Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value has dropped 7% over the past 24 hours to $83,237, as JPMorgan analysts clarify that the newest weak spot within the cryptocurrency is pushed extra by short-term market sentiment and liquidity circumstances than by the latest decline within the US greenback.

Regardless of the buck dropping floor, Bitcoin has didn’t stage its normal inverse rally, highlighting its present habits as a risk-sensitive asset quite than a conventional hedge in opposition to forex weak spot.

JPMorgan analysts observe that the U.S. greenback’s latest slide has been pushed primarily by short-term capital flows, tariffs, and shifts in investor sentiment, quite than any significant change in progress prospects or the Federal Reserve’s coverage outlook.

Though the greenback index (DXY) has fallen roughly 10% over the previous yr, strategists level out that rate of interest differentials have truly moved in favor of the US for the reason that starting of the yr. This reveals the greenback’s weak spot could also be short-term, much like the transient decline seen final April, with stabilization anticipated because the U.S. economic system reveals resilience.

Weaker greenback fails to spur Bitcoin positive aspects, however there is a motive for that, JPMorgan says

Greenback declining however Bitcoin flat: JPMorgan identifies structural shift in crypto correlations. Historic “digital gold” narrative challenged when conventional safe-haven habits disappears.…

— Dr Efi Pylarinou (@efipm) January 29, 2026

Bitcoin Stays Tied to Threat Sentiment

JPMorgan additional argues that Bitcoin’s underperformance highlights how buyers at present understand the asset. As an alternative of functioning as a retailer of worth like gold, Bitcoin continues to commerce in step with broader danger sentiment and world liquidity traits.

This was evident after the Federal Reserve saved rates of interest unchanged and Chair Jerome Powell maintained a hawkish stance, which weighed on danger belongings, together with cryptocurrencies. In distinction, gold and different exhausting belongings have rallied strongly amid the identical greenback weak spot, benefiting from their established function as macro hedges.

JPMORGAN: #BITCOIN FAILS TO RALLY DESPITE 10% DROP IN DOLLAR INDEX

JPMorgan Personal Financial institution notes that whereas the U.S. Greenback Index has fallen 10% over the previous yr, #Bitcoin is down 13%, breaking its #normal inverse correlation with greenback weak spot. Analysts say the greenback’s… pic.twitter.com/yfmQU6uiEv

— CryptOpus (@ImCryptOpus) January 29, 2026

Trying forward, JPMorgan expects Bitcoin to lag conventional inflation and forex hedges till macro fundamentals, equivalent to shifts in progress expectations or rate of interest dynamics, take over. For now, subdued buying and selling volumes and the upcoming crypto choices expiry proceed to restrict upside momentum for BTC.

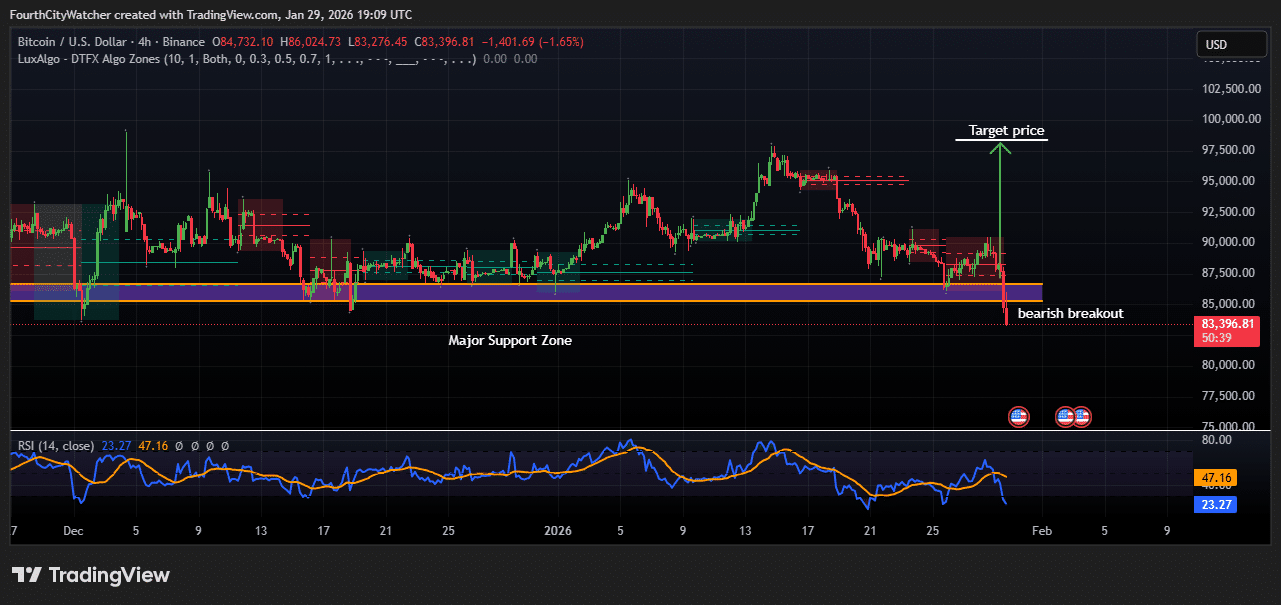

Bitcoin Breaks Key Assist at $85K as RSI Indicators Oversold Ranges

The Bitcoin value has damaged beneath a key help zone round $85,000, signaling a bearish breakout on the 4-hour chart. The transfer comes after a interval of sideways consolidation inside this main help space, indicating that the earlier stage of purchaser curiosity failed to carry. The breakout is accompanied by a pointy value drop to $83,397, highlighting elevated promoting stress within the brief time period.

The Relative Power Index (RSI) has fallen to 23.27, coming into deeply oversold territory. This implies that whereas sellers are dominant, the market could also be due for a brief reduction bounce or consolidation, although the prevailing pattern stays bearish till help ranges are regained. Traditionally, comparable breaks beneath main help zones have usually led to accelerated draw back strikes, that means merchants ought to be cautious of additional declines.

BTCUSD Chart Evaluation. Supply: Tradingview

Bitcoin Faces Brief-Time period Draw back

Resistance from prior value congestion seems close to $87,500–$88,000, which might act as a short-term ceiling if a corrective rebound happens. The chart additionally signifies a longer-term goal value above $95,000, however reaching this stage would require a major reversal in momentum and reclaiming beforehand misplaced help.

For now, the mixture of a bearish breakout, oversold RSI, and failure to keep up the help zone positions Bitcoin as weak to additional short-term draw back, whereas highlighting that any bounce could possibly be met with robust promoting stress.

Total, the technical image favors sellers, with the key help zone now appearing as a possible reference level for monitoring market response. Merchants ought to look ahead to RSI restoration indicators and value motion across the damaged help to establish potential reversal alternatives or continuation of the downtrend.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection