Bitcoin Overview

Our real-time BTC to USD worth replace reveals the present Bitcoin worth as $99,070 USD.

Our most up-to-date Bitcoin worth forecast signifies that its worth will enhance by 4.51% and attain 103542.74 by January 17, 2025.

Our technical indicators sign concerning the Bullish Bullish 96% market sentiment on Bitcoin, whereas the Concern & Greed Index is displaying a rating of 70 (Greed).

During the last 30 days, Bitcoin has had 15/30 (50%) inexperienced days and three.53% worth volatility.

Bitcoin Revenue Calculator

Revenue calculation please wait…

Bitcoin (BTC) Technical Overview

When discussing future buying and selling alternatives of digital property, it’s important to concentrate to market sentiments.

The bulls are main – promote and lock in your positive aspects!

Promote BTC now!

On the four-hour chart, Bitcoin is bearish. The 50-day transferring common is falling, suggesting a weakening short-term development. In the meantime, the 200-day transferring common has been falling since 12/01/2025, indicating a weak longer-term development.

Within the every day chart, Bitcoin is bullish. The 50-day transferring common, at present under the value, is rising, which could help future worth actions. The 200-day transferring common has been rising since 18/12/2024, exhibiting long-term energy.

On the weekly timeframe, Bitcoin seems bullish. The 50-day transferring common is under the value and rising, doubtlessly appearing as help. The 200-day transferring common, rising since 30/06/2024, helps a sustained development.

Bitcoin (BTC) Value Prediction For At present, Tomorrow and Subsequent 30 Days

Date

Value

Change

January 16, 202597402.24-1.68%January 17, 2025100686.381.63%January 18, 2025103542.744.51%January 19, 2025104803.135.79%January 20, 2025105861.126.85%January 21, 2025106642.747.64%January 22, 2025106548.047.55%January 23, 2025105947.766.94%January 24, 2025105632.266.62%January 25, 2025105484.596.47%January 26, 2025107255.728.26%January 27, 2025108975.7910%January 28, 2025110556.5811.59%January 29, 2025111614.9412.66%January 30, 2025112106.5713.16%January 31, 2025112945.7414.01%February 01, 2025113940.2715.01%February 02, 2025115748.2016.83%February 03, 2025117131.9018.23%February 04, 2025114528.0915.6%February 05, 2025112491.1813.55%February 06, 2025111630.6312.68%February 07, 2025111154.3712.2%February 08, 2025111010.0012.05%February 09, 2025111940.3012.99%February 10, 2025113232.7214.3%February 11, 2025112721.6213.78%February 12, 2025113056.9914.12%February 13, 2025117874.9018.98%February 14, 2025121939.3623.08%

Bitcoin Prediction Desk

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2040

2050

January

$97,402.24

$105,173.99

$112,945.74

February

$104,685.68

$113,312.52

$121,939.36

March

$100,069.35

$99,966.83

$99,864.30

All Time

$100,719.09

$106,151.11

$111,583.13

Select a 12 months

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2040

2050

Bitcoin Historic

In keeping with the newest knowledge gathered, the present worth of Bitcoin is $69,824.68, and BTC is presently ranked No. 1 in the whole crypto ecosystem. The circulation provide of Bitcoin is $1,375,660,239,109.04, with a market cap of 19,701,634 BTC.

Up to now 24 hours, the crypto has elevated by $1,277.79 in its present worth.

For the final 7 days, BTC has been in a very good upward development, thus growing by 12.82%. Bitcoin has proven very robust potential recently, and this might be a very good alternative to dig proper in and make investments.

Over the last month, the value of BTC has elevated by 5.49%, including a colossal common quantity of $3,833.37 to its present worth. This sudden progress implies that the coin can change into a stable asset now if it continues to develop.

Bitcoin Value Prediction 2024

In keeping with the technical evaluation of Bitcoin costs anticipated in 2024, the minimal price of Bitcoin can be $100,069.35. The utmost stage that the BTC worth can attain is $111,004.36. The typical buying and selling worth is predicted round $121,939.36.

January 2025: Bitcoin Value Forecast

In the midst of autumn 2024, the Bitcoin price can be traded on the common stage of $105,173.99. Crypto analysts anticipate that in January 2025, the BTC worth would possibly fluctuate between $97,402.24 and $112,945.74.

BTC Value Forecast for February 2025

Market specialists anticipate that in February 2025, the Bitcoin worth is not going to drop under a minimal of $104,685.68. The utmost peak anticipated this month is $121,939.36. The estimated common buying and selling worth can be on the stage of $113,312.52.

March 2025: Bitcoin Value Forecast

Cryptocurrency specialists have fastidiously analyzed the vary of BTC costs all through 2024. For March 2025, their forecast is the next: the utmost buying and selling worth of Bitcoin can be round $99,864.30, with a risk of dropping to a minimal of $100,069.35. In March 2025, the typical price can be $99,966.83.

