of at the very least 20-30%, if no more, within the following weeks.

Bollinger Bands

To additional verify this, the Bollinger Bands Width indicator, a software that measures volatility by monitoring worth deviation from a transferring common, additionally indicators that Bitcoin is coiled for an enormous transfer. The quarterly bands are at the moment at their tightest ranges since 2012, which means that worth compression is at an excessive. The final time this occurred, Bitcoin skilled a 200% worth surge inside weeks.

Analyzing earlier occurrences of comparable tight Bollinger Band setups, we discover:

2018: A 50% drop from $6,000 to $3,000.

2020: A breakout from $9,000 to $12,000, establishing the eventual rally to $40,000.

2023: A gradual accumulation part round $25,000 earlier than a fast bounce to $32,000.

Potential Route

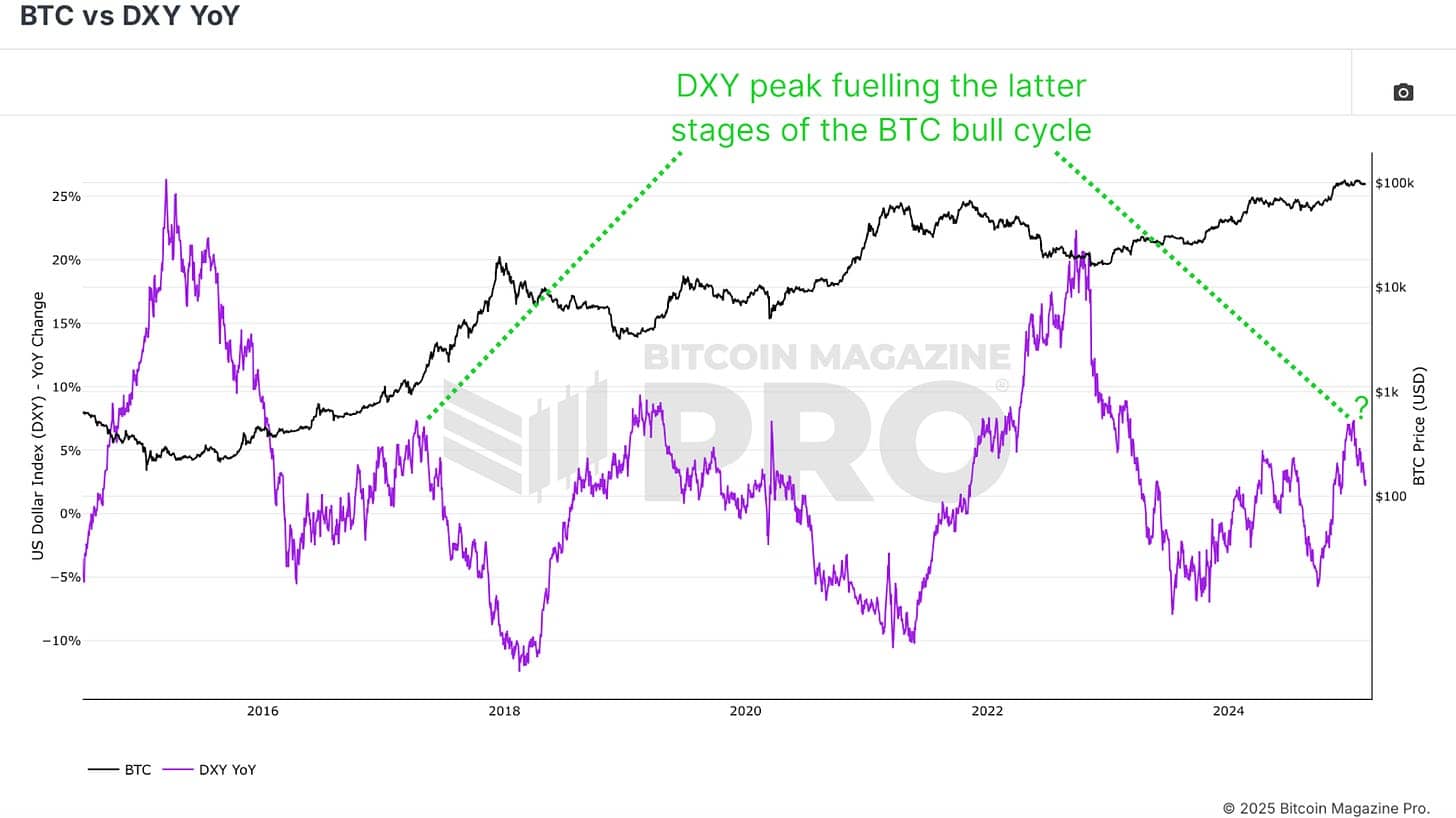

Understanding course is tougher than predicting volatility, however we’ve clues. One robust indicator is the US Greenback Energy Index (DXY) YoY, which has traditionally moved inversely to Bitcoin. Lately, the DXY has been rallying exhausting, but Bitcoin has held its floor. This means Bitcoin has underlying energy, even in much less favorable macro circumstances.

