In crypto, stablecoins are the closest factor to “protected”, or so we wish to imagine. Designed to carry regular amid market chaos, stablecoins have turn into the monetary glue of DeFi, powering every part from lending protocols to cross-border funds. However not all stablecoins are created equal.

On one aspect of the ring, you’ve got algorithmic stablecoins cleverly coded, reserve-free property that steadiness themselves by way of provide and demand logic. Alternatively, stand collateralized stablecoin tokens backed by actual property like fiat or crypto, providing a way of solidity in a risky market. Each fashions goal for a similar objective: stability. But, their paths couldn’t be extra completely different.

One depends on arithmetic, whereas the opposite is determined by funds. One guarantees decentralization; the opposite requires belief. And because the collapse of TerraUSD reminded the world, getting this steadiness flawed can have catastrophic penalties.

On this article, we unpack the core mechanics, professionals, cons, and threat profiles of each fashions, so you’ll be able to higher perceive how these digital lifelines work and which could climate the subsequent storm.

What are Algorithmic Stablecoins?

Algorithmic stablecoins are a sort of digital asset engineered to keep up a secure worth most frequently pegged to a fiat forex, such because the U.S. greenback—with out counting on conventional collateral. Relatively than being backed by reserves of fiat or crypto property, they depend on good contracts and algorithms that mechanically regulate provide in response to market demand.

So, how do algorithmic stablecoins preserve their peg? When the stablecoin trades above its goal worth, the protocol will increase the provision to push the value down. Conversely, when the value falls under the peg, the provision is decreased to drive it again up. This self-correcting mechanism is designed to stabilize the coin’s worth with out exterior backing.

A well known instance is TerraUSD (UST), which as soon as stood because the main algorithmic stablecoin earlier than its collapse. It operated utilizing a dual-token mannequin with LUNA, the place LUNA was used to soak up volatility and assist UST preserve its peg to the US greenback. One other instance is Ampleforth (AMPL), which makes use of a “rebase” system. As an alternative of adjusting the market provide broadly, AMPL adjustments the variety of tokens held in particular person wallets relying on worth actions increasing when costs are excessive and contracting when costs are low.

RELATED: Understanding Algorithmic Stablecoins With Ampleforth

These examples spotlight the various mechanisms by way of which algorithmic stablecoins goal to implement stability with out counting on collateralized reserves.

Market Response Submit Terra Luna Collapse

The collapse of Terra in Could 2022 marked a turning level for the stablecoin market, arguably its most dramatic and cautionary story. TerraUSD (UST), as soon as the flagship of algorithmic stablecoins, misplaced its $1 peg in a downward spiral that worn out over $40 billion in worth. In a determined try to revive the peg, the community flooded the market with LUNA tokens, triggering hyperinflation and accelerating the downfall.

RELATED: Terra LUNA 99% Crash: How Did It All Go Unsuitable?

The aftermath despatched shockwaves by way of the crypto ecosystem. Buyers reeled, and international regulators took discover, sounding alarms in regards to the systemic dangers posed by uncollateralized or partially collateralized fashions. Initiatives like Frax Finance shortly adjusted course, abandoning their partial algorithmic frameworks in favour of absolutely collateralized approaches to revive consumer confidence.

Within the wake of the turmoil, stablecoin market dominance consolidated round centralized gamers like USDT and USDC names seen as safer as a consequence of their clear reserve fashions and regulatory compliance.

The Terra debacle underscored a tough reality in crypto: confidence is every part. As soon as it’s damaged, even essentially the most modern mechanisms can unravel in a single day.

What are Collateralized Stablecoins?

Now, what are collateralized stablecoins? Collateralized stablecoins are digital property whose worth is supported by reserves of real-world or crypto-based property. This backing ensures that every stablecoin is anchored by tangible worth, offering a layer of belief and stability for customers. These stablecoins typically fall into two foremost classes: fiat-collateralized stablecoins and crypto-collateralized stablecoins.

Fiat-collateralized stablecoins are backed by conventional currencies such because the U.S. greenback, that are held in reserve by a centralized entity. In distinction, crypto-collateralized stablecoins are backed by different cryptocurrencies and are sometimes over-collateralized to cushion in opposition to the excessive volatility typical of crypto markets.