Bitcoin Value Prediction 2025

After the evaluation of the costs of Bitcoin in earlier years, it’s assumed that in 2025, the minimal worth of Bitcoin can be round $93,072. The utmost anticipated BTC worth could also be round $114,857. On common, the buying and selling worth may be $96,455 in 2025.

Month

Minimal Value

Common Value

Most Value

January 2025

$99,486.24

$119,815.66

$111,325.41

February 2025

$98,903.13

$117,691.97

$111,646.47

March 2025

$98,320.01

$115,568.27

$111,967.52

April 2025

$97,736.90

$113,444.57

$112,288.57

Might 2025

$97,153.79

$111,320.88

$112,609.63

June 2025

$96,570.68

$109,197.18

$112,930.68

July 2025

$95,987.56

$107,073.48

$113,251.73

August 2025

$95,404.45

$104,949.79

$113,572.79

September 2025

$94,821.34

$102,826.09

$113,893.84

October 2025

$94,238.23

$100,702.39

$114,214.89

November 2025

$93,655.11

$98,578.70

$114,535.95

December 2025

$93,072

$96,455

$114,857

Bitcoin Value Prediction 2026

Based mostly on the technical evaluation by cryptocurrency specialists concerning the costs of Bitcoin, in 2026, BTC is predicted to have the next minimal and most costs: about $133,957 and $163,464, respectively. The typical anticipated buying and selling price is $138,780.

Month

Minimal Value

Common Value

Most Value

January 2026

$96,479.08

$99,982.08

$118,907.58

February 2026

$99,886.17

$103,509.17

$122,958.17

March 2026

$103,293.25

$107,036.25

$127,008.75

April 2026

$106,700.33

$110,563.33

$131,059.33

Might 2026

$110,107.42

$114,090.42

$135,109.92

June 2026

$113,514.50

$117,617.50

$139,160.50

July 2026

$116,921.58

$121,144.58

$143,211.08

August 2026

$120,328.67

$124,671.67

$147,261.67

September 2026

$123,735.75

$128,198.75

$151,312.25

October 2026

$127,142.83

$131,725.83

$155,362.83

November 2026

$130,549.92

$135,252.92

$159,413.42

December 2026

$133,957

$138,780

$163,464

Bitcoin Value Prediction 2027

The specialists within the discipline of cryptocurrency have analyzed the costs of Bitcoin and their fluctuations throughout the earlier years. It’s assumed that in 2027, the minimal BTC worth would possibly drop to $204,087, whereas its most can attain $233,219. On common, the buying and selling price can be round $209,637.

Month

Minimal Value

Common Value

Most Value

January 2027

$139,801.17

$144,684.75

$169,276.92

February 2027

$145,645.33

$150,589.50

$175,089.83

March 2027

$151,489.50

$156,494.25

$180,902.75

April 2027

$157,333.67

$162,399

$186,715.67

Might 2027

$163,177.83

$168,303.75

$192,528.58

June 2027

$169,022

$174,208.50

$198,341.50

July 2027

$174,866.17

$180,113.25

$204,154.42

August 2027

$180,710.33

$186,018

$209,967.33

September 2027

$186,554.50

$191,922.75

$215,780.25

October 2027

$192,398.67

$197,827.50

$221,593.17

November 2027

$198,242.83

$203,732.25

$227,406.08

December 2027

$204,087

$209,637

$233,219

Bitcoin Value Prediction 2028

Based mostly on the evaluation of the prices of Bitcoin by crypto specialists, the next most and minimal BTC costs are anticipated in 2028: $358,451 and $305,183. On common, it will likely be traded at $313,569.

Month

Minimal Value

Common Value

Most Value

January 2028

$212,511.67

$218,298

$243,655

February 2028

$220,936.33

$226,959

$254,091

March 2028

$229,361

$235,620

$264,527

April 2028

$237,785.67

$244,281

$274,963

Might 2028

$246,210.33

$252,942

$285,399

June 2028

$254,635

$261,603

$295,835

July 2028

$263,059.67

$270,264

$306,271

August 2028

$271,484.33

$278,925

$316,707

September 2028

$279,909

$287,586

$327,143

October 2028

$288,333.67

$296,247

$337,579

November 2028

$296,758.33

$304,908

$348,015

December 2028

$305,183

$313,569

$358,451

Bitcoin Value Prediction 2029

Crypto specialists are always analyzing the fluctuations of Bitcoin. Based mostly on their predictions, the estimated common BTC worth can be round $464,473. It would drop to a minimal of $448,794, nevertheless it nonetheless would possibly attain $525,742 all through 2029.

