On-chain information reveals the Bitcoin holder teams are largely taking part in distribution, however one key cohort is displaying sturdy accumulation as a substitute.

Bitcoin Accumulation Pattern Rating Says 1,000 To 10,000 BTC Holders Are Shopping for

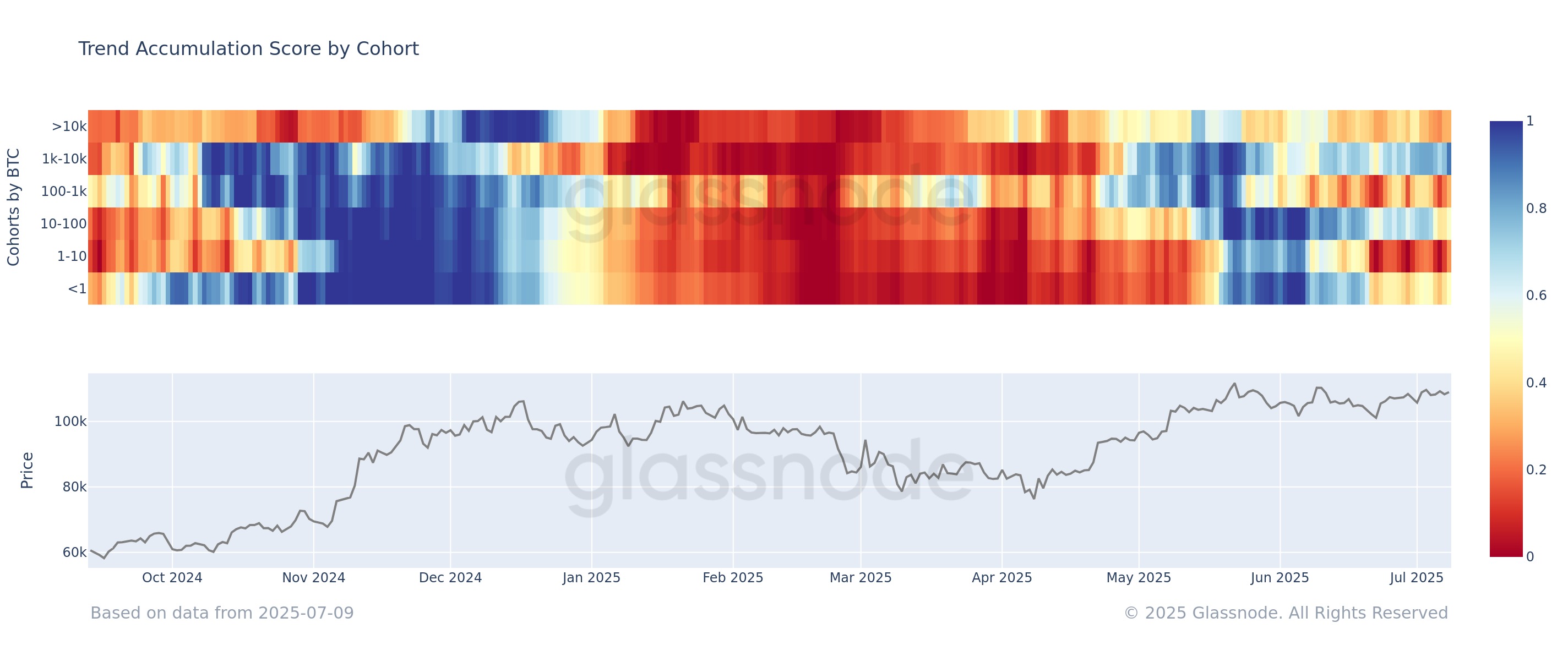

In a brand new publish on X, the on-chain analytics agency Glassnode has shared an replace on how the Accumulation Pattern Rating is in search of the assorted Bitcoin investor cohorts.

This indicator tells us about whether or not the Bitcoin holders are accumulating or distributing proper now. It takes under consideration for 2 components when figuring out this: the steadiness adjustments occurring within the wallets of the traders and the dimensions of the wallets concerned.

The metric represents the market conduct as a rating mendacity between 0 and 1. Naturally, because the pockets measurement can be thought of, bigger entities have a much bigger affect on this rating.

When the indicator is beneath 0.5, it means the big traders (or a lot of small entities) are participating in distribution. The nearer is the worth to 0, the stronger is that this conduct.

Alternatively, the metric being above the mark suggests the market is in a section of accumulation. For this aspect of 0.5, the intense level lies at 1, equivalent to the strongest potential shopping for conduct.

Now, right here is the chart shared by Glassnode that exhibits the pattern within the Accumulation Pattern Rating individually for the completely different segments of the Bitcoin userbase:

Seems just like the rating is not uniform throughout the market in the mean time | Supply: Glassnode on X

As is seen within the above graph, the Bitcoin Accumulation Pattern Rating leans in direction of being pink for a lot of the traders, indicating that distribution is being adopted.

The cohort that’s displaying the strongest promoting conduct is the 1 to 10 cash one. This group consists of the retail arms, who’re among the many smallest of entities on the community.

Whereas the market as a complete has been distributing, one cohort has stood out: the 1,000 to 10,000 BTC holders. On the present trade fee, the bounds of the vary convert to $109.5 million on the decrease one and $1.095 billion on the higher one. Thus, this group represents the big-money merchants, popularly often known as the whales.

From the chart, it’s obvious that the Accumulation Pattern Rating of the cohort may be very near 1, suggesting that these humongous entities are displaying near-perfect accumulation conduct.

The pattern is in sharp distinction to what the retail traders are displaying. “This divergence highlights a transparent cut up in conviction between small and enormous holders,” notes the analytics agency.

It now stays to be seen whether or not the bullish conviction being proven by the whales would repay, or if the traders exiting now would turn into the good ones.

BTC Value

On the time of writing, Bitcoin is floating round $109,500, unchanged from one week in the past.

The pattern within the worth of the coin during the last 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.