Is USDT a collateralized stablecoin? The reply is sure; USDT is a collateralized stablecoin, backed primarily by fiat and short-term securities.. Alternatively, DAI, created by MakerDAO, is a number one instance of a crypto-collateralized stablecoin that makes use of decentralized governance and over-collateralization to keep up its peg.

Collateralization helps preserve worth stability by providing a redemption mechanism: every stablecoin can, in idea, be exchanged for an equal quantity of its backing asset. This reserve-backed mannequin builds consumer confidence, offered the reserves are ample, clear, and often audited.

READ ALSO: Gold-Backed vs. USD-Backed Stablecoins: A Comparative Overview

Key Variations Between Algorithmic and Collateralized Stablecoins

Mechanism of Worth Stabilization

Algorithmic stablecoins preserve their worth by mechanically rising or reducing provide in response to market demand. That is performed by way of good contracts with out counting on exterior property. In distinction, collateralized stablecoins use precise reserves, comparable to fiat or crypto property to maintain their worth secure, offering a extra direct methodology of worth management.

Collateral Backing vs. Algorithmic Changes

Collateralized stablecoins are backed by tangible property, providing a transparent and verifiable basis for his or her worth. This makes them simpler to know and infrequently extra trusted by customers. Algorithmic stablecoins, nevertheless, use complicated code-based programs to simulate stability, which might be modern but additionally expose customers to larger threat in occasions of volatility or system breakdowns.

Transparency and Belief Mannequin

Collateralized stablecoins sometimes improve belief by providing third-party audits and public disclosures of their reserves, assuring customers of their solvency. In distinction, algorithmic stablecoins typically function in a extra opaque method, with their mechanisms and code tougher to confirm or audit, which may result in doubts about their long-term reliability.