Month

Minimal Value

Common Value

Most Value

January 2029

$317,150.58

$326,144.33

$372,391.92

February 2029

$329,118.17

$338,719.67

$386,332.83

March 2029

$341,085.75

$351,295

$400,273.75

April 2029

$353,053.33

$363,870.33

$414,214.67

Might 2029

$365,020.92

$376,445.67

$428,155.58

June 2029

$376,988.50

$389,021

$442,096.50

July 2029

$388,956.08

$401,596.33

$456,037.42

August 2029

$400,923.67

$414,171.67

$469,978.33

September 2029

$412,891.25

$426,747

$483,919.25

October 2029

$424,858.83

$439,322.33

$497,860.17

November 2029

$436,826.42

$451,897.67

$511,801.08

December 2029

$448,794

$464,473

$525,742

Bitcoin Value Prediction 2030

Yearly, cryptocurrency specialists put together forecasts for the value of Bitcoin. It’s estimated that BTC can be traded between $645,119 and $774,474 in 2030. Its common price is predicted at round $668,343 throughout the 12 months.

Month

Minimal Value

Common Value

Most Value

January 2030

$465,154.42

$481,462.17

$546,469.67

February 2030

$481,514.83

$498,451.33

$567,197.33

March 2030

$497,875.25

$515,440.50

$587,925

April 2030

$514,235.67

$532,429.67

$608,652.67

Might 2030

$530,596.08

$549,418.83

$629,380.33

June 2030

$546,956.50

$566,408

$650,108

July 2030

$563,316.92

$583,397.17

$670,835.67

August 2030

$579,677.33

$600,386.33

$691,563.33

September 2030

$596,037.75

$617,375.50

$712,291

October 2030

$612,398.17

$634,364.67

$733,018.67

November 2030

$628,758.58

$651,353.83

$753,746.33

December 2030

$645,119

$668,343

$774,474

Bitcoin Value Prediction 2031

Cryptocurrency analysts are able to announce their estimations of the Bitcoin’s worth. The 12 months 2031 can be decided by the utmost BTC worth of $1,111,105. Nonetheless, its fee would possibly drop to round $909,696. So, the anticipated common buying and selling worth is $943,114.

Month

Minimal Value

Common Value

Most Value

January 2031

$667,167.08

$691,240.58

$802,526.58

February 2031

$689,215.17

$714,138.17

$830,579.17

March 2031

$711,263.25

$737,035.75

$858,631.75

April 2031

$733,311.33

$759,933.33

$886,684.33

Might 2031

$755,359.42

$782,830.92

$914,736.92

June 2031

$777,407.50

$805,728.50

$942,789.50

July 2031

$799,455.58

$828,626.08

$970,842.08

August 2031

$821,503.67

$851,523.67

$998,894.67

September 2031

$843,551.75

$874,421.25

$1,026,947.25

October 2031

$865,599.83

$897,318.83

$1,054,999.83

November 2031

$887,647.92

$920,216.42

$1,083,052.42

December 2031

$909,696

$943,114

$1,111,105

Bitcoin Value Prediction 2032

After years of research of the Bitcoin worth, crypto specialists are prepared to supply their BTC price estimation for 2032. It is going to be traded for not less than $1,346,087, with the doable most peaks at $1,587,278. Subsequently, on common, you may anticipate the BTC worth to be round $1,383,812 in 2032.

Month

Minimal Value

Common Value

Most Value

January 2032

$946,061.92

$979,838.83

$1,150,786.08

February 2032

$982,427.83

$1,016,563.67

$1,190,467.17

March 2032

$1,018,793.75

$1,053,288.50

$1,230,148.25

April 2032

$1,055,159.67

$1,090,013.33

$1,269,829.33

Might 2032

$1,091,525.58

$1,126,738.17

$1,309,510.42

June 2032

$1,127,891.50

$1,163,463

$1,349,191.50

July 2032

$1,164,257.42

$1,200,187.83

$1,388,872.58

August 2032

$1,200,623.33

$1,236,912.67

$1,428,553.67

September 2032

$1,236,989.25

$1,273,637.50

$1,468,234.75

October 2032

$1,273,355.17

$1,310,362.33

$1,507,915.83

November 2032

$1,309,721.08

$1,347,087.17

$1,547,596.92

December 2032

$1,346,087

$1,383,812

$1,587,278

Bitcoin Value Prediction 2033

Cryptocurrency analysts are able to announce their estimations of the Bitcoin’s worth. The 12 months 2033 can be decided by the utmost BTC worth of $2,309,533. Nonetheless, its fee would possibly drop to round $1,841,587. So, the anticipated common buying and selling worth is $1,896,939.