View Dwell Chart 🔍

Moreover, political components might play a job. Traditionally, when Donald Trump took workplace in 2017, the DXY declined, and Bitcoin noticed an enormous bull run from $1,000 to $20,000. With the same setup doubtlessly unfolding in 2025, we might even see a repeat of this dynamic.

ETF Inflows

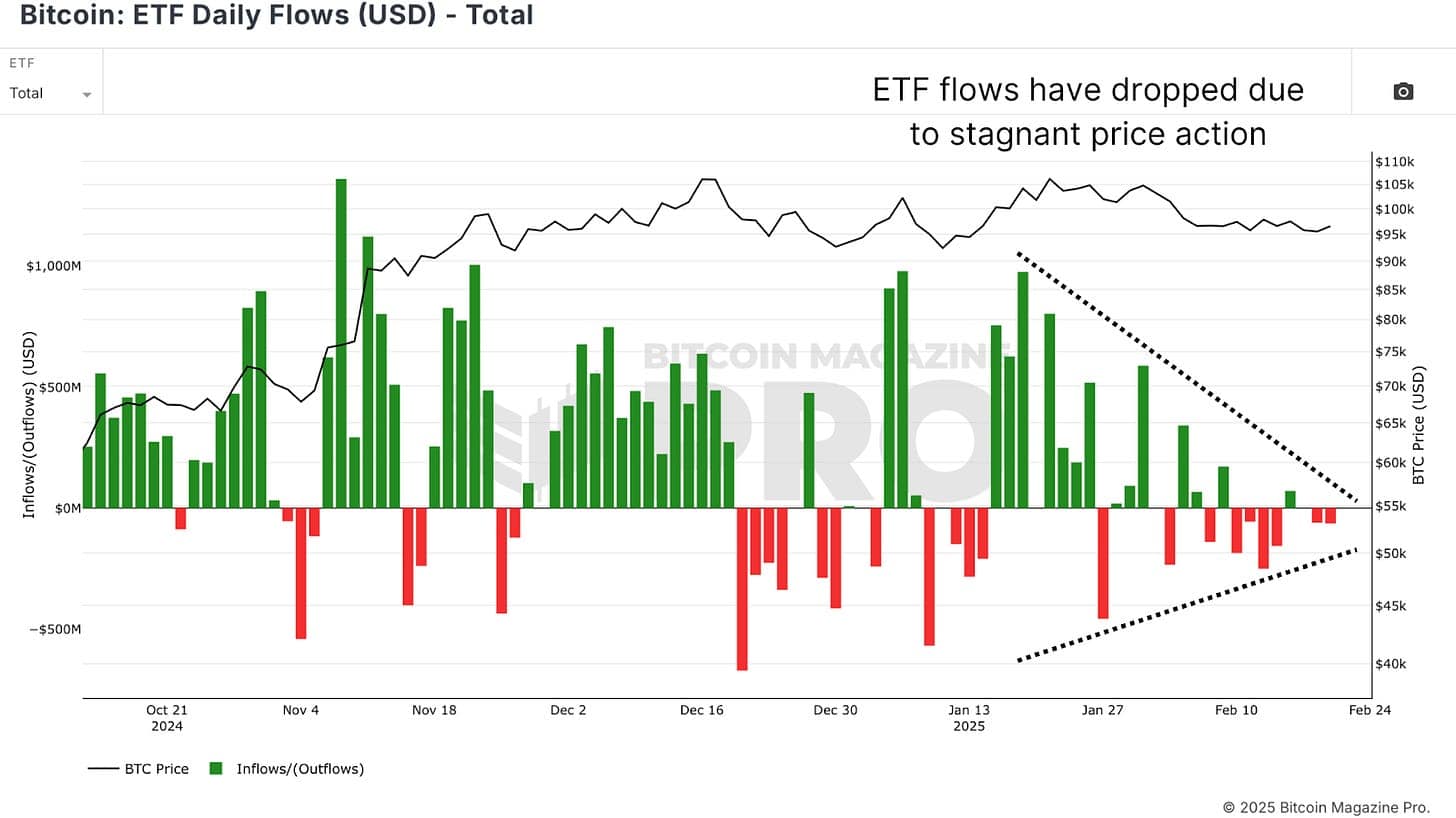

Moreover, Bitcoin ETF inflows, a proxy for institutional demand, have slowed considerably throughout this era of low volatility. This means that main gamers are ready for a confirmed breakout earlier than including to their positions. As soon as volatility returns, we might see renewed curiosity from establishments, driving Bitcoin even increased.

View Dwell Chart 🔍

Conclusion

Bitcoin’s volatility is at considered one of its lowest ranges in historical past, and such circumstances have by no means lasted lengthy. When volatility compresses this a lot, it units the stage for an explosive transfer. The information suggests a breakout is imminent, however whether or not it leans bullish or bearish depends upon macroeconomic circumstances, investor sentiment, and institutional flows.

For extra detailed Bitcoin evaluation and to entry superior options like reside charts, customized indicator alerts, and in-depth trade experiences, try Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your individual analysis earlier than making any funding selections.