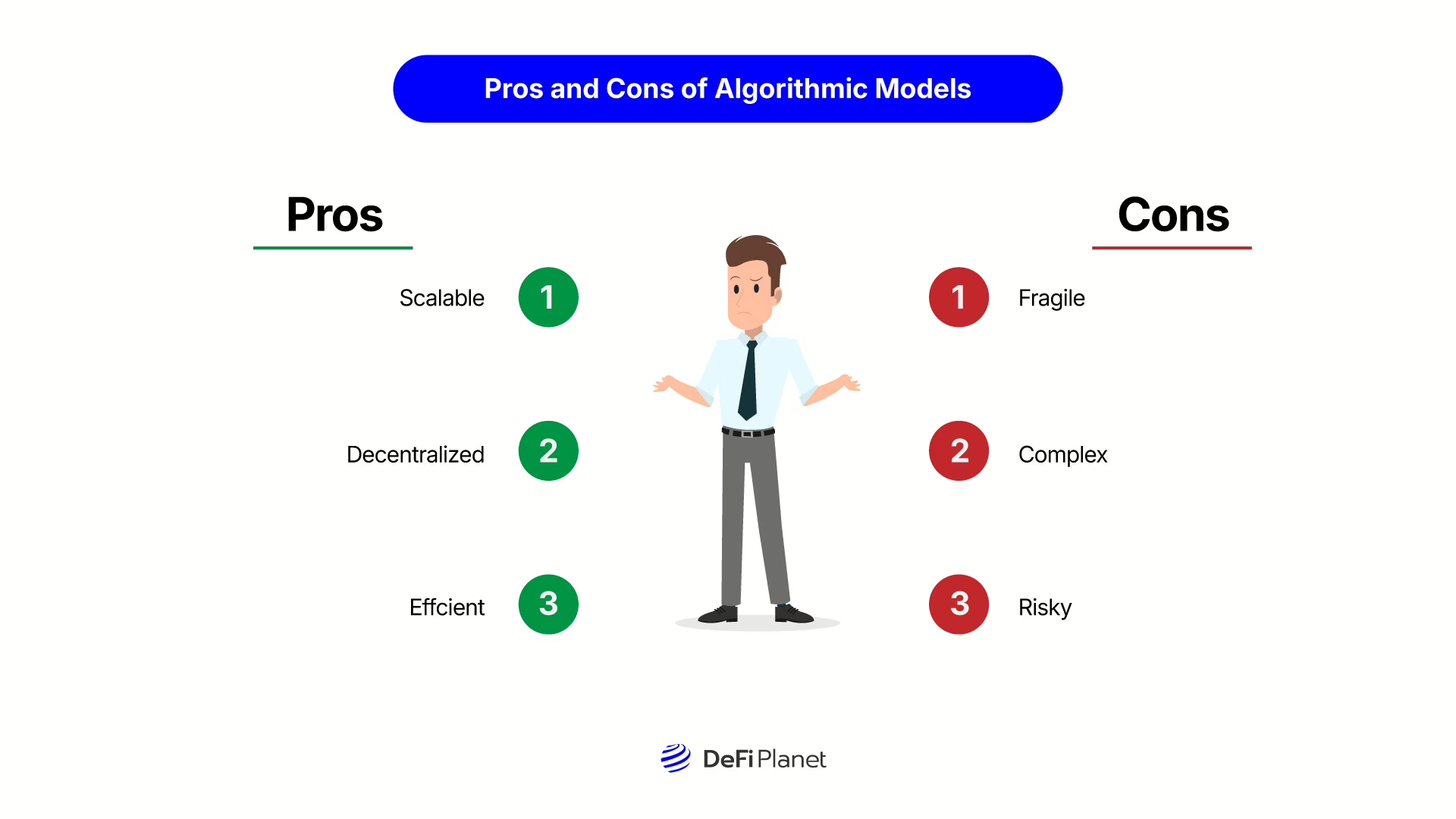

Professionals and Cons of Algorithmic Fashions

Algorithmic stablecoins include a singular set of benefits. For starters, they don’t require huge reserves sitting in financial institution vaults; simply good contracts and intelligent code. This makes them extra capital-efficient and theoretically extra decentralized, working completely on-chain with out the necessity for intermediaries. Their construction additionally permits for speedy scalability, since there’s no must handle bodily property or fiat backing as demand grows.

However these advantages include critical trade-offs. Their peg mechanisms are sometimes fragile, if public confidence wavers, the system can unravel shortly, because the TerraUSD collapse vividly demonstrated. Their underlying fashions are complicated, making them troublesome for the typical consumer to totally grasp. This lack of expertise can gasoline panic when costs swing.

In idea, algorithmic stablecoins are elegant and environment friendly. In follow, they stroll a tightrope one misstep, and the entire system can come crashing down.