Month

Minimal Value

Common Value

Most Value

January 2033

$1,387,378.67

$1,426,572.58

$1,647,465.92

February 2033

$1,428,670.33

$1,469,333.17

$1,707,653.83

March 2033

$1,469,962

$1,512,093.75

$1,767,841.75

April 2033

$1,511,253.67

$1,554,854.33

$1,828,029.67

Might 2033

$1,552,545.33

$1,597,614.92

$1,888,217.58

June 2033

$1,593,837

$1,640,375.50

$1,948,405.50

July 2033

$1,635,128.67

$1,683,136.08

$2,008,593.42

August 2033

$1,676,420.33

$1,725,896.67

$2,068,781.33

September 2033

$1,717,712

$1,768,657.25

$2,128,969.25

October 2033

$1,759,003.67

$1,811,417.83

$2,189,157.17

November 2033

$1,800,295.33

$1,854,178.42

$2,249,345.08

December 2033

$1,841,587

$1,896,939

$2,309,533

Bitcoin Value Prediction 2040

Cryptocurrency analysts are able to announce their estimations of the Bitcoin’s worth. The 12 months 2040 can be decided by the utmost BTC worth of $2,940,256. Nonetheless, its fee would possibly drop to round $2,693,654. So, the anticipated common buying and selling worth is $2,845,409.

Month

Minimal Value

Common Value

Most Value

January 2040

$1,912,592.58

$1,975,978.17

$2,362,093.25

February 2040

$1,983,598.17

$2,055,017.33

$2,414,653.50

March 2040

$2,054,603.75

$2,134,056.50

$2,467,213.75

April 2040

$2,125,609.33

$2,213,095.67

$2,519,774

Might 2040

$2,196,614.92

$2,292,134.83

$2,572,334.25

June 2040

$2,267,620.50

$2,371,174

$2,624,894.50

July 2040

$2,338,626.08

$2,450,213.17

$2,677,454.75

August 2040

$2,409,631.67

$2,529,252.33

$2,730,015

September 2040

$2,480,637.25

$2,608,291.50

$2,782,575.25

October 2040

$2,551,642.83

$2,687,330.67

$2,835,135.50

November 2040

$2,622,648.42

$2,766,369.83

$2,887,695.75

December 2040

$2,693,654

$2,845,409

$2,940,256

Bitcoin Value Prediction 2050

Cryptocurrency analysts are able to announce their estimations of the Bitcoin’s worth. The 12 months 2050 can be decided by the utmost BTC worth of $3,888,726. Nonetheless, its fee would possibly drop to round $3,414,491. So, the anticipated common buying and selling worth is $3,699,032.

Month

Minimal Value

Common Value

Most Value

January 2050

$2,753,723.75

$2,916,544.25

$3,019,295.17

February 2050

$2,813,793.50

$2,987,679.50

$3,098,334.33

March 2050

$2,873,863.25

$3,058,814.75

$3,177,373.50

April 2050

$2,933,933

$3,129,950

$3,256,412.67

Might 2050

$2,994,002.75

$3,201,085.25

$3,335,451.83

June 2050

$3,054,072.50

$3,272,220.50

$3,414,491

July 2050

$3,114,142.25

$3,343,355.75

$3,493,530.17

August 2050

$3,174,212

$3,414,491

$3,572,569.33

September 2050

$3,234,281.75

$3,485,626.25

$3,651,608.50

October 2050

$3,294,351.50

$3,556,761.50

$3,730,647.67

November 2050

$3,354,421.25

$3,627,896.75

$3,809,686.83

December 2050

$3,414,491

$3,699,032

$3,888,726

What Is Bitcoin (BTC)?

Bitcoin, Bitcoin… Is there something new to say about this cryptocurrency at this level? Even individuals who have zero curiosity within the business have heard its identify. Because the primary cryptocurrency, it enjoys unimaginably excessive costs (as much as $93K), a whole lot of consideration, and, in fact, a lot scrutiny.

Bitcoin is the primary cryptocurrency that was created again in 2009. It’s a decentralized digital forex that makes use of blockchain expertise to facilitate trustless peer-to-peer transactions. BTC makes use of a proof-of-work consensus mechanism, which implies it depends on Bitcoin miners to safe its community.

In recent times, Bitcoin has been one of the fashionable property for funding: not solely can or not it’s extraordinarily worthwhile as a result of excessive volatility of the cryptocurrency market, however additionally it is very simple to spend money on. All one must get Bitcoin is an Web connection.

Bitcoin, alongside the remainder of the cryptocurrency market, is understood for its capability to beat any challenges and have robust comebacks regardless of everybody writing it off. Varied monetary specialists have been predicting that the Bitcoin bubble will pop “within the close to future” each month with out fail for the previous eight or so years. And but, the coin stays on high, and BTC buyers take pleasure in excessive earnings, patiently ready for one more meteoric BTC worth rise.Nonetheless, because the crypto business evolves, introduces new cash, and expands its attain, some crypto lovers are beginning to doubt whether or not Bitcoin remains to be price investing in.

What Impacts the Worth of Bitcoin?

Quite a few elements can affect Bitcoin’s worth actions. In contrast to many altcoins, Bitcoin typically units the development for the cryptocurrency market, exhibiting much less dependency on the efficiency of different digital currencies. Nonetheless, Bitcoin stays delicate to common market influences equivalent to shifts in rates of interest or important developments within the crypto sector, notably these affecting main gamers like Ethereum or Shiba Inu. For instance, when Ethereum introduced The Merge part of its transition to a proof-of-stake mannequin, it additionally influenced the notion and worth of Bitcoin.

