Fast Details:

➡️ Arthur Hayes hyperlinks Bitcoin’s drawdown to a greenback liquidity crunch and nonetheless sees a path towards a $200K–$250K year-end spike.

➡️ ETF outflows, leveraged liquidations, and ‘excessive worry’ sentiment distinction with report inventory indices, hinting at brewing stress in conventional markets.

➡️ Bitcoin Hyper goals to show future Bitcoin rallies into real-world utility by way of a high-throughput Layer 2 that permits quick $BTC DeFi and funds.

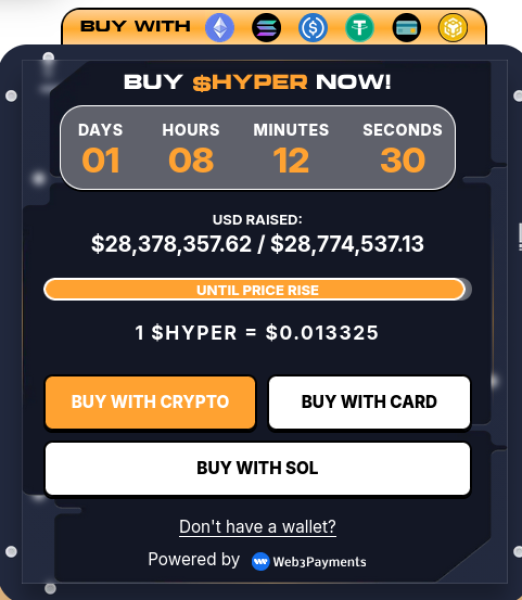

➡️ Its token presale has already raised over $28.3M up to now, signaling that buyers are bullish on Bitcoin-adjacent initiatives that assist unlock $BTC’s utility.

Bitcoin simply scared the life out of half the market, then Arthur Hayes walked in and principally mentioned: loosen up, this isn’t over, it’s gearing up.

In his newest Bitcoin worth prediction, the BitMEX co-founder pins the current drawdown on a brutal greenback liquidity crunch quite than any collapse in fundamentals.

Bitcoin has slipped from the highs into the low $80Ks whereas the S&P 500 and Nasdaq 100 hover close to all-time highs, a combo Hayes sees as a warning signal for conventional markets, not for Bitcoin’s long-term trajectory.

His base case isn’t precisely bearish. Hayes thinks $BTC may first wash out towards the $80K–$85K zone as ETF outflows, leveraged liquidations, and risk-off sentiment play out.

But when shares appropriate 10–20% whereas US yields stick close to 5%, he expects the Fed and Treasury to reopen the liquidity faucets.

In that state of affairs, he argues that Bitcoin may speed up towards $200K–$250K by 12 months’s finish as the first ‘weathervane’ for international fiat liquidity.

That backdrop explains the unusual cut up in conduct proper now. Retail sentiment has flipped to ‘excessive worry’, with many merchants capitulating after weeks of purple candles.

On the similar time, whales and establishments aren’t precisely rage-quitting crypto; stablecoin inflows present loads of capital merely rotating and ready for a greater entry.

That is the place Bitcoin-centric infrastructure comes into play. If Hayes is even partially proper and a contemporary liquidity wave drives Bitcoin to new highs, block house fills up, charges spike, and something that makes $BTC sooner and cheaper out of the blue issues.

Bitcoin Hyper ($HYPER), a Bitcoin Layer 2 mission is positioning itself as one of many principal methods to precise that thesis.

Bitcoin Hyper Turns Hayes’ Macro Guess Into On-Chain Utility

Bitcoin Hyper is constructed round a fairly easy thought: Bitcoin ought to keep the settlement spine, however on a regular basis exercise wants a sooner, cheaper rail.

The mission introduces a devoted Layer 2 that anchors to Bitcoin’s safety whereas executing transactions by way of a Solana Digital Machine-based atmosphere able to dealing with hundreds of transactions per second.

As soon as the L2 launches, you’ll have the ability to bridge $BTC into wrapped kind by way of a canonical bridge, apply it to L2 for funds, DeFi, and dApps, then periodically settle again to Layer 1.

Beneath the hood, Bitcoin Hyper batches transactions, makes use of zero-knowledge proofs for validity, and usually commits state to Bitcoin.

That offers it an fascinating profile: nearer to a ZK-rollup-style system than a easy sidechain, whereas nonetheless integrating with acquainted Solana-style tooling for builders.

When you’re an on a regular basis consumer, the promise is easy: near-instant $BTC transfers, low charges, and entry to good contracts, NFTs, meme cash, and different dApps with out ever abandoning the Bitcoin universe.

The timing issues, as Hayes’ framework is all about liquidity cycles. When greenback liquidity contracts, speculative property bleed; when liquidity returns, property with the strongest narrative and highest utility are likely to outperform.

If Bitcoin does rip into the $200K–$250K band on the again of renewed cash printing and risk-on flows, a Layer 2 that turns ‘digital gold’ into usable collateral, yield, and DeFi rails stands to seize a few of that upside.

Bitcoin Hyper leans instantly into that narrative: Bitcoin-grade safety, Solana-level velocity, and a design explicitly geared toward high-throughput BTC DeFi and funds.

The mission has already undergone exterior smart-contract auditing and positions itself as core infrastructure quite than a pure meme play. It’s clear why some buyers desire to play the subsequent Bitcoin cycle by way of L2 publicity as a substitute of solely stacking spot $BTC.

Bitcoin Hyper Presale Goes Viral and Hits $28.3M

On the capital-raising facet, Bitcoin Hyper is already appearing like a stay stress take a look at of threat urge for food in a fearful market. The general public presale, launched in mid-Could, has already raised over $28.3M, with the present stage worth at $0.013325 per token.

Staking is stay throughout the presale, with yields round 41% on the time of writing and designed to taper as extra tokens are locked.

Based mostly on our Bitcoin Hyper worth prediction, it will possibly hit a excessive of $0.20 by the top of 2026, however it would rely on how shortly the mainnet, canonical bridge, and main alternate listings land.

The presale move provides one other sign. On-chain information and reporting present {that a} whale purchased over $500K price of $HYPER, which marks a transparent distinction in opposition to Bitcoin, which trades round $85K.

When you’re a dealer who believes Hayes’ $200K prediction however dislike risky futures or short-lived altcoin narratives, $HYPER is a good selection. It’s a $BTC-centric L2 with fastened presale pricing and a transparent post-launch roadmap is a cleaner solution to specific that view.

Be part of the Bitcoin Hyper presale right this moment.

Disclaimer: This text is informational solely, not monetary recommendation; crypto and presale investments are extremely dangerous, and capital loss is feasible.

Authored by Bogdan Patru, Bitcoinist — https://bitcoinist.com/arthur-hayes-200k-bitcoin-price-prediction-favors-bitcoin-hyper

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.