Bitcoin (BTC) is down 3.6% over the previous week, falling from round $119,800 to the $114,500 vary on the time of writing. This weakening value motion can be mirrored in spot Bitcoin exchange-traded funds (ETFs), most notably in BlackRock’s IBIT Bitcoin ETF, which noticed over $2.6 billion in outflows on August 1.

IBIT Bitcoin ETF Sees Large Outflows

In response to a current CryptoQuant Quicktake by contributor Amr Taha, BlackRock’s IBIT ETF recorded greater than $2.6 billion in outflows on August 1 – the best determine previously two months throughout all listed Bitcoin ETFs.

Taha highlighted that the sharp reversal in institutional demand for Bitcoin ETFs comes after a number of weeks of constructive inflows, and signifies a rising sense of warning amongst ETF buyers. Information from SoSoValue confirms the pattern.

Associated Studying

For the week ending August 1, US-based spot Bitcoin ETFs recorded a web outflow of $643 million. This marked the top of a seven-week streak of constructive inflows, which had totaled greater than $10 billion.

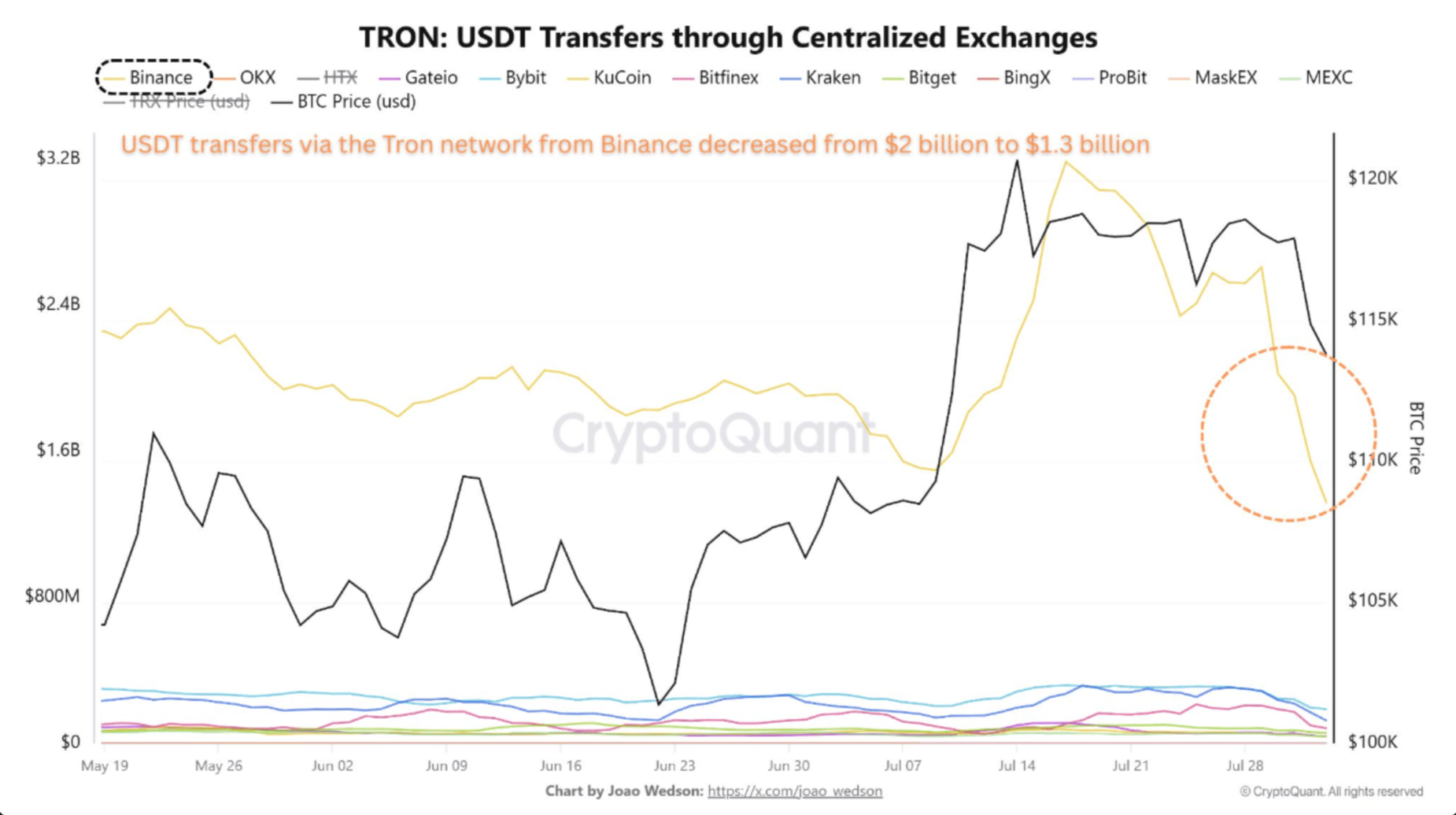

One other necessary level is that the $2.6 billion outflow from BlackRock’s IBIT ETF was not mirrored by different ETFs. Analyst Taha additionally recognized a correlation between IBIT outflows and Binance-origin USDT transfers on the Tron community.

In his evaluation, the CryptoQuant contributor famous that alongside the IBIT outflows, USDT transfers on Tron from Binance fell from roughly $2 billion to $1.3 billion – a pointy 35% decline. Taha added:

The timing strongly suggests a hyperlink between the ETF-driven promoting stress and the accelerated tempo of stablecoin withdrawal by way of Tron, a blockchain famend for quick and cost-efficient transactions.

Tron community’s low charges and pace make it a most well-liked blockchain for each retail and institutional stablecoin transfers. Subsequently, a drop in USDT transfers from Binance – occurring in tandem with IBIT outflows – means that institutional curiosity in BTC could also be quickly cooling off.

Latest on-chain information reveals Binance continues to steer different exchanges similar to OKX, HTX, and KuCoin by way of Tron-based USDT transfers. Because of this, Binance quantity tendencies usually function a dependable indicator of investor sentiment shifts.

Recent Information Presents Combined Forecasts

Past weakening ETF demand, new trade information indicators potential headwinds for Bitcoin within the close to time period. For instance, Binance’s web taker quantity dropped to -$160 million final week, indicating elevated sell-side exercise.

Associated Studying

From a technical standpoint, issues seem lower than optimistic. Crypto analyst Josh Olszewicz just lately predicted that BTC may stay range-bound till October 2025.

Nonetheless, not all indicators are bearish. A current report from CoinShares estimates that Bitcoin may rise to $189,000 if it captures simply 2% of world M2 cash provide or 5% of gold’s market cap. At press time, BTC trades at $114,494, up 0.3% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com