Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin has risen dramatically over the past 10 years in opposition to gold, with an increase of an unimaginable 13,693%, based on the monetary statistics shared by crypto entrepreneur Ted.

The figures reveal the alarming divergence between the 2 belongings from April 2015 and April 2025. Particularly, this putting ascent of Bitcoin has caught the attention of traders unfold across the globe.

Associated Studying

Bitcoin Vs. Gold: From Equal Footing To Huge Hole

Ten years in the past, gold and Bitcoin have been at related costs. In April 2015, Bitcoin moved between $200 and $250, whereas gold was ranging round $1,200 to $1,300 per ounce.

The fortunes of those investments have since grow to be completely totally different. Bitcoin has soared to about $84,000 per coin, up some 33,500% within the ten-year interval. The cryptocurrency briefly peaked at almost $109,000 throughout the timeframe.

If somebody tries to inform you gold is best than Bitcoin…

Simply present them this:

In 2015, 1 BTC = 1 ounce of gold.

Right this moment? That very same Bitcoin is up 13,693% in 10 years.

Let the numbers converse. pic.twitter.com/8JipH5IsNr

— Ted (@TedPillows) April 17, 2025

Gold, alternatively, has preserved its picture of reliability over volatility, somewhat than providing spectacular beneficial properties. The valuable metallic elevated by solely 156% over the identical interval. From the market onlookers, gold’s value proposition continues to be anchored on its constant, inflation-proof habits spanning very lengthy timescales.

Historic Context Demonstrates Divergent Patterns Of Progress

Going again even farther reveals a fair higher disparity within the development charges. In accordance with a market analyst on social media platform X, the worth of gold was solely $20.67 per ounce in 1933. As for 2025, the worth has gone up considerably to round $3,330 an oz, which is certainly a steep rise however a gradual enhance over a interval of just about a century.

Ted’s evaluation on X.

Bitcoin has had a very totally different historical past. From a value of $1 in 2011, it got here as much as $84,000 by 2025. With such speedy appreciation charges, each pleasure and skepticism have been introduced forth by monetary analysts debating the worthiness of such growths.

Sheer Disparity In Dimension

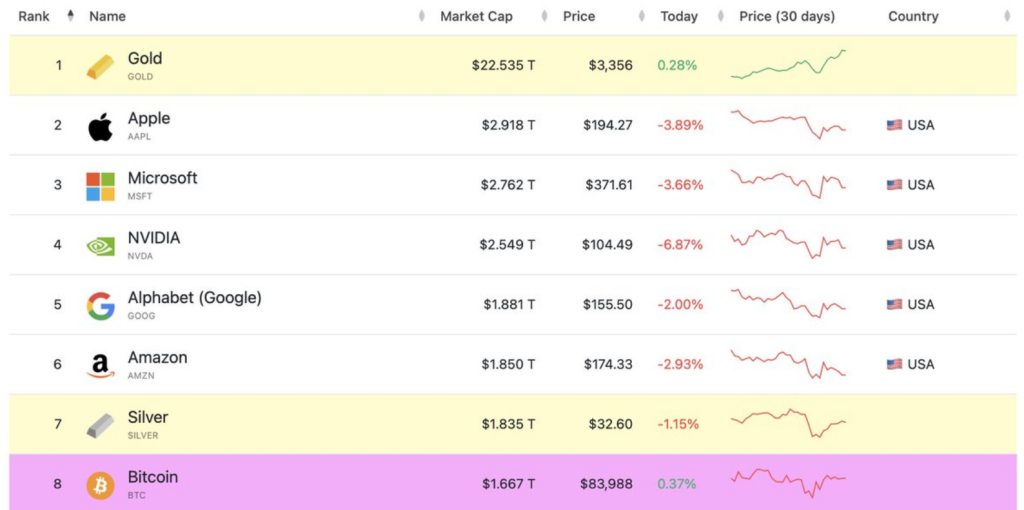

In accordance with analyst Belle, a stark distinction within the habits is because of the sheer distinction within the measurement of their market. Gold has roughly a market capitalization of a bit of over $22 trillion. On account of this nice measurement, gold supplies a component of stability, rendering the market much less delicate to particular person transactions or flows of short-term investments.

GOLD added $1 trillion to its market cap in someday.That’s almost all the worth of #Bitcoin proper now.

This reveals how huge conventional markets are & how early we nonetheless are with Bitcoin.Even a small shift into $BTC may ship it flying. pic.twitter.com/YsjSgOZKjx

— Belle (@Bitt_Belle) April 17, 2025

Bitcoin’s market capitalization is at roughly $1.667 trillion—giant however nonetheless solely a fraction of gold’s. This decreased measurement makes Bitcoin extra delicate to capital flows. Gold lately noticed a formidable $1 trillion rise in market capitalization over someday, however this was a a lot smaller share transfer than the identical greenback circulation would set off in Bitcoin’s worth.

Associated Studying

Identical Greenback Stream, Completely different Value Impression

In the meantime, the mathematics by way of market capitalization generates intriguing value motion situations. Primarily based on calculations reported, if Bitcoin have been to get a $1 trillion increase in market capitalization—corresponding to the latest one-day enhance in gold—its value per unit may rise from $84,000 to $135,000.

Featured picture from The Ledn Weblog, chart from TradingView