Bitcoin, like several asset, is inclined to information particularly about itself, the broader crypto exchanges, or blockchain developments. For example, crypto valuations typically surge with bulletins of widespread adoption or revolutionary technological developments. A primary instance is when main companies like Tesla, Microsoft, Starbucks, and so forth. introduced they’d begin accepting Bitcoin as fee, resulting in a pointy enhance in its worth. Conversely, any trace of uncertainty, like rumors of regulatory crackdowns, can affect the Bitcoin market, too, and swiftly scale back its worth.

Exterior, non-crypto information also can play a vital function in shaping Bitcoin’s worth. A notable instance was noticed within the spring of 2020, when the worldwide financial uncertainty as a result of pandemic heated up curiosity in Bitcoin as a possible protected haven, boosting its worth considerably. Subsequently, keeping track of inventory market traits can present deeper insights into the present state of Bitcoin.

Moreover, environmental information, equivalent to intense scrutiny over the vitality consumption of mining operations, is one other space that potential or present Bitcoin buyers ought to monitor carefully, because it more and more influences market dynamics.

The Function of Bitcoin ETFs: Demand, FOMO, and Value Dynamics

A brand new and more and more important issue shaping Bitcoin’s worth is the introduction of Bitcoin Change-Traded Funds (ETFs). These monetary merchandise have offered a regulated and accessible approach for each retail and institutional buyers to realize publicity to Bitcoin with out straight holding the asset.

1. Elevated Demand:Bitcoin ETFs have broadened the market’s attain by attracting buyers who have been beforehand hesitant to navigate the complexities of cryptocurrency. The demand created by ETFs has a direct affect on Bitcoin’s spot worth as a result of these funds want to carry Bitcoin to again their shares.

2. FOMO and Momentum:The approval of spot Bitcoin ETFs has triggered important Concern of Lacking Out (FOMO) amongst buyers. This psychological driver results in speedy shopping for, which accelerates worth will increase. The current surge to over $93,000 in November 2024, for instance, was fueled partially by FOMO as ETFs made Bitcoin extra accessible.

3. Market Sentiment and Liquidity:ETFs have additionally improved market liquidity, enabling smoother transactions and lowering volatility in some circumstances. Nonetheless, large-scale inflows or outflows in ETF holdings can nonetheless provoke worth swings. Optimistic sentiment surrounding the legitimacy and ease of funding by means of ETFs has amplified Bitcoin’s attraction, driving extra speculative investments.

Whereas Bitcoin ETFs characterize a significant step towards mainstream acceptance, additionally they invite new dangers. The push pushed by FOMO can result in overvaluation and subsequent corrections, highlighting the significance of warning in periods of heightened speculative exercise.

Historical past of Bitcoin

Bitcoin’s worth historical past is understood to most crypto lovers. From being finally practically nugatory, this coin has grown to change into one of many greatest property on the earth. At its top, Bitcoin’s market cap was even increased than that of a number of established companies.

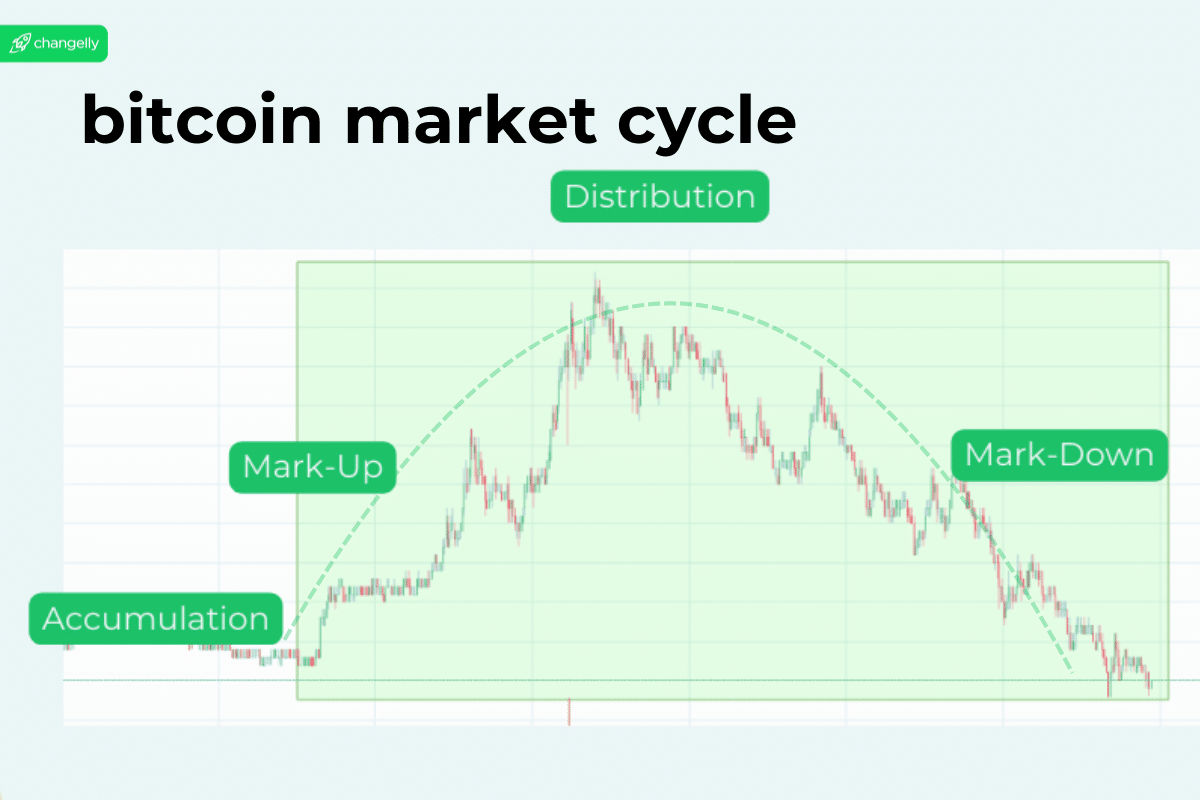

Let’s take a quick have a look at the Bitcoin worth chart.

Upon this chart, one factor that instantly turns into obvious is that Bitcoin’s worth cycles carry on shortening. Moreover, regardless of the coin commonly shedding worth, the typical worth of Bitcoin retains growing. This reveals a constructive development for the long run.

“Will Bitcoin return up?” is an evergreen query within the crypto market. The reality is, regardless of how arduous we examine BTC worth historical past and traits, we might not be capable of predict this precisely. Nonetheless, we will nonetheless contemplate these elements in addition to right now’s Bitcoin information to make a tentative prediction.

Bitcoin’s crypto market cap remains to be the very best within the business, and it nonetheless has probably the most recognition. Its circulating provide is slowly approaching its whole provide however there’s nonetheless a protracted approach to go until we attain a degree the place there can be no new Bitcoins launched.

General, Bitcoin worth historical past reveals us that there’s nonetheless room for this asset to develop even when there’s a bear market.

Please be aware that this doesn’t represent funding recommendation.

Will Bitcoin Go Again Up?

Will Bitcoin Go Again Up?

The long run trajectory of Bitcoin’s worth stays a sizzling subject, influenced by macroeconomic traits, main occasions within the cryptocurrency area, and shifting regulatory landscapes.

In November 2024, Bitcoin shattered expectations, attaining a brand new all-time excessive (ATH) of over $93,000. This historic milestone was pushed by a mix of key developments, together with the approval of spot Bitcoin Change-Traded Funds (ETFs) in the USA, which considerably elevated institutional participation.

April 2024 additionally marked the much-anticipated Bitcoin block reward halving, an occasion that traditionally triggers bull runs. This discount in provide has added to the already bullish sentiment, additional driving demand.

Constructing on this momentum, the 2024 U.S. presidential election noticed Donald Trump re-elected and introduced with it optimism for a pro-crypto administration. Trump’s marketing campaign guarantees, together with positioning the U.S. as a pacesetter in cryptocurrency innovation and doubtlessly establishing a nationwide Bitcoin reserve, have fueled constructive sentiment. This political shift is seen as a catalyst for additional Bitcoin adoption and worth stability.

Macroeconomic elements have additionally performed a big function. The Federal Reserve’s resolution to chop rates of interest earlier within the 12 months has pushed buyers in the direction of Bitcoin as a hedge towards inflation. Coupled with fears of forex devaluation, this has drawn each retail and institutional buyers to the digital asset.

Regardless of these optimistic developments, challenges persist. The gradual adaptation of Bitcoin in sure areas and its reliance on the environmentally taxing Proof-of-Work (PoW) consensus algorithm stay areas of concern. Moreover, whereas the cryptocurrency ecosystem continues to develop, strict international laws and public hesitation in the direction of digital property nonetheless pose obstacles to broader adoption.

Wanting forward, specialists imagine the crypto market is getting into a brand new progress cycle, doubtlessly peaking between 2024 and 2025, aligning with the historic four-year market cycle idea. Whereas exterior elements equivalent to geopolitical tensions or international market dynamics may affect Bitcoin’s trajectory, its historic resilience and adaptableness counsel it might proceed to surpass expectations.

As Bitcoin evolves, its function as a world monetary instrument turns into more and more evident. Whether or not as a hedge towards inflation, a retailer of worth, or a medium for monetary inclusion, Bitcoin continues to say its relevance within the ever-changing panorama of the worldwide economic system. Its capability to achieve new heights stays a tangible risk, backed by robust market fundamentals and rising institutional belief.

