Bitcoin is below stress because it exams a key help stage close to $105K after retracing from its latest all-time excessive of $112K. The pullback comes amid heightened market uncertainty, triggered by the Federal court docket’s momentary reinstatement of former President Donald Trump’s tariffs on dozens of nations. This surprising authorized growth has added new volatility to world markets, fueling hypothesis and nervousness throughout risk-on belongings, together with cryptocurrencies.

Regardless of a robust uptrend in latest months, BTC now faces a crucial second. The bulls try to defend the $105K–$106K area, which has emerged as a short-term demand zone. A decisive breakdown beneath this stage may open the door to a deeper retracement, whereas a robust bounce could reaffirm the broader bullish construction.

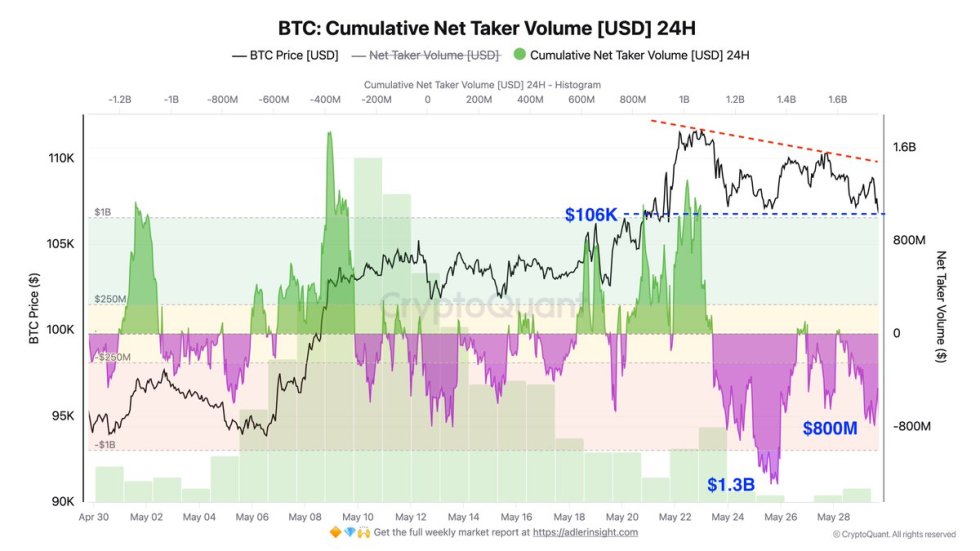

Including to the warning, on-chain information from CryptoQuant exhibits that the Bitcoin Cumulative Web Taker Quantity has turned adverse, indicating elevated aggressive promoting. This bearish power means that sellers are at the moment dominating market orders, doubtlessly undermining upward momentum if demand doesn’t choose up quickly.

Bitcoin Holds the Line As Bears Improve Strain

Bitcoin is testing a crucial help zone simply above $105K, a stage that would outline the subsequent section of this cycle. After reaching an all-time excessive of $112K, BTC has cooled off, and now the market is on edge as world financial tensions flare. The continued tariff standoff between the USA and China is reshaping macro circumstances, triggering volatility and defensive habits throughout markets.

Regardless of these headwinds, Bitcoin seems to be holding comparatively effectively. In contrast to equities and a few risk-on belongings, BTC and ETH proceed to indicate resilience within the face of macroeconomic uncertainty. Many buyers view Bitcoin as a hedge towards systemic stress, and the present value motion helps that thesis.

Nonetheless, stress is constructing. High analyst Axel Adler shared key insights revealing that bears have been placing on important stress over the previous 5 days, with robust sell-side quantity indicating elevated short-term uncertainty. This pattern means that whereas long-term holders stay assured, short-term merchants are actively promoting into power, doubtlessly capping any instant breakout makes an attempt.

If Bitcoin manages to carry present ranges and soak up the promoting stress, it may set off an impulsive transfer larger, confirming the broader uptrend. Nonetheless, a breakdown beneath help may invite deeper retracement and check market confidence. With quantity spiking and world headlines dictating sentiment, the approaching days may show pivotal for Bitcoin’s short-term course.

Value Motion Particulars: BTC Testing Demand

The 4-hour chart exhibits Bitcoin pulling again to check the $105K–$106K help zone after failing to reclaim the $109K resistance stage. Value motion has weakened for the reason that rejection close to the $112K all-time excessive, with consecutive decrease highs and decrease lows forming in latest classes. BTC is now buying and selling beneath the 34-period EMA and the 50 and 100 SMAs, indicating short-term bearish momentum is gaining traction.

The help at $105K is essential. It’s not solely the bottom of the final consolidation zone but in addition sits simply above the horizontal stage at $103,600, which marked the breakout construction earlier in Could. A breakdown beneath this vary may set off elevated promoting stress and open the door for a retest of the 200 SMA close to $102K.

Quantity stays elevated, and up to date candles present robust sell-side exercise, aligning with CryptoQuant information pointing to rising bearish power in internet taker quantity. Nonetheless, bulls nonetheless have an opportunity to defend this zone and reset the pattern. A profitable bounce from right here, adopted by a reclaim of $109K, would restore momentum and doubtlessly sign the subsequent leg larger. Till then, BTC stays range-bound and weak to additional draw back within the quick time period.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.