Analyst Weekly, July 7, 2025

Tax Reconciliation Invoice Handed: Core Implications

The tax reconciliation invoice (nicknamed the One Large Stunning Invoice, or OBBB) was handed and signed by President Trump on July 4, with the Senate needing a tie-breaking vote by VP Vance.

The invoice contains:

100% instant expensing for capital investments

Greater internet curiosity deductibility

Elevated tax credit score (from 25% to 35%) for semiconductor manufacturing investments starting 2026

An enlargement of the Orphan Cures Act, shielding multi-condition orphan medicine from Medicare worth negotiations

A $5 trillion enhance within the debt ceiling, permitting new Treasury issuance weighted towards short-term T-bills

Funding Takeaway:

Optimistic for capex-heavy sectors: industrials, protection, chemical substances, and telecoms profit from full expensing.

Semiconductors (gear makers and fab-heavy companies) stand to achieve from the improved manufacturing tax credit score.

Pharma/biotech companies with orphan drug pipelines profit from the expanded pricing exemption.

Treasury market affect: Emphasis on short-duration issuance (20% → 30% T-bill share) favors decrease curiosity value however will increase rollover danger – supportive of the brief finish of the curve over lengthy bonds

Corporations that profit from a number of provisions of the tax invoice embrace:

Industrials & Supplies: UPS (UPS), Worldwide Paper (IP), Northrop Grumman (NOC), Basic Dynamics (GD), Lockheed Martin (LMT)

Pharma/Biotech: Pfizer (PFE), Vertex (VRTX), Novartis (NOVN-CH), Amgen (AMGN), Illumina

Chemical compounds: Celanese (CE), Dow (DOW), LyondellBasell (LYB)

Telecom/Media: AT&T (T), Verizon (VZ)

Client & Staples: Altria (MO), Yum! Manufacturers (YUM), Tyson Meals (TSN)

Rising Tariffs, Shifting Provide Chains: Vietnam as a Take a look at Case and North America as a Commerce Winner

Opposite to widespread perception amongst some buyers, latest US commerce offers will not be resulting in decrease tariffs. As a substitute, the Trump administration is locking in a common 10% tariff ground, with country-specific charges which are usually considerably greater. Particularly, Asian nations are being focused resulting from their proximity to China and the administration’s deal with curbing transshipment, the follow of routing Chinese language items via third nations to keep away from direct tariffs. This method is aimed toward imposing stricter guidelines of origin and shutting longstanding commerce loopholes.

The brand new US-Vietnam commerce deal illustrates this coverage in motion. Vietnam will face a 20% tariff on most of its items and a 40% price on items imported from China after which shipped to the US This deal additionally exempts US items from Vietnamese tariffs, underscoring its uneven nature.

In distinction, Mexico and Canada are rising as beneficiaries of the administration’s commerce coverage. Each already adjust to stringent guidelines of origin below USMCA and face no common tariff, making a widening value benefit over Vietnam. This may increasingly speed up onshoring and provide chain migration nearer to the US.

Whereas Vietnam has but to substantiate the tariff particulars, the coverage framework now has clear boundaries, providing some certainty to Vietnam-exposed equities, which have underperformed since late 2024. India could strike a deal subsequent, with diplomatic strain mounting on Japan, the place negotiations stay stalled. The early completion of the Vietnam deal is seen as a strategic transfer to affect talks with different key buying and selling companions within the Asia-Pacific area.

In abstract, a brand new take care of Vietnam:

Raises tariffs to twenty% on most Vietnamese imports

Hikes to 40% on items made in China and rerouted by way of Vietnam

US items enter Vietnam tariff-free

Funding Takeaway:

Tariffs are going up, not down, even below commerce offers. That is detrimental for multinationals sourcing by way of Asia.

July 9 is the deadline for Trump’s new reciprocal tariff bulletins, concentrating on tariffs above 10% beginning August 1.