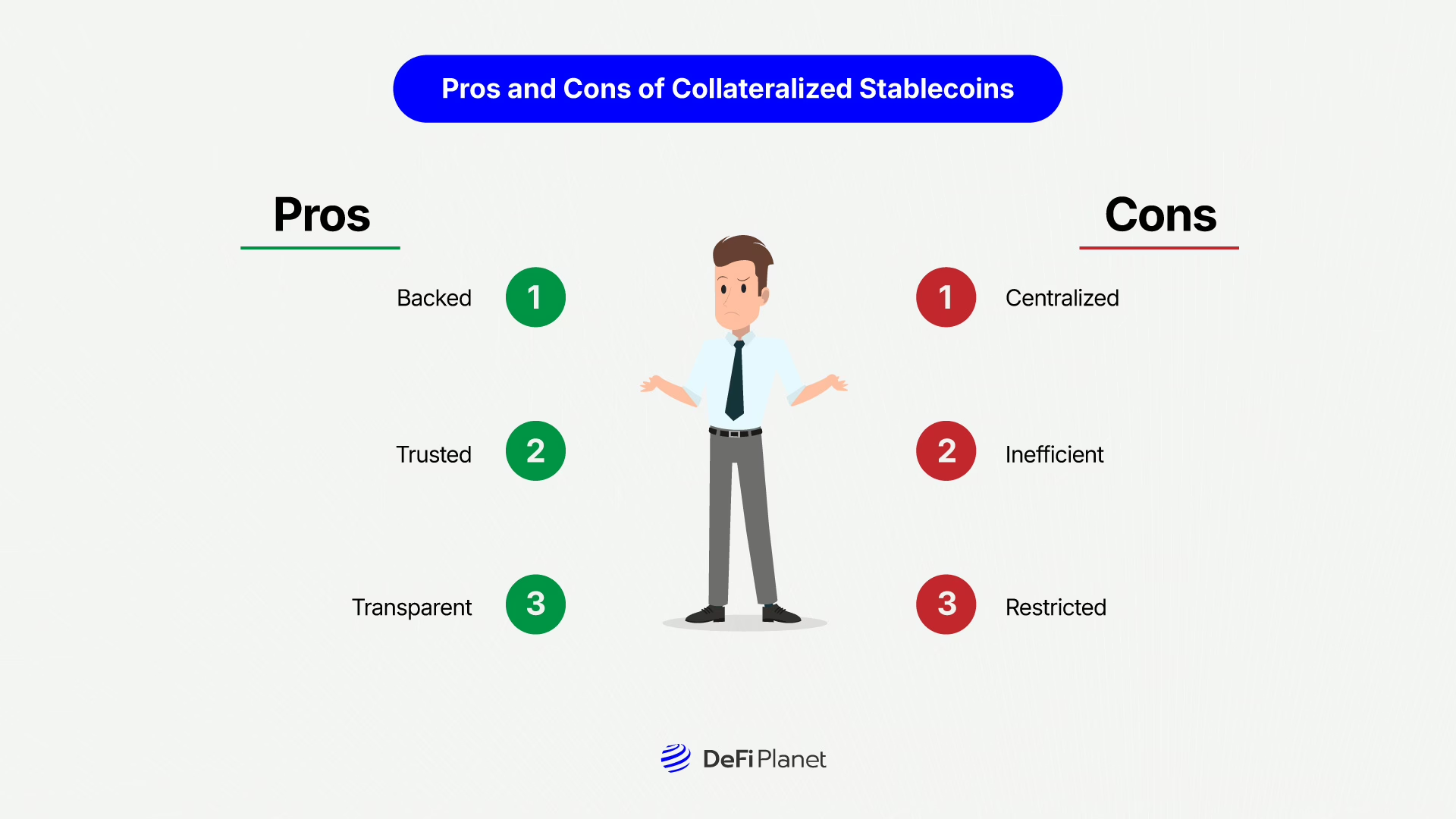

Professionals and Cons of Collateralized Stablecoins

Collateralized stablecoins have carved out a stronghold within the crypto area for one key purpose: they’re backed by one thing actual. Whether or not it’s fiat forex sitting in a checking account or crypto held in good contracts, this tangible asset backing provides customers confidence that their cash have precise worth behind them. For fiat-backed cash like USDC or USDT, reserve disclosures and third-party audits supply an additional layer of transparency that builds belief, particularly essential in a market the place sentiment can shift in a single day.

Nonetheless, this stability typically comes at a value. Fiat-collateralized fashions are inclined to depend on centralized entities, introducing the very dangers of censorship, mismanagement, or regulatory clampdowns that crypto was designed to keep away from. Alternatively, crypto-backed stablecoins attempt to hold issues decentralized however typically require over-collateralization to guard in opposition to volatility. Which means locking up $150 price of crypto to mint $100 in stablecoins an inefficient use of capital that limits broader adoption.

In essence, collateralized stablecoins supply peace of thoughts by way of real-world backing, however they need to steadiness belief, decentralization, and effectivity three forces that don’t all the time play properly collectively.

In Conclusion, Which One Can You Actually Belief?

The reality is there’s no one-size-fits-all reply. All of it comes right down to what issues most to you. In case your coronary heart beats for decentralization and censorship resistance, algorithmic stablecoins would possibly align along with your beliefs. However tread rigorously: their observe document in high-stress environments is shaky at greatest, and their peg mechanisms can unravel shortly underneath stress.

Alternatively, should you’re after stability, predictability, and broad adoption, collateralized stablecoins, particularly fiat-backed ones like USDC and USDT, supply a extra reassuring choice. They’re trusted by establishments, supported by audits, and usually maintain their worth nicely. Nonetheless, they arrive with their very own baggage: centralization dangers, regulatory publicity, and the ever-present query of whether or not these reserves are actually safe.

Neither mannequin is flawless. Algorithmic cash must show they will survive panic with out collapsing. Collateralized cash should work towards better transparency and scale back reliance on centralized custodians. Because the ecosystem matures, we may even see modern hybrid approaches emerge marrying decentralization with tangible backing.

Till then, the most effective strategy is cautious optimism. Whether or not you’re a DeFi developer, investor, or curious consumer, keep in mind the golden rule of crypto: Don’t belief—confirm. Diversify. And by no means cease asking onerous questions.

Disclaimer: This piece is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.