Roughly 17,000 Bitcoin reportedly moved onto crypto exchanges this week, a sample merchants watch carefully for promote stress. Bitcoin slipped because the influx appeared, struggling to carry latest highs as short-term sellers wakened. This transfer lands in a market formed by huge Bitcoin ETF demand and a rising tug-of-war between long-term holders and quick cash.

DISCOVER: Prime Ethereum Meme Cash to Purchase in 2026

Why Do Bitcoin Trade Inflows Matter?

When Bitcoin strikes onto exchanges, it typically alerts intent to promote. Consider it like taking money out of a financial savings account and inserting it on the counter. You may spend it. You may not. However the likelihood jumps.

(Supply: Final week Bitcoin exchanges netflow / Cryptoquant)

On-chain trackers noticed about 17,000 BTC hitting exchanges in a brief window. For newcomers, this issues as a result of heavy inflows typically precede pullbacks, particularly when costs already sit close to latest highs.

This habits stands out as a result of long-term holders not too long ago slowed promoting and even resumed accumulation, based on Glassnode. That cut up tells us short-term merchants are energetic, whereas affected person traders nonetheless present confidence.

DISCOVER: Prime 20 Crypto to Purchase in 2026

ETF Demand Is Altering Bitcoin’s Market Construction

Bitcoin ETFs now play an enormous function in value motion. In 2025 alone, spot Bitcoin ETFs absorbed over 617,800 BTC, pulling provide off the open market and tightening liquidity.

(Supply: Lastest Bitcoin ETFs stream information / CMC)

That demand explains why sell-offs look sharper however shorter. When Bitcoin dips, ETF consumers typically step in. In line with Cointelegraph, ETF flows now act like a sentiment engine, amplifying each concern and confidence.

So whereas alternate inflows elevate eyebrows, they not assure a protracted crash. The market has a brand new purchaser class with deep pockets and longer time horizons.

What Does This Imply for Common Bitcoin Holders?

If you’re new to Bitcoin, this information just isn’t a promote sign by itself. It’s a volatility warning. When most holders sit in revenue, promoting stress rises as a result of individuals really feel snug locking in good points.

Throughout previous rallies, on-chain profitability climbed above 95%, a zone the place pullbacks turn into widespread. That doesn’t kill the bull development. It resets it.

For newcomers, the sensible transfer is straightforward. Keep away from chasing inexperienced candles. Unfold buys over time. By no means use cash you want for lease, meals, or emergencies.

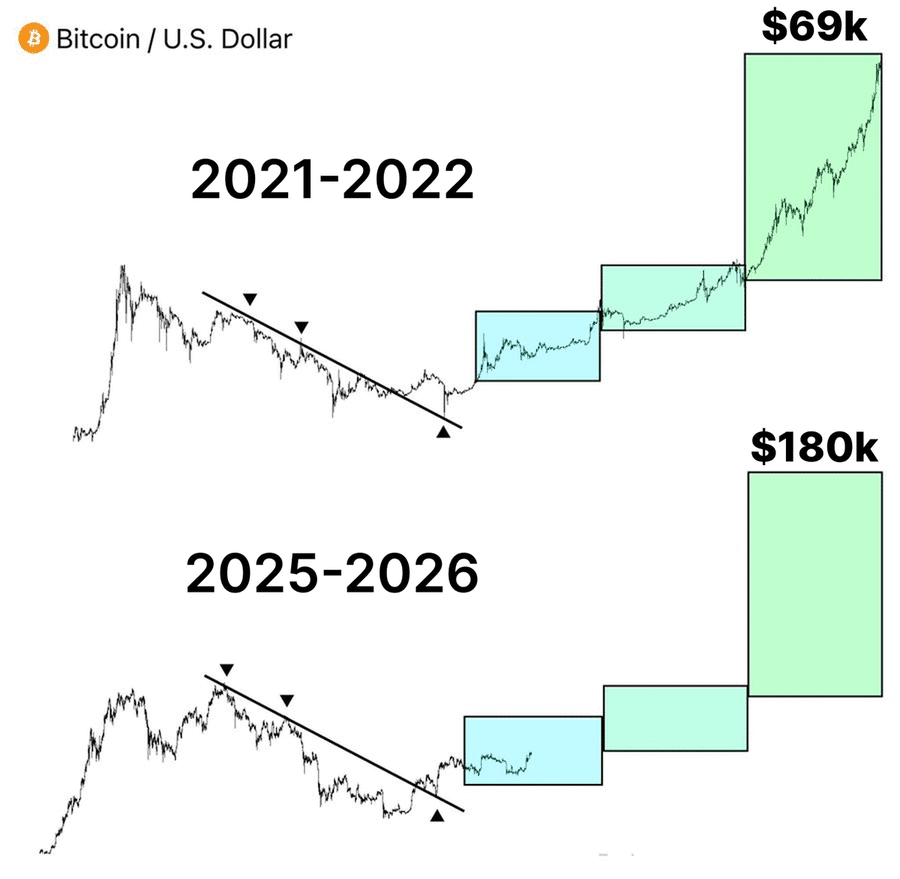

(Supply: Potential state of affairs for bitcoin / TradingView)

DISCOVER: Prime Solana Meme Cash to Purchase in 2026

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Day by day Professional Market Evaluation

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s staff members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Professional contributors

2000+

Crypto Initiatives Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the most recent updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now