How Excessive Will Bitcoin Go? Bitcoin Value Predictions by Specialists

Bitcoin’s current worth surge, reaching a brand new all-time excessive of over $93,000, has been attributed to a mixture of elements, together with institutional adoption, favorable regulatory developments, and post-election market euphoria. Many specialists agree that Bitcoin has entered a maturing part, setting the stage for substantial future progress.

Anthony Scaramucci of SkyBridge Capital foresees Bitcoin peaking at $170,000 throughout the subsequent 12 months, reflecting confidence in its present progress cycle.

Michael Saylor of MicroStrategy predicts a “provide shock” following Bitcoin’s current halving, which reduces miner rewards and traditionally triggers worth will increase. Based mostly on previous efficiency, Saylor anticipates one other bullish development within the coming months.

Marshall Beard, CEO of Gemini Change, initiatives Bitcoin may rally to $150,000 by the top of the 12 months, aligning with the optimistic outlook shared by Tom Lee of Fundstrat International Advisors. Lee envisions an identical $150,000 goal within the brief time period however speculates Bitcoin may soar to $500,000 throughout the subsequent 5 years.

Cathie Wooden of Ark Make investments presents one of the bold forecasts, predicting Bitcoin, pushed by its finite provide and growing adoption as a world retailer of worth, may attain $1 million inside 5 years.

https://twitter.com/saylor/standing/1781395787424891242

Different sources present various however optimistic estimates:

Digital Coin Value suggests a median worth of $210,644.67 for 2025, with peaks doubtlessly reaching $230,617.59.

Pockets Investor predicts Bitcoin may hit $103,675 inside a 12 months and climb to $196,072 in 5 years.

These bullish predictions are underpinned by Bitcoin’s finite provide and independence from exterior financial elements. Its rising acceptance and technological developments, regardless of the evolving regulatory landscapes, bolster its funding attraction.

The Bearish State of affairs

On the time of writing, the cryptocurrency business largely maintains a constructive view on Bitcoin, making it difficult to seek out notable bearish projections. Nonetheless, two major issues may negatively affect Bitcoin’s worth.

Firstly, Bitcoin’s substantial vitality consumption continues to attract criticism, posing a possible risk to its market worth. Secondly, the evolving regulatory panorama, notably regarding anti-money laundering (AML) and Know Your Buyer (KYC) legal guidelines, presents important challenges that bother buyers.

If Bitcoin’s worth crashes, then the values of different cryptocurrencies are prone to observe swimsuit.

Is Bitcoin a Good Funding?

Learn additionally: What if I Make investments $100 in Bitcoin At present?

Regardless of if it’s in a down- or uptrend, Bitcoin is sort of at all times predicted to maintain rising sooner or later. So, it may be a very good funding. Nonetheless, please DYOR and thoroughly contemplate the dangers earlier than investing in BTC or every other cryptocurrency.

Our Bitcoin worth prediction is fairly conservative and doesn’t bear in mind any random media hype or sudden laws which will occur within the close to future — these elements are too unpredictable. Nonetheless, should you’re contemplating investing in Bitcoin, you’ll want to be sure to’re prepared for its worth to fluctuate wildly.

Bitcoin is much less dangerous than different cryptocurrencies, however it’s nonetheless pretty unstable and unpredictable compared to conventional funding avenues just like the inventory market.

Is Bitcoin nonetheless protected to spend money on?

Investing in Bitcoin carries severe dangers as a consequence of its excessive volatility. It’s advisable just for these with a excessive danger tolerance, a steady monetary basis, and the capability to soak up potential losses. Earlier than investing, make sure you totally perceive what you’re stepping into and conduct thorough analysis.In the event you’re new to cryptocurrency, contemplate trying out our complete information on crypto investments for newcomers.

Is it too late to purchase Bitcoin?

Historical past reveals that it’s by no means too late to purchase Bitcoin on-line. The Bitcoin worth right now remains to be decrease than its ATH, which implies it might rise and go for a full-scale bull run once more sooner or later.

FAQ

Why is Bitcoin taking place?

Bitcoin’s current decline could be linked to a number of elements on the coronary heart of uncertainty within the crypto market.

Decrease buying and selling volumes have magnified the affect of enormous trades, resulting in heightened volatility.

Moreover, financial issues, equivalent to these in China’s property sector, have bolstered the notion of Bitcoin as a risk-on asset, inclined to broader financial downturns.

Particular occasions just like the shutdown of Binance Join and notable departures from crypto corporations have additionally shaken investor confidence, additional influencing market sentiment and contributing to cost drops.

What is going to $100 of Bitcoin be price in 2030?

If Bitcoin is at present priced at $90,000, $100 would purchase roughly 0.00111111 BTC. If Bitcoin reaches $500,000 by 2030, your funding can be price $555.56.

How a lot was 1 Bitcoin in 2010?

