US Bitcoin spot exchange-traded funds (ETFs) have seen extra inflows this yr to date in comparison with the identical level in 2024, based on knowledge.

Bitcoin Spot ETF Internet Inflows Have Crossed $14.8 Billion In 2025 So Far

In a brand new publish on X, the Head of Analysis at CryptoQuant, Julio Moreno, has mentioned about how the US spot ETF inflows examine between 2024 and 2025 for Bitcoin.

Spot ETFs check with funding automobiles that present for another route of publicity to BTC’s value actions. These ETFs commerce on conventional platforms and the investor doesn’t need to cope with custody themselves, because the ETF supplier holds the coin on their behalf.

Which means merchants who don’t need to hassle with digital asset wallets and exchanges can use these automobiles to take a position into Bitcoin in a mode that’s acquainted to them.

Within the US, the Securities and Trade Fee (SEC) accepted BTC spot ETFs on January tenth, 2024. The ETFs had been fast to realize recognition and in the present day symbolize an essential cornerstone of the market.

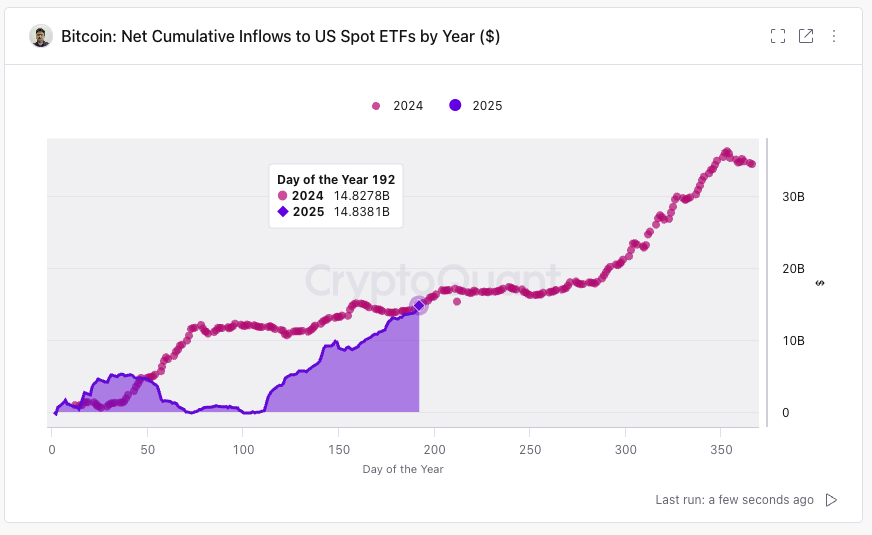

Whereas 2024 was extra of an up-only yr for them, 2025 has to date been totally different. Beneath is the chart shared by Moreno that reveals how the cumulative web influx pattern for the Bitcoin spot ETFs has in contrast this yr versus the final.

Appears just like the 2025 pattern is now simply outpacing the 2024 one | Supply: @jjcmoreno on X

As is seen within the graph, the US Bitcoin spot ETF inflows had been initially forward of tempo in 2025 relative to 2024, however because the market downturn took maintain, inflows dried up and 2025 fell considerably behind.

A couple of months into the yr, although, demand for spot ETFs began to return and the hole started to shrink. Now, following the most recent wave of inflows that has accompanied the rally to the brand new value all-time highs (ATHs), 2025 inflows have flipped 2024.

From the chart, it’s obvious that 2025 cumulative web inflows stand at $14.8381 billion proper now. On the identical part of the yr in 2024, they amounted to $14.8278 billion.

The spot ETF demand had been sideways at this level of the time final yr, so it’s attainable that if inflows proceed on the present tempo, 2025 will acquire far.

That stated, it solely stays to be seen how lengthy demand can sustain, as in 2024, inflows noticed an acceleration towards the top of the yr as curiosity flooded into the market alongside the surge past $100,000.

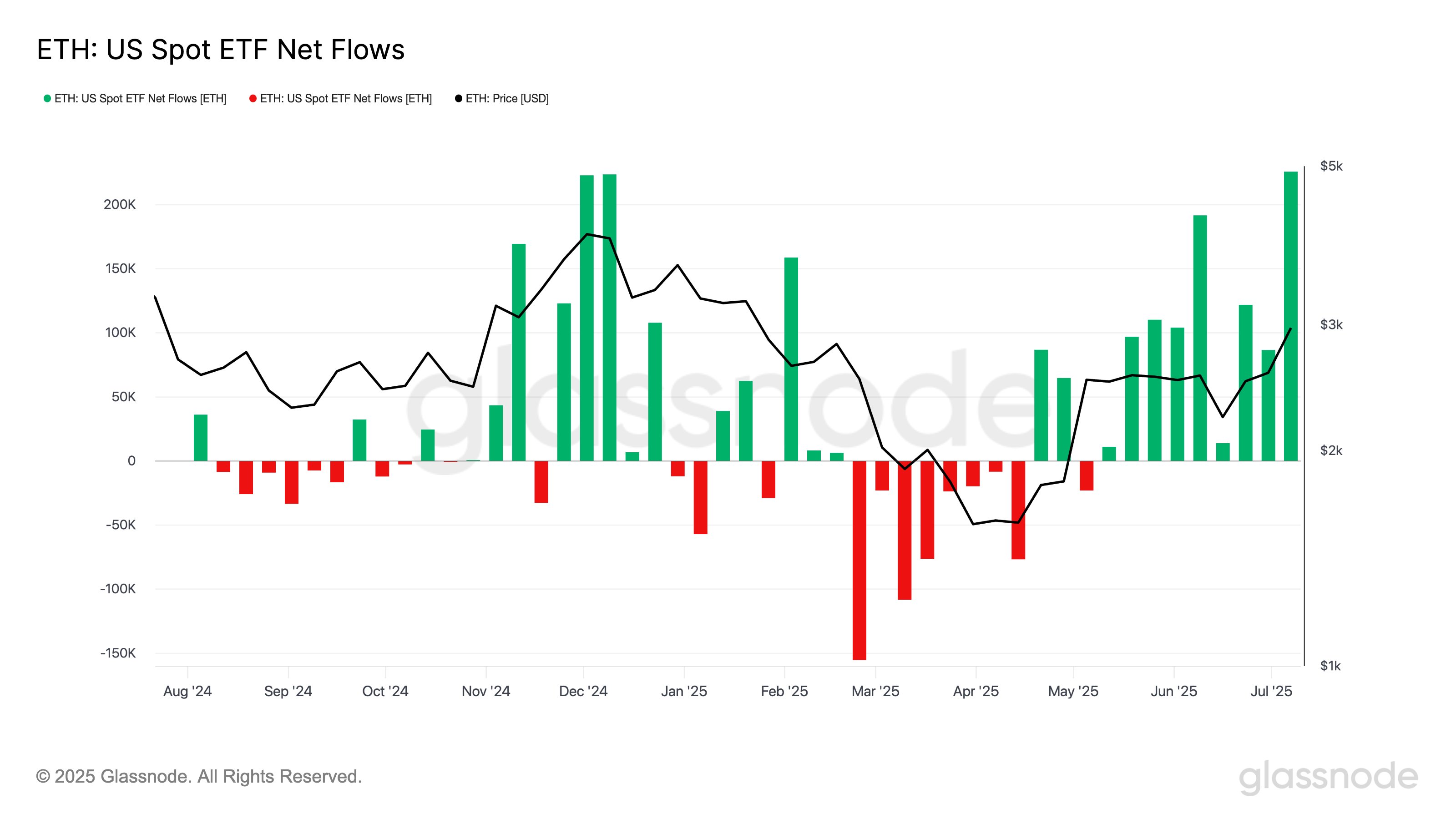

In another information, US Ethereum spot ETFs have been seeing a increase of their very own lately, because the netflow has remained inexperienced for a lot of weeks now.

The pattern within the US ETH spot ETF netflow over the previous yr | Supply: Glassnode on X

Final week was the biggest for the Ethereum spot ETFs for the reason that SEC approval in mid-2024, with inflows totaling at 225,857 ETH.

BTC Value

Bitcoin set a brand new ATH past $123,000 yesterday, however the asset has since registered a drop as its value has returned to $117,300.

The worth of the coin seems to have plunged over the past 24 hours | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.