On-chain information reveals the Bitcoin Mining Hashrate has witnessed a pointy rise in the direction of a brand new all-time excessive amid all of the chaos out there.

Bitcoin Mining Hashrate Has Shot Up Lately

The “Mining Hashrate” refers to a metric that retains monitor of the full quantity of computing energy that the Bitcoin miners as a complete have related to the community. The indicator is measured in models of hashes per second (H/s) or the bigger and extra sensible terahashes per second (TH/s).

When the worth of this metric rises, it means new miners are becoming a member of the community and/or current ones are increasing their services. Such a development implies these chain validators are discovering the blockchain a sexy alternative.

Alternatively, the indicator taking place suggests among the miners have determined to disconnect their machines from the chain, probably as a result of they’re now not making a revenue on BTC mining.

Now, here’s a chart from Blockchain.com that reveals the development within the 7-day common Bitcoin Mining Hashrate over the previous yr:

The 7-day common worth of the metric seems to have spiked in current days | Supply: Blockchain.com

As displayed within the above graph, the 7-day common Bitcoin Mining Hashrate rose to an all-time excessive (ATH) of round 817,700 TH/s throughout the beginning days of the yr, however the metric couldn’t maintain at these ranges as its worth quickly registered a plunge.

The indicator confirmed consolidation about its lows for the remainder of January, however it might seem February has lastly introduced contemporary winds as its worth has seen a steep uptrend and has smashed previous its earlier peak to set a brand new file of about 832,600 TH/s.

This renewed growth from the miners has curiously come whereas the cryptocurrency has been going by an unsure interval with its worth displaying excessive volatility in each instructions.

The Mining Hashrate serves as a glance into the sentiment among the many miners, so this newest improve would suggest these chain validators imagine the asset would in the end come out of this unstable interval within the bullish course.

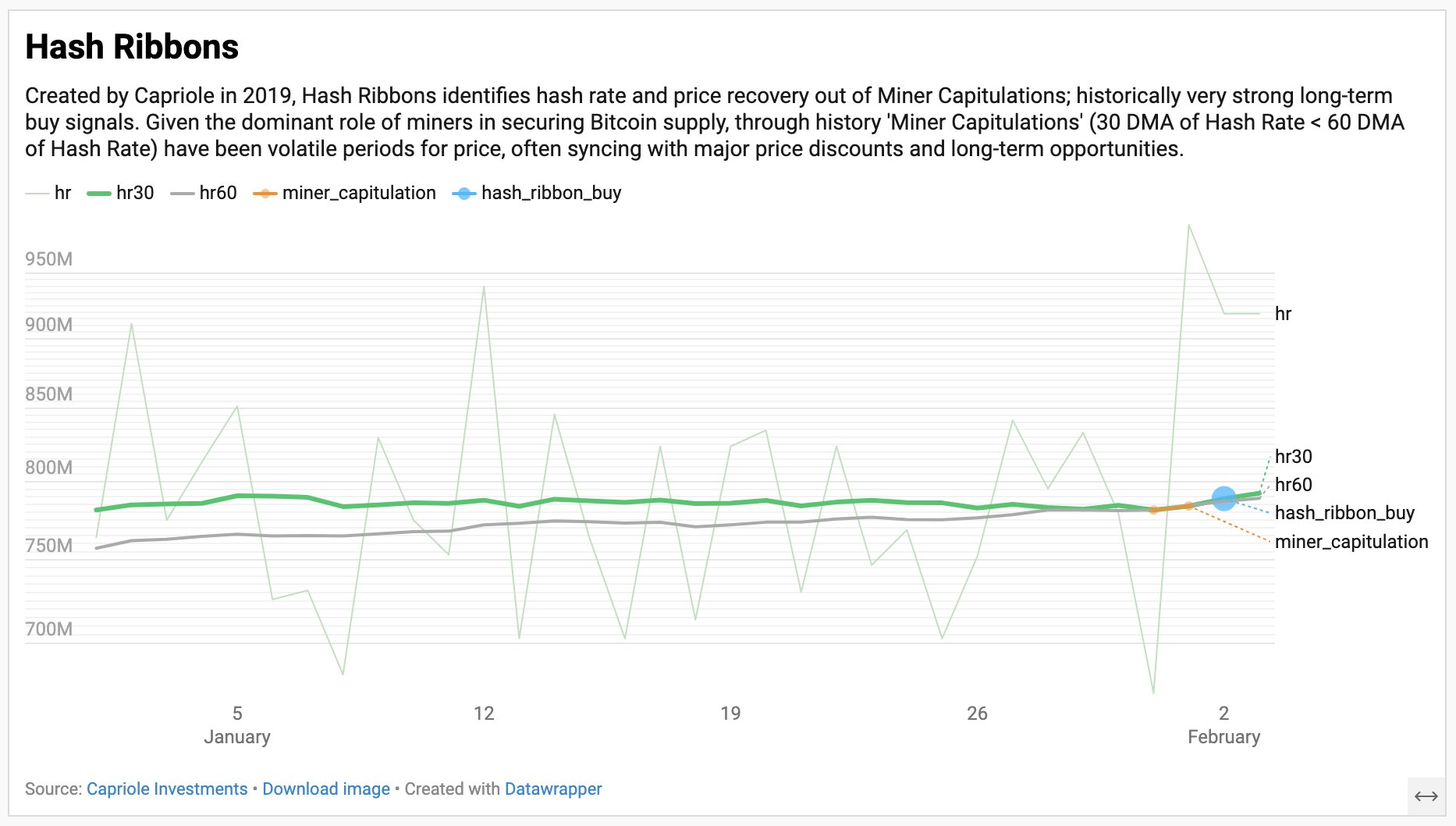

An indicator that makes it straightforward to make use of the Hashrate for monitoring the scenario of the miners is the Hash Ribbons. This metric is made up of two transferring common (MAs) of the Hashrate: 30-day and 60-day.

As Capriole Investments founder Charles Edwards has defined in an X put up, the Hash Ribbons flashed a really transient capitulation sign at first of the month.

The development within the BTC Hash Ribbons over the previous month | Supply: @caprioleio on X

Miner ‘capitulation’ happens when the 30-day MA falls below the 60-day one. This crossover couldn’t final for lengthy this time because the Hashrate noticed a pointy improve, resulting in a reverse crossover going down. Traditionally, this has served as a shopping for sign for Bitcoin.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $100,000, down 3% within the final week.

Appears like the value of the coin has been going by a rollercoaster not too long ago | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Blockchain.com, Capriole.com, chart from TradingView.com