In 2010, Bitcoin was nonetheless in its infancy and skilled important worth fluctuations. Bitcoin’s worth began the 12 months 2010 at round a fraction of a cent. The precise worth is difficult to pinpoint as a result of Bitcoin was not traded on any exchanges till later within the 12 months. Nonetheless, it was valued under $0.01 for the primary few months.

The value of Bitcoin noticed its first important enhance in 2010, reaching round $0.08 in July. The utmost worth of the 12 months was conquered on November 6, 2010, when Bitcoin hit roughly $0.50.

Will Bitcoin go to zero?

It’s extremely unlikely that Bitcoin will go to zero. With its decentralized construction, restricted provide, and growing institutional adoption, Bitcoin has solidified its place as a key monetary asset. Whereas volatility and regulatory challenges may affect its worth, its widespread acceptance makes an entire collapse inconceivable.

Will Bitcoin hit 1 million?

Some specialists, like Cathie Wooden of Ark Make investments, predict Bitcoin may attain $1 million throughout the subsequent 5 years, citing growing adoption and its function as a retailer of worth. Nonetheless, such a milestone would require important macroeconomic shifts, mass adoption, and continued institutional curiosity. Whereas it’s a daring prediction, the timeline and situations stay speculative.

Will Bitcoin attain 1 million?

There are some distinguished figures within the monetary and funding world who imagine that Bitcoin may attain $1 million. Notably, Cathie Wooden of ARK Make investments has predicted that Bitcoin’s worth may exceed $1 million by 2030. Her predictions hinge on numerous elements, together with the elevated adoption of Bitcoin as a retailer of worth and the affect of technological and monetary developments on its valuation.

These optimistic forecasts replicate a perception in Bitcoin’s long-term progress potential, pushed by its broadening and deepening integration into the monetary programs and the broader acceptance of cryptocurrencies as authentic funding automobiles. Nonetheless, as with all funding, there’s an inherent danger, and such excessive targets are primarily based on very bullish market situations and assumptions.

Is Bitcoin a very good funding?

The forecast for Bitcoin worth is sort of constructive. It’s anticipated that BTC worth would possibly meet a bull development within the nearest future. We kindly remind you to at all times do your personal analysis earlier than investing in any asset.

To maximise funding potential, one ought to commonly monitor their pockets Bitcoin steadiness and transaction historical past for accuracy and indicators of unauthorized exercise.

How a lot will Bitcoin be price in 2025?

The Bitcoin community is evolving at a swift tempo. The forecast for Bitcoin in 2025 is essentially optimistic. Analysts anticipate the typical worth of Bitcoin to fluctuate between a most of $121,440.85 and a minimal of $45,871.41.

How a lot will Bitcoin be price in 2030?

With a conducive surroundings for progress, Bitcoin’s future seems to be promising. Predictions for 2030 are extremely constructive, with enterprise analysts anticipating that Bitcoin may soar to a most worth of $500,000.

Will Bitcoin ever hit $100K?

In March 2024, Bitcoin’s worth soared to a brand new all-time excessive of $73,800, a milestone that many view as the top of the crypto winter and the start of a promising new market cycle. With this resurgence, a wave of optimism has swept by means of analysts and buyers alike, a lot of whom at the moment are anticipating a strong bull run by the top of 2024 and into early 2025. They predict that this momentum may propel Bitcoin’s worth to even higher heights, doubtlessly breaching the elusive $100,000 mark.For a deeper evaluation of the elements influencing Bitcoin’s trajectory in the direction of this milestone, in addition to professional insights, check with our detailed exploration within the article: When Will Bitcoin Hit $100,000?

Will Bitcoin return all the way down to $10K?

It’s doable. In any case, the cryptocurrency market is extremely risky, and the query of crypto regulation stays unsure.

How excessive can Bitcoin go in 10 years?

In 10 years, Bitcoin might attain $1,000,000 and even increased. So long as there are not any threats to it by way of competitors and regulation, its finite provide and rising reputation ought to make sure that it retains conquering new worth highs.

Why can there solely ever be 21 million Bitcoins?

The easy reply to this query is “as a result of it was designed that approach.” Properly, however why can’t this restrict be prolonged? Amongst different issues, BTC’s finite provide acts as a deflationary measure and is likely one of the the reason why Bitcoin’s worth is as excessive as it’s. As for why this precise determine was chosen, there are a couple of theories about it. One states that it’s as a result of the full worth of all bodily cash on the earth when BTC was developed was equal to $21 trillion. Because of this, if Bitcoin had been then to utterly change fiat, 1 BTC would have been price $1M, and one satoshi — $0.01.

Is Bitcoin a protected long-term funding?

Bitcoin is a comparatively protected funding in comparison with different cryptocurrencies. Nonetheless, it’s nonetheless a high-risk, high-reward kind of asset and shouldn’t be seen as a dependable long-term retailer of worth.

Disclaimer: Please be aware that the contents of this text will not be monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.