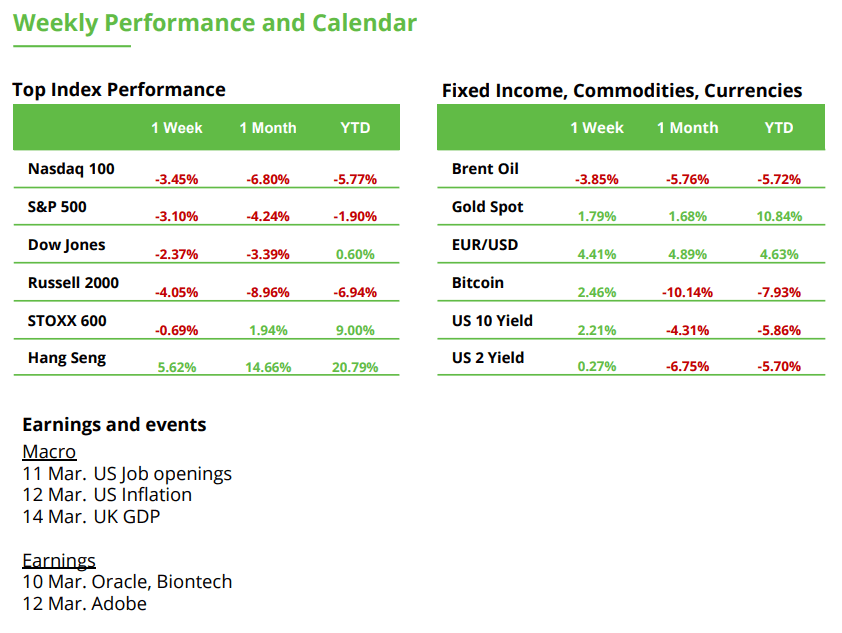

Simply when buyers thought they’d readability, they acquired chaos. President Trump slapped 25% tariffs on imports from Canada and Mexico, sending markets right into a tailspin. By March 6, the White Home threw in a last-minute exemption for USMCA-compliant items, bringing temporary aid, however wait, there’s extra! A 30-day delay on auto tariffs added one other layer of confusion.

Why does this matter? Markets hate uncertainty. When tariffs flip-flop, companies pause investments, retailers warn of worth hikes, and sectors like tech and autos get hammered. Greatest Purchase ($BBY) and different shopper giants are already flagging greater prices and stagflation fears.

The Fed: “WE’RE IN NO RUSH” Fed Chair Powell didn’t sugarcoat it- fee cuts aren’t coming anytime quickly. With inflation nonetheless hovering above 2%, the Fed is in wait-and-see mode. The US financial system added 151K jobs in February (higher than final month, however nonetheless meh), giving Powell sufficient motive to pump the brakes on easing. In the meantime, throughout the pond… The ECB lower charges, however Lagarde cautioned that rising power costs from geopolitical tensions might shift coverage. Investor takeaway: Price cuts aren’t a given. Progress shares (particularly tech) would possibly see extra volatility, whereas financials and dividend-paying performs might maintain regular.

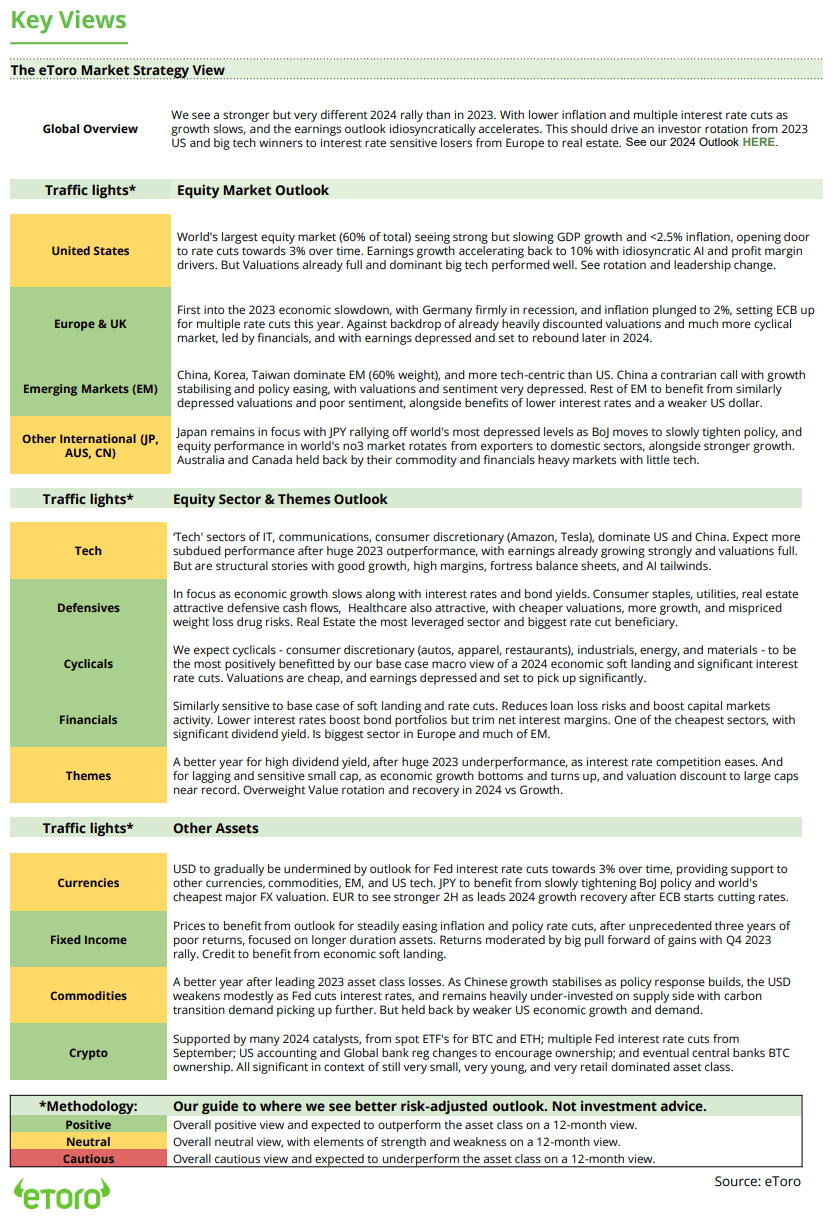

How Buyers Are Enjoying 2025: With markets swinging like a pendulum, buyers are tweaking their playbook: diversifying, hedging, and attempting to find stability.

Core methods: Buyers are hedging single-stock threat with broad market publicity via diversified ETFs.

Worldwide Equities ($VEU): With international markets exhibiting pockets of resilience, buyers are dipping into European and Asian shares for diversification.

High quality over Hype: Buyers give attention to high-quality ($QUAL) firms with strong fundamentals as a substitute of chasing meme shares.

Sector Themes: Who’s Profitable & Shedding?

Defensive Sectors on the Rise: Healthcare ($XLV), utilities ($XLU), and shopper staples ($XLP) are attracting inflows as buyers search stability.

Financials Discover Their Footing: Extra Than Only a Bounce? Monetary shares ($XLF, $VFH) have proven notable resilience amid current market turmoil. Banks ($KBE) and worth shares outperformed, supported by rising web curiosity margins and enhancing mortgage development.

Thematic Investing: Cash is shifting towards long-term development themes like: 1. Protection shares, international army spending is skyrocketing, led by Europe. 2. Clear power ($ICLN), authorities subsidies preserving momentum alive.

Hedging: How sensible cash is defending itself

Gold ($GLD) & Commodities ETFs: A traditional inflation hedge as fee lower expectations stay murky.

Bond ETFs ($TLT) for Revenue: With the US 10-year yield at ~4.3%, some buyers are locking in yields earlier than central banks pivot. Additionally they generate common earnings and assist stabilize returns throughout inventory market turbulence.

Crypto Allocation: In unstable instances, it’s clever to stay with the crypto blue-chips. Bitcoin ($BTC) and Ethereum ($ETH) stay the go-to holdings for a lot of buyers. Why? They’ve the most important networks, probably the most adoption, and critical institutional backing.

Bottomline: For years, tech was the undisputed king. However 2025 is perhaps different- as a substitute of simply AI shares carrying the market, we’re seeing a extra balanced efficiency throughout a number of sectors. Buyers are adjusting accordingly: favoring high quality & stability over hypothesis.

Europe’s New Funding Technique Boosts the Euro

The Market Is Repricing the Euro: EUR/USD ($EURUSD) surged final week, rising from beneath 1.04 to over 1.08, a 4.4% acquire and the strongest weekly improve in years. The euro reached its highest stage since November, signaling a possible elementary shift. Europe is now focusing extra on a brand new funding technique to stimulate development, offering extra assist for the euro. Not way back, there have been fears that the pair would drop again to parity as a result of “Trump Commerce”. These considerations now appear to have light.

Fiscal Coverage Shift: EU Fee President von der Leyen plans to mobilize as much as €800 billion to strengthen Europe’s protection capabilities and keep assist for Ukraine. On the identical time, the CDU and SPD, at present in coalition negotiations for the brand new German authorities, have agreed on a €500 billion particular fund for infrastructure modernization. Moreover, the debt brake is about to be relaxed for focused protection spending.

Bond Market Turmoil: The ten-year German bond yield (see chart) surged from 2.39% to 2.85% final week – the sharpest improve in years. Buyers are demanding greater yields as a threat premium for rising authorities debt. Nonetheless, greater yields additionally imply elevated borrowing prices, as long-term market rates of interest are carefully tied to 10-year bonds.

A Lot of Optimism Is Already Priced In: The shares of European protection firms similar to Rheinmetall, BAE Techniques, Safran, Thales, Dassault Aviation, Kongsberg, and Saab AB share one widespread trait: in accordance with the RSI indicator, they’re short-term overbought – some greater than others. This market overheating displays excessive expectations for elevated protection spending. Whereas valuations seem stretched within the quick time period, the general development development stays intact, making tactical timing more and more vital.

Bottomline: At this level, we stay cautiously optimistic in regards to the protection sector, supported by huge investments within the coming years. The important thing query might be how funds are allotted and which firms are finest positioned to profit. Whereas Europe goals for better army independence from the US, a portion of the funds will nonetheless movement to American protection firms. Raytheon Applied sciences, Honeywell, and Lockheed Martin ought to subsequently even be on the watchlist.

10-year German bond yield

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.