Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth surged 4% up to now 24 hours to commerce at $91,393 as of two:41 a.m. EST on buying and selling quantity that rose 14% to $75.7 billion.

BTC rebounded during the last day, climbing above $91,000 as rising expectations of a US Federal Reserve charge lower drove a wave of renewed investor curiosity.

Markets now worth in roughly an 85% likelihood of a quarter-point discount in December, a pointy soar from a measly 44% likelihood per week in the past, in response to information from CME FedWatch.

Rates of interest are too excessive.

The Fed ought to lower 50 foundation factors in December.

— Anthony Pompliano 🌪 (@APompliano) November 26, 2025

If a charge lower happens, decrease charges might raise “threat belongings” similar to Bitcoin by growing liquidity and boosting urge for food for higher-yielding belongings.

In the meantime, as the biggest crypto by market capitalization recovered, a crypto pockets related to SpaceX moved 1,163 BTC valued at round $105 million to a brand new pockets, in response to Arkham Intelligence information.

Nonetheless, it stays unclear whether or not SpaceX moved the cash for custody functions or with the intent to promote them.

Bitcoin lastly broke out of a fragile $81,000-$89,000 zone, a zone that highlighted the market’s lack of liquidity and demand.

Can the restoration be sustained and Bitcoin’s worth rise even greater?

Bitcoin Worth Poised For A Sustained Restoration

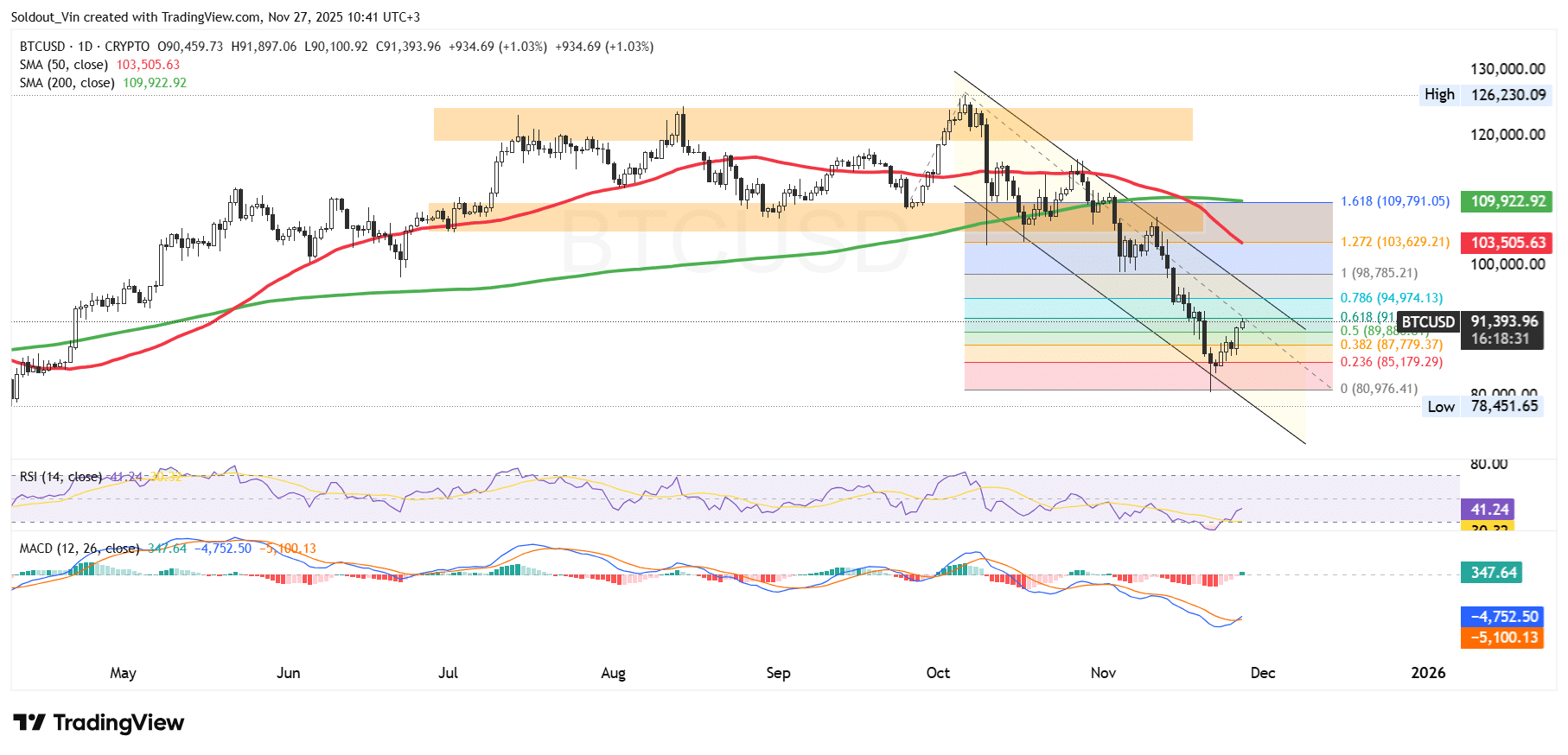

After a sustained surge from Might, the BTC worth was rejected above the $123,000 zone, forcing it to commerce sideways between this degree and the $107,400 help.

Nonetheless, the Bitcoin worth couldn’t maintain that degree, main the bears to push the crypto right into a well-defined falling channel, with BTC crossing key Fibonacci help ranges. BTC is now surging towards the 0.5 Fibonacci ($89,880) and the 0.618 Fibonacci ($91,982) ranges.

The sustained bearish pattern has pushed BTC’s worth beneath each the 50-day and 200-day Easy Transferring Averages (SMAs), suggesting the bearish pattern stays in place.

In the meantime, on the day by day chart, the Relative Power Index (RSI) is recovering from oversold territory, at present at 41, suggesting consumers are taking again management.

The Transferring Common Convergence Divergence (MACD) additionally helps the restoration try, because the blue MACD line has crossed above the orange sign line. With inexperienced bars now forming on the histogram, BTC is at present using optimistic momentum.

BTC Worth Prediction

In keeping with the BTC/USD chart evaluation, the Bitcoin worth is making an attempt a short-term rebound after touching the decrease Fibonacci zone close to the 0.236–0.382 ranges, which frequently act as response factors throughout corrective phases.

If momentum continues to enhance, the subsequent key resistance for BTC lies across the 0.5 and 0.618 Fibonacci retracements at $89,800–$91,800, the place sellers are more likely to re-enter.

A profitable breakout from the descending channel might open the trail towards the $95,000–$98,500 zone, which falls throughout the 0.786 Fib degree and a previous consolidation area.

Nonetheless, if the Bitcoin worth fails to carry above current lows, a retest of the $80,000–$82,000 help vary turns into attainable, because it aligns with the Fib backside and former liquidity ranges.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection