Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value edged up a fraction of a proportion within the final 24 hours to commerce at $117,217 as of 5:00 a.m. EST on a 42.97% improve in every day buying and selling quantity to $66.51 billion.

The rise in value comes proper after the US Federal Reserve reduce rates of interest by 25 foundation factors on Sept. 17, 2025. Fed Chair Jerome Powell defined this resolution by pointing to a slowing labor market, despite the fact that inflation stays excessive.

J-Powell and the Fed reduce charges by 25 bps.

What does that imply for Bitcoin?

“It is positively bullish for Bitcoin” – @Andre_Dragosch from @Bitwise_Europe mentioned on #CHAINREACTION.

3 fundamental causes:

💹 Lower in actual yield💵 Inflation 🔼 = BTC upside💰 Cash provide progress = 🚀 pic.twitter.com/lKZmSSggUT

— Gareth Jenkinson (@gazza_jenks) September 18, 2025

That exhibits a change in US financial coverage aiming to assist the financial system develop. Powell talked about sluggish job progress and strange modifications in labor provide as causes to ease the strict financial coverage.

📝 Powell’s message yesterday was easy: the Fed reduce as a result of the labor market cracked.

🟡 Unemployment is rising and job creation is now under the breakeven charge🟡 Inflation is again up and nonetheless “considerably elevated”🟡 Development has slowed, exercise is moderating🟡 Tariffs are… pic.twitter.com/qECoEhawij

— Er. Vipin (@Er_Vpin) September 18, 2025

The reduce helps debtors with excessive prices and makes many buyers hopeful. This optimism unfold throughout totally different investments, together with Bitcoin and different cryptocurrencies.

The Fed’s charge reduce goals to steadiness job progress and hold costs secure, which has been powerful with combined financial indicators.

Decrease charges normally imply extra liquidity within the markets, which inspires folks to put money into riskier property like Bitcoin.

Bitcoin On-Chain Evaluation Reveals Rising Demand

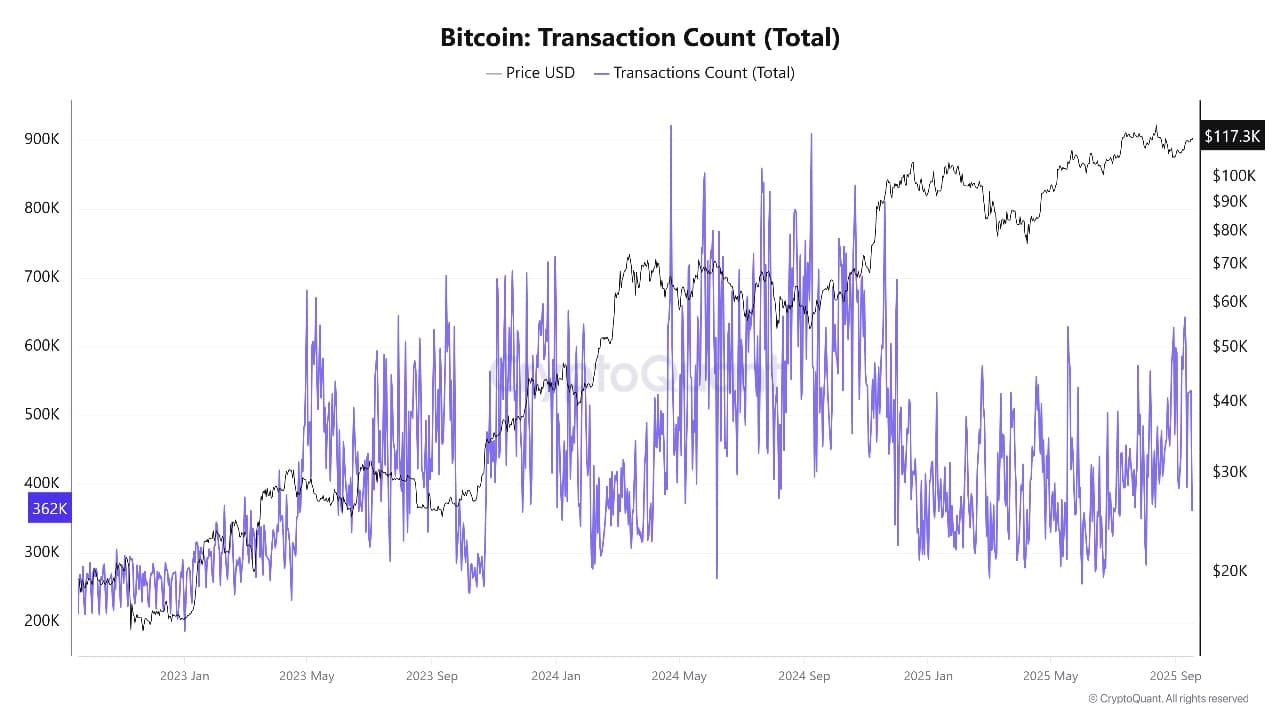

Bitcoin’s on-chain information, there are indicators of sturdy demand supporting the latest value rise. Extra Bitcoin transactions are occurring, and extra pockets addresses are energetic. This implies extra persons are utilizing Bitcoin.

Additionally, there’s a noticeable pattern of Bitcoin shifting off exchanges, which implies holders are preserving their cash slightly than promoting. This reduces the provision obtainable on the market and helps the worth go up.

Taking cash off exchanges is normally very bullish as a result of it limits promoting stress and exhibits that holders anticipate the worth to rise additional.

The regular improve in transactions additionally factors to a wholesome community, giving further confidence to merchants throughout instances of financial uncertainty.

Bitcoin Transaction Depend Supply: Crypto Quant

Bitcoin Value Technical Evaluation Helps Additional Upside

Bitcoin’s weekly chart exhibits that its value stays sturdy above $117,000, with a achieve of about 1.69%. The worth discovered assist close to the $110,000 and $105,000 ranges, which have stopped it from falling throughout latest dips.

BTCUSD Evaluation Supply: Tradingview

The chart options Bitcoin buying and selling effectively above its 50-week shifting common round $98,000, a key stage that exhibits the long-term uptrend is alive. The following resistance or goal stage is at $124,500, which might be reached as the worth rides the present upward channel.

Technical indicators assist the optimistic view: the Relative Power Index (RSI) is about 60.7, suggesting the worth is gaining power however not but too excessive. The Shifting Common Convergence Divergence (MACD) has optimistic bars, confirming the bullish pattern.

In the meantime, the Common Directional Index (ADX) close to 24.7 exhibits a reasonably sturdy pattern pushing the worth upward. If Bitcoin stays above the $110,000 assist, it may quickly transfer previous $124,500 and possibly even attain new file highs within the coming weeks.

In abstract, Bitcoin is gaining from the Fed’s charge reduce, which will increase cash circulation out there and makes buyers extra prepared to take dangers. On-chain indicators present holders really feel assured and should not promoting, decreasing market provide. Technical evaluation additionally signifies Bitcoin is trending up with sturdy momentum.

The worth shifting previous $117,000 is an enormous step, with stable assist ranges able to hold it regular. When combining these components, Fed coverage, blockchain information, and technical developments, the outlook is beneficial for Bitcoin to proceed rising and check greater value ranges quickly.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection