The Bitcoin value has continued to impress over this weekend, recovering strongly from the late week blues that noticed it fall towards $101,000. From a broader perspective, BTC will probably be focusing on the $110,000 mark and seeking to reclaim its all-time-high value. With the premier cryptocurrency already closing in on the $106,000 stage, the query is — the place is the following impediment on this restoration journey?

BTC Worth Faces Important Resistance Above $106K

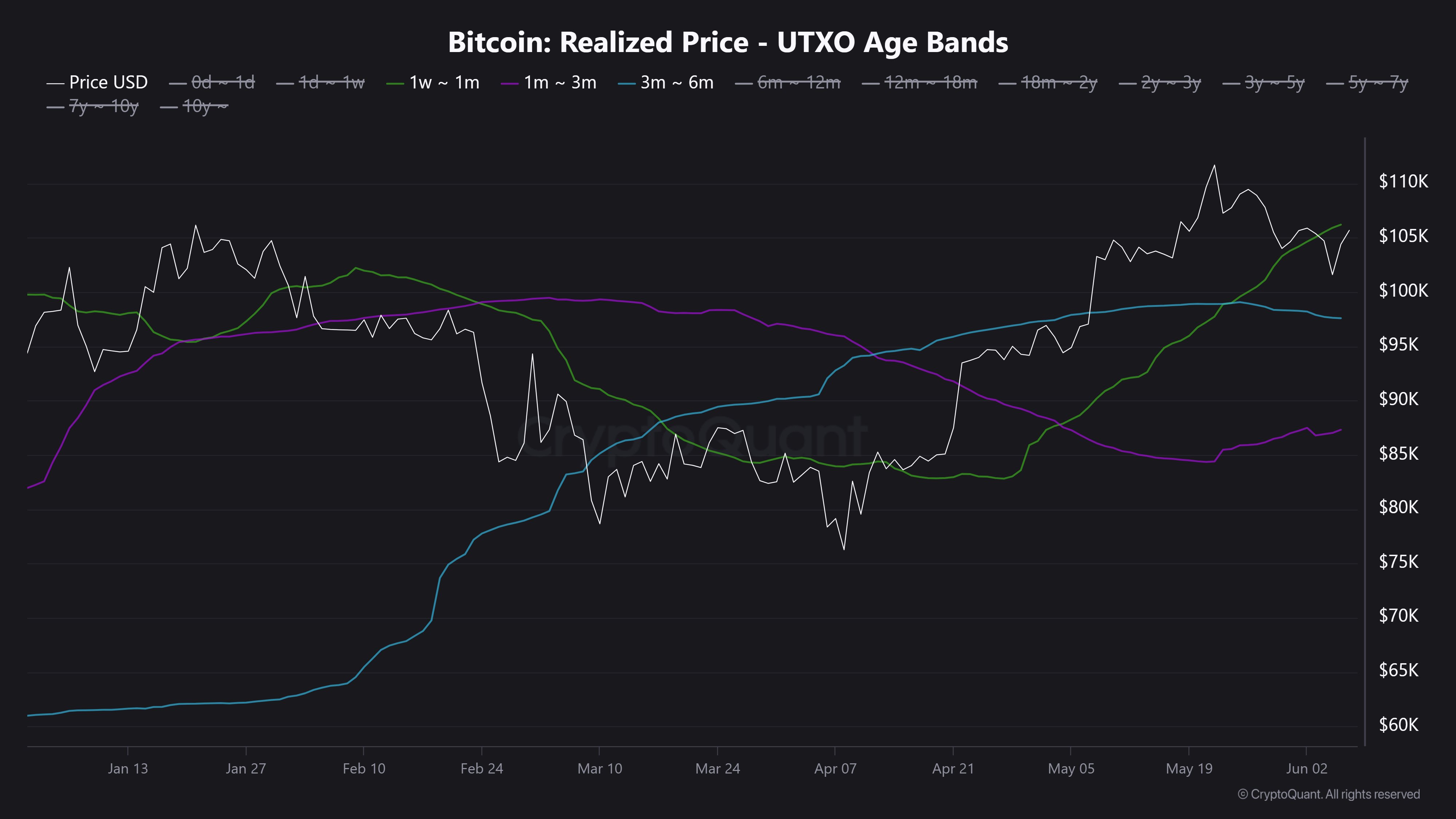

In a brand new publish on the social media platform X, on-chain analyst Burak Kesmeci revealed two main ranges that could possibly be important to the mid- to long-term trajectory of the Bitcoin value. This evaluation is predicated on the realized value of a particular class of traders referred to as short-term holders (STH).

The Bitcoin short-term holders are recognized for his or her reactive and speculative nature, as they’re usually triggered by sudden value actions. Therefore, these traders are inclined to open and shut their positions inside a brief interval.

In his publish on X, Kesmeci revealed three necessary ranges primarily based on the realized costs of traders inside sure unspent transaction output (UTXO) age bands. Particularly, the on-chain analyst highlighted value bases of traders inside 1 week – 4 week ($106,200), 1 month – 3 month ($87,300), and three month – 6 month ($97,500) age bands.

Supply: @burak_kesmeci on X

In response to Kesmeci, the Bitcoin value is more likely to face vital resistance at across the $106,200 stage, the place 1-week – 4-week traders have their value bases. The rationale behind that is that STH at a loss might shut their positions after they return to their value foundation, resulting in downward stress and the formation of a resistance stage.

On the flip facet, Kesmeci additionally highlighted the realized value ($97,500) of short-term traders throughout the 3-month – 6-month age band as one other important stage for the Bitcoin value. The analyst talked about traders inside this class might take into account a transfer in direction of this realized value as a chance to defend their positions, resulting in the formation of a help cushion.

In essence, this piece of on-chain information means that the Bitcoin value may be approaching a serious resistance stage simply above $106,000. If it efficiently breaches this stage, traders would possibly see the premier cryptocurrency revisit its all-time excessive of $111,871.

Bitcoin Worth At A Look

As of this writing, the value of BTC stands at round $105,700, reflecting a 1.3% enhance prior to now 24 hours. In response to information from CoinGecko, the market chief is up by greater than 1% within the final seven days.

The worth of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.