Vietnam now serves as a check case for “guidelines of origin” enforcement to forestall tariff evasion by way of transshipment.

Capital rotation towards North American suppliers: We see Mexico and Canada positioned as relative winners. These nations already adjust to stricter origin guidelines below USMCA and keep away from the brand new tariffs.

Industrials and logistics companies with publicity to US-Mexico/Canada commerce could profit from commerce re-routing and provide chain onshoring.

Bitcoin on the Verge of a Breakout? This Week Might Be Essential

This week might change into probably the most vital for the complete crypto market within the second half of the 12 months. Bitcoin has just lately approached its all-time excessive, which was set in Could at $110,872.

Above this stage, there are not any clear technical reference factors on the chart. Nevertheless, instruments like Fibonacci extensions can nonetheless present steerage. The subsequent potential worth goal is close to $130,000, based mostly on the 161.8% retracement of the latest correction.

As is well-known, worth motion within the crypto market can transfer shortly. However solely a transparent breakout above the file excessive would considerably enhance the probabilities of reaching this subsequent goal.

Because of the sharp rally since April, a number of help zones—so-called Honest Worth Gaps—have fashioned under present ranges. The primary of those zones lies between $98,000 and $100,000. This space was efficiently defended three weeks in the past and should act as a help once more.

If this zone fails to carry, nonetheless, a pullback towards the $86,000 to $92,000 vary might observe.

Bitcoin, weekly chart

Capital Allocation Dilemma: Structural Strengths of Europe and the US

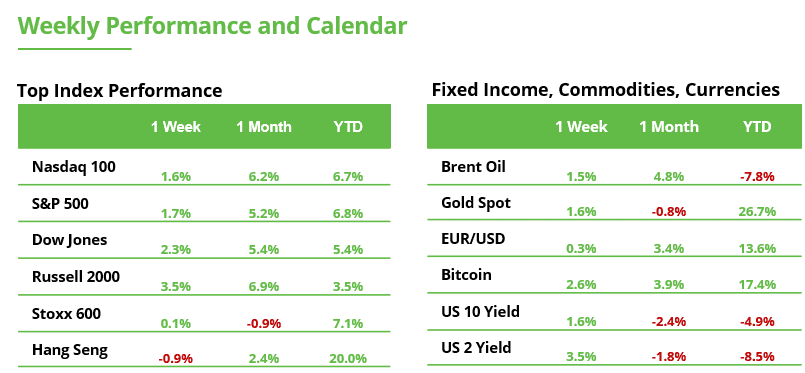

The place ought to I make investments my cash – in Europe or the US? Few funding matters have sparked as a lot debate in 2025. Many buyers stay unsure. To this point this 12 months, European fairness markets have outperformed their US counterparts. The STOXX Europe 600 is up 7.6%, in comparison with a 5.9% achieve within the S&P 500. The lead is slender, however that’s solely half the story.

Forex results add one other layer of complexity. Because the starting of the 12 months, the US greenback has misplaced round 14% in opposition to the euro. For US buyers with European holdings, that’s created a big enhance in returns. Conversely, the weaker greenback has eroded income for European buyers in US property. From a world perspective, the weaker greenback would possibly truly seem enticing, appearing like a built-in low cost for shares.

Structurally, Europe is extra defensively positioned, much less growth-oriented, however gives greater dividend yields on common. In distinction, the US is pushed by innovation, simpler entry to enterprise capital and lighter regulation. In an setting that favors development, the US could have the sting, particularly with megatrends like synthetic intelligence and robotics.

Lengthy-term buyers seeking to diversify broadly can hardly keep away from allocating to each areas. It’s much less about “either-or” and extra about getting the weighting proper. On a stock-by-stock stage, there are additionally development alternatives in Europe and enticing dividend performs within the US.

Don’t make investments except you’re ready to lose all the cash you make investments. It is a high-risk funding, and you shouldn’t anticipate to be protected if one thing goes flawed. Take 2 minutes to be taught extra.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.